Do Chinese Investors Get What They Don`t Pay For? Expense

... relatively new, and so far research on China’s fund industry is not abundant enough to paint a complete picture. After the financial crisis in 2008, China's fund market has been gradually recovering, and open-end mutual funds are now playing an important role in China's fund market. The first open-e ...

... relatively new, and so far research on China’s fund industry is not abundant enough to paint a complete picture. After the financial crisis in 2008, China's fund market has been gradually recovering, and open-end mutual funds are now playing an important role in China's fund market. The first open-e ...

Download paper (PDF)

... variable to identify the effect of exogenous price changes, but instead focus on the equilibrium correlation between the valuation multiples and takeovers. Note that, in the behavioral corporate finance literature, temporary overvaluation often improves a firm’s fundamental value as it allows manager ...

... variable to identify the effect of exogenous price changes, but instead focus on the equilibrium correlation between the valuation multiples and takeovers. Note that, in the behavioral corporate finance literature, temporary overvaluation often improves a firm’s fundamental value as it allows manager ...

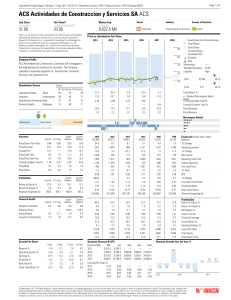

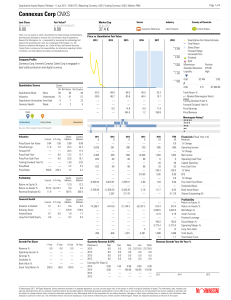

ACS Actividades de Construccion y Servicios SA ACS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Venture Capital Fund

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

The Effectiveness of Sell Discipline Strategies in Institutional Portfolios

... have noted the certainty premium, and attributed it to the idea that individuals prefer lower variability. This does not address negative prospects however, as the respondents actually preferred the option with worse expected value and higher variability. In addition to the empirical findings throug ...

... have noted the certainty premium, and attributed it to the idea that individuals prefer lower variability. This does not address negative prospects however, as the respondents actually preferred the option with worse expected value and higher variability. In addition to the empirical findings throug ...

Consumer Negative Voice and Firm

... the brand equity literature (Keller 2003; Keller and Aaker 1993). According to this literature, a firm’s good brand image and strong public reputation represent another critical intangible asset that has financial content and long-term value. It is likely that in the competitive marketplace, a large ...

... the brand equity literature (Keller 2003; Keller and Aaker 1993). According to this literature, a firm’s good brand image and strong public reputation represent another critical intangible asset that has financial content and long-term value. It is likely that in the competitive marketplace, a large ...

The Market for Corporate Control

... in this system have relatively little use for detailed knowledge about the firm or the plans of competing management teams beyond that normally used for the market’s price setting function. Stockholders have no loyalty to incumbent managers; they simply choose the highest dollar value offer from tho ...

... in this system have relatively little use for detailed knowledge about the firm or the plans of competing management teams beyond that normally used for the market’s price setting function. Stockholders have no loyalty to incumbent managers; they simply choose the highest dollar value offer from tho ...

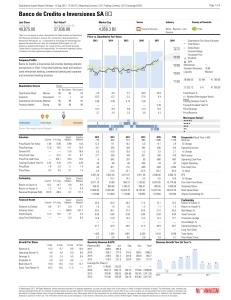

Banco de Credito e Inversiones SA BCI

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

MEFA II Mid Question bank

... Manohar started business with capital of Rs.100000 Purchased goods worth of Rs.10000 Sold goods to gopi Rs.20000 Cash purchases Rs.20000 Paid to salaries Rs. 5000 Sold for cash Rs.15000 Bought furniture paid by cheque 2000 Cash paid to ravi Rs.9800 Received cash from gopi Rs.19500 (discount received ...

... Manohar started business with capital of Rs.100000 Purchased goods worth of Rs.10000 Sold goods to gopi Rs.20000 Cash purchases Rs.20000 Paid to salaries Rs. 5000 Sold for cash Rs.15000 Bought furniture paid by cheque 2000 Cash paid to ravi Rs.9800 Received cash from gopi Rs.19500 (discount received ...

Documento gestión proyecto

... Faster and more aggressive acquisition policy. As already mention in this report, Roca finances all its acquisitions with their funds, while competitors, even like AS (that is listed in Stock Exchange), are not so conservative with debt ratios. This fact can provide Roca’s competitors with extra fun ...

... Faster and more aggressive acquisition policy. As already mention in this report, Roca finances all its acquisitions with their funds, while competitors, even like AS (that is listed in Stock Exchange), are not so conservative with debt ratios. This fact can provide Roca’s competitors with extra fun ...

Herding Behavior - Evidence from Portuguese Mutual Funds

... their trading accounts for an increasing share of total trading. More and more, institutional investors trading strategies impact prices. Institutional investors may have incentives to buy and sell the same stocks at the same time. This convergence in trading strategies is commonly known as herding. ...

... their trading accounts for an increasing share of total trading. More and more, institutional investors trading strategies impact prices. Institutional investors may have incentives to buy and sell the same stocks at the same time. This convergence in trading strategies is commonly known as herding. ...

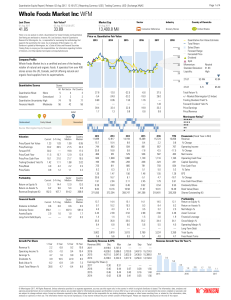

Whole Foods Market Inc WFM

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

UP TO 14501236 SHARES Class A Common Stock - corporate

... This prospectus relates to the offer and sale from time to time by the selling stockholders identified in this prospectus of up to an aggregate of 14,501,236 shares of Class A common stock, par value $0.01 per share, of The Habit Restaurants, Inc. Out of the 14,501,236 shares of Class A common stock ...

... This prospectus relates to the offer and sale from time to time by the selling stockholders identified in this prospectus of up to an aggregate of 14,501,236 shares of Class A common stock, par value $0.01 per share, of The Habit Restaurants, Inc. Out of the 14,501,236 shares of Class A common stock ...

The Case for Strategic Convertible Allocations

... fixed-income-like in others. Because of their structural complexities, convertible securities demand active management within asset allocations. Often, convertible securities are thought of as a single asset class; this ignores the variations within the convertible universe. Our approach is to use d ...

... fixed-income-like in others. Because of their structural complexities, convertible securities demand active management within asset allocations. Often, convertible securities are thought of as a single asset class; this ignores the variations within the convertible universe. Our approach is to use d ...

The Hedge Fund Landscape

... A managed fund is fully customizable, and not only offers the investor many of the positive characteristics of a managed account, but also, if sensibly structured, can reduce the burden on managers and, therefore, also adverse selection bias. One simplified way to think of it is as a separately mana ...

... A managed fund is fully customizable, and not only offers the investor many of the positive characteristics of a managed account, but also, if sensibly structured, can reduce the burden on managers and, therefore, also adverse selection bias. One simplified way to think of it is as a separately mana ...

Deterrence - Investor Voice, Securities Regulation in Canada

... September 2002 to form the Insider Trading Task Force with the objective of evaluating how best to address illegal insider trading on Canadian capital markets. Illegal insider trading involves the buying or selling of a security while in possession of undisclosed material information about the issue ...

... September 2002 to form the Insider Trading Task Force with the objective of evaluating how best to address illegal insider trading on Canadian capital markets. Illegal insider trading involves the buying or selling of a security while in possession of undisclosed material information about the issue ...

Guidance Note 1/05 - Central Bank of Ireland

... - The main categories of financial instruments e.g. bonds, equities, other collective investment undertakings, cash deposits, money market instruments, financial derivative instruments; - References to bonds should indicate whether they are corporate or government, their duration and rating; - Infor ...

... - The main categories of financial instruments e.g. bonds, equities, other collective investment undertakings, cash deposits, money market instruments, financial derivative instruments; - References to bonds should indicate whether they are corporate or government, their duration and rating; - Infor ...

derivatives - Bombay Chartered Accountants` Society

... Transaction Cost Valuation at the year end Time of accrual of premium for writer Pradip Kapasi & Co. Chartered Accountants ...

... Transaction Cost Valuation at the year end Time of accrual of premium for writer Pradip Kapasi & Co. Chartered Accountants ...

Russell Investments` 2012 Global Survey on Alternative Investing

... Based on Survey results and the work we do with clients, it is clear to us that institutional investors are successfully using alternatives to pursue specific investment objectives. At the same time, investors face myriad challenges in assessing the range of alternatives across an expanding spectrum ...

... Based on Survey results and the work we do with clients, it is clear to us that institutional investors are successfully using alternatives to pursue specific investment objectives. At the same time, investors face myriad challenges in assessing the range of alternatives across an expanding spectrum ...

A Proposal to Limit the Anti-Competitive Power of Institutional Investors

... owners have financial interests related to the firm’s activities other than the profits will typically instruct firms to maximize outcomes other than profits. 9 Julio Rotemberg noted, in an unpublished and poorly remembered paper, that this trend might imply that the diversification, which investors ...

... owners have financial interests related to the firm’s activities other than the profits will typically instruct firms to maximize outcomes other than profits. 9 Julio Rotemberg noted, in an unpublished and poorly remembered paper, that this trend might imply that the diversification, which investors ...

Margin Credit and Stock Return Predictability

... invests 100% in the S&P 500 or 100% in the risk free asset. This strategy can be implemented even by small investors who do not trade in the S&P 500 futures market. We find that this long-only strategy also out-performs the simple buy-and-hold strategy by a large margin. It generates a Sharpe Ratio ...

... invests 100% in the S&P 500 or 100% in the risk free asset. This strategy can be implemented even by small investors who do not trade in the S&P 500 futures market. We find that this long-only strategy also out-performs the simple buy-and-hold strategy by a large margin. It generates a Sharpe Ratio ...

Word - corporate

... directly or indirectly, to a parent. This standard requires, among other items, that a noncontrolling interest be included in the consolidated balance sheet within equity separate from the parent’s equity; consolidated net income to be reported at amounts inclusive of both the parent’s and noncontro ...

... directly or indirectly, to a parent. This standard requires, among other items, that a noncontrolling interest be included in the consolidated balance sheet within equity separate from the parent’s equity; consolidated net income to be reported at amounts inclusive of both the parent’s and noncontro ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.