Sustainable Landscapes: Investor Mapping in Asia

... and/or the preservation or enhancement of critical habitat'. The study captures investments across three conservation areas: sustainable food and fiber production, habitat conservation, and water quality and quantity conservation. Source: “Investing in Conservation: A landscape assessment of an em ...

... and/or the preservation or enhancement of critical habitat'. The study captures investments across three conservation areas: sustainable food and fiber production, habitat conservation, and water quality and quantity conservation. Source: “Investing in Conservation: A landscape assessment of an em ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... take up 90% of the market share Top 10 investment trust companies (AUM for non-bond fund ) ...

... take up 90% of the market share Top 10 investment trust companies (AUM for non-bond fund ) ...

the clorox company

... revoke any votes you previously made via the Company’s WHITE proxy card. How many shares must be present to conduct the Annual Meeting? We must have a “quorum” to conduct the Annual Meeting. A quorum is a majority of the outstanding shares of Common Stock entitled to vote at the meeting, present in ...

... revoke any votes you previously made via the Company’s WHITE proxy card. How many shares must be present to conduct the Annual Meeting? We must have a “quorum” to conduct the Annual Meeting. A quorum is a majority of the outstanding shares of Common Stock entitled to vote at the meeting, present in ...

PROSPECTUS SUN LIFE OF CANADA PROSPERITY DOLLAR

... stock and in the investment of the proceeds of these sales in fixed income instruments denominated in US Dollars issued by the Philippine government, other major economies, or corporations operating therein. The Company’s foreign investments may either be purchased directly or through one or more se ...

... stock and in the investment of the proceeds of these sales in fixed income instruments denominated in US Dollars issued by the Philippine government, other major economies, or corporations operating therein. The Company’s foreign investments may either be purchased directly or through one or more se ...

The Colors of Investors` Money: The Role of Institutional

... Licht (2003) and Siegel (2005) claim that U.S. enforcement is not fully effective in the case of non-U.S. firms that list on a U.S. exchange, but the voluntary disclosure that result from cross-listing allows firms to bond themselves by building their reputation. ...

... Licht (2003) and Siegel (2005) claim that U.S. enforcement is not fully effective in the case of non-U.S. firms that list on a U.S. exchange, but the voluntary disclosure that result from cross-listing allows firms to bond themselves by building their reputation. ...

Financial Markets and the Real Economy

... of wealth2 VW answers the question, “How much happier would you be if you found a dollar on the street?” It measures “hunger”—marginal utility, not total utility. The discount factor is high at t + 1 if you desperately want more wealth at t + 1—and would be willing to give up a lot of wealth in othe ...

... of wealth2 VW answers the question, “How much happier would you be if you found a dollar on the street?” It measures “hunger”—marginal utility, not total utility. The discount factor is high at t + 1 if you desperately want more wealth at t + 1—and would be willing to give up a lot of wealth in othe ...

L. Favre, A. Signer. "The difficulties of measuring the benefits of hedge funds" Journal of Alternative Investment (Summer 2002)

... If, however, risk is only defined as standard deviation or variation of a return distribution, the investor is faced with two main problems with this risk measurement. First, the negative and positive deviations from the mean value are incorporated in the standard deviation calculation, but investor ...

... If, however, risk is only defined as standard deviation or variation of a return distribution, the investor is faced with two main problems with this risk measurement. First, the negative and positive deviations from the mean value are incorporated in the standard deviation calculation, but investor ...

Stock Market Liquidity and the Cost of Issuing Equity

... these intermediation costs.2 Since it should be easier to place an equity issue in a liquid market than to place it in an illiquid market, the stock market liquidity of the issuing firm should be an important determinant of the investment banking fees. To test this hypothesis, we examine a sample of ...

... these intermediation costs.2 Since it should be easier to place an equity issue in a liquid market than to place it in an illiquid market, the stock market liquidity of the issuing firm should be an important determinant of the investment banking fees. To test this hypothesis, we examine a sample of ...

Systemic Risk and Hedge Funds

... The term “systemic risk” is commonly used to describe the possibility of a series of correlated defaults among financial institutions—typically banks—that occurs over a short period of time, often caused by a single major event. A classic example is a banking panic in which large groups of depositor ...

... The term “systemic risk” is commonly used to describe the possibility of a series of correlated defaults among financial institutions—typically banks—that occurs over a short period of time, often caused by a single major event. A classic example is a banking panic in which large groups of depositor ...

NBER WORKING PAPER SERIES TRANSPARENCY AND INTERNATIONAL INVESTOR BEHAVIOR R. Gaston Gelos

... international financial institutions have actively promoted more transparency among their member countries as well as made strides to become more transparent in their own operations. The strive for more transparency presupposes that destabilizing behavior by individual investors can be avoided or at ...

... international financial institutions have actively promoted more transparency among their member countries as well as made strides to become more transparent in their own operations. The strive for more transparency presupposes that destabilizing behavior by individual investors can be avoided or at ...

PowerPoint for Chapter 8

... 8.2.2 Short Selling (Dyl Model) The Dyl introduced short selling with margin requirements by creating a new set of risky securities, the ones sold short, which are negatively correlated with the existing set of risky securities. These new securities greatly enhance the diversification effect when t ...

... 8.2.2 Short Selling (Dyl Model) The Dyl introduced short selling with margin requirements by creating a new set of risky securities, the ones sold short, which are negatively correlated with the existing set of risky securities. These new securities greatly enhance the diversification effect when t ...

Vanguard Emerging Markets Select Stock Fund Prospectus Investor

... expenses that you would incur over various periods if you were to invest $10,000 in the Fund’s shares. This example assumes that the Fund provides a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expens ...

... expenses that you would incur over various periods if you were to invest $10,000 in the Fund’s shares. This example assumes that the Fund provides a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expens ...

An investor`s guide to purchasing mutual funds and 529

... used to determine the sales load decreases. In fact, the entire sales charge may be waived for investors who make very large purchases ($500,000 or $1,000,000) of Class A shares. ...

... used to determine the sales load decreases. In fact, the entire sales charge may be waived for investors who make very large purchases ($500,000 or $1,000,000) of Class A shares. ...

mid cap: the goldilocks asset class

... For individual investors, investing may be a rational process, but markets are still driven largely by fear and greed. Large and small cap stocks fit neatly into the fear and greed pathology: small cap stocks appeal to investors’ greed with a perceived high risk/high return profile. Investors who ar ...

... For individual investors, investing may be a rational process, but markets are still driven largely by fear and greed. Large and small cap stocks fit neatly into the fear and greed pathology: small cap stocks appeal to investors’ greed with a perceived high risk/high return profile. Investors who ar ...

Boundless Study Slides

... • treasury stock A treasury or "reacquired" stock is one which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings). • vesting period A period of time an investor or other person holding a right to something m ...

... • treasury stock A treasury or "reacquired" stock is one which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings). • vesting period A period of time an investor or other person holding a right to something m ...

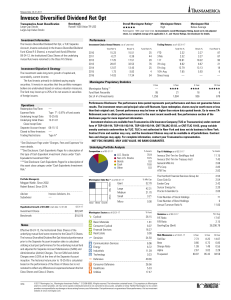

An Economic Perspective on Dividends

... Data shown in this report reflects historical performance which is no guarantee to be reliable, but not guaranteed as to accuracy or completeness. All indices shown are of future results. Dividend yield is one component of performance and should not be unmanaged and unavailable for direct investment ...

... Data shown in this report reflects historical performance which is no guarantee to be reliable, but not guaranteed as to accuracy or completeness. All indices shown are of future results. Dividend yield is one component of performance and should not be unmanaged and unavailable for direct investment ...

long-term portfolio guide - Responsible Investment Association

... in markets that are imperfect? Can we trace and profit from patterns in the deviation of market prices from “fundamental” or “intrinsic” value? What exploitable advantages do long-term investors have? What type of relationships between providers, managers and recipients of capital lead to better lon ...

... in markets that are imperfect? Can we trace and profit from patterns in the deviation of market prices from “fundamental” or “intrinsic” value? What exploitable advantages do long-term investors have? What type of relationships between providers, managers and recipients of capital lead to better lon ...

Equity and Bond Ownership in America, 2008

... exchange-traded funds (ETFs), and unit investment trusts (UITs). ICI seeks to encourage adherence to high ethical standards, promote public understanding, and otherwise advance the interests of funds, their shareholders, directors, and advisers. Members of ICI manage total assets of $9.6 trillion an ...

... exchange-traded funds (ETFs), and unit investment trusts (UITs). ICI seeks to encourage adherence to high ethical standards, promote public understanding, and otherwise advance the interests of funds, their shareholders, directors, and advisers. Members of ICI manage total assets of $9.6 trillion an ...

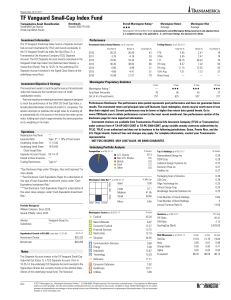

TF Vanguard Small-Cap Index Fund

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

Tilburg University The Economic Benefits of Political Connections in

... Our most signi…cant result is that politicians on the boards of new-technology …rms were associated with increased access to external equity …nance. In addition, these …rms had higher stock market values than otherwise identical …rms did without politicians (which may be due to the increased access ...

... Our most signi…cant result is that politicians on the boards of new-technology …rms were associated with increased access to external equity …nance. In addition, these …rms had higher stock market values than otherwise identical …rms did without politicians (which may be due to the increased access ...

Explaining the Disconnection between China`s Economic

... years this took on the form of explicit quota every year allocated to different regions. Firms must also show profits in three consecutive years, among other explicit financial requirements, to satisfy listing standards set by the CSRC. Moreover, one of the stated purposes of establishing the stock ...

... years this took on the form of explicit quota every year allocated to different regions. Firms must also show profits in three consecutive years, among other explicit financial requirements, to satisfy listing standards set by the CSRC. Moreover, one of the stated purposes of establishing the stock ...

securities regulations

... that investors are informed (disclosure) and regulating the conduct of securities market participants (including brokers, dealer, advisors, underwriters, portfolio mngrs.) Investor confidence and market efficiency are mutually reinforcing: Foster capital markets that are efficient and that warrant ...

... that investors are informed (disclosure) and regulating the conduct of securities market participants (including brokers, dealer, advisors, underwriters, portfolio mngrs.) Investor confidence and market efficiency are mutually reinforcing: Foster capital markets that are efficient and that warrant ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.