Society-Centered Approach to Macroeconomic Policy +

... • Goal: stable exchange rates AND domestic economic autonomy • Components: – Exchange rate “flexibility” (adjustable peg to gold – NOT a “flexible exchange rate” policy) – Capital controls (currency exchange restrictions) – Stabilization fund (all members contribute, can borrow during BoP deficits) ...

... • Goal: stable exchange rates AND domestic economic autonomy • Components: – Exchange rate “flexibility” (adjustable peg to gold – NOT a “flexible exchange rate” policy) – Capital controls (currency exchange restrictions) – Stabilization fund (all members contribute, can borrow during BoP deficits) ...

MACROECONOMICS 1. A supply curve slopes upward - FBLA-PBL

... d. as more is produced, total cost of production falls 2. The aggregate demand curve, when plotted against price: a. slopes upwards because all governments subsidize the export of goods and services b. slopes downward because of the income effect and the substitution effect, just as with individual ...

... d. as more is produced, total cost of production falls 2. The aggregate demand curve, when plotted against price: a. slopes upwards because all governments subsidize the export of goods and services b. slopes downward because of the income effect and the substitution effect, just as with individual ...

WORLD

... central bankers, he did leave the door open for further stimulus. Given the dismal state of the U.S. economy after QE2, which pumped nearly $600 billion into longer-term Treasury securities designed to lower interest rates and encourage investment, Bernanke should be humble in his expectations about ...

... central bankers, he did leave the door open for further stimulus. Given the dismal state of the U.S. economy after QE2, which pumped nearly $600 billion into longer-term Treasury securities designed to lower interest rates and encourage investment, Bernanke should be humble in his expectations about ...

The Backing of the Currency and Economic Stability

... that Roosevelt suspended specie payments to every entity except foreign governments. From the end of World War II until 1971, the world’s currencies were based on the Bretton Woods system. As Rothbard notes, the United States was, after 1931, the only major country left on any type of gold standard, ...

... that Roosevelt suspended specie payments to every entity except foreign governments. From the end of World War II until 1971, the world’s currencies were based on the Bretton Woods system. As Rothbard notes, the United States was, after 1931, the only major country left on any type of gold standard, ...

ruth de krivoy

... Ms. Krivoy was President of the Central Bank of Venezuela from 1992 - 1994. During her tenure, the law was reformed to establish the independence of the Central Bank. Her direction of monetary policy significantly fostered confidence and stability in the midst of severe political and financial turbu ...

... Ms. Krivoy was President of the Central Bank of Venezuela from 1992 - 1994. During her tenure, the law was reformed to establish the independence of the Central Bank. Her direction of monetary policy significantly fostered confidence and stability in the midst of severe political and financial turbu ...

conclusions for small open economies

... overly and fully involved from the very beginning, which has already made apparent the sizeable long-term costs, should not be regarded as a long-term policy. Second, the so far failed attempts of politicians and civil servants to act as bankers have in many countries already drained the public cred ...

... overly and fully involved from the very beginning, which has already made apparent the sizeable long-term costs, should not be regarded as a long-term policy. Second, the so far failed attempts of politicians and civil servants to act as bankers have in many countries already drained the public cred ...

Overview

... regulations that ban borrowing in foreign currencies and/or over variable interest rates for households have served their purpose amid increased exchange rate volatility and rising interest rates. The effect of exchange rate developments on the indebtedness of non-financial corporates has remained l ...

... regulations that ban borrowing in foreign currencies and/or over variable interest rates for households have served their purpose amid increased exchange rate volatility and rising interest rates. The effect of exchange rate developments on the indebtedness of non-financial corporates has remained l ...

Exchange Rate Regimes

... overvalued, then the government will find it too costly to defend the exchange rate and a devaluation will occur. If only a few investors believe a currency is overvalued, it may be possible for the government to maintain a fixed exchange rate. Elements of self-fulfilling panic are key in sg ...

... overvalued, then the government will find it too costly to defend the exchange rate and a devaluation will occur. If only a few investors believe a currency is overvalued, it may be possible for the government to maintain a fixed exchange rate. Elements of self-fulfilling panic are key in sg ...

Related Issue Three Review

... vi. The Cold War 2. Key Ideas of Contemporary Global Economics a. John Maynard Keynes i. Argued against unrestricted capitalism and for government control of economies. Governments could provide to those citizens with relief and provide money to increase demand. b. Friedrich Hayek i. Mistrusted gove ...

... vi. The Cold War 2. Key Ideas of Contemporary Global Economics a. John Maynard Keynes i. Argued against unrestricted capitalism and for government control of economies. Governments could provide to those citizens with relief and provide money to increase demand. b. Friedrich Hayek i. Mistrusted gove ...

CHAPTER 14 FIGURES

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

SIUDY_SESSION_4_PresentationSouth_Bank

... • A minimum of 20% paid-up share (10% of which can be in local currencies) in five and ten years. ...

... • A minimum of 20% paid-up share (10% of which can be in local currencies) in five and ten years. ...

Rappoteur awan santosh by Ram

... Collapse of a ‘Model’: The Mexican Financial Crisis: The Mexican government liberalized the trade sector in 1985, adopted an economic stabilization plan at the end of 1987, and gradually introduced market-oriented institutions. Those reforms led to the resumption of economic growth, which averaged 3 ...

... Collapse of a ‘Model’: The Mexican Financial Crisis: The Mexican government liberalized the trade sector in 1985, adopted an economic stabilization plan at the end of 1987, and gradually introduced market-oriented institutions. Those reforms led to the resumption of economic growth, which averaged 3 ...

Chapter 21

... Exchange Rate Strategies Dollarization 1. Adopt a foreign currency like the U.S. dollar as the country’s money → even stronger commitment mechanism → no possibility of speculative attack. 2. Usual disadvantages of fixed exchange rate regime. 3. Lose seignorage (the revenue that a government receive ...

... Exchange Rate Strategies Dollarization 1. Adopt a foreign currency like the U.S. dollar as the country’s money → even stronger commitment mechanism → no possibility of speculative attack. 2. Usual disadvantages of fixed exchange rate regime. 3. Lose seignorage (the revenue that a government receive ...

10. Economic and Monetary Union

... Participation in the ERM II is voluntary for the non eurozone MS. The exchange rate can fluctuate within a band, normally set at +/- 15% around the central rate. All other currencies are floating freely against the euro. ...

... Participation in the ERM II is voluntary for the non eurozone MS. The exchange rate can fluctuate within a band, normally set at +/- 15% around the central rate. All other currencies are floating freely against the euro. ...

President’s Message

... will increase as money velocity accelerates or the Fed will have to withdraw the excess reserves, which will result in rapidly rising interest rates and major losses for bond holders. If the Fed does not shrink its balance sheet, the economy could be stuck in very slow growth as the government consu ...

... will increase as money velocity accelerates or the Fed will have to withdraw the excess reserves, which will result in rapidly rising interest rates and major losses for bond holders. If the Fed does not shrink its balance sheet, the economy could be stuck in very slow growth as the government consu ...

download... - Stewart Financial

... will have a better (higher) exchange rate than a country with a volatile government, declining economic growth and poor investment opportunities. Currently, Canada fits the former description and the US fits the latter. Canada has a fairly stable government (much to Stephane Dion’s chagrin), a very ...

... will have a better (higher) exchange rate than a country with a volatile government, declining economic growth and poor investment opportunities. Currently, Canada fits the former description and the US fits the latter. Canada has a fairly stable government (much to Stephane Dion’s chagrin), a very ...

Snímek 1

... the Russian default. Bank in the City of London alone were estimated to have lost 7,5 billion pounds in 1998 as a result of losses in emerging markets, but especially in Russia. ...

... the Russian default. Bank in the City of London alone were estimated to have lost 7,5 billion pounds in 1998 as a result of losses in emerging markets, but especially in Russia. ...

Document

... regard to global imbalances, much of the emphasis is on the overconsumption of the United States or low wages and an undervalued currency of ...

... regard to global imbalances, much of the emphasis is on the overconsumption of the United States or low wages and an undervalued currency of ...

Trumponomics: Deja vu Reaganomics?

... real income. In addition, it would make the external funding requirement larger. How these possible developments get addressed will be important in driving market returns during the Trump era. The great irony could be that after naming China a currency manipulator, the two great powers get together ...

... real income. In addition, it would make the external funding requirement larger. How these possible developments get addressed will be important in driving market returns during the Trump era. The great irony could be that after naming China a currency manipulator, the two great powers get together ...

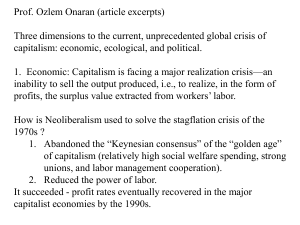

Misunderstanding the Great Depression, making the next one worse

... • After the crisis… – It is important to start by stating the obvious, namely, that the baby should not be thrown out with the bathwater…” (Blanchard Dell'Ariccia et al. 2010; emphasis added) • Reality – Neoclassical macroeconomics is a baby that should never have been conceived ...

... • After the crisis… – It is important to start by stating the obvious, namely, that the baby should not be thrown out with the bathwater…” (Blanchard Dell'Ariccia et al. 2010; emphasis added) • Reality – Neoclassical macroeconomics is a baby that should never have been conceived ...

The Shifts and the Shocks: geneRal DisCussiOn mr. Wolf:

... These things were supposed to only happen in emerging markets. And emerging markets often dealt with debt overhangs and debt restructuring. Could you comment on your view of restructuring issues in the periphery and debt restructuring in general? Mr. Wolf: I think the observation is correct that de ...

... These things were supposed to only happen in emerging markets. And emerging markets often dealt with debt overhangs and debt restructuring. Could you comment on your view of restructuring issues in the periphery and debt restructuring in general? Mr. Wolf: I think the observation is correct that de ...

Why Study Money, Banking, and Financial Markets?

... • The foreign exchange market is where funds are converted from one currency into another • The foreign exchange rate is the price of one currency in terms of another currency • The foreign exchange market determines the foreign exchange rate ...

... • The foreign exchange market is where funds are converted from one currency into another • The foreign exchange rate is the price of one currency in terms of another currency • The foreign exchange market determines the foreign exchange rate ...

Economic Advantages of America

... thanks to a majority in the Congress and a partly-manufactured recession scare. But it is a sign of the times that it is considered a political accomplishment when the President is able to convince people to accept a tax cut. In the past, presidents either responsibly resisted popular desires for ta ...

... thanks to a majority in the Congress and a partly-manufactured recession scare. But it is a sign of the times that it is considered a political accomplishment when the President is able to convince people to accept a tax cut. In the past, presidents either responsibly resisted popular desires for ta ...

UN must intervene after failure of US and BWIs to address crisis

... while the crisis bore a 'Made in the United States' label, it was in fact worldwide and required a global response that must be consistent with justice and social solidarity for all countries, reflect an understanding of the necessary balance between government and markets, and respect the principle ...

... while the crisis bore a 'Made in the United States' label, it was in fact worldwide and required a global response that must be consistent with justice and social solidarity for all countries, reflect an understanding of the necessary balance between government and markets, and respect the principle ...

3.1.4 Loss of competitiveness arising from exchange rate policies

... Causes, Effects And Regulatory Implications Of Financial and Economic Turbulence in Emerging Markets ...

... Causes, Effects And Regulatory Implications Of Financial and Economic Turbulence in Emerging Markets ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.