Global Financial Crisis

... of easy liquidity, stable growth and low inflation - profits kept coming, and everyone got lulled into a false sense of security in the firm belief that profits will keep rolling in forever. The magic of the financial sector gave it such a larger than life profile that we began to believe that for e ...

... of easy liquidity, stable growth and low inflation - profits kept coming, and everyone got lulled into a false sense of security in the firm belief that profits will keep rolling in forever. The magic of the financial sector gave it such a larger than life profile that we began to believe that for e ...

The Rikoon Group Winter commentary – 2015

... bought new machinery and fueled North America’s farm machinery manufacturers biggest and longest rally in memory. It looks like the entire U.S. agriculture sector is now set to contract. Energy producers are, for the first time in 40 years, shipping unrefined American oil to Europe and Asia. One of ...

... bought new machinery and fueled North America’s farm machinery manufacturers biggest and longest rally in memory. It looks like the entire U.S. agriculture sector is now set to contract. Energy producers are, for the first time in 40 years, shipping unrefined American oil to Europe and Asia. One of ...

Economics Principles and Applications - YSU

... • To maintain fixed exchange rates would have required high interest rates and a reduction in government deficits, leading to a reduction in aggregate demand, output and employment. ...

... • To maintain fixed exchange rates would have required high interest rates and a reduction in government deficits, leading to a reduction in aggregate demand, output and employment. ...

Chapter 10

... Would Vesi have been better off using the current spot rate as the forecast of the future spot rate, 90 days out? Forecasting the future is obviously a daunting ...

... Would Vesi have been better off using the current spot rate as the forecast of the future spot rate, 90 days out? Forecasting the future is obviously a daunting ...

Business Cycles and Macroeconomic Policy in Emerging Market

... the monetary policy in the center country becomes more restrictive, capital flows revert, and this leads to a currency depreciation in the periphery, triggering a deleveraging, a fall in asset prices, and may even produce a full-scale financial crisis. As Gourinchas and Obstfeld (2012) document, fin ...

... the monetary policy in the center country becomes more restrictive, capital flows revert, and this leads to a currency depreciation in the periphery, triggering a deleveraging, a fall in asset prices, and may even produce a full-scale financial crisis. As Gourinchas and Obstfeld (2012) document, fin ...

Market Update

... fresh domestic merger and acquisition activity, including the multi-billion dollar battle between Tabcorp and The Pacific Consortium for control of Tatts Group. RBA leaves interest rates on hold The Reserve Bank of Australia (RBA) left the official cash rate unchanged at a record low 1.50% throughou ...

... fresh domestic merger and acquisition activity, including the multi-billion dollar battle between Tabcorp and The Pacific Consortium for control of Tatts Group. RBA leaves interest rates on hold The Reserve Bank of Australia (RBA) left the official cash rate unchanged at a record low 1.50% throughou ...

PowerPoint

... Agricultural commodities are by their nature entirely replaceable, and agricultural economists can predict the marginal cost of producing approximately sufficient of each commodity to satisfy the market in the short term Agricultural commodity supply in the long run is infinitely ...

... Agricultural commodities are by their nature entirely replaceable, and agricultural economists can predict the marginal cost of producing approximately sufficient of each commodity to satisfy the market in the short term Agricultural commodity supply in the long run is infinitely ...

Presentation

... of financial gaps in the banking system the foresight of financial stability the size and duration of financial gaps in the economy ...

... of financial gaps in the banking system the foresight of financial stability the size and duration of financial gaps in the economy ...

Presentation

... of financial gaps in the banking system the foresight of financial stability the size and duration of financial gaps in the economy ...

... of financial gaps in the banking system the foresight of financial stability the size and duration of financial gaps in the economy ...

Comments on Capital Flows and Excess Saving

... strong growth & return Capital flows; Policy response is less effective, create distortion & Spill-over effects, Intraregional trade Preventing Factors: Modality & non-economic sensitivity Stages: Institution-lite, ownership, basket with different composition & weights then standardized PLUS reg ...

... strong growth & return Capital flows; Policy response is less effective, create distortion & Spill-over effects, Intraregional trade Preventing Factors: Modality & non-economic sensitivity Stages: Institution-lite, ownership, basket with different composition & weights then standardized PLUS reg ...

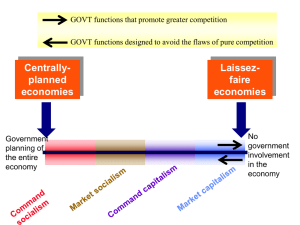

economics and politics.ppt

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

P t US

... • June 2012: Spain requests a bailout for private banks only. • June 25: Cyprus requests a bailout ...

... • June 2012: Spain requests a bailout for private banks only. • June 25: Cyprus requests a bailout ...

DAGSKRÁ

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

3.E Money in the European Union High School Lesson Plan

... Then, teacher will guide students to practice using current exchange rates, which can be found online. Using proportional reasoning and ratios, students will convert prices from US Dollars to Euros and will convert between other types of currencies. After some guided practice, students will work on ...

... Then, teacher will guide students to practice using current exchange rates, which can be found online. Using proportional reasoning and ratios, students will convert prices from US Dollars to Euros and will convert between other types of currencies. After some guided practice, students will work on ...

EC827_B5

... What has happened over the past 50 years that makes the term Globalization meaningful with regard to economic interaction on an economy-wide scale? ...

... What has happened over the past 50 years that makes the term Globalization meaningful with regard to economic interaction on an economy-wide scale? ...

Presentation to a conference celebrating Professor Rachel McCulloch: “Is... Optimal in the 21

... At the same time, the Federal Reserve is actively collaborating with other supervisors in the United States and globally, and encouraging private sector initiatives designed to strengthen the resilience of the financial sector and to improve its ability to manage the stresses that might emerge in th ...

... At the same time, the Federal Reserve is actively collaborating with other supervisors in the United States and globally, and encouraging private sector initiatives designed to strengthen the resilience of the financial sector and to improve its ability to manage the stresses that might emerge in th ...

Document

... - Interest rates stuck and cannot stimulate domestic investment. - With no change in interest rates, cannot repel foreign investment and depreciate currency. ...

... - Interest rates stuck and cannot stimulate domestic investment. - With no change in interest rates, cannot repel foreign investment and depreciate currency. ...

Economic policy, examination questions, school year 2007-2008

... 1. Hyperinflation in some European countries after WWI: basic causes. 2. Short term economic policy of Stop and Go, principles and mistakes. 3. Main features of gold standard before WWI 4. Alternative explanations of the origin, depth and duration of Great Depression 5. Disinflation policies and twi ...

... 1. Hyperinflation in some European countries after WWI: basic causes. 2. Short term economic policy of Stop and Go, principles and mistakes. 3. Main features of gold standard before WWI 4. Alternative explanations of the origin, depth and duration of Great Depression 5. Disinflation policies and twi ...

Macro Lessons of the 1930s Economist

... exposure to banks and sovereign bonds elsewhere in the euro zone. Even countries with relatively robust economies such as France and the Netherlands have not been spared. No matter how secure an economy’s fiscal position, a short-term liquidity crunch driven by panic can drive it into insolvency. Hi ...

... exposure to banks and sovereign bonds elsewhere in the euro zone. Even countries with relatively robust economies such as France and the Netherlands have not been spared. No matter how secure an economy’s fiscal position, a short-term liquidity crunch driven by panic can drive it into insolvency. Hi ...

New Financial Regulation HEC, Paris, February 2011 Petr Blizkovsky

... Source: Fender, Ingo, and Jacob Gyntelberg, Overview: global financial Crisis Spurs Unprecedented Policy ...

... Source: Fender, Ingo, and Jacob Gyntelberg, Overview: global financial Crisis Spurs Unprecedented Policy ...

Paraguay_en.pdf

... risk aversion, the increase in lending is indicative of greater confidence in the financial system and in the economy in general; moreover, it is consistent with the decline in lending rates. As regards the inflation target (5%), the consumer price index recorded a final variation close to the upper ...

... risk aversion, the increase in lending is indicative of greater confidence in the financial system and in the economy in general; moreover, it is consistent with the decline in lending rates. As regards the inflation target (5%), the consumer price index recorded a final variation close to the upper ...

Monetary Policy in Singapore - Economic Society of Singapore

... Slower export growth & slack in econo my Inflation goes down ...

... Slower export growth & slack in econo my Inflation goes down ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.