The Gold Standard

... Bank of England loses reserves because it is forced to buy pounds and sell gold to keep the pound price of gold fixed. Foreign Central Banks gain reserves as they buy gold with their currencies ...

... Bank of England loses reserves because it is forced to buy pounds and sell gold to keep the pound price of gold fixed. Foreign Central Banks gain reserves as they buy gold with their currencies ...

Chapter 10 The Determination of Exchange Rates

... COUNTERPOINT: There is no way that the countries of Africa will ever establish a common currency, due to a flawed and inadequate institutional framework. Political pressures in many African countries are too intense to allow the separation of monetary policy from political expediency. Countries in t ...

... COUNTERPOINT: There is no way that the countries of Africa will ever establish a common currency, due to a flawed and inadequate institutional framework. Political pressures in many African countries are too intense to allow the separation of monetary policy from political expediency. Countries in t ...

exchange rates

... CHOOSE THE CORRECT OPTION. The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) ...

... CHOOSE THE CORRECT OPTION. The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) ...

Search for Recovery C.P. Chandrasekhar

... Even as the progress of the taper triggers capital flight from emerging economies, disrupting their markets and depressing their currencies, the World Bank and the IMF have held out hopes of a recovery. A growth rebound in the US, signs that the recession has bottomed in Europe, and expectations tha ...

... Even as the progress of the taper triggers capital flight from emerging economies, disrupting their markets and depressing their currencies, the World Bank and the IMF have held out hopes of a recovery. A growth rebound in the US, signs that the recession has bottomed in Europe, and expectations tha ...

Third World Network - the United Nations

... This study stated that "capital controls are a legitimate part of the toolkit to manage capital inflows in certain circumstances," and that the use of capital controls by governments during the threat of financial crisis "was associated with avoiding some of the worst growth outcomes associated with ...

... This study stated that "capital controls are a legitimate part of the toolkit to manage capital inflows in certain circumstances," and that the use of capital controls by governments during the threat of financial crisis "was associated with avoiding some of the worst growth outcomes associated with ...

PDF Download

... $700.0bn. South Korea has reserves of $155.0bn, Taiwan more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time bef ...

... $700.0bn. South Korea has reserves of $155.0bn, Taiwan more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time bef ...

ECON 4423-001 International Finance

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

Transitioning to More Balanced and Sustainable Growth introduction John Murray

... Happily, there are positive signs on the horizon. The advanced economies seem to be getting their act together. The preconditions for a return to stronger growth are present in the United States. Europe has emerged from a sixquarter recession and is progressing, albeit slowly, with its reforms. Japa ...

... Happily, there are positive signs on the horizon. The advanced economies seem to be getting their act together. The preconditions for a return to stronger growth are present in the United States. Europe has emerged from a sixquarter recession and is progressing, albeit slowly, with its reforms. Japa ...

Kronick`s Global Research Brief

... the shock coming from the EU and US is unlikely to be affected by any of the SSA variables, it is ordered first in the SVAR. ...

... the shock coming from the EU and US is unlikely to be affected by any of the SSA variables, it is ordered first in the SVAR. ...

1 REFORMING THE WORLD`S INTERNATIONAL MONEY by Paul

... caused the collapse of financial markets and threatened the viability of financial institutions world wide as the contagion spread quickly via the existing international payments system. If we are to prevent a global Great Depression, it is time to restore Keynes’s vision of how the international pa ...

... caused the collapse of financial markets and threatened the viability of financial institutions world wide as the contagion spread quickly via the existing international payments system. If we are to prevent a global Great Depression, it is time to restore Keynes’s vision of how the international pa ...

Eco 200 – Principles of Macroeconomics

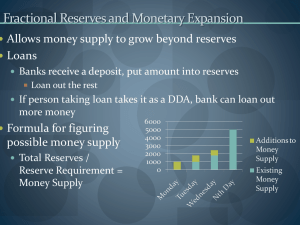

... 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 District Bank Presidents selected on a rotating basis, but always including President of NY Fed) ...

... 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 District Bank Presidents selected on a rotating basis, but always including President of NY Fed) ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... Chinese currency assets. This has indeed been the case in recent years. 3. (20 points). The Greek economy has suffered a lot recently. Many people argue that what they need to do is devalue their currency. However, Greece is part of the eurozone, so that is not an option. ...

... Chinese currency assets. This has indeed been the case in recent years. 3. (20 points). The Greek economy has suffered a lot recently. Many people argue that what they need to do is devalue their currency. However, Greece is part of the eurozone, so that is not an option. ...

INBU 4200 Spring 2004

... China's economy grew at a ferocious pace last year, with GDP up 9.1% compared with 8% in 2002. Ordinarily, this lopsided U.S. demand for Chinese goods should force China's currency, the yuan, higher against the dollar. As China's exports to the U.S. increase more than China's imports from the U.S., ...

... China's economy grew at a ferocious pace last year, with GDP up 9.1% compared with 8% in 2002. Ordinarily, this lopsided U.S. demand for Chinese goods should force China's currency, the yuan, higher against the dollar. As China's exports to the U.S. increase more than China's imports from the U.S., ...

Gold Market - University of Hong Kong

... During the last financial crisis we have recently experienced, the price of gold from the top to the bottom reduced 20%, ranking the least decreasing rate among the entire investment products ...

... During the last financial crisis we have recently experienced, the price of gold from the top to the bottom reduced 20%, ranking the least decreasing rate among the entire investment products ...

ECON 4423-001 International Finance

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

... understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, balance of payments crises, the choice of exchange rate systems, and international debt. ...

9 Surplus reversals in large nations: The cases of France and Great

... The build up of large foreign reserves (sterling and dollars mainly) and then gold stocks in the late 1920s bears a striking resemblance to the situation of financial globalisation today where surplus nations are highly exposed to the debt of deficit nations. And it highlights the potential for syst ...

... The build up of large foreign reserves (sterling and dollars mainly) and then gold stocks in the late 1920s bears a striking resemblance to the situation of financial globalisation today where surplus nations are highly exposed to the debt of deficit nations. And it highlights the potential for syst ...

FX and the Demographic Divide: Indian Rupee vs U.S. Dollar

... from this economic divide. Economic growth differentials are expected to favor India by a large margin, albeit with considerable economic and political uncertainties about the government’s ability to steer the economy. Our analysis suggests that the potential real GDP growth rate for the U.S. has dr ...

... from this economic divide. Economic growth differentials are expected to favor India by a large margin, albeit with considerable economic and political uncertainties about the government’s ability to steer the economy. Our analysis suggests that the potential real GDP growth rate for the U.S. has dr ...

Presentation_Nov_11_B

... 1940: Published How to Pay for the War, proposing low interest rates, compulsory savings (deferred pay) to prevent inflation (like that in WWI); moved to the Treasury as an adviser ...

... 1940: Published How to Pay for the War, proposing low interest rates, compulsory savings (deferred pay) to prevent inflation (like that in WWI); moved to the Treasury as an adviser ...

SEMINAR IN INTERNATIONAL RELATIONS

... 1. Classroom Discussion: This course is a seminar, not a lecture series. It is the student's responsibility to be prepared to discuss the information and claims found in the readings and explore the related research possibilities. If either of us shirks our responsibility, this class cannot proceed. ...

... 1. Classroom Discussion: This course is a seminar, not a lecture series. It is the student's responsibility to be prepared to discuss the information and claims found in the readings and explore the related research possibilities. If either of us shirks our responsibility, this class cannot proceed. ...

The Rise and Demise of the Housing Bubble

... 1) East Asian countries hold up the value of the dollar against their currencies. 2) The U.S. runs low budget deficits to keep interest rates from rising. 3) Slow growth in U.S., slow growth in Asian exports. 4) Remember accounting identities: Foreign savings = Public savings + Private savings X-M = ...

... 1) East Asian countries hold up the value of the dollar against their currencies. 2) The U.S. runs low budget deficits to keep interest rates from rising. 3) Slow growth in U.S., slow growth in Asian exports. 4) Remember accounting identities: Foreign savings = Public savings + Private savings X-M = ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.