FREDERIC T. KUTSCHER ASSOCIATES, INC.

... resilience through the decades. The year 2005 fits well within this context, as we’ve faced the high hurdles of rising interest rates, spiking energy costs, natural disasters (including Katrina and Rita), high trade and budget deficits, and military operations in Iraq and ...

... resilience through the decades. The year 2005 fits well within this context, as we’ve faced the high hurdles of rising interest rates, spiking energy costs, natural disasters (including Katrina and Rita), high trade and budget deficits, and military operations in Iraq and ...

I Human Environment Relationship

... 1. Static efficiency is inadequate when time is important in affecting the payoff (1) Resource and environmental problems are not static issues. Current use of env/res services affect future stocks (2) Example: (i) oil: extraction now reduces future stock (ii) nuclear waste generated now affect futu ...

... 1. Static efficiency is inadequate when time is important in affecting the payoff (1) Resource and environmental problems are not static issues. Current use of env/res services affect future stocks (2) Example: (i) oil: extraction now reduces future stock (ii) nuclear waste generated now affect futu ...

Equity and Time to Sale in the Real Estate Market

... that down payments and other borrowing constraints can add a self-reinforcing mechanism to demand shocks. When housing prices fall, equity losses on current homes may prevent potential buyers who rely on the proceeds from the sale of their existing home for a down payment on the next from purchasing ...

... that down payments and other borrowing constraints can add a self-reinforcing mechanism to demand shocks. When housing prices fall, equity losses on current homes may prevent potential buyers who rely on the proceeds from the sale of their existing home for a down payment on the next from purchasing ...

FM11 Ch 09 Instructors Manual

... then the WACC should include a short-term debt component. Noninterest-bearing debt is generally not included in the cost of capital estimate because these funds are netted out when determining investment needs, that is, net rather than gross working capital is included in capital expenditures. a. ...

... then the WACC should include a short-term debt component. Noninterest-bearing debt is generally not included in the cost of capital estimate because these funds are netted out when determining investment needs, that is, net rather than gross working capital is included in capital expenditures. a. ...

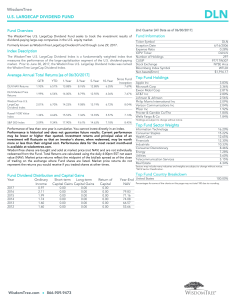

WisdomTree LargeCap Dividend Fund

... There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for ...

... There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for ...

COMPUTER SCIENCE 20, SPRING 2012 DISCRETE MATHEMATICS FOR COMPUTER SCIENCE

... Homework, due in hard copy Wednesday 4/18/2012 at 10:10am 1. Your financial advisor tells you about two possible investment options for your $1000. The first option is investing in Apple shares. The Apple shares have a 80% chance of doubling in value and a 20% chance of losing all of their value. Th ...

... Homework, due in hard copy Wednesday 4/18/2012 at 10:10am 1. Your financial advisor tells you about two possible investment options for your $1000. The first option is investing in Apple shares. The Apple shares have a 80% chance of doubling in value and a 20% chance of losing all of their value. Th ...

Sample Questions 3 - U of L Class Index

... A) An investment is acceptable if its calculated payback period is less than some prespecified number of years. B) An investment should be accepted if the payback is positive and rejected if it is negative. C) An investment should be rejected if the payback is positive and accepted if it is negative ...

... A) An investment is acceptable if its calculated payback period is less than some prespecified number of years. B) An investment should be accepted if the payback is positive and rejected if it is negative. C) An investment should be rejected if the payback is positive and accepted if it is negative ...

OCBSFFund1qtr2014 copy

... charges. A schedule of fees and charges and maximum commissions is available from the management company on request. Commission and incentives may be paid and if so, would be included in the overall costs. CIS are traded at ruling prices and forward pricing is used. CIS can engage in borrowing and s ...

... charges. A schedule of fees and charges and maximum commissions is available from the management company on request. Commission and incentives may be paid and if so, would be included in the overall costs. CIS are traded at ruling prices and forward pricing is used. CIS can engage in borrowing and s ...

chap6

... less marketability, than short-term securities. • Since long-term securities have greater risk, investors require greater premiums to give up liquidity. • The yield curve therefore must have liquidity premium added to it. The liquidity premium explains an upward sloping yield curve, and that it will ...

... less marketability, than short-term securities. • Since long-term securities have greater risk, investors require greater premiums to give up liquidity. • The yield curve therefore must have liquidity premium added to it. The liquidity premium explains an upward sloping yield curve, and that it will ...

STAT 473. Practice Problems for Exam 2 Spring 2015 Description

... period binomial tree for modeling the price movements of a non-dividend-paying stock (the so-called forward tree). (i) The period is 3 months. (ii) The initial stock price is $100. (iii) The stocks volatility is 30%. (iv) The continuously compounded risk-free interest rate is 4%. At the beginning of ...

... period binomial tree for modeling the price movements of a non-dividend-paying stock (the so-called forward tree). (i) The period is 3 months. (ii) The initial stock price is $100. (iii) The stocks volatility is 30%. (iv) The continuously compounded risk-free interest rate is 4%. At the beginning of ...

"Impact of Firmsâ¬" Earnings and Economic Value

... if all of the profits were distributed to the outstanding shares at the end of the year. Earnings per share is also a calculation that shows how profitable a company is on a shareholder basis. So a larger company's profits per share can be compared to smaller company's profits per share. Economic va ...

... if all of the profits were distributed to the outstanding shares at the end of the year. Earnings per share is also a calculation that shows how profitable a company is on a shareholder basis. So a larger company's profits per share can be compared to smaller company's profits per share. Economic va ...

Chapter 11

... Municipal bonds - sometimes called munis. Issued by a state or local government, including cities, counties, school districts, and special taxing districts. Use funds for ongoing costs and to build major projects such as schools, airports, and bridges. General obligation bonds are backed by ...

... Municipal bonds - sometimes called munis. Issued by a state or local government, including cities, counties, school districts, and special taxing districts. Use funds for ongoing costs and to build major projects such as schools, airports, and bridges. General obligation bonds are backed by ...

The Efficient Market Hypothesis

... • The Lucky Event Issue: in virtually any month it seems we read an article about some investor or investment company with fantastic investment performance over the recent past. • Surely the superior records of such investors disprove the efficient market hypothesis. ...

... • The Lucky Event Issue: in virtually any month it seems we read an article about some investor or investment company with fantastic investment performance over the recent past. • Surely the superior records of such investors disprove the efficient market hypothesis. ...

Chapter 7 - CSUN.edu

... The longer the maturity of a bond, the more of an effect a change in interest rates will have on it. The reason for this is that the price change is compounded into the bond price for more periods. Therefore, you can rule out statements b and e. A bond that pays coupons will be less affected by inte ...

... The longer the maturity of a bond, the more of an effect a change in interest rates will have on it. The reason for this is that the price change is compounded into the bond price for more periods. Therefore, you can rule out statements b and e. A bond that pays coupons will be less affected by inte ...

File

... Larger than direct costs, but more difficult to measure and estimate Stockholders want to avoid a formal bankruptcy filing Bondholders want to keep existing assets intact so they can at least receive that money Assets lose value as management spends time worrying about avoiding bankruptcy instead of ...

... Larger than direct costs, but more difficult to measure and estimate Stockholders want to avoid a formal bankruptcy filing Bondholders want to keep existing assets intact so they can at least receive that money Assets lose value as management spends time worrying about avoiding bankruptcy instead of ...

Document

... that what is often not appreciated in debates about the economics of nuclear power is that the cost of equity, that is companies using their own money to pay for new plants, is generally higher than the cost of debt.The Doomsday Machine, Cohen and McKillop (Palgrave 2012) page 199 Another advantage ...

... that what is often not appreciated in debates about the economics of nuclear power is that the cost of equity, that is companies using their own money to pay for new plants, is generally higher than the cost of debt.The Doomsday Machine, Cohen and McKillop (Palgrave 2012) page 199 Another advantage ...

Issue - Value over time

... Constant-dollar benefit-cost analyses of proposed investments and regulations should report net present value and other outcomes determined using a real discount rate of 7 percent. This rate approximates the marginal pretax rate of return on an average investment in the private sector in recent year ...

... Constant-dollar benefit-cost analyses of proposed investments and regulations should report net present value and other outcomes determined using a real discount rate of 7 percent. This rate approximates the marginal pretax rate of return on an average investment in the private sector in recent year ...