* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download chap6

Yield spread premium wikipedia , lookup

Financialization wikipedia , lookup

Systemic risk wikipedia , lookup

Business valuation wikipedia , lookup

History of pawnbroking wikipedia , lookup

Credit rationing wikipedia , lookup

Present value wikipedia , lookup

Credit card interest wikipedia , lookup

Interest rate swap wikipedia , lookup

Interbank lending market wikipedia , lookup

Securitization wikipedia , lookup

Financial economics wikipedia , lookup

Auction rate security wikipedia , lookup

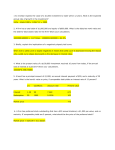

Fin221: CHAPTER 6 THE STRUCTURE OF INTEREST RATES Why interest rate vary among different financial claims? Interest Rate Changes & Differences Between Interest Rates (yield) among financial claims Can Be Explained by Several Variables : • Term to Maturity. • Default Risk. • Tax Treatment. • Marketability. • Special features : Call or Put Options & Convertibility. 2 The Term structure of interest rate • Term to maturity of a financial claim is the length of time until the principal amount borrowed becomes payable. • The term structure of interest rate refers to the relationship between yield (interest rate) and term to maturity on securities that differ only in length of time to maturity. • May be studied by plotting a Yield Curve at a point in time • The yield curve may be ascending, flat, or descending. • Several theories explain the slope and the shape of the yield curve, including the Expectations Theory and Market Segmentation Theory. 3 Yield Curves in the 2000s Exhibit 6.1 4 The Expectations Theory of the Term Structure • The shape and slope of the yield curve is determined by expectations of future interest rate movements, and changes in these expectations lead to changes in the shape of the yield curve: – Ascending: future interest rates are expected to increase. – Descending: future interest rates are expected to decrease. • Investors are assumed to be profit maximizers and that they are indifferent towards interest rate risk (indifferent about holding short-term or long-term securities). • The theory implies a strong relationship between long and short-term interest rates. Long-term interest rates represent the geometric average of the current and a series of expected future (implied, forward) interest rates. 5 Term Structure Formula from Expectation Theory 1 t Rn 1 t R1 1 t 1f1 1 t 2 f1 1 t n1f1 n 1 where : R the observed market rate, f the forward rate, t time period for which the rate is applicable , n maturity of the bond. 6 The Term Structure Formula and The Implied Forward Rate The term structure formula can be used to calculate the implied forward rate (f1) given any two adjacent spot rates (tRn) and (tRn-1). The formula used to calculate the implied forward rate is : 1 t Rn f 1 t n 1 1 n 1 1 t Rn1 n 7 Finding a One-Year Implied Forward Rate • Using term structure of interest rates from January 29, 1999, find the one-year implied forward rate for year three. – 1-year Treasury bill – 2-year Treasury note – 3-year Treasury note 4.51% 4.58% 4.57% 1 .0457 3 1 0 . 0455 or 4.55% 3 f1 2 1 .0458 8 Term Structure and Liquidity Premium Theory • Investors however know that long-term securities have greater price variability (price risk) and have less marketability, than short-term securities. • Since long-term securities have greater risk, investors require greater premiums to give up liquidity. • The yield curve therefore must have liquidity premium added to it. The liquidity premium explains an upward sloping yield curve, and that it will be more upward sloping than that predicted by the expectation theory. 9 The Market Segmentation Theory • Maturity preferences by investors may affect security prices (yields), explaining variations in yields by time • Market participants have strong preferences for securities of particular maturity and buy and sell securities consistent with their maturity preferences. • As a result of these preferences, the yield curve is determined by interaction of supply and demand for securities at or near a particular maturity, and thus the curve is segmented. • If market participants do not trade outside their maturity preferences, then discontinuities are possible in the yield curve. 10 The Market Segmentation and the Preferred Habitat Theory • The Preferred Habitat Theory is an extension of the Market Segmentation Theory. • The Preferred Habitat Theory allows market participants to trade outside their preferred habitat (maturity preferences) if adequately compensated for the additional risk by a risk premium. • Investors will reallocate their security holding in response to the expected risk premium. This allows for humps or twists in the yield curve, but limits the discontinuities possible under Segmentation Theory. 11 Which Theory is Right? • Day-to-day changes in the term structure are most consistent with the Preferred Habitat Theory. • However, in the long-run, expectations of future interest rates and liquidity premiums are important components of the position and shape of the yield curve. 12 Economic implications of the Yield Curve Yield Curves are directly related to the level of economic activity (the Business Cycle) and profits of financial institutions: An ascending (upward sloping) yield curve indicates the market expectations of higher interest rates, higher periods of economic expansion and/or higher inflation levels. The yield curve starts sloping upwards at the beginning of the business cycle. Banks and financial institutions are expected to make better profits. The more the steeper the yield curve, the higher are the expected profits A descending (downward sloping) yield curve forecasts the opposite indications. 13 Interest-Rate and Yield-Curve Patterns Over the Business Cycle 14 Uses of the Yield Curve • At any point in time, the slope of the yield curve can be used to assess the general expectations of borrowers and lenders about future interest rates! • Investors can use the yield curve to identify under-priced securities for their portfolios. • Issuers may use the yield curve to price their securities. • Investors use the yield curve for a strategy known as riding the yield curve. 15 Default Risk • It is the probability of the borrower not honoring the security contract. Losses may range from “interest a few days late” to a complete loss of principal. • Risk averse investors want adequate compensation for expected default losses. • Investors charge a Default Risk Premium for added risk of default. It is measured as: DRP = i - irf • The DRP is the difference between the promised or nominal rate and the yield on a comparable (same term) risk-free securities. • Investors are satisfied if the default risk premium is equal to the expected default loss. 16 Default Risk: Risk Premiums (May 2004) 17 Default Risk, cont. • Default Risk Premiums Increase (Widen) in Periods of Recession and Decrease in Economic Expansion • In good times, risky security prices are bid up; yields move nearer that of riskless securities. • With increased economic pessimism, investors sell risky securities and buy “quality” widening the DRP. • Credit Rating Agencies Measure and Grade Relative Default Risk Security Issuers • Cash flow, level of debt, profitability, and variability of earnings are indicators of default riskness. • As conditions change, rating agencies alter rating of businesses and governmental debtors. 18 Corporate Bond-Rating Systems 19 Tax Effects on Yields • The Taxation of Security Gains and Income Affects the Yield Differences Among Securities • The after-tax return, iat, is found by multiplying the pre-tax return by one minus the marginal tax rate. iat = ibt(1-t) • Municipal bond interest income is tax exempt. • Coupon income and capital gains have been taxed differently in the past, but are now both taxed at the same rate as ordinary income for individuals. 20 To Buy a Municipal or a Corporate Bond? 21