Week13-2

... reserves and buying back their own currency • Doing this caused a monetary contraction for each country ...

... reserves and buying back their own currency • Doing this caused a monetary contraction for each country ...

By: Sebastian Spio

... “Give me control of a nation’s money and I care not who makes its laws” - M.A Rothschild Unwilling to submit itself to a stringent IMF program, unable to source international donor financing, skittish about taping the Eurobond markets and stymied from quickly raising domestic tax revenue, Nigeria’s ...

... “Give me control of a nation’s money and I care not who makes its laws” - M.A Rothschild Unwilling to submit itself to a stringent IMF program, unable to source international donor financing, skittish about taping the Eurobond markets and stymied from quickly raising domestic tax revenue, Nigeria’s ...

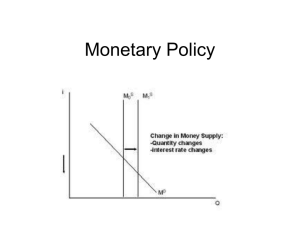

Monetary Policy

... • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

PowerPoint-presentatie - EESC European Economic and Social

... targeted longer term refinancing operation: auctioning of 4-year loans at ultra-low interest rates under the condition that the institutions would pass on the funds to companies (funding-for-lending) ...

... targeted longer term refinancing operation: auctioning of 4-year loans at ultra-low interest rates under the condition that the institutions would pass on the funds to companies (funding-for-lending) ...

A fleeting coincidence of events or a powerful new underlying force?

... since the beginning of 2002 (the yen and the won depreciated slightly against the dollar but all the others, and especially Greater China’s, remained tightly pegged). Their domestic interest rates are at comparably similar low levels when adjusted for differences in local inflation rates. And their ...

... since the beginning of 2002 (the yen and the won depreciated slightly against the dollar but all the others, and especially Greater China’s, remained tightly pegged). Their domestic interest rates are at comparably similar low levels when adjusted for differences in local inflation rates. And their ...

AP MACRO UNIT 8 MR. LIPMAN

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter). ...

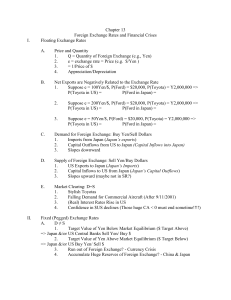

Chapter 13 - Montana State University

... High interest rates in US (Volcker disinflation) LDCs burdened by high oil import costs Plunging (other) commodity prices Widespread defaults: Negotiations; repay 30 cents on the dollar ...

... High interest rates in US (Volcker disinflation) LDCs burdened by high oil import costs Plunging (other) commodity prices Widespread defaults: Negotiations; repay 30 cents on the dollar ...

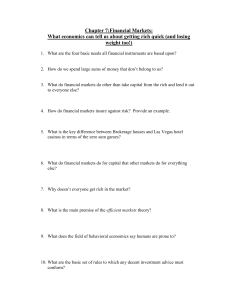

Naked Economics Chapter 10: The Federal Reserve

... 10. What are the basic set of rules to which any decent investment advice must conform? ...

... 10. What are the basic set of rules to which any decent investment advice must conform? ...

From Gold to the Ecu: The International Monetary System in

... about three decades, greenback and then bimetallist agitation had caused real doubt about the durability of the U.S. gold standard, doubt reflected in otherwise surprisingly high interest rates on dollar-denominated bonds (Friedman and Schwartz 1982, 515–17). In 1914 the major powers shared practica ...

... about three decades, greenback and then bimetallist agitation had caused real doubt about the durability of the U.S. gold standard, doubt reflected in otherwise surprisingly high interest rates on dollar-denominated bonds (Friedman and Schwartz 1982, 515–17). In 1914 the major powers shared practica ...

Foreign Exchange and the International Monetary System

... Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to slow the domestic economy to prevent change in exchange rate Higher taxes, higher interest rates, lower spending ...

... Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to slow the domestic economy to prevent change in exchange rate Higher taxes, higher interest rates, lower spending ...

Traditional Interest Rate Channels

... Lesson for Monetary Policy 1. Dangerous to associate easing or tightening with fall or rise in nominal interest rates. 2. Other asset prices besides short-term debt have information about stance of monetary policy. 3. Monetary policy effective in reviving economy even if short-term interest rates n ...

... Lesson for Monetary Policy 1. Dangerous to associate easing or tightening with fall or rise in nominal interest rates. 2. Other asset prices besides short-term debt have information about stance of monetary policy. 3. Monetary policy effective in reviving economy even if short-term interest rates n ...

Contemporary Logistics Currency Internationalization and

... In this stage, the U.S. truly achieved dollar internationalization, and gained DPIF status. The key world’s currency is provided generally by the strongest economic strength. The British economy was far behind the United States due to wars, which lost the economic foundation of monopolizing internat ...

... In this stage, the U.S. truly achieved dollar internationalization, and gained DPIF status. The key world’s currency is provided generally by the strongest economic strength. The British economy was far behind the United States due to wars, which lost the economic foundation of monopolizing internat ...

Fundamental Flaws in the European Project

... contract because of adverse trade performance and if private sector saving represents yet another leakage from the circular flow of income, a proactive fiscal deficit will be needed to maintain the pace of economic growth. A conservative budget merely adds to the contractionary tendencies while alle ...

... contract because of adverse trade performance and if private sector saving represents yet another leakage from the circular flow of income, a proactive fiscal deficit will be needed to maintain the pace of economic growth. A conservative budget merely adds to the contractionary tendencies while alle ...

EC120 week 1 - University of Essex

... ̶ In Europe, steps towards closer economic integration and monetary union were only possible with converging (or at least stable) rates of inflation, a task not easily accomplished (for an indication of the consequences of differential inflation in foreign exchange markets, see Baldwin & Wyplosz (20 ...

... ̶ In Europe, steps towards closer economic integration and monetary union were only possible with converging (or at least stable) rates of inflation, a task not easily accomplished (for an indication of the consequences of differential inflation in foreign exchange markets, see Baldwin & Wyplosz (20 ...

Il quadro economico globale

... This solution is not unlike that adopted by private firms in financial difficulty ...

... This solution is not unlike that adopted by private firms in financial difficulty ...

Prospects for Asia and the Global Economy: Conference Summary

... recent global financial crisis. He classifies monetary regimes into three categories: those that target the inflation rate; those maintaining a “hard” exchange rate peg to some stable foreign currency either by accepting it as separate legal tender or by adopting a currency board arrangement or a co ...

... recent global financial crisis. He classifies monetary regimes into three categories: those that target the inflation rate; those maintaining a “hard” exchange rate peg to some stable foreign currency either by accepting it as separate legal tender or by adopting a currency board arrangement or a co ...

Document

... sell government securities. Rush to liquidity was inflamed because of the competitive maneuvering among some private banks. The decline in the value of government securities and the rise in the sovereign risk because of the fragility of the financial system led foreign investors to accelerate their ...

... sell government securities. Rush to liquidity was inflamed because of the competitive maneuvering among some private banks. The decline in the value of government securities and the rise in the sovereign risk because of the fragility of the financial system led foreign investors to accelerate their ...

Presentation by Mr. Christopher Towe, Deputy Director, Monetary

... over mortgage originators to improve underwriting standards Stricter application of consolidated supervision: Basel II reduces the incentives to move off-balance sheet, but vigilance will still be required Fair value accounting: Care is needed to minimize the procyclicality of this system Improve li ...

... over mortgage originators to improve underwriting standards Stricter application of consolidated supervision: Basel II reduces the incentives to move off-balance sheet, but vigilance will still be required Fair value accounting: Care is needed to minimize the procyclicality of this system Improve li ...

Title Goes Here - Binus Repository

... tax on international currency transactions like the socalled Tobin tax to culb the speculative inflow and outflow of foreign capital – a central ingredient in the 1997 Asian currency crisis. Bina Nusantara University ...

... tax on international currency transactions like the socalled Tobin tax to culb the speculative inflow and outflow of foreign capital – a central ingredient in the 1997 Asian currency crisis. Bina Nusantara University ...

Testimony before

... framework while strengthening its main principles and objectives. The ECB considers this a good starting-point for rebuilding confidence in the budgetary policy framework. Finally, neither the discussion on monetary or fiscal policy, nor the current economic outlook should divert attention from the ...

... framework while strengthening its main principles and objectives. The ECB considers this a good starting-point for rebuilding confidence in the budgetary policy framework. Finally, neither the discussion on monetary or fiscal policy, nor the current economic outlook should divert attention from the ...

IR.week8b.DevelopmentWhatToDo

... • Policy advice from abroad should fit local circumstances (India, S. Korea, China ignored the Washington Consensus; Mexico & Argentina listened • The best thing we can do to end global poverty is to increase trade and economic access (Perhaps more international labor mobility? Evidence from Mexican ...

... • Policy advice from abroad should fit local circumstances (India, S. Korea, China ignored the Washington Consensus; Mexico & Argentina listened • The best thing we can do to end global poverty is to increase trade and economic access (Perhaps more international labor mobility? Evidence from Mexican ...

International Economics PPT

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

Global economy and the nation-state

... One example is the run on the dollar in the spring of 1995, which forced President Clinton to abandon his earlier spending plans and embrace a balanced budget. The run was triggered by the failure of the Republican majority in the Senate to pass a constitutional amendment calling for a balanced bud ...

... One example is the run on the dollar in the spring of 1995, which forced President Clinton to abandon his earlier spending plans and embrace a balanced budget. The run was triggered by the failure of the Republican majority in the Senate to pass a constitutional amendment calling for a balanced bud ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.