PROSPECTS FOR THE DEVELOPING COUNTRIES

... • Balance of payments and exchange rate weakness problems • Exchange rate/inflation vicious cycle • Sharp falls in economic growth • Worst affected will be those countries where Neo-liberal ideology still dominates policy making (1-3) ...

... • Balance of payments and exchange rate weakness problems • Exchange rate/inflation vicious cycle • Sharp falls in economic growth • Worst affected will be those countries where Neo-liberal ideology still dominates policy making (1-3) ...

The Gold Standard

... • Increased demand for currency as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate • The price of the foreign currency in local currency increases. • Home Currency Depreciation happens when the foreign currency’s “price” rises. In other words, t ...

... • Increased demand for currency as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate • The price of the foreign currency in local currency increases. • Home Currency Depreciation happens when the foreign currency’s “price” rises. In other words, t ...

FRBSF E L CONOMIC ETTER

... Petri of Brandeis University shows that East Asia interdependence, defined as the preference for trade among regional partners, actually fell in the 1980s, but has been growing in the last decade. He points out that most of this increasing interdependence is attributable to trade relationships foste ...

... Petri of Brandeis University shows that East Asia interdependence, defined as the preference for trade among regional partners, actually fell in the 1980s, but has been growing in the last decade. He points out that most of this increasing interdependence is attributable to trade relationships foste ...

What Hazard? - Inter-American Development Bank

... Expansionary monetary policy? Pou's departure and currency basket? Fiscal devaluation? ...

... Expansionary monetary policy? Pou's departure and currency basket? Fiscal devaluation? ...

PDF - Winthrop Capital Management

... The Demise of the Banking System After the repeal of the Glass-Steagall Act in 1999, banks were incentivized to diversify their revenue into more stable fee oriented businesses which didn’t require high levels of capital. At the same time, the Federal Reserve allowed interest rates to drop to extrem ...

... The Demise of the Banking System After the repeal of the Glass-Steagall Act in 1999, banks were incentivized to diversify their revenue into more stable fee oriented businesses which didn’t require high levels of capital. At the same time, the Federal Reserve allowed interest rates to drop to extrem ...

Slide 1

... Avoid high levels of short-term external debt Avoid sustained and substantial appreciation of country’s real effective exchange rate (REER) Avoid massive drawdown of foreign exchange reserves in vain attempt to defend unrealistic exchange rate Strengthen domestic financial sector, especially banks ( ...

... Avoid high levels of short-term external debt Avoid sustained and substantial appreciation of country’s real effective exchange rate (REER) Avoid massive drawdown of foreign exchange reserves in vain attempt to defend unrealistic exchange rate Strengthen domestic financial sector, especially banks ( ...

BOP Crisis and Economic Policy

... capital account, independent monetary and fiscal policies - expansionary policy caused higher inflation and appreciation of domestic currency but governments did not allow exchange rate to change. -When this policy became unsustainable government devalued. The debt stock of local firms and banks in ...

... capital account, independent monetary and fiscal policies - expansionary policy caused higher inflation and appreciation of domestic currency but governments did not allow exchange rate to change. -When this policy became unsustainable government devalued. The debt stock of local firms and banks in ...

China’s RenMinBi Strategy* C.P. Chandrasekhar and Jayati Ghosh

... People’s Bank of China (the central bank) raised the value slightly through its open market operations, to close the day at 6.3975 per dollar, compared to the low of 6.4010 per dollar of the previous day. An official of the bank has announced that “there is no basis for the exchange rate to continue ...

... People’s Bank of China (the central bank) raised the value slightly through its open market operations, to close the day at 6.3975 per dollar, compared to the low of 6.4010 per dollar of the previous day. An official of the bank has announced that “there is no basis for the exchange rate to continue ...

The Open Economy: International Trade and Finance

... • Measures international sales of financial assets • Stocks, securities, savings bonds • Capital inflows and outflows ...

... • Measures international sales of financial assets • Stocks, securities, savings bonds • Capital inflows and outflows ...

ECONOMIC GLOBALIZATION

... World Bank and the International Monetary Fund (IMF) The World Bank provides loans to less developed countries, and is an agency of the Untied Nations and controlled by its 184 ...

... World Bank and the International Monetary Fund (IMF) The World Bank provides loans to less developed countries, and is an agency of the Untied Nations and controlled by its 184 ...

Argentina Crisis Presentation

... Fiscal issues/Debt • Circumvention of currency board implicit fiscal discipline through the issuance of quasi-moneys by both provinces and federal government. • Interest payment Brady Bonds negotiated in 90’s ( interest rate increased cost of servicing foreign debt). • After Russian crisis: inte ...

... Fiscal issues/Debt • Circumvention of currency board implicit fiscal discipline through the issuance of quasi-moneys by both provinces and federal government. • Interest payment Brady Bonds negotiated in 90’s ( interest rate increased cost of servicing foreign debt). • After Russian crisis: inte ...

1 CHAPTER 10 INTERNATIONAL MONETARY SYSTEM 1. Explain

... returned to the gold standard at a new, lower par value that reflected the inflation of previous years. c. The U.S. decision in 1934 to devalue its currency and Britain's decision not to do so lowered the price of U.S. exports and increased the price of British goods imported. It now took $8.24 to b ...

... returned to the gold standard at a new, lower par value that reflected the inflation of previous years. c. The U.S. decision in 1934 to devalue its currency and Britain's decision not to do so lowered the price of U.S. exports and increased the price of British goods imported. It now took $8.24 to b ...

Graphing Exchange Rates

... • Depreciation = decrease in value of currency – Dollar depreciates => Imports more expensive & Exports cheaper – Leads to smaller Trade Deficit (NX↑ ) & AD shifts right ...

... • Depreciation = decrease in value of currency – Dollar depreciates => Imports more expensive & Exports cheaper – Leads to smaller Trade Deficit (NX↑ ) & AD shifts right ...

Document

... Loans from IMF to the deficit countries to cover loss in their international reserves IMF encourages contractionary monetary and fiscal policies Devaluation happens only if IMF loans are not sufficient IMF cannot force surplus countries (Ger) to revalue. U.S. could not devalue the dollar d ...

... Loans from IMF to the deficit countries to cover loss in their international reserves IMF encourages contractionary monetary and fiscal policies Devaluation happens only if IMF loans are not sufficient IMF cannot force surplus countries (Ger) to revalue. U.S. could not devalue the dollar d ...

View full article - Economic Research

... that the objective function contains only U.S. objectives. But foreign objectives belong in the objective function of the United States. The United States has an intense practical interest, not just an altruistic one, in political stability and economic progress abroad. The real constraint on U.S. e ...

... that the objective function contains only U.S. objectives. But foreign objectives belong in the objective function of the United States. The United States has an intense practical interest, not just an altruistic one, in political stability and economic progress abroad. The real constraint on U.S. e ...

“International” Finance?

... value of the keiretsu—a family of firms to which the individual firms belongs. ...

... value of the keiretsu—a family of firms to which the individual firms belongs. ...

New Keynesian Economics

... Interpretation of the model • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not i ...

... Interpretation of the model • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not i ...

PROBLEMS OF DEVELOPING COUNTRIES

... Records income and expenditure flows e.g. from trade and profits, interest and dividends on foreign owned assets ...

... Records income and expenditure flows e.g. from trade and profits, interest and dividends on foreign owned assets ...

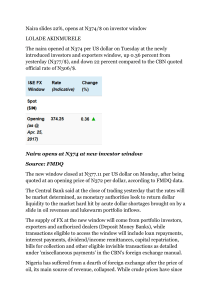

Naira opens at N374 at new investor window Source

... risen, there is an estimated $4 billion backlog in the foreign exchange market that is yet to be cleared, traders say. The naira has traded at around 305 per dollar on the interbank market since August. The black-market rate plummeted to a record 520 against the greenback in February, but recovered ...

... risen, there is an estimated $4 billion backlog in the foreign exchange market that is yet to be cleared, traders say. The naira has traded at around 305 per dollar on the interbank market since August. The black-market rate plummeted to a record 520 against the greenback in February, but recovered ...

Africa in the international financial architecture

... All countries to converge to an Anglo-American model of capitalism ...

... All countries to converge to an Anglo-American model of capitalism ...

1. Efficiency of the international monetary system means that the

... the trade in goods and services, but also by capital flows, among them the very volatile short-term portfolio flows. These shortterm flows are sensitive to policy failures. How to solve these two problems? There are two lines of answer, somewhat related. 3. In order to prevent currency crises – the ...

... the trade in goods and services, but also by capital flows, among them the very volatile short-term portfolio flows. These shortterm flows are sensitive to policy failures. How to solve these two problems? There are two lines of answer, somewhat related. 3. In order to prevent currency crises – the ...

What is a Useful Central Bank?

... SIFIs pose larger problems than previously expected Liquidity developments are key Contagion between submarkets and jurisdictions. ...

... SIFIs pose larger problems than previously expected Liquidity developments are key Contagion between submarkets and jurisdictions. ...

Exchange Rates - Continental Economics

... 3 beer/1pack of cigarettes means that cigarettes cost three times more than one beer One can also say: 3 beer exchange for 1 pack of cigarettes in a barter Thus exchange rates are prices and are linked to the exchange ratios of goods ...

... 3 beer/1pack of cigarettes means that cigarettes cost three times more than one beer One can also say: 3 beer exchange for 1 pack of cigarettes in a barter Thus exchange rates are prices and are linked to the exchange ratios of goods ...

financialglobalization

... The banking crises so crippled credit markets that lending virtually stopped. Depositors would not keep money in banks fearing that banks would close. So a run on the banks developed at the first sign of difficulties. ...

... The banking crises so crippled credit markets that lending virtually stopped. Depositors would not keep money in banks fearing that banks would close. So a run on the banks developed at the first sign of difficulties. ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.