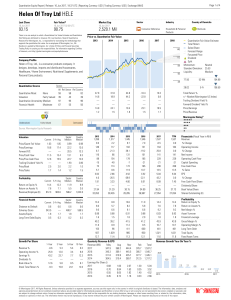

Helen Of Troy Ltd HELE

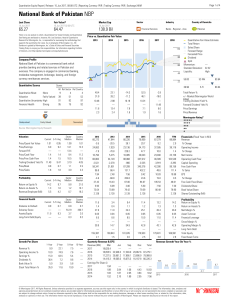

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

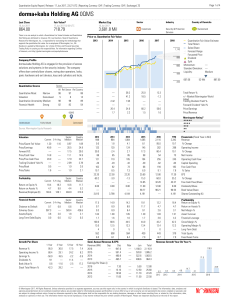

dorma+kaba Holding AG 0QMS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

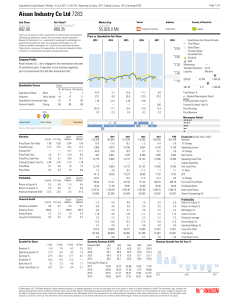

Aisan Industry Co Ltd 7283

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

chapter 1 - Test Bank wizard

... Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? a. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" o ...

... Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? a. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" o ...

Conference Program

... the roundtables give you the opportunity to interact directly with a mix of traditional, alternative and OCIO consulting professionals. Enjoy direct dialogue with experienced individuals as they provide organizational updates, discuss strategic research themes, and share search activity specific to ...

... the roundtables give you the opportunity to interact directly with a mix of traditional, alternative and OCIO consulting professionals. Enjoy direct dialogue with experienced individuals as they provide organizational updates, discuss strategic research themes, and share search activity specific to ...

word - Investor Relations Solutions

... The Company is committed to bringing the best personal computing, portable digital music and mobile communication experience to students, educators, creative professionals, businesses, government agencies, and consumers through its innovative hardware, software, peripherals, services, and Internet o ...

... The Company is committed to bringing the best personal computing, portable digital music and mobile communication experience to students, educators, creative professionals, businesses, government agencies, and consumers through its innovative hardware, software, peripherals, services, and Internet o ...

The Development of Collective Investment

... laws to cater for companies with variable capital may be required in some jurisdictions before Open Ended CISs become operational. ...

... laws to cater for companies with variable capital may be required in some jurisdictions before Open Ended CISs become operational. ...

Understanding Investor Preferences for Mutual Fund Information

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

Chapter 6-Risk and Rates of Return

... Market related Risk - Risk due to overall market conditions Stock price is likely to rise if overall stock market is ...

... Market related Risk - Risk due to overall market conditions Stock price is likely to rise if overall stock market is ...

Should Dark Pools Improve Upon Visible Quotes

... In recent years, concern has arisen over the impact of dark trading on equity markets. While dark markets are not new, this concern comes as they begin to match the electronic organization of visible markets, and gain a significant share of global trading activity. The CFA Institute estimates that ...

... In recent years, concern has arisen over the impact of dark trading on equity markets. While dark markets are not new, this concern comes as they begin to match the electronic organization of visible markets, and gain a significant share of global trading activity. The CFA Institute estimates that ...

The Unintended Consequences of Banning Derivatives in Asset Management Alessandro Beber, Cass Business School Christophe Pérignon, HEC Paris

... are used to hedge away some risks, whereas other derivatives strategies are used to increase risk exposures. Thus, the derivatives market is a global market for risks, allowing for risk transfers and leading to a better allocation of risks among economic agents. A derivative is a financial instru ...

... are used to hedge away some risks, whereas other derivatives strategies are used to increase risk exposures. Thus, the derivatives market is a global market for risks, allowing for risk transfers and leading to a better allocation of risks among economic agents. A derivative is a financial instru ...

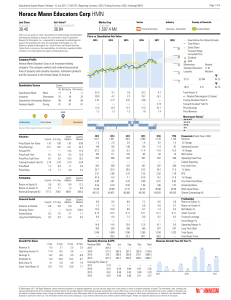

Horace Mann Educators Corp HMN

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

February 9, 1994 File No. ---------------

... Each share of Seagull's common stock has the same rights and privileges as every other share. The holders of common stock are entitled to one vote for each share held and are not permitted to cumulate their votes in electing directors. The holders of a majority of the outstanding shares of common s ...

... Each share of Seagull's common stock has the same rights and privileges as every other share. The holders of common stock are entitled to one vote for each share held and are not permitted to cumulate their votes in electing directors. The holders of a majority of the outstanding shares of common s ...

The Asset Allocation Debate: Provocative Questions

... security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important ...

... security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important ...

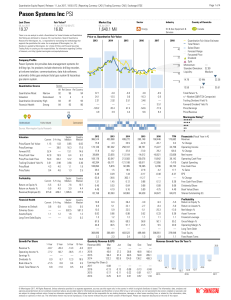

Pason Systems Inc PSI

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Document

... Recall from the preceding chapter: Investment is important for long-run economic growth. Hence, budget deficits reduce the economy’s growth rate and future standard of living. © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for u ...

... Recall from the preceding chapter: Investment is important for long-run economic growth. Hence, budget deficits reduce the economy’s growth rate and future standard of living. © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for u ...

Managed Futures: Portfolio Diversification Opportunities

... As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign ...

... As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign ...

The UK equity gap

... 1. What is the equity gap? Defining the equity gap In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held acro ...

... 1. What is the equity gap? Defining the equity gap In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held acro ...

hussman strategic dividend value fund

... hedges using indices that are correlated, though perhaps imperfectly, with the stocks owned by the Fund. These may include indices of U.S. stocks such as the Standard & Poor’s 500 Index. The portion of the Fund’s net assets invested at any given time in securities of issuers engaged in industries wi ...

... hedges using indices that are correlated, though perhaps imperfectly, with the stocks owned by the Fund. These may include indices of U.S. stocks such as the Standard & Poor’s 500 Index. The portion of the Fund’s net assets invested at any given time in securities of issuers engaged in industries wi ...

Forthcoming, Journal of Empirical Finance Measuring The Market

... Hedge funds often employ opportunistic trading strategies on a leveraged basis. It is natural to find their footprints in most major market events. A "small bet" by large hedge funds can be a sizeable transaction that can impact a market. This study estimates hedge fund exposures during a number of ...

... Hedge funds often employ opportunistic trading strategies on a leveraged basis. It is natural to find their footprints in most major market events. A "small bet" by large hedge funds can be a sizeable transaction that can impact a market. This study estimates hedge fund exposures during a number of ...

Do Stocks with Dividends Outperform the Market during Recessions?

... payers. The more interesting result was that, whatever their characteristics, firms had simply become less likely to pay dividends. The evidence that firms had become less likely to pay dividends, even after controlling for characteristics, suggested that the perceived benefits of dividends had decl ...

... payers. The more interesting result was that, whatever their characteristics, firms had simply become less likely to pay dividends. The evidence that firms had become less likely to pay dividends, even after controlling for characteristics, suggested that the perceived benefits of dividends had decl ...

Nov 2012 Visitors Program_v3

... • Use the viewpoint to guide industry and sector outlooks • Drill-down to select best securities in each sector ...

... • Use the viewpoint to guide industry and sector outlooks • Drill-down to select best securities in each sector ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.