A New Keynesian Perspective on the Great Recession

... The Great Recession had adverse shocks that lased much longer and were much more severe Zero lower bound on short-term interest rate Need more complete and detailed assessment of monetary policymaking strategy ...

... The Great Recession had adverse shocks that lased much longer and were much more severe Zero lower bound on short-term interest rate Need more complete and detailed assessment of monetary policymaking strategy ...

Effects of the Financial Crisis on The U.S.-China Economic Relationship

... towards trade, there are in fact more subtle forms of protectionism that remain pervasive. For instance, through its repressed financial system that mainly consists of state-owned banks, China provides cheap capital to many of its enterprises. Subsidies to land and energy have also held down the eff ...

... towards trade, there are in fact more subtle forms of protectionism that remain pervasive. For instance, through its repressed financial system that mainly consists of state-owned banks, China provides cheap capital to many of its enterprises. Subsidies to land and energy have also held down the eff ...

East Asian financial crisis

... Until 1997, Asia attracted almost half of total capital inflow to developing countries. The economies of Southeast Asia in particular maintained high interest rates attractive to foreign investors looking for a high rate of return. As a result the region's economies received a large inflow of hot mo ...

... Until 1997, Asia attracted almost half of total capital inflow to developing countries. The economies of Southeast Asia in particular maintained high interest rates attractive to foreign investors looking for a high rate of return. As a result the region's economies received a large inflow of hot mo ...

Module23

... The History of the Dollar • In the early days of European settlement, the colonies that would become the United States used commodity money, partly consisting of gold and silver coins minted in Europe. Later in American history, commodity-backed paper money came into widespread use. • In 1933, when ...

... The History of the Dollar • In the early days of European settlement, the colonies that would become the United States used commodity money, partly consisting of gold and silver coins minted in Europe. Later in American history, commodity-backed paper money came into widespread use. • In 1933, when ...

Steigum, E (2008). “Monetary instability, financial - Jean Pisani

... bank loans mushroomed from 0.2% to 5%. From 1991 to 1993 Sweden’s GDP fell by a total of around 6%. Unemployment shot up from 3% to 12%. Public sector deficit worsened to as much as 12% of GDP. ...

... bank loans mushroomed from 0.2% to 5%. From 1991 to 1993 Sweden’s GDP fell by a total of around 6%. Unemployment shot up from 3% to 12%. Public sector deficit worsened to as much as 12% of GDP. ...

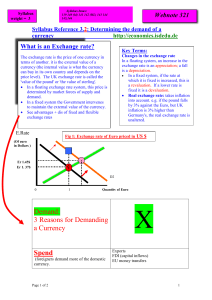

Demand for a currency - yELLOWSUBMARINER.COM

... save in UK banks and other financial institutions (long term capital movements) speculate on the currency in the hope that the pound will become more valuable in the future (these are short term capital movements; called 'hot money') ...

... save in UK banks and other financial institutions (long term capital movements) speculate on the currency in the hope that the pound will become more valuable in the future (these are short term capital movements; called 'hot money') ...

July 2016 – Gearing for a Stronger Half

... The environment of slow-but-steady growth and low inflation has also benefited U.S. high-yield credit which returned 5.8% in the second quarter, according to the Bank of America-Merrill Lynch High-Yield Corporate Bond Index. Spreads have staged a remarkable recovery from their February wides of 887 ...

... The environment of slow-but-steady growth and low inflation has also benefited U.S. high-yield credit which returned 5.8% in the second quarter, according to the Bank of America-Merrill Lynch High-Yield Corporate Bond Index. Spreads have staged a remarkable recovery from their February wides of 887 ...

Press Release-Concluding Statement AIV PPM

... visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF’s Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored pr ...

... visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF’s Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored pr ...

The Euro Through a Glass Darkly

... To be sure, Ireland’s boom was mainly the result of the fact that the country is home to so many electronics firms. Similarly, the fact that growth there has now decelerated mainly reflects the slowdown in the high-tech sector worldwide. California went through a very similar cycle over the last fiv ...

... To be sure, Ireland’s boom was mainly the result of the fact that the country is home to so many electronics firms. Similarly, the fact that growth there has now decelerated mainly reflects the slowdown in the high-tech sector worldwide. California went through a very similar cycle over the last fiv ...

Presentation - International Development Economics Associates

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

Post-Keynesian Theory and a Policy for Managing

... on the presumption of an ergodic stochastic process that governs the movement of all the heavenly bodies from the moment of the “Big Bang” to the day the universe ends. Accordingly, statistical analysis using past measurements of the movements of heavenly bodies permits astronomers to predict future ...

... on the presumption of an ergodic stochastic process that governs the movement of all the heavenly bodies from the moment of the “Big Bang” to the day the universe ends. Accordingly, statistical analysis using past measurements of the movements of heavenly bodies permits astronomers to predict future ...

The Effects of Money Laundering on Economic Development

... Illicit capital flight worsens scarcity of capital in developing countries ‘The costs of capital flight are well known: they include a loss of productive capacity, tax base and control over monetary aggregates - imposing a substantial burden on the public… and rendering policymaking more difficult ...

... Illicit capital flight worsens scarcity of capital in developing countries ‘The costs of capital flight are well known: they include a loss of productive capacity, tax base and control over monetary aggregates - imposing a substantial burden on the public… and rendering policymaking more difficult ...

International political economy exam, january 2016

... allowed fixed exchange rates (to the dollar, which was fixed at $35/ounce) and monetary policy autonomy (central banks could manipulate money supply), but this meant that European countries and Japan imposed capital controls in order to tame speculation (Wigan, 2015b). However, after the breakdown o ...

... allowed fixed exchange rates (to the dollar, which was fixed at $35/ounce) and monetary policy autonomy (central banks could manipulate money supply), but this meant that European countries and Japan imposed capital controls in order to tame speculation (Wigan, 2015b). However, after the breakdown o ...

Does creditor protection mitigate the likelihood of financial crises

... Many foreigners share the view expressed by French officials in the 1960s that the dominance of the dollar confers an "exorbitant privilege" on the United States. They argue that this automatic financing of US external deficits—since most international transactions are financed in dollars—means tha ...

... Many foreigners share the view expressed by French officials in the 1960s that the dominance of the dollar confers an "exorbitant privilege" on the United States. They argue that this automatic financing of US external deficits—since most international transactions are financed in dollars—means tha ...

International Trade - Madison County Schools

... – Nation’s currency likely to depreciate if its growth of national income is more rapid than that of other countries (country’s imports vary directly with its income level; as income rises in U.S., people buy more domestic and foreign goods, thus causing a demand in foreign currency, depreciating U. ...

... – Nation’s currency likely to depreciate if its growth of national income is more rapid than that of other countries (country’s imports vary directly with its income level; as income rises in U.S., people buy more domestic and foreign goods, thus causing a demand in foreign currency, depreciating U. ...

A Constant Unit of Account Richard W. Rahn

... transparently adjusted to reflect (1) changes in exchange rates and (2) the relative importance of each country and currency in world trade and output—much like what is done with the present SDR. The CUA would be an improvement over the SDR because adjustments in currency block weights would be cont ...

... transparently adjusted to reflect (1) changes in exchange rates and (2) the relative importance of each country and currency in world trade and output—much like what is done with the present SDR. The CUA would be an improvement over the SDR because adjustments in currency block weights would be cont ...

Recent Development and Outlook: ASEAN+3 Economies Reza Siregar Group Head/Lead Economist

... there could be upward pressure on government bond yields as investors move into higher yielding, riskier assets. Sudden surge and sharp reversal of risk appetite towards Asia would undermine regional financial stability. ...

... there could be upward pressure on government bond yields as investors move into higher yielding, riskier assets. Sudden surge and sharp reversal of risk appetite towards Asia would undermine regional financial stability. ...

Lecture 1: Why study Money, Banking and Financial Markets? Intro

... not happened in more than 20 years; a huge scandal with one of the largest baks in Europe – Societe Generale; big losses from the sub-prime mortgage investments of the largest banks in US were also announced. Why are these things happening? And, when they are happening, what is their impact on incom ...

... not happened in more than 20 years; a huge scandal with one of the largest baks in Europe – Societe Generale; big losses from the sub-prime mortgage investments of the largest banks in US were also announced. Why are these things happening? And, when they are happening, what is their impact on incom ...

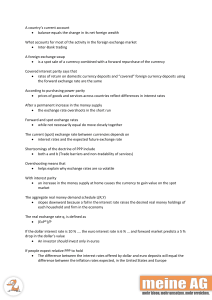

A country`s current account • balance equals the change

... is a spot sale of a currency combined with a forward repurchase of the currency Covered interest parity says that rates of return on domestic currency deposits and “covered” foreign currency deposits using the forward exchange rate are the same According to purchasing power parity prices of go ...

... is a spot sale of a currency combined with a forward repurchase of the currency Covered interest parity says that rates of return on domestic currency deposits and “covered” foreign currency deposits using the forward exchange rate are the same According to purchasing power parity prices of go ...

The Future of the U.S. Dollar and its Competition with the Euro

... The effects of fiscal policy on the current account balance remains unclear. Studies suggest that fiscal policy changes are a poor and costly (both internally and globally) way of reducing the current account deficits. The effects of an increase in government savings on the current account balance d ...

... The effects of fiscal policy on the current account balance remains unclear. Studies suggest that fiscal policy changes are a poor and costly (both internally and globally) way of reducing the current account deficits. The effects of an increase in government savings on the current account balance d ...

ECON 404: Lecture on Deflation

... trend • Great Depression: U.S., Germany (U.K. and Sweden left gold standard first) • In postwar fixed exchange rate regime, no significant deflation -- money was linked to the dollar and the U.S. ran balance of payments surpluses to increase international holdings of dollars. • Small economies heavi ...

... trend • Great Depression: U.S., Germany (U.K. and Sweden left gold standard first) • In postwar fixed exchange rate regime, no significant deflation -- money was linked to the dollar and the U.S. ran balance of payments surpluses to increase international holdings of dollars. • Small economies heavi ...

issues to correctly assess the investment climate and its risks.

... likely to continue until these plates stop shaking. The dollar’s strength presents challenges however, especially to businesses selling products and services internationally. U.S.-based company sales and earnings have been severely challenged as they compete with international companies based in Eur ...

... likely to continue until these plates stop shaking. The dollar’s strength presents challenges however, especially to businesses selling products and services internationally. U.S.-based company sales and earnings have been severely challenged as they compete with international companies based in Eur ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.