Atlantia Low risk, high return

... end-2008 for Autostrade per l’Italia or ASPI, representing ca. 90% of Atlantia Group’s revenues and EBITDA) of the first update of the relevant concessionaire’s financial plan, or, upon the first periodical revision of the concession contract subsequent to the entry into force of the new legislation ...

... end-2008 for Autostrade per l’Italia or ASPI, representing ca. 90% of Atlantia Group’s revenues and EBITDA) of the first update of the relevant concessionaire’s financial plan, or, upon the first periodical revision of the concession contract subsequent to the entry into force of the new legislation ...

The art of Japanese candlestick charting

... popularity among today's traders. The Japanese are credited for developing the candlestick techniques still in use today. These techniques originated in the technical charting methods used as far back as the 1600’s. Over 100 years before the West developed the bar, point and figure analysis systems, ...

... popularity among today's traders. The Japanese are credited for developing the candlestick techniques still in use today. These techniques originated in the technical charting methods used as far back as the 1600’s. Over 100 years before the West developed the bar, point and figure analysis systems, ...

The Art of Japanese Candlestick Charting By Brett Fogle

... popularity among today's traders. The Japanese are credited for developing the candlestick techniques still in use today. These techniques originated in the technical charting methods used as far back as the 1600’s. Over 100 years before the West developed the bar, point and figure analysis systems, ...

... popularity among today's traders. The Japanese are credited for developing the candlestick techniques still in use today. These techniques originated in the technical charting methods used as far back as the 1600’s. Over 100 years before the West developed the bar, point and figure analysis systems, ...

Market Efficiency: A Theoretical Distinction and So What?

... class, how to price a new security, or how to price risky assets in a merger or acquisition. The CAPM starts with some assumptions about investors and markets and deduces its dramatic conclusions from these assumptions. First, it assumes that investors seek mean–variance efficient portfolios; in oth ...

... class, how to price a new security, or how to price risky assets in a merger or acquisition. The CAPM starts with some assumptions about investors and markets and deduces its dramatic conclusions from these assumptions. First, it assumes that investors seek mean–variance efficient portfolios; in oth ...

The Market Reaction to Stock Split Announcements

... Another reason why stock splits have been considered dubious information events, relates to the difficulty in identifying the cost associated with the stock split, which is required for a credible signal. However, if managers follow a rule where they are more likely to split their firm’s stock when ...

... Another reason why stock splits have been considered dubious information events, relates to the difficulty in identifying the cost associated with the stock split, which is required for a credible signal. However, if managers follow a rule where they are more likely to split their firm’s stock when ...

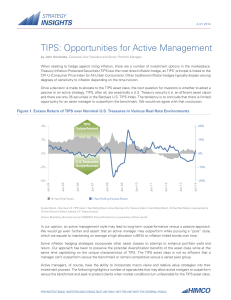

TIPS: Opportunities for Active Management

... which we equate to maintaining on average a high allocation (≥90%) to inflation-linked bonds over time. Some inflation hedging strategies incorporate other asset classes to attempt to enhance portfolio yield and return. Our approach has been to preserve the potential diversification benefits of the ...

... which we equate to maintaining on average a high allocation (≥90%) to inflation-linked bonds over time. Some inflation hedging strategies incorporate other asset classes to attempt to enhance portfolio yield and return. Our approach has been to preserve the potential diversification benefits of the ...

Chapter 23- Real Estate Investment Trusts

... Problems with FFO, AFFO, etc., The principle underlying “The FFO Movement” is valid: Cash flow matters more than accounting numbers. However, in practice several problems arose with the use of FFO: • The REIT industry could never agree on a single, mandatory standard definition of how to define and ...

... Problems with FFO, AFFO, etc., The principle underlying “The FFO Movement” is valid: Cash flow matters more than accounting numbers. However, in practice several problems arose with the use of FFO: • The REIT industry could never agree on a single, mandatory standard definition of how to define and ...

DOC - Investor Relations

... qualified by all such risk factors and other cautionary statements, which could cause the Company's actual Condition and Results to differ materially from those estimated or desired and included in the Company's forward-looking statements or other information. Although the Company believes that its ...

... qualified by all such risk factors and other cautionary statements, which could cause the Company's actual Condition and Results to differ materially from those estimated or desired and included in the Company's forward-looking statements or other information. Although the Company believes that its ...

Risk Perceptions, Directional Goals and the Link between Risk and

... participants is assigned to consider a prospective investment in the firm’s stock (and thus do not have a directional goal). We also vary the observability of the inputs to a fair value estimate (i.e., Level 2 and Level 3 in the fair value hierarchy in ASC 820 [FASB 2014]). Level 3 estimates are th ...

... participants is assigned to consider a prospective investment in the firm’s stock (and thus do not have a directional goal). We also vary the observability of the inputs to a fair value estimate (i.e., Level 2 and Level 3 in the fair value hierarchy in ASC 820 [FASB 2014]). Level 3 estimates are th ...

Gold ETF - Sangai Investments

... The alternative is to : Follow markets very closely Time your entry and exit very well ...

... The alternative is to : Follow markets very closely Time your entry and exit very well ...

The Initial Public Offering Handbook

... Benefits and Costs of the IPO and Being Public Introduction An initial public offering is the realization of a dream for many entrepreneurs, executives, board members and stockholders, a singular achievement that demonstrates their success in building a strong business and creating value for owners, ...

... Benefits and Costs of the IPO and Being Public Introduction An initial public offering is the realization of a dream for many entrepreneurs, executives, board members and stockholders, a singular achievement that demonstrates their success in building a strong business and creating value for owners, ...

Investor Scale and Performance in Private Equity Investments

... assessments of absolute PE performance than studies that take advantage of fund-level cash flow information. At the same time, data on the overall PE portfolios is what is required to assess if there are different returns between larger and smaller PE investors, particularly because most investors d ...

... assessments of absolute PE performance than studies that take advantage of fund-level cash flow information. At the same time, data on the overall PE portfolios is what is required to assess if there are different returns between larger and smaller PE investors, particularly because most investors d ...

Risk and Long-Run IPO Returns - Berkeley-Haas

... following the IPO. To directly test the hypothesis that the greater liquidity lowers expected stock return, we add a liquidity risk factor to a model containing the three factors of Fama and French (1993) as well as a momentum factor [Carhart (1997)]. To our knowledge, this is the rst empirical as ...

... following the IPO. To directly test the hypothesis that the greater liquidity lowers expected stock return, we add a liquidity risk factor to a model containing the three factors of Fama and French (1993) as well as a momentum factor [Carhart (1997)]. To our knowledge, this is the rst empirical as ...

Changes in Ownership Structure

... behavior—the consumption of perquisites. Managers can express such preferences, Fields (1988) suggested, only if there exist positive monitoring costs for the owners of firms and market imperfections in the products market. Alchian and Demsetz (1972) argued that managers will act in their own best i ...

... behavior—the consumption of perquisites. Managers can express such preferences, Fields (1988) suggested, only if there exist positive monitoring costs for the owners of firms and market imperfections in the products market. Alchian and Demsetz (1972) argued that managers will act in their own best i ...

In Millions

... assets of the subsidiary and also the parent's ownership interest in those assets (the investment in subsidiary account). The consolidated statements should not show both amounts. The investment in subsidiary account is deleted by the eliminating entry along with the subsidiary’s owners’ equity. Con ...

... assets of the subsidiary and also the parent's ownership interest in those assets (the investment in subsidiary account). The consolidated statements should not show both amounts. The investment in subsidiary account is deleted by the eliminating entry along with the subsidiary’s owners’ equity. Con ...

Endogenous Tick Sizes, Bid-Ask Spreads, Depth, and Trading Volumes

... in local currency, SET tick sizes for different price groups (in Thai baht). Also shown are relative tick sizes, i.e., the ratio of the tick size to share price. The table shows the median, minimum, and maximum tick-to-price ratios. It becomes evident that the SET expanded the number of price ranges ...

... in local currency, SET tick sizes for different price groups (in Thai baht). Also shown are relative tick sizes, i.e., the ratio of the tick size to share price. The table shows the median, minimum, and maximum tick-to-price ratios. It becomes evident that the SET expanded the number of price ranges ...

Financial Reporting Quality and Information Asymmetry in Europe

... asymmetry and lower financial market liquidity. These findings are consistent with differences in the composition of information between public and private information affecting information risk Easley and O’Hara (2004), where poor or less public information implies more information asymmetry. At fi ...

... asymmetry and lower financial market liquidity. These findings are consistent with differences in the composition of information between public and private information affecting information risk Easley and O’Hara (2004), where poor or less public information implies more information asymmetry. At fi ...

Dominated assets, the expected utility maxim, and mean

... dominated asset is included in the menu of investment opportunities. Asset A dominates asset B if (1) the cash payments to A are at least as high as those to B and strictly greater than the payoff to B in at least one possible state outcome, and (2) if the current price of A is less than or equal to ...

... dominated asset is included in the menu of investment opportunities. Asset A dominates asset B if (1) the cash payments to A are at least as high as those to B and strictly greater than the payoff to B in at least one possible state outcome, and (2) if the current price of A is less than or equal to ...

Español - Investor Relations Solutions

... categorías fuertes del "hágalo usted mismo", como la pintura. A lo largo de este ciclo económico redujimos los gastos para mantener la rentabilidad a medida que disminuían las ventas, manteniendo al mismo tiempo un enfoque agudo en la búsqueda del equilibrio entre el control cuidadoso de los gastos ...

... categorías fuertes del "hágalo usted mismo", como la pintura. A lo largo de este ciclo económico redujimos los gastos para mantener la rentabilidad a medida que disminuían las ventas, manteniendo al mismo tiempo un enfoque agudo en la búsqueda del equilibrio entre el control cuidadoso de los gastos ...

Why do foreign firms have less idiosyncratic risk than U.S.... Söhnke M. Bartram, Gregory Brown, and René M. Stulz*

... leads firms to undertake riskier investments, but they are inconsistent with theories predicting that more firm-specific information increases idiosyncratic stock return volatility. ...

... leads firms to undertake riskier investments, but they are inconsistent with theories predicting that more firm-specific information increases idiosyncratic stock return volatility. ...

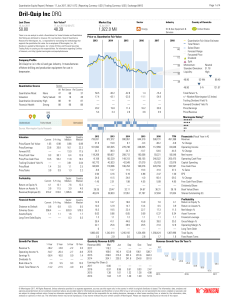

Dril-Quip Inc DRQ

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

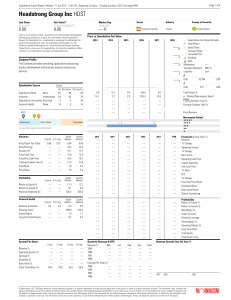

Headstrong Group Inc HDST

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

Overconfidence and Firm Decision Making: Evidence from

... 2013). They generally show that corporations led by overconfident managers are more active in the corporate takeover market, and that they tend to be more risk taking – reflected in higher stock volatility and higher leverage. While these results are interesting, it would be nice to also take a look ...

... 2013). They generally show that corporations led by overconfident managers are more active in the corporate takeover market, and that they tend to be more risk taking – reflected in higher stock volatility and higher leverage. While these results are interesting, it would be nice to also take a look ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.