Top margin 1

... Third, in some cases prices and wages have adjusted too slowly to changes in national cyclical conditions and competitiveness trends. Fourth, spill-over effects have had an impact. For example, housing booms in several economies have affected both the demand for traded goods and the level of in ...

... Third, in some cases prices and wages have adjusted too slowly to changes in national cyclical conditions and competitiveness trends. Fourth, spill-over effects have had an impact. For example, housing booms in several economies have affected both the demand for traded goods and the level of in ...

The REAL Story By - Seamount Financial Group

... experiencing is not the result of the severity of the Great Recession or that its root cause was a banking crisis, which by nature is more difficult and complex to resolve, but rather a direct result of government policies. These policies of the past several years, in my opinion, have directly and a ...

... experiencing is not the result of the severity of the Great Recession or that its root cause was a banking crisis, which by nature is more difficult and complex to resolve, but rather a direct result of government policies. These policies of the past several years, in my opinion, have directly and a ...

GI Research Market Commentary Second CNY depreciation

... Nevertheless, over the short run they may be strong volatility until markets have fully digested the new (more flexible) fixing method of the Chinese currency. China’s stock markets have lost part of last week’s gains. In Europe, stock markets fell back slightly below the previous trough of end of J ...

... Nevertheless, over the short run they may be strong volatility until markets have fully digested the new (more flexible) fixing method of the Chinese currency. China’s stock markets have lost part of last week’s gains. In Europe, stock markets fell back slightly below the previous trough of end of J ...

Chapter 6 - FacStaff Home Page for CBU

... a. the replacement of a foreign currency withU.S. dollars. b. This process is a step beyond a currency board because it forces the local currency to be replaced by the U.S. dollar. c. Although dollarization and a currency board both attempt to peg the local currency’s value, the currency board does ...

... a. the replacement of a foreign currency withU.S. dollars. b. This process is a step beyond a currency board because it forces the local currency to be replaced by the U.S. dollar. c. Although dollarization and a currency board both attempt to peg the local currency’s value, the currency board does ...

ECON 2020-200 Principles of Macroeconomics

... obtain basic understanding of economic thinking . There is also discussion of some U.S. institutions such as the Federal Reserve System and commercial banks. The exact sequence of chapters to be covered is announced in the first class. This is a demanding class and requires special attention to do w ...

... obtain basic understanding of economic thinking . There is also discussion of some U.S. institutions such as the Federal Reserve System and commercial banks. The exact sequence of chapters to be covered is announced in the first class. This is a demanding class and requires special attention to do w ...

Comment

... The lever that pushes national polities against the wall can be a common monetary policy pursuing a rather rigid inflation target or fiscal austerity. It conveys the message that things can’t go on as they always have and that therefore structural reforms are imperative. This strategy has experience ...

... The lever that pushes national polities against the wall can be a common monetary policy pursuing a rather rigid inflation target or fiscal austerity. It conveys the message that things can’t go on as they always have and that therefore structural reforms are imperative. This strategy has experience ...

Coping with Asia`s Large Capital Inflows in a Multi

... In Asia since 2008, India, followed by Indonesia, have had the greatest tendency to float, given EMP; Hong Kong & Singapore the least, followed by Malaysia & China. ...

... In Asia since 2008, India, followed by Indonesia, have had the greatest tendency to float, given EMP; Hong Kong & Singapore the least, followed by Malaysia & China. ...

Balanced Global Economy Growth: Responsibility and Policy of China and USA

... The imbalance in the global economy is an historical problem for human beings as well as the deficit of America’s current account. However, after the sub-prime crisis, many American state officers and specialists made up a new story upon the imbalance of the global economy, the basic logic of it is ...

... The imbalance in the global economy is an historical problem for human beings as well as the deficit of America’s current account. However, after the sub-prime crisis, many American state officers and specialists made up a new story upon the imbalance of the global economy, the basic logic of it is ...

Quarterly Review and Outlook

... effect of weakening nominal GDP at a time when it is already slow and decelerating. Prior to the Fed’s December rate hike M2 grew at annual rates of 5.3% and 5.6%, for the three and six month periods, respectively. Subsequent to the Fed’s change in policy, three conventional monetary influences have ...

... effect of weakening nominal GDP at a time when it is already slow and decelerating. Prior to the Fed’s December rate hike M2 grew at annual rates of 5.3% and 5.6%, for the three and six month periods, respectively. Subsequent to the Fed’s change in policy, three conventional monetary influences have ...

Slide 1

... Corporate bond market is shallow and illiquid: even more so than in other countries (although comparable to India). Underdeveloped local institutional investor base and regulatory impediments (over-regulation, regulatory cap on corporate bond rates) hamper development. Special working group es ...

... Corporate bond market is shallow and illiquid: even more so than in other countries (although comparable to India). Underdeveloped local institutional investor base and regulatory impediments (over-regulation, regulatory cap on corporate bond rates) hamper development. Special working group es ...

Introduction to Elliott Wave

... Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, an ...

... Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, an ...

Icelandic banks 2008 in context

... ability to stand behind them as lender – or borrower – of last resort Do not allow banks to operate branches abroad rather than subsidiaries, thus exposing domestic deposit insurance schemes to foreign obligations ...

... ability to stand behind them as lender – or borrower – of last resort Do not allow banks to operate branches abroad rather than subsidiaries, thus exposing domestic deposit insurance schemes to foreign obligations ...

`Crappy` Gold Mining

... investments are perceived to be more attractive. However, gold to the stock and bond markets is like an ant to an elephant, so the aforementioned shift in investment demand results in far more money making its way towards the goldmining industry than can be used efficiently. Geology exacerbates the ...

... investments are perceived to be more attractive. However, gold to the stock and bond markets is like an ant to an elephant, so the aforementioned shift in investment demand results in far more money making its way towards the goldmining industry than can be used efficiently. Geology exacerbates the ...

Financial supervision and crisis management in the EU

... • As the major international financial “think tank” the FSF would be a logical location for the development of the new rules. • It has the right sort of membership – gathering together regulators, central banks, and treasury departments – and it could form a macro-prudential counterpart to the Basel ...

... • As the major international financial “think tank” the FSF would be a logical location for the development of the new rules. • It has the right sort of membership – gathering together regulators, central banks, and treasury departments – and it could form a macro-prudential counterpart to the Basel ...

Euro and Yen vis-à-vis the Dollar in the Global Economy

... The second insight from the Japanese perspective is that costs of such erratic exchange rate movements are immense. How did it come that Japan, the most dynamic OECD economy of the 1970s and 1980s has entered such a long period of economic stagnation. If “structural problems” are the main reason, ho ...

... The second insight from the Japanese perspective is that costs of such erratic exchange rate movements are immense. How did it come that Japan, the most dynamic OECD economy of the 1970s and 1980s has entered such a long period of economic stagnation. If “structural problems” are the main reason, ho ...

economic

... – Outgrowth of General Agreement on Tariffs and Trade (GATT), that functioned to encourage trade liberalization from 1947 to 1995 ...

... – Outgrowth of General Agreement on Tariffs and Trade (GATT), that functioned to encourage trade liberalization from 1947 to 1995 ...

Answers to Questions: Chapter 7

... a. Credit; current account; decreases U.S. balance of payments deficit. b. Debit; capital account; increases U.S. balance of payments deficit. c. Credit; capital account; decreases U.S. balance of payments deficit. d. Debit; current account; increases U.S. balance of payments deficit. ...

... a. Credit; current account; decreases U.S. balance of payments deficit. b. Debit; capital account; increases U.S. balance of payments deficit. c. Credit; capital account; decreases U.S. balance of payments deficit. d. Debit; current account; increases U.S. balance of payments deficit. ...

Stallings-Two-Crises-PPT

... Crises of 1990s and 2000s were both crucial for East Asia, but their origins and consequences were different Why no financial crises in EA in 2000s, when finance was main source of crises there in 1990s and elsewhere today? Two-part study: regional economic analysis and country political economy ana ...

... Crises of 1990s and 2000s were both crucial for East Asia, but their origins and consequences were different Why no financial crises in EA in 2000s, when finance was main source of crises there in 1990s and elsewhere today? Two-part study: regional economic analysis and country political economy ana ...

International Finance II (Spring 2013) lecture topics and readings

... a. Modelling the World Economy Obstfeld and Rogoff, Chapter 1.3. ‘A Two-Region World Economy’ and Chap 5.5 b. Global imbalances: i. Precautionary motive in emerging market economies. ii. Risk concentration, precautionary savings and global imbalances. iii. Asset price bubbles and global imbalances. ...

... a. Modelling the World Economy Obstfeld and Rogoff, Chapter 1.3. ‘A Two-Region World Economy’ and Chap 5.5 b. Global imbalances: i. Precautionary motive in emerging market economies. ii. Risk concentration, precautionary savings and global imbalances. iii. Asset price bubbles and global imbalances. ...

Real Exchange Rate

... Causes of Higher Long-run Exchange Rates • A decrease in a country’s relative price level (If U.S goods are cheaper than in India, more people will buy U.S goods, and bid up the price of the dollar) • An increase in a country’s relative productivity • (If U.S goods are made more productively, they ...

... Causes of Higher Long-run Exchange Rates • A decrease in a country’s relative price level (If U.S goods are cheaper than in India, more people will buy U.S goods, and bid up the price of the dollar) • An increase in a country’s relative productivity • (If U.S goods are made more productively, they ...

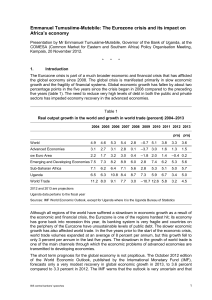

Emmanuel Tumusiime-Mutebile: The Eurozone crisis and its impact

... binding constraint to output growth in Africa. As a result, it is not conceivable to envisage that African agriculture can be modernized and production increased by ignoring the continent’s smallholder farmers and focusing instead on large farms. The priority of agricultural policy should be to supp ...

... binding constraint to output growth in Africa. As a result, it is not conceivable to envisage that African agriculture can be modernized and production increased by ignoring the continent’s smallholder farmers and focusing instead on large farms. The priority of agricultural policy should be to supp ...

The Eurozone crisis strikes back Global economy watch – April 2013

... approach to assessing the Eurozone’s economic environment. Our analysis highlights that investor perceptions of credit risk, as measured by government bond yields, evolved markedly over the last year (see Figure 3 below). In particular, investors’ attitudes towards investing in Ireland and Portugal ...

... approach to assessing the Eurozone’s economic environment. Our analysis highlights that investor perceptions of credit risk, as measured by government bond yields, evolved markedly over the last year (see Figure 3 below). In particular, investors’ attitudes towards investing in Ireland and Portugal ...

May 6, 2016

... of the nation’s aging population and its low fertility rates. HSBC global economist James Pomeroy notes that China’s older citizens will stall economic growth and add strain to government spending. The country’s median age is projected to be over 40 in eight years and that it will be another 10+ yea ...

... of the nation’s aging population and its low fertility rates. HSBC global economist James Pomeroy notes that China’s older citizens will stall economic growth and add strain to government spending. The country’s median age is projected to be over 40 in eight years and that it will be another 10+ yea ...

foreign exchange ppt

... 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency ...

... 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.