ch697

... There is more than one possible future return. The probability of each outcome is unknown. ®1999 South-Western College Publishing ...

... There is more than one possible future return. The probability of each outcome is unknown. ®1999 South-Western College Publishing ...

Solutions_ch2_ch3_2

... EM = 1 + D/E EM = 1 + 0.65 = 1.65 One formula to calculate return on equity is: ROE = (ROA)(EM) ROE = .085(1.65) = .1403 or 14.03% ...

... EM = 1 + D/E EM = 1 + 0.65 = 1.65 One formula to calculate return on equity is: ROE = (ROA)(EM) ROE = .085(1.65) = .1403 or 14.03% ...

The revaluation model requires as asset, after initial

... According to IAS 40, an investment property shall be measured initially at cost, including transaction charges. Again, the principles for determining cost are similar to those contained in IAS 16, in particular for replacement and subsequent expenditure. Measurement rules – subsequent measurement- r ...

... According to IAS 40, an investment property shall be measured initially at cost, including transaction charges. Again, the principles for determining cost are similar to those contained in IAS 16, in particular for replacement and subsequent expenditure. Measurement rules – subsequent measurement- r ...

Investment

... Tobin’s q • A firm’s q is measured as the financial value of a firm divided by the replacement cost of capital. • When a firm is valued by financial markets at levels greater than the sale value of its capital, then capital is worth more inside the firm than out and the firm should add capital. • W ...

... Tobin’s q • A firm’s q is measured as the financial value of a firm divided by the replacement cost of capital. • When a firm is valued by financial markets at levels greater than the sale value of its capital, then capital is worth more inside the firm than out and the firm should add capital. • W ...

Chapter 11

... represents ownership in the corporation. A portion of stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit ...

... represents ownership in the corporation. A portion of stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit ...

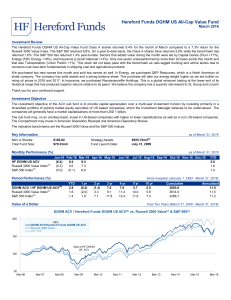

Evaluating Asset Management firms by using the Divi- Ha Bui

... Some view investing in stock markets as gambling. However, there have been examples of investors who were able to beat the market by using different investment strategies. In Finland, previous studies have shown the ability of value-investing to earn higher returns compared to the market or to growt ...

... Some view investing in stock markets as gambling. However, there have been examples of investors who were able to beat the market by using different investment strategies. In Finland, previous studies have shown the ability of value-investing to earn higher returns compared to the market or to growt ...

Sample Problem

... YesMatching, conservatism It is unlikely that Roy will pay, or be able to pay, his debt. It should be charged off and matched against current income. ...

... YesMatching, conservatism It is unlikely that Roy will pay, or be able to pay, his debt. It should be charged off and matched against current income. ...

Chapter 11

... Valuation of Common Stock • Both of these approaches and all of these valuation techniques have several common factors: – All of them are significantly affected by investor’s required rate of return on the stock because this rate becomes the discount rate or is a major component of the discount rat ...

... Valuation of Common Stock • Both of these approaches and all of these valuation techniques have several common factors: – All of them are significantly affected by investor’s required rate of return on the stock because this rate becomes the discount rate or is a major component of the discount rat ...

REVIEW NOTES FOR THE SECOND BENCHMARK TEST

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...

... The inverse or opposite operation for addition is subtraction, for subtraction it is addition. The inverse or opposite operation for multiplication is division, for division it is multiplication. Remember: when inequalities are multiplied or divided by negative numbers, the inequality symbol reverse ...

Cash payment

... The Market Rate of Interest The selling price of a bond is determined by the market rate of interest versus the stated rate of interest. Interest ...

... The Market Rate of Interest The selling price of a bond is determined by the market rate of interest versus the stated rate of interest. Interest ...

Corporate Finance

... bond rate at that time was 2.75%. Using an estimated equity risk premium of 5.76%, we estimated the cost of equity for Disney to be 8.52%: Cost of Equity = 2.75% + 1.0013(5.76%) = 8.52% Disney’s bond rating in May 2009 was A, and based on this rating, the estimated pretax cost of debt for Disney is ...

... bond rate at that time was 2.75%. Using an estimated equity risk premium of 5.76%, we estimated the cost of equity for Disney to be 8.52%: Cost of Equity = 2.75% + 1.0013(5.76%) = 8.52% Disney’s bond rating in May 2009 was A, and based on this rating, the estimated pretax cost of debt for Disney is ...

Credit Risk: Individual Loan Risk Chapter 11

... decision rather than adjustments to the rate. » Credit rationing. » If accepted, customers sorted by loan quantity. ...

... decision rather than adjustments to the rate. » Credit rationing. » If accepted, customers sorted by loan quantity. ...

FORM No. IV

... [Indicate the details of an asset, only if the total current value of any particular asset in any particular category (e.g. furniture fixtures, electronic equipments etc. ) exceeds two months basic pay or Rs. 1.00 lakh as the case may be) ...

... [Indicate the details of an asset, only if the total current value of any particular asset in any particular category (e.g. furniture fixtures, electronic equipments etc. ) exceeds two months basic pay or Rs. 1.00 lakh as the case may be) ...

Idiosyncratic risk and long-run stock performance following

... combined offers of several classes of securities (i.e., unit offers of stocks and warrants); (7) nondomestic and simultaneous domestic-international offers; (8) pure secondary offerings; and (9) SEOs lacking CRSP data to compute idiosyncratic volatility for the year ...

... combined offers of several classes of securities (i.e., unit offers of stocks and warrants); (7) nondomestic and simultaneous domestic-international offers; (8) pure secondary offerings; and (9) SEOs lacking CRSP data to compute idiosyncratic volatility for the year ...