Introduction to Investments (Chapter 1)

... • Commitment of money that is expected to generate additional money • Current commitment of dollars for a period of time to desire future payments that will compensate the investor for – The time the funds are committed – The expected rate of inflation, and – The uncertainty of the future payments ...

... • Commitment of money that is expected to generate additional money • Current commitment of dollars for a period of time to desire future payments that will compensate the investor for – The time the funds are committed – The expected rate of inflation, and – The uncertainty of the future payments ...

PROFIT REPORTING SEASON

... 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objecti ...

... 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objecti ...

Chapter 11

... and Access to the Payments System 3. Liquidity 4. Risk sharing 5. Information services – Bank is an information warehouse. – Collecting and processing standardized financial information. ...

... and Access to the Payments System 3. Liquidity 4. Risk sharing 5. Information services – Bank is an information warehouse. – Collecting and processing standardized financial information. ...

Assignment #1 File

... earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available for family support. Tom wants to calculate his human life value and believes 5 percent dis ...

... earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available for family support. Tom wants to calculate his human life value and believes 5 percent dis ...

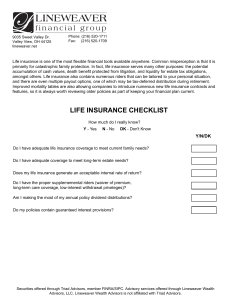

life insurance checklist - Lineweaver Financial Group

... primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and liquidity for estate tax obligations, amongst others. Life insurance also contains numerous riders that can be tai ...

... primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and liquidity for estate tax obligations, amongst others. Life insurance also contains numerous riders that can be tai ...

Did moral hazard and adverse selection affect CMBS loan quality?

... of the Board of Governors of the Federal Reserve System of its staff. ...

... of the Board of Governors of the Federal Reserve System of its staff. ...

Slide 1

... dramatically less than that provided by the program when it was first rolled out in March.“ "To what extent has the lack of demand for secondary and tertiary tranches dampened overall demand for TALF financing?" The lawmakers also expressed concerns about the integrity of ratings given to triple-A a ...

... dramatically less than that provided by the program when it was first rolled out in March.“ "To what extent has the lack of demand for secondary and tertiary tranches dampened overall demand for TALF financing?" The lawmakers also expressed concerns about the integrity of ratings given to triple-A a ...

Lecture 27: CAPM and Risk Premium

... capitalism) is $10 million and the expected payoff of a safe investment (say, government bonds) is $9 million, then the risk premium is $1 million. ii. Note these are expected payoffs. If agents were risk-neutral, the expected payoffs would be the same. e. It’s not unreasonable that people are risk ...

... capitalism) is $10 million and the expected payoff of a safe investment (say, government bonds) is $9 million, then the risk premium is $1 million. ii. Note these are expected payoffs. If agents were risk-neutral, the expected payoffs would be the same. e. It’s not unreasonable that people are risk ...

Recommendations from Squam Lake

... risks, and fees associated with a given investment; automatic enrollment for employees who do not specifically opt out of a plan; and limits on the amount of company stock that an employee can hold. Although these suggestions are certainly worthy of consideration, it is not clear to this reviewer wh ...

... risks, and fees associated with a given investment; automatic enrollment for employees who do not specifically opt out of a plan; and limits on the amount of company stock that an employee can hold. Although these suggestions are certainly worthy of consideration, it is not clear to this reviewer wh ...

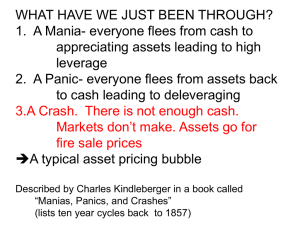

The Global Financial Crisis

... Conflicts of interest characterize the granting of credit (lending) and the use of credit (investing) by the same entity Depository institutions possess enormous financial power, by virtue of their control of other people’s money (O-P-M), must be limited to ensure soundness and competition in the ma ...

... Conflicts of interest characterize the granting of credit (lending) and the use of credit (investing) by the same entity Depository institutions possess enormous financial power, by virtue of their control of other people’s money (O-P-M), must be limited to ensure soundness and competition in the ma ...

Value-at-Risk Analysis of Portfolios

... In recent years, risk management is no longer an instrument of risk control after event happens, but a management system to be required establishing within the enterprise. Firms benefit high reputations and good investor relations from risk controlling. To manage market risk efficiently, financial f ...

... In recent years, risk management is no longer an instrument of risk control after event happens, but a management system to be required establishing within the enterprise. Firms benefit high reputations and good investor relations from risk controlling. To manage market risk efficiently, financial f ...

On Regulation of Financial Institutions – 07/11/97

... and specifically reaffirms state regulation of insurance and specifically provides that no person may sell insurance without being properly licensed by the states; and WHEREAS, state laws contain comprehensive provisions for licensing and regulation of insurance companies and producers and protectio ...

... and specifically reaffirms state regulation of insurance and specifically provides that no person may sell insurance without being properly licensed by the states; and WHEREAS, state laws contain comprehensive provisions for licensing and regulation of insurance companies and producers and protectio ...

Synopsis_2014_v3 ed 7 and 8

... http://www.businessinsider.com/the-european-economic-crisis-explained-in-just-two-charts-2013-7 Discuss the basic cause of the problem. Discuss its principal solution, by using some equations, see combination of austerity and supply side politics. If you spend too much on borrowed money, you need to ...

... http://www.businessinsider.com/the-european-economic-crisis-explained-in-just-two-charts-2013-7 Discuss the basic cause of the problem. Discuss its principal solution, by using some equations, see combination of austerity and supply side politics. If you spend too much on borrowed money, you need to ...

Risk transfer mechanisms

... with corporate bonds having almost identical ratings. Compensated for illiquidity, possible model inaccuracies and newness premiums. – Diversification effects: Risk profile that is less correlated with the credit cycle or traditional insurance products. ______________________________________________ ...

... with corporate bonds having almost identical ratings. Compensated for illiquidity, possible model inaccuracies and newness premiums. – Diversification effects: Risk profile that is less correlated with the credit cycle or traditional insurance products. ______________________________________________ ...

VRSK

... 2. Agreements with data contributors in which the particular uses of data are specified 3. “Mining” data found inside transactions supported by VRSK’s solutions 4. Source data from public sources including Federal, State, and Local governments 5. Physically gathering data at the request of property ...

... 2. Agreements with data contributors in which the particular uses of data are specified 3. “Mining” data found inside transactions supported by VRSK’s solutions 4. Source data from public sources including Federal, State, and Local governments 5. Physically gathering data at the request of property ...

Slide 1

... However, the insurance company asks for a risk premium to be added to the ParPrice, this risk premium must be greater (or equal) 1 and monoton increasing. To calculate the new price, a function h(p), 0 p 1, is considered, which has the property stated above, namely: ...

... However, the insurance company asks for a risk premium to be added to the ParPrice, this risk premium must be greater (or equal) 1 and monoton increasing. To calculate the new price, a function h(p), 0 p 1, is considered, which has the property stated above, namely: ...

Figure 15.1

... Occurs when one party has an incentive to behave differently once an agreement is made between parties ...

... Occurs when one party has an incentive to behave differently once an agreement is made between parties ...

The Traditional Securitization Process Bank

... to making the loan in its entirety and then assembles participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The ...

... to making the loan in its entirety and then assembles participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The ...

Housing Finance

... (Pre-sold) Insurance • Pre-building approval contract: is the sale which is carried out before the definitive building approval by the city government (Municipality). This contract is a legal promise that involves some form of a down payment by the buyer for the right to close the purchase and have ...

... (Pre-sold) Insurance • Pre-building approval contract: is the sale which is carried out before the definitive building approval by the city government (Municipality). This contract is a legal promise that involves some form of a down payment by the buyer for the right to close the purchase and have ...

Restructuring Distressed Financial Institutions

... was always a favorite theme in the literature on central banking and supervision. Ample experience in both developing and advanced economies (plenty more now). Reality is messy and action by the authorities rarely complies fully with the norm. Structure of the presentation: – Causes, Phases, P ...

... was always a favorite theme in the literature on central banking and supervision. Ample experience in both developing and advanced economies (plenty more now). Reality is messy and action by the authorities rarely complies fully with the norm. Structure of the presentation: – Causes, Phases, P ...

THE IMPACT OF NATURAL CATASTROPHES ... ON INSURERS

... the form of bonds. As such, they help the (re)insurer to spread the peak exposures caused by extreme natural catastrophes by transferring the risk to the capital market. Financial innovation permits greater competition among capital suppliers. In the last few years, clear and well-defined cat event ...

... the form of bonds. As such, they help the (re)insurer to spread the peak exposures caused by extreme natural catastrophes by transferring the risk to the capital market. Financial innovation permits greater competition among capital suppliers. In the last few years, clear and well-defined cat event ...

Slides 3

... In our setset-up, agents first choose to become either firm--entrepreneurs, or bankfirm bank-entrepreneurs, or depositors, and then they make their investment and financing decisions. We establish a mapping between bank market power rents and investment and consumption allocations independently of a ...

... In our setset-up, agents first choose to become either firm--entrepreneurs, or bankfirm bank-entrepreneurs, or depositors, and then they make their investment and financing decisions. We establish a mapping between bank market power rents and investment and consumption allocations independently of a ...