chapter four ppoint - MDC Faculty Home Pages

... • Began monitoring GATT agreements in 1995 World Bank Lends money to less-developed and developing countries. • Funds projects that build or expand infrastructure. • Provides assistance and advice. International Monetary Fund Promotes trade through financial cooperation. • Makes short-term loans to ...

... • Began monitoring GATT agreements in 1995 World Bank Lends money to less-developed and developing countries. • Funds projects that build or expand infrastructure. • Provides assistance and advice. International Monetary Fund Promotes trade through financial cooperation. • Makes short-term loans to ...

Document

... • Began monitoring GATT agreements in 1995 World Bank Lends money to less-developed and developing countries. • Funds projects that build or expand infrastructure. • Provides assistance and advice. International Monetary Fund Promotes trade through financial cooperation. • Makes short-term loans to ...

... • Began monitoring GATT agreements in 1995 World Bank Lends money to less-developed and developing countries. • Funds projects that build or expand infrastructure. • Provides assistance and advice. International Monetary Fund Promotes trade through financial cooperation. • Makes short-term loans to ...

Washington consensus

... enterprises; these should be privatised; i: also, reducing G takes pressure off Government financial borrowing requirement (PBR), enabling i-rts to fall and reducing ‘crowding out’ of private Investment (X- M): end import protection, thus enabling switch of resources exports. In some cases, deval ...

... enterprises; these should be privatised; i: also, reducing G takes pressure off Government financial borrowing requirement (PBR), enabling i-rts to fall and reducing ‘crowding out’ of private Investment (X- M): end import protection, thus enabling switch of resources exports. In some cases, deval ...

THE INTERNATIONAL MONETARY SHOULD IT BE REFORMED? Working Paper No. 2163

... Prominent on the agenda has been the question of reform. How should the international monetary system be reformed so as to function more effectively? The premise underlying this question is that the international ...

... Prominent on the agenda has been the question of reform. How should the international monetary system be reformed so as to function more effectively? The premise underlying this question is that the international ...

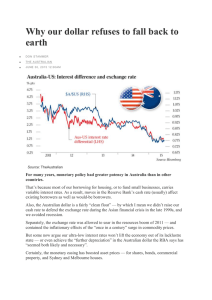

Why our dollar refuses to fall back to earth

... For our dollar to decline usefully against the greenback, we may have to wait for expectations the US will soon raise its cash rate — or cut our interest rates and live with a housing bubble in the two biggest cities. Even then, the Australian dollar may not move as low as many people now wish for. ...

... For our dollar to decline usefully against the greenback, we may have to wait for expectations the US will soon raise its cash rate — or cut our interest rates and live with a housing bubble in the two biggest cities. Even then, the Australian dollar may not move as low as many people now wish for. ...

To view this press release as a file

... quantitative easing programs in Europe and Japan. This accommodation forced several countries (such as Sweden and Switzerland) to adopt similar policy, and in other countries central banks had to reduce the interest rate and intervene in the foreign exchange market to prevent further currency apprec ...

... quantitative easing programs in Europe and Japan. This accommodation forced several countries (such as Sweden and Switzerland) to adopt similar policy, and in other countries central banks had to reduce the interest rate and intervene in the foreign exchange market to prevent further currency apprec ...

Fixed Rate System: Preview of Results

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

Country outlook

... in the immediate wake of Hurricane Katrina in late August. The storm has raised questions in the minds of many Americans about Mr Bush's leadership qualities and abilities as a "crisis manager". His approval ratings improved marginally following the more successful clean-up exercise after Hurricane ...

... in the immediate wake of Hurricane Katrina in late August. The storm has raised questions in the minds of many Americans about Mr Bush's leadership qualities and abilities as a "crisis manager". His approval ratings improved marginally following the more successful clean-up exercise after Hurricane ...

OVERVIEW

... filed for bankruptcy protection in September 2008. The situation, which emerged as a liquidity problem in the interbank markets during the early stages of the crisis, gradually turned into concerns regarding the reliability of financial institutions. Accordingly, deposit owners and other investors h ...

... filed for bankruptcy protection in September 2008. The situation, which emerged as a liquidity problem in the interbank markets during the early stages of the crisis, gradually turned into concerns regarding the reliability of financial institutions. Accordingly, deposit owners and other investors h ...

A Foreign Exchange and Policy Perspective

... First, recognition that higher inflation would not bring about lower unemployment, a view that was widely held before the 1970s. A second development—closely related to the first—concerns the procedures used at central banks for setting the instruments of monetary policy. The main change here is tha ...

... First, recognition that higher inflation would not bring about lower unemployment, a view that was widely held before the 1970s. A second development—closely related to the first—concerns the procedures used at central banks for setting the instruments of monetary policy. The main change here is tha ...

Course Outline School of Business and Economics BUSN 6030/1

... 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries. 7. Describe the history, current scope, and future prospects of the world’s most important region ...

... 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries. 7. Describe the history, current scope, and future prospects of the world’s most important region ...

white paper of Nautiluscoin

... document serves an introduction to the three pronged approach employed by Nautiluscoin to reduce volatility, maintain low fees and regulate money supply. The Nautiluscoin Stability Fund seeks to reduce volatility, while the Proof of Stake algorithm does away with the need for expensive mining equipm ...

... document serves an introduction to the three pronged approach employed by Nautiluscoin to reduce volatility, maintain low fees and regulate money supply. The Nautiluscoin Stability Fund seeks to reduce volatility, while the Proof of Stake algorithm does away with the need for expensive mining equipm ...

FRBSF L CONOMIC

... impaired. Also, official credibility and transparency are crucial. Uncertainty about the health of financial institutions can prolong and deepen crises. Maurice Obstfeld and Kenneth Rogoff argued that, although global imbalances in trade and capital flows didn’t cause the crisis, they were generated ...

... impaired. Also, official credibility and transparency are crucial. Uncertainty about the health of financial institutions can prolong and deepen crises. Maurice Obstfeld and Kenneth Rogoff argued that, although global imbalances in trade and capital flows didn’t cause the crisis, they were generated ...

Asia Financial Crisis

... Bailouts (rescue packages) for the most affected economies to enable affected nations to avoid default. ...

... Bailouts (rescue packages) for the most affected economies to enable affected nations to avoid default. ...

china currency conundrum - Quist Wealth Management

... devaluation of its currency, the yuan, versus the U.S. dollar. Despite reports suggesting otherwise, this is not the first time China has used its currency’s exchange rate as a policy tool. In fact, China has been manipulating the value of its currency for at least a decade, if not longer. The last ...

... devaluation of its currency, the yuan, versus the U.S. dollar. Despite reports suggesting otherwise, this is not the first time China has used its currency’s exchange rate as a policy tool. In fact, China has been manipulating the value of its currency for at least a decade, if not longer. The last ...

World Economic Situation and Prospects 2004

... • Lower external demand, world trade excess capacity investment slowdown • Depressed domestic demand lower prices, output lower employment, incomes ...

... • Lower external demand, world trade excess capacity investment slowdown • Depressed domestic demand lower prices, output lower employment, incomes ...

Aristotle`s Taxonomy of Political Systems

... Most of the world's systems, including Yugoslavia, Spain, All polyarchal systems: Portugal, most of Latin America, North American Western new African nations, the Middle European, and others [AICs] East except Israel, and all of noncommunist Asia except Japan [LDCs] Communist systems except Yugoslav ...

... Most of the world's systems, including Yugoslavia, Spain, All polyarchal systems: Portugal, most of Latin America, North American Western new African nations, the Middle European, and others [AICs] East except Israel, and all of noncommunist Asia except Japan [LDCs] Communist systems except Yugoslav ...

Chapter 15 The EU and Regional Trade Areas

... Rationalization of production across Europe to reduce cost Pan-European capital market Increase range of investment options available to both individuals and institutions ...

... Rationalization of production across Europe to reduce cost Pan-European capital market Increase range of investment options available to both individuals and institutions ...

solution

... GDP growth were higher than for an average of the euro area. At the same time, short term money market rates were 2.5% to 0.5% higher in the UK. Had the UK been part of the euro area, it would have shared monetary policy with the other countries. On the one hand, this would have meant interest rates ...

... GDP growth were higher than for an average of the euro area. At the same time, short term money market rates were 2.5% to 0.5% higher in the UK. Had the UK been part of the euro area, it would have shared monetary policy with the other countries. On the one hand, this would have meant interest rates ...

CHAPTER 20 Optimum Currency Areas and the European Experience

... that adopt a single currency. Yet it made sense for eleven European countries to form a monetary union in 1999 because a. System (i) is vulnerable to currency crises—especially when there are no restrictions on capital flows—whereas system (ii) is not. b. The single currency was intended as “a poten ...

... that adopt a single currency. Yet it made sense for eleven European countries to form a monetary union in 1999 because a. System (i) is vulnerable to currency crises—especially when there are no restrictions on capital flows—whereas system (ii) is not. b. The single currency was intended as “a poten ...

here

... Sponsored by: Russian Federation Submitted by: United States of America ,Italy, Ukraine, United Kingdom , France , Russian Federation, Mexico , Czech Republic, Malta, Azerbaijan, Denmark, Australia, Germany, Brazil, Liechtenstein, Switzerland, India, Cuba, Serbia, New Zeeland, Cyprus, Spain, Hellas, ...

... Sponsored by: Russian Federation Submitted by: United States of America ,Italy, Ukraine, United Kingdom , France , Russian Federation, Mexico , Czech Republic, Malta, Azerbaijan, Denmark, Australia, Germany, Brazil, Liechtenstein, Switzerland, India, Cuba, Serbia, New Zeeland, Cyprus, Spain, Hellas, ...

I Easy Money and the Decapitalization of America GEORGE WILLIAM H.

... of promising greater price-level stability than a gold standard. Yet monetary reform on its own will not be enough to reverse the destruction of U.S. capital: the federal government also needs to reform its own vast range of capitaldestroying policies. Such reforms would include, among others, the f ...

... of promising greater price-level stability than a gold standard. Yet monetary reform on its own will not be enough to reverse the destruction of U.S. capital: the federal government also needs to reform its own vast range of capitaldestroying policies. Such reforms would include, among others, the f ...

SECTION 8: Open Economy: International Trade & Finance Need to Know The , consists of international transactions that don’t create liabilities.

... A country has a Fixed Exchange Rate when the government keeps the exchange rate against some other currency at or near a particular target. For example, Hong Kong has an official policy of setting an exchange rate of HK$7.80 per US$1. o This is called exchange market intervention. The governm ...

... A country has a Fixed Exchange Rate when the government keeps the exchange rate against some other currency at or near a particular target. For example, Hong Kong has an official policy of setting an exchange rate of HK$7.80 per US$1. o This is called exchange market intervention. The governm ...

Mr. Tietmeyer discusses the benefits, opportunities and pitfalls of

... A number of countries will closely watch the outcome of this experiment, which may change Europe considerably. This is true in particular of those countries of the European Union which do not wish to join the monetary union as yet. Accession candidates in central and eastern Europe, too, will of cou ...

... A number of countries will closely watch the outcome of this experiment, which may change Europe considerably. This is true in particular of those countries of the European Union which do not wish to join the monetary union as yet. Accession candidates in central and eastern Europe, too, will of cou ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.