How the Federal Reserve Monetary System Destroys Liberty

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

Issue23 - Cleobury Country Centre

... Over a little over the past century, the world economies have lurched around the extremities of this trilemma. There was the Victorian gold Standard, where all currencies were pegged to the price of gold, capital flows were free and there was no domestic monetary policy. There was the Bretton Woods, ...

... Over a little over the past century, the world economies have lurched around the extremities of this trilemma. There was the Victorian gold Standard, where all currencies were pegged to the price of gold, capital flows were free and there was no domestic monetary policy. There was the Bretton Woods, ...

How the Federal Rerserve Monetary System Destroys Liberty

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

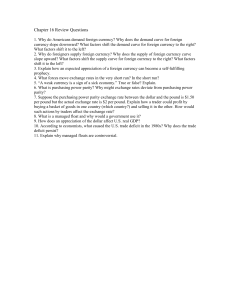

Chapter 29

... 4. What forces move exchange rates in the very short run? In the short run? 5. “A weak currency is a sign of a sick economy.” True or false? Explain. 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rat ...

... 4. What forces move exchange rates in the very short run? In the short run? 5. “A weak currency is a sign of a sick economy.” True or false? Explain. 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rat ...

Exchange Rate Policy and Open

... If the fixed rate is above the market equilibrium rate, there is a surplus of that nation’s currency in the foreign exchange market. There are typically three ways in which the government can reduce the price to reach the target exchange rate. Likewise, if the fixed rate is below the market equi ...

... If the fixed rate is above the market equilibrium rate, there is a surplus of that nation’s currency in the foreign exchange market. There are typically three ways in which the government can reduce the price to reach the target exchange rate. Likewise, if the fixed rate is below the market equi ...

The East Asia Crisis

... Malaysia, Philippines, Singapore, Taiwan and Thailand pegged their currencies to the US dollar. Depreciation of the local currencies on the foreign-exchange market means an increased burden of external debt. Pegged exchange rates forced Asian banks to keep interest rates comparable to US rates and c ...

... Malaysia, Philippines, Singapore, Taiwan and Thailand pegged their currencies to the US dollar. Depreciation of the local currencies on the foreign-exchange market means an increased burden of external debt. Pegged exchange rates forced Asian banks to keep interest rates comparable to US rates and c ...

Speech by the Governor of the Bank of Italy Ignazio

... Political and financial tensions can still affect market stability in the area, but the risks of contagion are fewer than in the recent past. The investment plan announced by the President of the European Commission at the end of last year marks the first attempt to organize a coordinated response a ...

... Political and financial tensions can still affect market stability in the area, but the risks of contagion are fewer than in the recent past. The investment plan announced by the President of the European Commission at the end of last year marks the first attempt to organize a coordinated response a ...

Document

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

... are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only ...

international assets advisory, llc (“iaa”) “pure” foreign currency

... underlying performance of the company and how, as a result, its price in the local currency market will rise or fall. Futures contracts are marked to market; an investor may need to add funds to his original investment if the currency falls. Early termination of CDs usually results in a penalty. So, ...

... underlying performance of the company and how, as a result, its price in the local currency market will rise or fall. Futures contracts are marked to market; an investor may need to add funds to his original investment if the currency falls. Early termination of CDs usually results in a penalty. So, ...

The Effect of Financial Stability on Monetary Policy

... Another way in which the effectiveness of monetary policy is impaired by financial instability, which is relevant for emerging economies is one where there is an alternative risk-free asset, foreign exchange. If, in response to an exogenous instability shock, a CB cuts its KPR and injects liquid ...

... Another way in which the effectiveness of monetary policy is impaired by financial instability, which is relevant for emerging economies is one where there is an alternative risk-free asset, foreign exchange. If, in response to an exogenous instability shock, a CB cuts its KPR and injects liquid ...

economic development course proposal

... In order to analyze the problems of contemporary poor countries it is essential to understand how they became “less developed” than today’s rich countries and how they have attempted to catch up. The main focus of this week is on the division of the world into agricultural and industrialized countri ...

... In order to analyze the problems of contemporary poor countries it is essential to understand how they became “less developed” than today’s rich countries and how they have attempted to catch up. The main focus of this week is on the division of the world into agricultural and industrialized countri ...

NBER WORKING PAPER SERIES AN ESSAY ON THE REVIVED

... When Europe’s development strategy shifted toward free markets, financial controls were lifted and the fixed rate system soon collapsed into the floating regime of the 1970s. But in our view the system of freely floating exchange rates and open capital markets was itself only a transition during whi ...

... When Europe’s development strategy shifted toward free markets, financial controls were lifted and the fixed rate system soon collapsed into the floating regime of the 1970s. But in our view the system of freely floating exchange rates and open capital markets was itself only a transition during whi ...

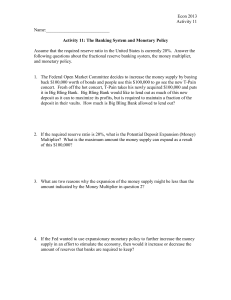

Activity 11 - The Banking System and Monetary Policy

... Activity 11: The Banking System and Monetary Policy Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...

... Activity 11: The Banking System and Monetary Policy Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...

Lesson 5 - C21 Student

... FX = foreign exchange Exchange rates float freely Rates change relative to each other only ...

... FX = foreign exchange Exchange rates float freely Rates change relative to each other only ...

probsetFinance3

... 5. In a fixed price Keynesian framework, why is the value of the expenditure multiplier in a large open economy is greater than the small-economy multiplier but lower than the closed-economy multiplier? 6. If we have fixed exchange rates and rigid prices, we can have either equilibrium at full emplo ...

... 5. In a fixed price Keynesian framework, why is the value of the expenditure multiplier in a large open economy is greater than the small-economy multiplier but lower than the closed-economy multiplier? 6. If we have fixed exchange rates and rigid prices, we can have either equilibrium at full emplo ...

GLOBAL ECONOMIC PROSPECTS: The Continuing Crisis

... • Ensuring that Greece and (at least some) other European countries can roll over their debt and finance their deficits • The question is: Will it work? • Market response: Risk of default has gone down considerably, but is still significant • Question: Why hasn’t the trillion-dollar rescue done a be ...

... • Ensuring that Greece and (at least some) other European countries can roll over their debt and finance their deficits • The question is: Will it work? • Market response: Risk of default has gone down considerably, but is still significant • Question: Why hasn’t the trillion-dollar rescue done a be ...

走在十字路口的中国经济 - United Nations Economic and Social

... China’s growth was characterized by investment- driven and export- driven ...

... China’s growth was characterized by investment- driven and export- driven ...

Nominální efektivní kurz koruny

... the eurozone countries are identified as a single currency area. The number of eurozone countries corresponds to the actual state. In the first variant, the weights relate to the overall trade turnover, whereas in the second variant the weights relate only to the turnover in SITC groups 5–8. The tim ...

... the eurozone countries are identified as a single currency area. The number of eurozone countries corresponds to the actual state. In the first variant, the weights relate to the overall trade turnover, whereas in the second variant the weights relate only to the turnover in SITC groups 5–8. The tim ...

lecture 5.slides - Lancaster University

... - encourages trade - encourages investment (inc. FDI) • lower inflation and interest rates - central bank independent of member govts - member states have to keep wage increases in line to maintain competitiveness ...

... - encourages trade - encourages investment (inc. FDI) • lower inflation and interest rates - central bank independent of member govts - member states have to keep wage increases in line to maintain competitiveness ...

Chap31

... Foreign exchange rates between major currencies are free to float, with market forces determining the relative value of a currency. Spot exchange rates adjust to compensate for the relative inflation rate between two countries. ...

... Foreign exchange rates between major currencies are free to float, with market forces determining the relative value of a currency. Spot exchange rates adjust to compensate for the relative inflation rate between two countries. ...

The Euro and the World Economy

... relative economic performance in the United States and Europe—due mainly to poorer results in the United States. A rapid fall of the dollar, combined with the precipitous rise of world energy prices that is likely to continue and indeed escalate further, could produce a series of major setbacks to a ...

... relative economic performance in the United States and Europe—due mainly to poorer results in the United States. A rapid fall of the dollar, combined with the precipitous rise of world energy prices that is likely to continue and indeed escalate further, could produce a series of major setbacks to a ...

Issue 2 - John Birchall

... by a policy that allows the yuan to strengthen against the dollar, so beginning the process of reducing the apparent permanent march of Chinese exports. Many now think that China needs a more flexible exchange rate mechanism and that if it does allow a revaluation of the yuan then other Asian countr ...

... by a policy that allows the yuan to strengthen against the dollar, so beginning the process of reducing the apparent permanent march of Chinese exports. Many now think that China needs a more flexible exchange rate mechanism and that if it does allow a revaluation of the yuan then other Asian countr ...

Int'l Monetary Crisis - University of Texas at Austin

... There be no more corruption Day Sammy dollar die We will love each other I say, the day Mr. dollar die. No more inflation, The day Mr. dollar die ...

... There be no more corruption Day Sammy dollar die We will love each other I say, the day Mr. dollar die. No more inflation, The day Mr. dollar die ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.