U.S. “Quantitative Easing” is Fracturing the Global Economy Michael

... growth … since the 1950s.” But this debt explosion was justified by the “surge in home prices [that] pushed up the ratio of household net worth to disposable personal income to nearly 640 percent.” Instead of saving, most Americans borrowed as much as they could to buy property they expected to rise ...

... growth … since the 1950s.” But this debt explosion was justified by the “surge in home prices [that] pushed up the ratio of household net worth to disposable personal income to nearly 640 percent.” Instead of saving, most Americans borrowed as much as they could to buy property they expected to rise ...

THE DEVELOPING COUNTRIES' HAZARDOUS OBSESSION WITH GLOBAL INTEGRATION Dani Rodrik

... sequentially, and only after an initial period of high growth—and as part of a broader package with many unconventional features. The disappointing outcomes with deep liberalization have been absorbed into the faith with remarkable aplomb. While global integration remains the key prerequisite for ec ...

... sequentially, and only after an initial period of high growth—and as part of a broader package with many unconventional features. The disappointing outcomes with deep liberalization have been absorbed into the faith with remarkable aplomb. While global integration remains the key prerequisite for ec ...

Fiscal Policy Under Flexible Exchange Rates

... The Effects of Fiscal and Monetary Policy Under Flexible Exchange Rates Under a flexible exchange rate system, combinations of income and interest rates not on the BP curve will cause disequilibrium in foreign exchange markets, and force an adjustment in the exchange rate. This will cause the BP ...

... The Effects of Fiscal and Monetary Policy Under Flexible Exchange Rates Under a flexible exchange rate system, combinations of income and interest rates not on the BP curve will cause disequilibrium in foreign exchange markets, and force an adjustment in the exchange rate. This will cause the BP ...

Developments in the Global Economy and Financial Markets

... in CIS countries that borrowed in foreign currency, requiring massive cutbacks in investment and employment. Latin America suffered from the same trio of shocks as the CIS countries, but the overall impact was less severe than in Europe because public and private balance sheets were relatively stron ...

... in CIS countries that borrowed in foreign currency, requiring massive cutbacks in investment and employment. Latin America suffered from the same trio of shocks as the CIS countries, but the overall impact was less severe than in Europe because public and private balance sheets were relatively stron ...

Maurice Obstfeld Working

... sector resource allocation, there is no incentive for unexpected realignments that offset entrenched distortions, or for realignments that hasten relative-price adjustment. The main motivation to adjust exchange rates, in the present rarefied setup, would be to offset an excessive trend inflation ra ...

... sector resource allocation, there is no incentive for unexpected realignments that offset entrenched distortions, or for realignments that hasten relative-price adjustment. The main motivation to adjust exchange rates, in the present rarefied setup, would be to offset an excessive trend inflation ra ...

Document

... – Long term interest rates no more than 2 percentage points above the average of the 3 countries with the lowest rates Exchange rate – has joined ERM II (Exchange Rate Mechanism) for previous 2 years and not devalued its currency ...

... – Long term interest rates no more than 2 percentage points above the average of the 3 countries with the lowest rates Exchange rate – has joined ERM II (Exchange Rate Mechanism) for previous 2 years and not devalued its currency ...

03 RA Mundell - rivista Politica Economica

... US monetary power became activated, and ever since the United States was able to play a determining role in the international monetary system. Dollar prices had become «world» prices and money increasingly came to mean the dollar. The gold standard that had been reinstated in the 1920s broke down no ...

... US monetary power became activated, and ever since the United States was able to play a determining role in the international monetary system. Dollar prices had become «world» prices and money increasingly came to mean the dollar. The gold standard that had been reinstated in the 1920s broke down no ...

Chapter 12

... borrowing overnight from the RBNZ. In terms of the foreign exchange (or currency) market the higher relative interest rates would see an increase in the demand for NZ dollars as international investors seek higher returns (illustrated by a rightward shift out in the demand curve) and hence the price ...

... borrowing overnight from the RBNZ. In terms of the foreign exchange (or currency) market the higher relative interest rates would see an increase in the demand for NZ dollars as international investors seek higher returns (illustrated by a rightward shift out in the demand curve) and hence the price ...

Panel Discussion Lyle E. Gramley*

... advance (for internal purposes, not for publication) what its response function will be to deviations in output and inflation from targeted levels. I am not suggesting slavishly following a rule; but tentative decision rules could serve to focus attention on whether levels of the instrument variable ...

... advance (for internal purposes, not for publication) what its response function will be to deviations in output and inflation from targeted levels. I am not suggesting slavishly following a rule; but tentative decision rules could serve to focus attention on whether levels of the instrument variable ...

Key External Developments

... Key Risk II: Nigeria • Nigeria’s emergence as Africa’s largest economy due mostly to rapid growth in services • However, country still depends on oil for more than 60% of state revenues and 90% of export earnings • Compounding the problem is the escalating Islamist insurgency in parts of the North. ...

... Key Risk II: Nigeria • Nigeria’s emergence as Africa’s largest economy due mostly to rapid growth in services • However, country still depends on oil for more than 60% of state revenues and 90% of export earnings • Compounding the problem is the escalating Islamist insurgency in parts of the North. ...

How Far Will International Economic Integration Go?

... bounds once it recognized the importance of private initiative, even though it flouted every other rule in the guidebook. Much of the rest of east Asia generated an economic miracle relying on industrial policies that have since been banned by the World Trade Organization. Scores of countries in Lat ...

... bounds once it recognized the importance of private initiative, even though it flouted every other rule in the guidebook. Much of the rest of east Asia generated an economic miracle relying on industrial policies that have since been banned by the World Trade Organization. Scores of countries in Lat ...

Study Questions for Final File

... the exchange rate between any two currencies is equal to the ratio of their price indexes. b. relative prices determine interest rates. c. the same good sells for the same price internationally. d. the percentage change in the exchange rate is equal to the inflation differential between the domestic ...

... the exchange rate between any two currencies is equal to the ratio of their price indexes. b. relative prices determine interest rates. c. the same good sells for the same price internationally. d. the percentage change in the exchange rate is equal to the inflation differential between the domestic ...

3rd Trimester, 2015

... markets caused by the concerns of the investor public over a global financial crisis, will apparently lead to an environment of low interest rates for a longer period than originally expected. Against this backdrop, it is possible that the initial interest rate hike in the US will be delayed, and mo ...

... markets caused by the concerns of the investor public over a global financial crisis, will apparently lead to an environment of low interest rates for a longer period than originally expected. Against this backdrop, it is possible that the initial interest rate hike in the US will be delayed, and mo ...

Money

... any tangible asset such as gold, silver, or even seashells. • The issuing government has decreed by fiat that “this money is a legal exchange medium, and it is worth what we say.” • Lacking a gold backing or backing some other precious metal, what gives the currency value? ...

... any tangible asset such as gold, silver, or even seashells. • The issuing government has decreed by fiat that “this money is a legal exchange medium, and it is worth what we say.” • Lacking a gold backing or backing some other precious metal, what gives the currency value? ...

Quarterly Press Briefing

... Headline inflation was 1.3 per cent for the March quarter, slightly lower than the Bank’s initial expectations of 1.5 to 2.5 per cent, and followed a three-month period when there was no change in the consumer price index. The higher rate of inflation was due largely to the strengthening in non-food ...

... Headline inflation was 1.3 per cent for the March quarter, slightly lower than the Bank’s initial expectations of 1.5 to 2.5 per cent, and followed a three-month period when there was no change in the consumer price index. The higher rate of inflation was due largely to the strengthening in non-food ...

PDF Download

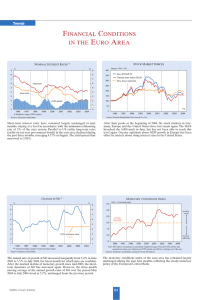

... the next six months. In Ireland, Spain and Finland present economic activity continued to be assessed very positively. In the Netherlands, Portugal, Germany and Italy assessments of the present situation improved compared to the April survey, but remained below the euroarea average. In all countries ...

... the next six months. In Ireland, Spain and Finland present economic activity continued to be assessed very positively. In the Netherlands, Portugal, Germany and Italy assessments of the present situation improved compared to the April survey, but remained below the euroarea average. In all countries ...

ECON403 sample questions for chapters 17 and 19

... 13. If the inflation rate in the United States is higher than that in Mexico and productivity is growing at a slower rate in the United States than in Mexico, then, in the long run, ________, everything else held constant. A) the Mexican peso will appreciate relative to the U.S. dollar B) the Me ...

... 13. If the inflation rate in the United States is higher than that in Mexico and productivity is growing at a slower rate in the United States than in Mexico, then, in the long run, ________, everything else held constant. A) the Mexican peso will appreciate relative to the U.S. dollar B) the Me ...

Summary (PDF, 47 KB)

... situation on the labour market will improve only gradually. In the United States economic activity will trend upwards in the forecast period, but economic growth will slow down perceptibly, after the strong expansion in the second half of last year. The euro area will be a cyclical latecomer also in ...

... situation on the labour market will improve only gradually. In the United States economic activity will trend upwards in the forecast period, but economic growth will slow down perceptibly, after the strong expansion in the second half of last year. The euro area will be a cyclical latecomer also in ...

国际金融与开放宏观经济学

... About Price index _Basis time point ; The structure of Index; The method of measurement About The meaning of RE level: Appreciation and Depreciation : Relative to the Nominal Exchange rates on the Basis time; Showing the change of international comparative power Excises: Calculation the RE of REB ag ...

... About Price index _Basis time point ; The structure of Index; The method of measurement About The meaning of RE level: Appreciation and Depreciation : Relative to the Nominal Exchange rates on the Basis time; Showing the change of international comparative power Excises: Calculation the RE of REB ag ...

chapter 19

... directors heeded this by amending the Fund's Articles of Agreement to recognize the new reality of floating rates. Floating exchange rates enabled countries to pursue divergent expansionary policies after the first oil shock. This advantage of floating exchange rates proved to be a disadvantage as ...

... directors heeded this by amending the Fund's Articles of Agreement to recognize the new reality of floating rates. Floating exchange rates enabled countries to pursue divergent expansionary policies after the first oil shock. This advantage of floating exchange rates proved to be a disadvantage as ...

China, the US, and Currency Issues

... of the Dollar after 1913 • In 1913, the £ was on top, • the same as in 1899: – ≈ 60 % of the world’s trade invoicing – ≈ 2/3 of known forex holdings of official institutions, • > twice the total of the next nearest competitors, • the French franc & German mark. ...

... of the Dollar after 1913 • In 1913, the £ was on top, • the same as in 1899: – ≈ 60 % of the world’s trade invoicing – ≈ 2/3 of known forex holdings of official institutions, • > twice the total of the next nearest competitors, • the French franc & German mark. ...

ch21-OCA-EMU

... It also standardized many regulations and gave the EU institutions more control over defense policies. ...

... It also standardized many regulations and gave the EU institutions more control over defense policies. ...

The World Economy at the end of the Millennium

... and various other fads and fashions, he could happily neglect the voluminous literature they spawned in the time he had been asleep. But being of a curious bent he would probably have decided to read some condensed account of what had happened to the world while he was sleeping. He would have been a ...

... and various other fads and fashions, he could happily neglect the voluminous literature they spawned in the time he had been asleep. But being of a curious bent he would probably have decided to read some condensed account of what had happened to the world while he was sleeping. He would have been a ...

The Policy Debate: Keynesians versus Monetarists

... Monetarist (Classical) View: (1) AS curve is steep, even in short-run recessions will not be severe. (2) Self-correcting forces are sufficient to stabilize the economy. (3) Policy makers should follow “rules.” Discretionary policies do more harm than good. ...

... Monetarist (Classical) View: (1) AS curve is steep, even in short-run recessions will not be severe. (2) Self-correcting forces are sufficient to stabilize the economy. (3) Policy makers should follow “rules.” Discretionary policies do more harm than good. ...

Chicago Fed Letter The fall and rise of the global economy

... other countries. Overall, however, economists generally attribute only a small share of worker dislocation in the U.S. to trade, roughly 10% or less.16 (Such challenges may, of course, be greater in some other countries, particularly those where entrenched cultural and institutional barriers restric ...

... other countries. Overall, however, economists generally attribute only a small share of worker dislocation in the U.S. to trade, roughly 10% or less.16 (Such challenges may, of course, be greater in some other countries, particularly those where entrenched cultural and institutional barriers restric ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.