Nov 2012 Visitors Program_v3

... • Use the viewpoint to guide industry and sector outlooks • Drill-down to select best securities in each sector ...

... • Use the viewpoint to guide industry and sector outlooks • Drill-down to select best securities in each sector ...

Speaking of the Short-term: Disclosure Horizon and Capital Market

... meet short-term capital-market benchmarks. We find that short-term oriented firms have higher absolute discretionary accruals, exhibit higher likelihood of just beating analyst forecasts, higher likelihood of reporting small positive earnings, and a higher likelihood of being the subject of an Acco ...

... meet short-term capital-market benchmarks. We find that short-term oriented firms have higher absolute discretionary accruals, exhibit higher likelihood of just beating analyst forecasts, higher likelihood of reporting small positive earnings, and a higher likelihood of being the subject of an Acco ...

Avangrid, Inc. - corporate

... consolidated balance sheets, condensed consolidated statements of income, comprehensive income, cash flows and changes in equity for the interim periods described herein. All such adjustments are of a normal and recurring nature, except as otherwise disclosed. The results for the three months ended ...

... consolidated balance sheets, condensed consolidated statements of income, comprehensive income, cash flows and changes in equity for the interim periods described herein. All such adjustments are of a normal and recurring nature, except as otherwise disclosed. The results for the three months ended ...

Price Volatility and Investor Behavior in an Overlapping

... upon depreciation, while contrarians trade in the opposite way. Such trading behavior is found in both domestic and international markets. Moreover, prices in these markets are found to vary much more than the stocks’ fundamental values. Indeed in some markets, prices exhibit common movements that a ...

... upon depreciation, while contrarians trade in the opposite way. Such trading behavior is found in both domestic and international markets. Moreover, prices in these markets are found to vary much more than the stocks’ fundamental values. Indeed in some markets, prices exhibit common movements that a ...

Mutual Fund Assets and Flows in 1999

... Brian Reid is Assistant Vice President and Director of Industry and Financial Analysis, and Kimberlee Millar is Senior Research Associate at the Investment Company Institute. Travis Lee provided research support, and Janet Thompson-Conley prepared the charts and tables. ...

... Brian Reid is Assistant Vice President and Director of Industry and Financial Analysis, and Kimberlee Millar is Senior Research Associate at the Investment Company Institute. Travis Lee provided research support, and Janet Thompson-Conley prepared the charts and tables. ...

Stock market performance and pension fund investment policy

... asset classes) relative to the pension fund’s strategic asset allocation, motivated by short-term return expectations. Note that where no equity trades are made, it is difficult to distinguish between free float (passive management) and market timing (active management), as allowing the asset alloca ...

... asset classes) relative to the pension fund’s strategic asset allocation, motivated by short-term return expectations. Note that where no equity trades are made, it is difficult to distinguish between free float (passive management) and market timing (active management), as allowing the asset alloca ...

Do Precious Metals Shine in the Portfolio of a Nordic

... point of 2011 (before which gold price had been booming for ten years). These relatively They define a hedge as an asset that is, on average, negatively correlated with the stock market. A safe haven is defined as an asset that is negatively correlated with the stock market particularly in stressed ...

... point of 2011 (before which gold price had been booming for ten years). These relatively They define a hedge as an asset that is, on average, negatively correlated with the stock market. A safe haven is defined as an asset that is negatively correlated with the stock market particularly in stressed ...

Wolverine Form 10-K 2014

... This document contains “forward-looking statements,” which are statements relating to future, not past, events. In this context, forward-looking statements often address management’s current beliefs, assumptions, expectations, estimates and projections about future business and financial performance ...

... This document contains “forward-looking statements,” which are statements relating to future, not past, events. In this context, forward-looking statements often address management’s current beliefs, assumptions, expectations, estimates and projections about future business and financial performance ...

Do Firms Choose Their Stock Liquidity? A Study of Innovative Firms

... section and describe the data in §3. §4 presents evidence on innovative firms having greater stock liquidity and §5 shows the specific actions that these firms take in order to maintain or improve their stock liquidity. In §6, we show the characteristics of debt issued by firms that have more liquid ...

... section and describe the data in §3. §4 presents evidence on innovative firms having greater stock liquidity and §5 shows the specific actions that these firms take in order to maintain or improve their stock liquidity. In §6, we show the characteristics of debt issued by firms that have more liquid ...

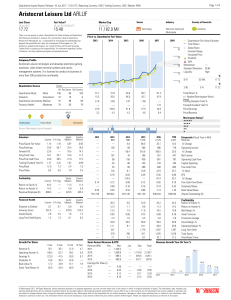

Aristocrat Leisure Ltd ARLUF

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

An Expanded Study on the Stock Market Temperature

... Hsee and Welch (2001) provided theories linking mood and feelings to general decision-making, while Etzioni (1988), Romer (2000), and Hanock (2002) established the importance of emotions in economic decision-making. Mehra and Sah (2002) showed theoretically that the emotional state of investors will ...

... Hsee and Welch (2001) provided theories linking mood and feelings to general decision-making, while Etzioni (1988), Romer (2000), and Hanock (2002) established the importance of emotions in economic decision-making. Mehra and Sah (2002) showed theoretically that the emotional state of investors will ...

Reliance SIP Insure

... The alternative is to : Follow markets very closely Time your entry and exit very well ...

... The alternative is to : Follow markets very closely Time your entry and exit very well ...

Les faits

... jointly propose be issued against the Respondents. The sanctions are as follows: 1. pursuant to paragraph 184(1)(c)(ii) of the Act, the Respondent shall cease trading in all securities, other than those beneficially owned directly by him, for a period of 10 years; 2. pursuant to paragraph 184(1)(d) ...

... jointly propose be issued against the Respondents. The sanctions are as follows: 1. pursuant to paragraph 184(1)(c)(ii) of the Act, the Respondent shall cease trading in all securities, other than those beneficially owned directly by him, for a period of 10 years; 2. pursuant to paragraph 184(1)(d) ...

quarterly statement - Prepared Insurance

... The officers of this reporting entity being duly sworn, each depose and say that they are the described officers of said reporting entity, and that on the reporting period stated above, all of the herein described assets were the absolute property of the said reporting entity, free and clear from an ...

... The officers of this reporting entity being duly sworn, each depose and say that they are the described officers of said reporting entity, and that on the reporting period stated above, all of the herein described assets were the absolute property of the said reporting entity, free and clear from an ...

Demystifying Responsible Investment Performance

... The threat of climate change impacts, the struggle to protect fragile ecosystems, and the under standing of the economic and social impacts of urban and industrial pollution, have embedded themselves in the global public perception as real and present dangers. We cannot underestimate the influence ...

... The threat of climate change impacts, the struggle to protect fragile ecosystems, and the under standing of the economic and social impacts of urban and industrial pollution, have embedded themselves in the global public perception as real and present dangers. We cannot underestimate the influence ...

The Performance of Firms Post Dividend Announcement: A

... conclusion on what increased dividend announcement try to convey from Malaysian perspective. The significance of investigating on what increased dividend convey, lies in informing investors about the Malaysian listed companies life cycle stage, either maturity stage or growth stage , it might be eve ...

... conclusion on what increased dividend announcement try to convey from Malaysian perspective. The significance of investigating on what increased dividend convey, lies in informing investors about the Malaysian listed companies life cycle stage, either maturity stage or growth stage , it might be eve ...

Momentum, Acceleration, and Reversal

... We show that accelerated returns also increase the likelihood of individual stock drops, and thus provide explanations for poor future performance. A natural question to ask is how accelerated price increases can occur. One possibility is the well-known positive feedback process or herding, which ca ...

... We show that accelerated returns also increase the likelihood of individual stock drops, and thus provide explanations for poor future performance. A natural question to ask is how accelerated price increases can occur. One possibility is the well-known positive feedback process or herding, which ca ...

Volatility patterns of CDS, bond and stock markets before and during

... bond yield spreads. Over the recent years, the market for credit default swaps (CDS) has received special attention, as CDS should reflect pure credit risk of borrowers. The relationship between those variables has been subject to many empirical studies with the result that in particular the stock a ...

... bond yield spreads. Over the recent years, the market for credit default swaps (CDS) has received special attention, as CDS should reflect pure credit risk of borrowers. The relationship between those variables has been subject to many empirical studies with the result that in particular the stock a ...

In Short Supply: Short‐Sellers and Stock Returns

... One aspect of equity markets that has received increased academic attention in recent years is the informational role played by short sellers. Prior studies have consistently demonstrated that, as a group, short‐sellers are sophisticated investors with superior information processing capabilities ...

... One aspect of equity markets that has received increased academic attention in recent years is the informational role played by short sellers. Prior studies have consistently demonstrated that, as a group, short‐sellers are sophisticated investors with superior information processing capabilities ...

Inequality, stock market participation, and the equity premium

... is finite, when the wealthy hold relatively more stocks, the middle and lower classes must hold relatively less, therefore the participation rate falls. Holding all else equal, a distribution with more inequality requires less participation. At the other extreme, when only participation costs decrea ...

... is finite, when the wealthy hold relatively more stocks, the middle and lower classes must hold relatively less, therefore the participation rate falls. Holding all else equal, a distribution with more inequality requires less participation. At the other extreme, when only participation costs decrea ...

Changes and Losses to Index Fund Investors

... companies from its indices based on market capitalization, stock price, and float (number of shares available to the investing public). To pick a candidate company for inclusion, Standard & Poor’s uses four criteria, which are not always strictly enforced: The company must have sufficient liquidity; ...

... companies from its indices based on market capitalization, stock price, and float (number of shares available to the investing public). To pick a candidate company for inclusion, Standard & Poor’s uses four criteria, which are not always strictly enforced: The company must have sufficient liquidity; ...

words

... efficiently than silicon amplifiers, and battery life is a critical system feature in these portable applications. Alpha has been a leader in innovative GaAs power amplifier ICs. During the fourth quarter of fiscal 2000, we became the first merchant semiconductor company to offer a 3 volt, high-effi ...

... efficiently than silicon amplifiers, and battery life is a critical system feature in these portable applications. Alpha has been a leader in innovative GaAs power amplifier ICs. During the fourth quarter of fiscal 2000, we became the first merchant semiconductor company to offer a 3 volt, high-effi ...

Enron Corporation

... $110 million form the deal, even though analysts questioned the technical viability and market demand of the service. • When the net work failed to work, Blockbuster pulled out of the contract, Enron continued to recognized future profits, even though the deal resulted in a loss. ...

... $110 million form the deal, even though analysts questioned the technical viability and market demand of the service. • When the net work failed to work, Blockbuster pulled out of the contract, Enron continued to recognized future profits, even though the deal resulted in a loss. ...

4212201 WFA Hedge Fund Guide

... Risks of investing in hedge funds and funds of hedge funds Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering do ...

... Risks of investing in hedge funds and funds of hedge funds Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering do ...

united states securities and exchange commission - corporate

... $310 million over a five-year period; however, during the third quarter of fiscal 2007, PG&E announced its plans to request proposals from a small group of vendors in order to evaluate such vendors’ ability to address potential future functionality requirements for the electric portion of its servic ...

... $310 million over a five-year period; however, during the third quarter of fiscal 2007, PG&E announced its plans to request proposals from a small group of vendors in order to evaluate such vendors’ ability to address potential future functionality requirements for the electric portion of its servic ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.