The International Monetary Fund and East Asian Financial Crisis

... Furthermore, an increased percentage of bank loans went to construction, real estate, stock markets, and other services. Since these sectors often lead to speculative bubbles, many East Asian governments had placed limits on excessive growth in sectors like real estate. But, the IMF believed that s ...

... Furthermore, an increased percentage of bank loans went to construction, real estate, stock markets, and other services. Since these sectors often lead to speculative bubbles, many East Asian governments had placed limits on excessive growth in sectors like real estate. But, the IMF believed that s ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... number of large devaluations—deviations from the preannounced policy—have turned out to validate the expectations that market interest rates reflect. In the area of external debt, Brazil is surely the biggest (if not the leading) problem case. In June 1981 its external indebtedness to banks stood at ...

... number of large devaluations—deviations from the preannounced policy—have turned out to validate the expectations that market interest rates reflect. In the area of external debt, Brazil is surely the biggest (if not the leading) problem case. In June 1981 its external indebtedness to banks stood at ...

Spotlight on Fellows: Guo Xuejun

... arena. We can all recall the disputes between the US and Germany and the US and Japan. For me, it is not a purely economic issue or financial issue. As for the reason for the exchange rate, the overwhelming idea is that only by means of this could we adjust the global trade imbalance. This is the pe ...

... arena. We can all recall the disputes between the US and Germany and the US and Japan. For me, it is not a purely economic issue or financial issue. As for the reason for the exchange rate, the overwhelming idea is that only by means of this could we adjust the global trade imbalance. This is the pe ...

A Call for an “Asian Plaza”

... reached about $400 billion in 2007 and, while growing more slowly in the future, is likely to reach $500 billion by next year. It will thus be almost as large as America’s global current account deficit in absolute terms in an economy about one-third the size of the United States. The surplus exceed ...

... reached about $400 billion in 2007 and, while growing more slowly in the future, is likely to reach $500 billion by next year. It will thus be almost as large as America’s global current account deficit in absolute terms in an economy about one-third the size of the United States. The surplus exceed ...

Foreign Exchange Rate Forecasting

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

Russia – The Way Out of The Economic Downturn

... Sources: IMF, World Economic Outlook; and IMF staff estimates. ...

... Sources: IMF, World Economic Outlook; and IMF staff estimates. ...

the international monetary and financial environment

... ■ The U.S. government agreed to buy and sell unlimited amounts of gold in order to maintain this fixed rate. ■ Each of Bretton Woods’ other signatories agreed to establish a par value of its currency in terms of the U.S. dollar and to maintain this pegged value through central bank intervention. ■ ...

... ■ The U.S. government agreed to buy and sell unlimited amounts of gold in order to maintain this fixed rate. ■ Each of Bretton Woods’ other signatories agreed to establish a par value of its currency in terms of the U.S. dollar and to maintain this pegged value through central bank intervention. ■ ...

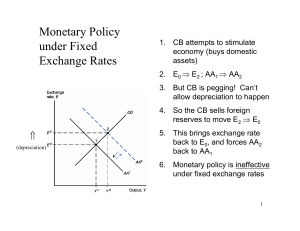

Fixed Exchange Rates and Macroeconomic Policy

... Disadvantages of Fixed Exchange Rates • With a fixed exchange rate you give up on an independent monetary policy • So you cannot use monetary policy to target domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls ...

... Disadvantages of Fixed Exchange Rates • With a fixed exchange rate you give up on an independent monetary policy • So you cannot use monetary policy to target domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls ...

One market, One Money

... origins, denounced the ‘mistake’ made by classical economists who had not understood that an international market could not work without effective supranational government. Classical economists had understood that the internal market did not consist of a spontaneous order, but of a series of rules o ...

... origins, denounced the ‘mistake’ made by classical economists who had not understood that an international market could not work without effective supranational government. Classical economists had understood that the internal market did not consist of a spontaneous order, but of a series of rules o ...

The European Currency Crisis (1992

... Germany becomes free to set monetary policy for itself while the other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keepi ...

... Germany becomes free to set monetary policy for itself while the other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keepi ...

P R I M

... Sweden. In contrast, during the 1990s, foreign investment financed about 10 percent of an average emerging country’s capital imports. ...

... Sweden. In contrast, during the 1990s, foreign investment financed about 10 percent of an average emerging country’s capital imports. ...

NUS Business School National University of Singapore BMA5011

... The first is to introduce MBA students to the basic tools (“core models”) of macroeconomics and international economics. The course begins with the long run analysis of what drives economic growth. It then moves on to the short run analysis of business cycle dynamics (how output, employment, interes ...

... The first is to introduce MBA students to the basic tools (“core models”) of macroeconomics and international economics. The course begins with the long run analysis of what drives economic growth. It then moves on to the short run analysis of business cycle dynamics (how output, employment, interes ...

Vortrag/Präsentation - EESC European Economic and Social

... Conclusion – something has to give We need monetary and fiscal policy engines to ensure take-off, faster NGDP growth and fiscal consolidation We need higher public investment for longer-term restructuring and performance Either abrogation/suspension of fiscal rules at EU and national level (g ...

... Conclusion – something has to give We need monetary and fiscal policy engines to ensure take-off, faster NGDP growth and fiscal consolidation We need higher public investment for longer-term restructuring and performance Either abrogation/suspension of fiscal rules at EU and national level (g ...

Currencies Aren`t the Problem

... book, Exorbitant Privilege, oªers a compelling analysis of these debates.) But unlike today, the United States was not then running a large trade deficit—in fact, its trade balance and its current account were in surplus throughout the 1960s, albeit shrinking. The world was not dependent on U.S. spe ...

... book, Exorbitant Privilege, oªers a compelling analysis of these debates.) But unlike today, the United States was not then running a large trade deficit—in fact, its trade balance and its current account were in surplus throughout the 1960s, albeit shrinking. The world was not dependent on U.S. spe ...

Chapter 8.

... less. Joseph Stiglitz and other critics: such measures during a crisis can only deepen the crisis and recession. They argue that government should increase expenditures and aggregate demand so that the economy is brought out of recession. ...

... less. Joseph Stiglitz and other critics: such measures during a crisis can only deepen the crisis and recession. They argue that government should increase expenditures and aggregate demand so that the economy is brought out of recession. ...

International Economics - Mr. Zittle`s Classroom

... 6. If U.S. demand for Japanese goods increases, will the U.S. pay more or less for Japanese goods? 7. What happens to exports when the U.S. $ appreciates? 8. Name 3 factors that will cause an increase in U.S. imports. 9. Create a scenario that would affect the U.S. current account. 10. Capital accou ...

... 6. If U.S. demand for Japanese goods increases, will the U.S. pay more or less for Japanese goods? 7. What happens to exports when the U.S. $ appreciates? 8. Name 3 factors that will cause an increase in U.S. imports. 9. Create a scenario that would affect the U.S. current account. 10. Capital accou ...

AVOIDING AND MANAGING COMMON MISTAKES AND PROBLEMS Important Terms

... allows goods to be transported without the need to handle the goods 6. Hard Currency Currency that is widely accepted on the foreign currency exchange market and can easily be converted to another currency 7. Infrastructure The large-scale public systems, services, and facilities of a country or reg ...

... allows goods to be transported without the need to handle the goods 6. Hard Currency Currency that is widely accepted on the foreign currency exchange market and can easily be converted to another currency 7. Infrastructure The large-scale public systems, services, and facilities of a country or reg ...

FEATURES OF ECONOMIC UNION

... of stronger economies such as Germany and France with inflation more difficult to control - fears that because fiscal policy can be be more effectively used in a common monetary zone that it could thereby be used irresponsibly by some governments ...

... of stronger economies such as Germany and France with inflation more difficult to control - fears that because fiscal policy can be be more effectively used in a common monetary zone that it could thereby be used irresponsibly by some governments ...

Welcome to Era 9 Paradoxes of Global Accelerationn

... In 1971, however, the high cost of the Vietnam War prompted President Richard Nixon to abolish the fixed currency exchange rates that had been established at Bretton Woods. Gold backing for currencies was eliminated. World currencies “floated.” ...

... In 1971, however, the high cost of the Vietnam War prompted President Richard Nixon to abolish the fixed currency exchange rates that had been established at Bretton Woods. Gold backing for currencies was eliminated. World currencies “floated.” ...

Welcome to Era 9 Paradoxes of Global Accelerationn

... Several of the new nations pursued a non-aligned policy. • In 1955 India, Indonesia, and Yugoslavia sponsored the Bandung Conference of NonAligned nations. It aimed to promote ...

... Several of the new nations pursued a non-aligned policy. • In 1955 India, Indonesia, and Yugoslavia sponsored the Bandung Conference of NonAligned nations. It aimed to promote ...

The World in 1945

... Several of the new nations pursued a non-aligned policy. • In 1955 India, Indonesia, and Yugoslavia sponsored the Bandung Conference of NonAligned nations. It aimed to promote ...

... Several of the new nations pursued a non-aligned policy. • In 1955 India, Indonesia, and Yugoslavia sponsored the Bandung Conference of NonAligned nations. It aimed to promote ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.