![2017.03 Economic Advantage ProcessFINALv2[17156].ai](http://s1.studyres.com/store/data/019095547_1-a901fcc214a4c2f19d62e00613571f15-300x300.png)

Adapt to survive - Aberdeen Asset Management Asia

... on emerging market bond and equity valuations. When investors in developed countries expected higher yields on domestic bonds and rising returns from domestic equities, there seemed less reason to accept the greater volatility and risk inherent in emerging markets. No wonder Federal Reserve hints in ...

... on emerging market bond and equity valuations. When investors in developed countries expected higher yields on domestic bonds and rising returns from domestic equities, there seemed less reason to accept the greater volatility and risk inherent in emerging markets. No wonder Federal Reserve hints in ...

Seeing the positive - The Business Times

... income is an asset class that still offers positive yields in both US dollar denominated bonds and local currency denominated bonds. Another theme is the growing impact of political risk and geopolitics in financial market volatility. So with a backdrop of low yields and rising volatility becoming th ...

... income is an asset class that still offers positive yields in both US dollar denominated bonds and local currency denominated bonds. Another theme is the growing impact of political risk and geopolitics in financial market volatility. So with a backdrop of low yields and rising volatility becoming th ...

US Equities

... or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do not guarantee future results. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Inv ...

... or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do not guarantee future results. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Inv ...

CHAPTER 1: INTRODUCTION

... quantitative finance often develop models to price various assets being traded across the markets, and upon finding price discrepancies, one can make use of a specific combination of derivatives in order make a riskless profit. ...

... quantitative finance often develop models to price various assets being traded across the markets, and upon finding price discrepancies, one can make use of a specific combination of derivatives in order make a riskless profit. ...

Ch. 15: Financial Markets

... Ch. 15: Financial Markets • Financial markets – link borrowers and lenders. – determine interest rates, stock prices, bond prices, etc. ...

... Ch. 15: Financial Markets • Financial markets – link borrowers and lenders. – determine interest rates, stock prices, bond prices, etc. ...

Market Review

... Our feeling is that people who start businesses should face only nominal taxes on the assets they create, something on the order of 5-10%. For companies that are private, special provision should be made for allowing intergenerational transfers rather than subjecting them to estate taxes that often ...

... Our feeling is that people who start businesses should face only nominal taxes on the assets they create, something on the order of 5-10%. For companies that are private, special provision should be made for allowing intergenerational transfers rather than subjecting them to estate taxes that often ...

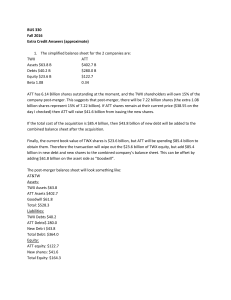

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

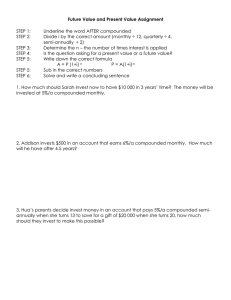

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

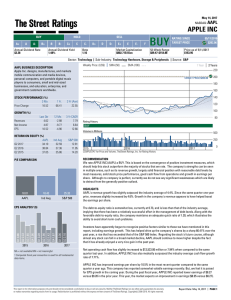

APPLE INC - TheStreet

... should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, solid stock price performance, good cash flow from operations and g ...

... should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, solid stock price performance, good cash flow from operations and g ...

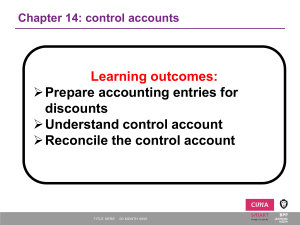

Slide 1

... the sample is 49.36. In terms of log difference, it is 1.67. Therefore, the effect of an inter-quartile improvement in turnover ratio is -0.27 (-0.16 * 1.67) or a reduction of 27% of volatility. The average growth volatility is 2.1%. A decrease of 27% would mean a decrease of 0.50 percentage point ( ...

... the sample is 49.36. In terms of log difference, it is 1.67. Therefore, the effect of an inter-quartile improvement in turnover ratio is -0.27 (-0.16 * 1.67) or a reduction of 27% of volatility. The average growth volatility is 2.1%. A decrease of 27% would mean a decrease of 0.50 percentage point ( ...

Innovest - Kellogg School of Management

... Sector-Intensity Rating: Not all sectors are exposed to the same levels of risk, and different sectors call for different policies. For example, a company in the oil and gas sector needs to have a human rights policy in place that addresses issues such as landuse and the protection of indigenous cul ...

... Sector-Intensity Rating: Not all sectors are exposed to the same levels of risk, and different sectors call for different policies. For example, a company in the oil and gas sector needs to have a human rights policy in place that addresses issues such as landuse and the protection of indigenous cul ...

Chapters 1 and 2

... of expected cash flows. The existence of future and forward markets in inputs can help lock-in future input costs. H. Goals in the Public Sector and the Not-For-Profit (NFP) Enterprise 1. NFP organizations such as performing arts groups, most hospitals and universities, and volunteer organizations r ...

... of expected cash flows. The existence of future and forward markets in inputs can help lock-in future input costs. H. Goals in the Public Sector and the Not-For-Profit (NFP) Enterprise 1. NFP organizations such as performing arts groups, most hospitals and universities, and volunteer organizations r ...

CH. 4 KEY - Allen ISD

... The Federal Reserve can put more money into the economy (how and why)Lowering Reserve Requirements, Buy US government securities on the open market, Lowering Interest Rates (Discount Rates) The Federal Reserve can effectively take money out of the economy (how and why)Raising Reserve Requirements, S ...

... The Federal Reserve can put more money into the economy (how and why)Lowering Reserve Requirements, Buy US government securities on the open market, Lowering Interest Rates (Discount Rates) The Federal Reserve can effectively take money out of the economy (how and why)Raising Reserve Requirements, S ...

Module C - Treasury Management

... Exchange rate is expressed as the price per unit of foreign currency in terms of the home currency is known as the “Home currency quotation” or “Direct Quotation” Exchange rate is expressed as the price per unit of home currency in terms of the foreign currency is known as the “Foreign Currency ...

... Exchange rate is expressed as the price per unit of foreign currency in terms of the home currency is known as the “Home currency quotation” or “Direct Quotation” Exchange rate is expressed as the price per unit of home currency in terms of the foreign currency is known as the “Foreign Currency ...