PDF Download

... come about as a result of rising capital mobility. To overcome the inconsistency, one element of the quartet had to be dropped. The international community decided to drop the fixed exchange rate element and moved to a regime of floating rates. Europe decided to drop independent monetary policy and ...

... come about as a result of rising capital mobility. To overcome the inconsistency, one element of the quartet had to be dropped. The international community decided to drop the fixed exchange rate element and moved to a regime of floating rates. Europe decided to drop independent monetary policy and ...

FLC Class 2/19/2003 - Stony Brook University

... Supply & demand economy—free and open markets rule via “comparative advantage” Privatization and private ownership Specialization and division of labor within a global economy—Economies of scale Free trade instead of protectionism or autarky ...

... Supply & demand economy—free and open markets rule via “comparative advantage” Privatization and private ownership Specialization and division of labor within a global economy—Economies of scale Free trade instead of protectionism or autarky ...

The East Asian Financial Crisis: Diagnosis, Remedies, Prospects

... total lending on some countries ...

... total lending on some countries ...

“Nation” state

... • The Euro crisis has similarities to pre-Depression Gold Standard and 1990s crises (Asia, Argentina) – Fixed exchange rates and few/no capital controls facilitated high borrowing, high growth – Banks became overextended, could not repay loans – Troubled governments could not use monetary or fiscal ...

... • The Euro crisis has similarities to pre-Depression Gold Standard and 1990s crises (Asia, Argentina) – Fixed exchange rates and few/no capital controls facilitated high borrowing, high growth – Banks became overextended, could not repay loans – Troubled governments could not use monetary or fiscal ...

The International Use of Currencies: The U.S. Dollar and the Euro

... lead to a gradual increase in the euro’s use as a unit of account in the denomination of trade flows, particularly in transactions between the euro area and developing and transition countries. Moreover, if all 15 EU countries eventually join the euro area, then more than 60 percent of their current ...

... lead to a gradual increase in the euro’s use as a unit of account in the denomination of trade flows, particularly in transactions between the euro area and developing and transition countries. Moreover, if all 15 EU countries eventually join the euro area, then more than 60 percent of their current ...

The Fallacy of the Revised Bretton Woods Hypothesis: Why Today’s

... Asian economies ultimately face capital losses on their dollar reserve holdings. This assumption tacitly assumes the conclusion that the system is unstable. In fact, it is quite possible that China could end up reaping large capital gains on its holdings. The logic is as follows. China is resisting ...

... Asian economies ultimately face capital losses on their dollar reserve holdings. This assumption tacitly assumes the conclusion that the system is unstable. In fact, it is quite possible that China could end up reaping large capital gains on its holdings. The logic is as follows. China is resisting ...

Monetary Law and Monetary Policy 12. Institutional and monetary

... indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality” Treaty establishing the European Stability Mechanism (ESM Treaty) – signed on 2 February 2012, took effect on 27 ...

... indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality” Treaty establishing the European Stability Mechanism (ESM Treaty) – signed on 2 February 2012, took effect on 27 ...

www.pug.univ.trieste.it

... Overall risks to the outlook seem less threatening than six months ago but remained weighted on the downside, with increasing concerns about financial risks. ...

... Overall risks to the outlook seem less threatening than six months ago but remained weighted on the downside, with increasing concerns about financial risks. ...

O Why High Yield Corporate Bonds Will Remain Attractive in 2012

... sentiment almost everywhere. ...

... sentiment almost everywhere. ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

Presentation: The International Roles of the Dollar and Euro in Trade

... fairly well understood ...

... fairly well understood ...

Presentation - Stephany Griffiths-Jones

... liquidity effects from liquidation of positions or insufficient funding liquidity to meet margin calls by actors like hedge funds (FSF 2007 Report) Key role for G-8 where most major financial centres are and with links to off-shore centres ...

... liquidity effects from liquidation of positions or insufficient funding liquidity to meet margin calls by actors like hedge funds (FSF 2007 Report) Key role for G-8 where most major financial centres are and with links to off-shore centres ...

The World Trade Organization

... • These institutions arose out of the plans by the US to avoid financial crisis after WWII. – World Bank was to give loans to reconstruct Europe, but gave loans to poor countries instead. – IMF gives loans and advice for dealing with short term financial crisis. ...

... • These institutions arose out of the plans by the US to avoid financial crisis after WWII. – World Bank was to give loans to reconstruct Europe, but gave loans to poor countries instead. – IMF gives loans and advice for dealing with short term financial crisis. ...

Economic Interdependence Notes

... Canada, and Mexico agree to not put protective tariffs on goods that are traded between each other. It’s purpose is to increase competition, productivity, and strengthen the economies c. WTO (World Trade Organization): Sets rules that govern trading practices between nations to ensure equality d. IM ...

... Canada, and Mexico agree to not put protective tariffs on goods that are traded between each other. It’s purpose is to increase competition, productivity, and strengthen the economies c. WTO (World Trade Organization): Sets rules that govern trading practices between nations to ensure equality d. IM ...

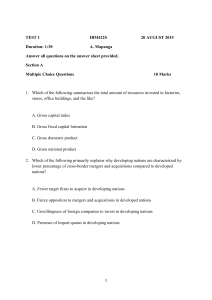

TEST 1 IBM422S 20 AUGUST 2015

... A. Trading of equities of foreign companies and currency conversion B. Reducing currency volatility and setting interest rates C. Insuring companies against interest rate risk and enabling imports and exports D. Currency conversion and providing some insurance against foreign exchange risk 6. A pair ...

... A. Trading of equities of foreign companies and currency conversion B. Reducing currency volatility and setting interest rates C. Insuring companies against interest rate risk and enabling imports and exports D. Currency conversion and providing some insurance against foreign exchange risk 6. A pair ...

Currency Wars - Western Asset

... In an era of paper money and (mostly) floating exchange rates, and with daily trading volumes in the global FX market of US$4 to US$5 trillion, the concept of competitive devaluations is not realistic. Absent capital controls and/or sustained, concerted and credible central bank intervention, the ab ...

... In an era of paper money and (mostly) floating exchange rates, and with daily trading volumes in the global FX market of US$4 to US$5 trillion, the concept of competitive devaluations is not realistic. Absent capital controls and/or sustained, concerted and credible central bank intervention, the ab ...

European Monetary Union Smyth 61

... When the Treaty of Rome was signed in 1957, Its six original signatories France, Italy, \Vcst-Germany and the Benelux countries - aimed to lay the foundations of an cvcr closcr union amongst the people of Europe. A Monetary Commlttce was sct up In 1958 to consider the possibility of a common monetar ...

... When the Treaty of Rome was signed in 1957, Its six original signatories France, Italy, \Vcst-Germany and the Benelux countries - aimed to lay the foundations of an cvcr closcr union amongst the people of Europe. A Monetary Commlttce was sct up In 1958 to consider the possibility of a common monetar ...

International Insolvency Law Organisational matters

... request for bail-out loan from the EU insisting of the Eurogroup on the involvement of bank creditors and depositors first proposal (16 March 2013): ‘haircut’ would be imposed on all depositors, even those covered by the deposit guarantee scheme (below 100.000 EUR) closure of banks (‘bank holiday’) ...

... request for bail-out loan from the EU insisting of the Eurogroup on the involvement of bank creditors and depositors first proposal (16 March 2013): ‘haircut’ would be imposed on all depositors, even those covered by the deposit guarantee scheme (below 100.000 EUR) closure of banks (‘bank holiday’) ...

By dint of railing at fools, we risk becoming fools

... Gustave Flaubert—be kind to politicians and central bankers, therefore! ...

... Gustave Flaubert—be kind to politicians and central bankers, therefore! ...

Will Failure of the "European Monetary Union" Jeopardise the

... which played the role of a numeraire to fix the central rates of European currencies and of a unit of account in the intervention and the credit mechanisms; 2. an Exchange Rate Mechanism (ERM), which allowed a margin of fluctuation of each EC currency of + 2.25% in respect to the central rate, for ...

... which played the role of a numeraire to fix the central rates of European currencies and of a unit of account in the intervention and the credit mechanisms; 2. an Exchange Rate Mechanism (ERM), which allowed a margin of fluctuation of each EC currency of + 2.25% in respect to the central rate, for ...

Monetary policy

... We will achieve lower unemployment and higher inflation and by means of depreciation there will be an improvement in the balance of goods and services. Expansionary monetary policy will reduce unemployment and improve the balance of goods and services in the short period of time; as for the long ter ...

... We will achieve lower unemployment and higher inflation and by means of depreciation there will be an improvement in the balance of goods and services. Expansionary monetary policy will reduce unemployment and improve the balance of goods and services in the short period of time; as for the long ter ...

Changes in Financial Markets and Their Effects on

... assets traded internationally. The U.S. dollar’ is the world’s principal reserve currency. While a depreciating U.S. dollar’ does weaken its use as a reserve currency, there appears to be no readily available substitute at a relevant scale of use in international transactions. ...

... assets traded internationally. The U.S. dollar’ is the world’s principal reserve currency. While a depreciating U.S. dollar’ does weaken its use as a reserve currency, there appears to be no readily available substitute at a relevant scale of use in international transactions. ...

The Euro by Carlos Rios

... participating in monetary union – adopts guidelines to ensure performance of tasks of ESCB – makes monetary policy of community, key interest rates and supplies of reserves in ...

... participating in monetary union – adopts guidelines to ensure performance of tasks of ESCB – makes monetary policy of community, key interest rates and supplies of reserves in ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.