Offering and Investor Fees - Handout

... to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire fee generally isn’t an issue for the company if only a handful of large i ...

... to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire fee generally isn’t an issue for the company if only a handful of large i ...

Master Thesis The Relation Between Quantitative Easing and

... interest rates, investors start looking for higher returns. In this quest for even higher returns, risk premiums reduce and asset prices increase, with the risk of bubbles. Until now, no specific research has been conducted that considers the effect(s) of QE on stock market bubbles. This thesis aims ...

... interest rates, investors start looking for higher returns. In this quest for even higher returns, risk premiums reduce and asset prices increase, with the risk of bubbles. Until now, no specific research has been conducted that considers the effect(s) of QE on stock market bubbles. This thesis aims ...

Regulation to amend Regulation 81

... For the purposes of Item 2, if it has been less than 10 years since securities of the mutual fund were first available to the public, and if the mutual fund is a clone fund and the underlying fund has 10 years of performance history, or if there is another mutual fund with 10 years of performance hi ...

... For the purposes of Item 2, if it has been less than 10 years since securities of the mutual fund were first available to the public, and if the mutual fund is a clone fund and the underlying fund has 10 years of performance history, or if there is another mutual fund with 10 years of performance hi ...

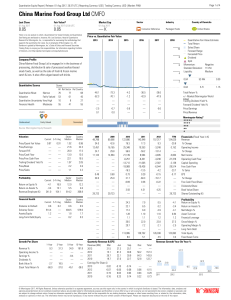

China Marine Food Group Ltd CMFO

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

... Kreuger and Madoff’s schemes. Like Kreuger, Madoff’s legitimate activities acted as a cover for his fraudulent dealings. Madoff oversaw a secretive, guarded arm of his renowned firm that provided wealth management services. Keeping it separate from the rest of his business, even physically segregati ...

... Kreuger and Madoff’s schemes. Like Kreuger, Madoff’s legitimate activities acted as a cover for his fraudulent dealings. Madoff oversaw a secretive, guarded arm of his renowned firm that provided wealth management services. Keeping it separate from the rest of his business, even physically segregati ...

Broad-Based Stock Options and Company

... in its industry group (two digit SIC code) was selected . Sometimes both members of a comparison pair (i.e., two companies) were not available . For example, there were times when the stock option firm had no larger company in its industry group to which it could be compared . In such cases, only on ...

... in its industry group (two digit SIC code) was selected . Sometimes both members of a comparison pair (i.e., two companies) were not available . For example, there were times when the stock option firm had no larger company in its industry group to which it could be compared . In such cases, only on ...

What types of investors drive commonality in

... and Viswanathan (2010), estimating the strength of commonality through sensitivity of changes in individual stock liquidity to changes in market liquidity. Second, following methodology by Chordia et al. (2000) we measure commonality in liquidity through the level of explanatory power when regressin ...

... and Viswanathan (2010), estimating the strength of commonality through sensitivity of changes in individual stock liquidity to changes in market liquidity. Second, following methodology by Chordia et al. (2000) we measure commonality in liquidity through the level of explanatory power when regressin ...

TRANSMISSION OF INFORMATION ACROSS INTERNATIONAL

... liquidity-based price movements, which are normally related to high trading volume, can also be transmitted across borders and have a global impact on market performance in other countries. Last but not least, this study explores the economic significance of international information spillovers and ...

... liquidity-based price movements, which are normally related to high trading volume, can also be transmitted across borders and have a global impact on market performance in other countries. Last but not least, this study explores the economic significance of international information spillovers and ...

Major Points

... stream during its remaining years (largely from servicing equipment it has sold in the past); analysts project that common stockholders will receive regular cash dividends from operations of $3.85 per share each year, along with a liquidating dividend of $13.00 per share at the end of year 7. If the ...

... stream during its remaining years (largely from servicing equipment it has sold in the past); analysts project that common stockholders will receive regular cash dividends from operations of $3.85 per share each year, along with a liquidating dividend of $13.00 per share at the end of year 7. If the ...

IFM7 Chapter 28

... Conclusions As more stocks are added, each new stock has a smaller risk-reducing impact on the portfolio. p falls very slowly after about 40 stocks are included. The lower limit for p is about 20% = M . By forming well-diversified portfolios, investors can eliminate about half the riskiness of ...

... Conclusions As more stocks are added, each new stock has a smaller risk-reducing impact on the portfolio. p falls very slowly after about 40 stocks are included. The lower limit for p is about 20% = M . By forming well-diversified portfolios, investors can eliminate about half the riskiness of ...

Predictable returns and asset allocation

... predictability is ‘‘small’’ rather than ‘‘large’’. By conditioning this normal distribution on both the unexplained variance of returns and on the variance of the predictor variable, we create a direct mapping from the investor’s prior beliefs on model parameters to a well-defined prior over the R2 ...

... predictability is ‘‘small’’ rather than ‘‘large’’. By conditioning this normal distribution on both the unexplained variance of returns and on the variance of the predictor variable, we create a direct mapping from the investor’s prior beliefs on model parameters to a well-defined prior over the R2 ...

Form: 10-K, Received: 09/13/2011 15:47:50

... We have contracted with AGR Peak Well Management Limited (“AGR”) to manage our exploration drilling project in offshore Republic of Guinea. AGR will handle well construction project management services, logistics, tendering and contracting for materials as well as overall management responsibilities ...

... We have contracted with AGR Peak Well Management Limited (“AGR”) to manage our exploration drilling project in offshore Republic of Guinea. AGR will handle well construction project management services, logistics, tendering and contracting for materials as well as overall management responsibilities ...

Market Linked Securities

... against moderate declines. However, during major market rallies your return potential will typically be limited, as most Market Linked Securities have a capped value. In addition, if the market measure decreases in value below a specified threshold level, you will incur a loss on your investment, wh ...

... against moderate declines. However, during major market rallies your return potential will typically be limited, as most Market Linked Securities have a capped value. In addition, if the market measure decreases in value below a specified threshold level, you will incur a loss on your investment, wh ...

What rate of return can we expect over the next decade?

... The final component of return is the percentage change in the stock-price multiple over the holding period. For instance, if stocks currently trade at a high valuation, a forecaster might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock pri ...

... The final component of return is the percentage change in the stock-price multiple over the holding period. For instance, if stocks currently trade at a high valuation, a forecaster might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock pri ...

What rate of return can we expect over the next decade?

... The final component of return is the percentage change in the stock-price multiple over the holding period. For instance, if stocks currently trade at a high valuation, a forecaster might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock pri ...

... The final component of return is the percentage change in the stock-price multiple over the holding period. For instance, if stocks currently trade at a high valuation, a forecaster might expect the stock-price multiple to contract, dragging down returns, and vice versa for a currently low stock pri ...

Cash

... Brokerage fee attached to remaining 2,550 shares: $3,000 x (3,400 sh.– 850 sh.)/ 3,400 sh. = $2,250. Brokerage fee attached to remaining 1,200 shares: Entire $1,255 (none sold). Brokerage fee attached to remaining 2,500 shares: Entire $2,890 (none sold). ...

... Brokerage fee attached to remaining 2,550 shares: $3,000 x (3,400 sh.– 850 sh.)/ 3,400 sh. = $2,250. Brokerage fee attached to remaining 1,200 shares: Entire $1,255 (none sold). Brokerage fee attached to remaining 2,500 shares: Entire $2,890 (none sold). ...

Equity Management

... Oklahoma State University, in compliance with Title VI and VII of the Civil Rights Act of 1964, Executive Order 11246 as amended, Title IX of the Education Amendments of 1972, Americans with Disabilities Act of 1990, and other federal laws and regulations, does not discriminate on the basis of race, ...

... Oklahoma State University, in compliance with Title VI and VII of the Civil Rights Act of 1964, Executive Order 11246 as amended, Title IX of the Education Amendments of 1972, Americans with Disabilities Act of 1990, and other federal laws and regulations, does not discriminate on the basis of race, ...

Insider Trading and CEO Pay - Chicago Unbound

... Permitting insiders to sell their shares in an attempt to optimize their private wealth portfolio can reduce opportunity costs for the firm, while preserving incentives for managers to act in the interests of shareholders. Insiders will want to sell all or nearly all of their shares, but will likely ...

... Permitting insiders to sell their shares in an attempt to optimize their private wealth portfolio can reduce opportunity costs for the firm, while preserving incentives for managers to act in the interests of shareholders. Insiders will want to sell all or nearly all of their shares, but will likely ...

Are abnormal buy and holding returns in mergers subject to value

... reported a negative five-year abnormal return of - 21.9 %. Rau and Vermaelen (1998) reported a 3-year abnormal return of - 4.04 %. They used the control portfolio approach. The results of short-term performance studies (≤ 3 days) on M&A’s show that there is a big gain for target shareholders and onl ...

... reported a negative five-year abnormal return of - 21.9 %. Rau and Vermaelen (1998) reported a 3-year abnormal return of - 4.04 %. They used the control portfolio approach. The results of short-term performance studies (≤ 3 days) on M&A’s show that there is a big gain for target shareholders and onl ...

Private Equity Institutional Investor Trends for

... large amounts of capital that have been returned to them over the last three years, though the strong pace of new commitments over this period means a number of investors are nearing the top of their allocations. . . . though one of investors’ strongest fears is that the market is nearing the top ...

... large amounts of capital that have been returned to them over the last three years, though the strong pace of new commitments over this period means a number of investors are nearing the top of their allocations. . . . though one of investors’ strongest fears is that the market is nearing the top ...

Angel Investing: Changing Strategies During Volatile Times Jeffrey

... ventures to be sold to venture capitalists and the more profitable ones to be retained by the more skillful entrepreneurs. Thus, angels may attempt to overcome these inherent difficulties with an increased reliance on personal communications with the entrepreneur and the ability to judge their chara ...

... ventures to be sold to venture capitalists and the more profitable ones to be retained by the more skillful entrepreneurs. Thus, angels may attempt to overcome these inherent difficulties with an increased reliance on personal communications with the entrepreneur and the ability to judge their chara ...

Estimating the Gains from Trade in Limit

... these markets focus on emerging companies that wish to have access to public equity financing but that do not meet the listing requirements of more senior exchanges. The companies trading on these venture exchanges have characteristics that differ from a typical New York Stock Exchange stock. They t ...

... these markets focus on emerging companies that wish to have access to public equity financing but that do not meet the listing requirements of more senior exchanges. The companies trading on these venture exchanges have characteristics that differ from a typical New York Stock Exchange stock. They t ...

Over/Under-Reaction of Stock Markets

... Section V: Sub Period Analysis One of the interesting findings documented in Table IV is that the relative strength strategy produces positive returns in 96% (24 out of 25) of the Aprils. The large (3.33%) and consistently positive April returns may be related to the fact that corporations must ...

... Section V: Sub Period Analysis One of the interesting findings documented in Table IV is that the relative strength strategy produces positive returns in 96% (24 out of 25) of the Aprils. The large (3.33%) and consistently positive April returns may be related to the fact that corporations must ...

Risk and risk management of Collateralized Debt Obligations

... CDO Rating Models and the Current Financial Crisis There are a number of rating agencies, e.g., Standard & Poor’s, Fitch and Moody, whose major interest is in the potential risk that any investor of a CDO is faced with. These agencies, therefore, provide investors with information and advice on the ...

... CDO Rating Models and the Current Financial Crisis There are a number of rating agencies, e.g., Standard & Poor’s, Fitch and Moody, whose major interest is in the potential risk that any investor of a CDO is faced with. These agencies, therefore, provide investors with information and advice on the ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.