European Commission

... Because we have a currency union of 17 countries, and 25 or soon 26 are committed to be part of this currency union at a certain point, giving up their own monetary policy and following strict rules on fiscal policy. But this currency union does not have a long-term future if there is continuing div ...

... Because we have a currency union of 17 countries, and 25 or soon 26 are committed to be part of this currency union at a certain point, giving up their own monetary policy and following strict rules on fiscal policy. But this currency union does not have a long-term future if there is continuing div ...

Restrictiveness of the monetary and fiscal policy and

... the great significance that the EU membership has for Poland and the potential future benefits of the common currency, it also emphasises the fact that at present the mechanisms of the Monetary Union are under enormous pressure and they may be soon modified. What is more, even if the system ...

... the great significance that the EU membership has for Poland and the potential future benefits of the common currency, it also emphasises the fact that at present the mechanisms of the Monetary Union are under enormous pressure and they may be soon modified. What is more, even if the system ...

Conference on “Reforming the Financial System: Proposals, Constraints and New Directions”

... of market liberalization and globalization. They seized upon the political opportunities created first by the crisis of the Bretton Woods regime, and then by each of the crises caused by the implementation of the neo-liberal program by pushing harder for a new round of reforms allegedly needed to ac ...

... of market liberalization and globalization. They seized upon the political opportunities created first by the crisis of the Bretton Woods regime, and then by each of the crises caused by the implementation of the neo-liberal program by pushing harder for a new round of reforms allegedly needed to ac ...

chapter 29

... exchanged for U.S. dollars) because they want to buy U.S. goods and services or U.S. assets. In general economists believe that the supply curve for foreign currency is upward sloping. As the price of foreign currency increases, U.S. goods and services become cheaper. Foreigners buy more U.S. goods ...

... exchanged for U.S. dollars) because they want to buy U.S. goods and services or U.S. assets. In general economists believe that the supply curve for foreign currency is upward sloping. As the price of foreign currency increases, U.S. goods and services become cheaper. Foreigners buy more U.S. goods ...

Strategic Considerations

... The perilous fiscal position of the world’s major economies is well known and, to varying degrees remedial measures are being applied; though whether they can all be applied in unison is extremely doubtful. Nowhere is the need for structural reform more acute than in the Euro-Zone. It is highly like ...

... The perilous fiscal position of the world’s major economies is well known and, to varying degrees remedial measures are being applied; though whether they can all be applied in unison is extremely doubtful. Nowhere is the need for structural reform more acute than in the Euro-Zone. It is highly like ...

Balance of Payments

... Exports and Imports 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup t the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exch ...

... Exports and Imports 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup t the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exch ...

Breaking Up is Hard to Do, Brussels Will Play Hardball With the U.K.

... 2015. The Act calls for the Treasury Department to look for three key elements to determine whether a country is acting unfairly: a significant bilateral trade surplus with the United States, a current account surplus above 3% of GDP and persistent one-sided intervention in foreign exchange markets. ...

... 2015. The Act calls for the Treasury Department to look for three key elements to determine whether a country is acting unfairly: a significant bilateral trade surplus with the United States, a current account surplus above 3% of GDP and persistent one-sided intervention in foreign exchange markets. ...

Equipping The Bahamian Economy For Sustained Growth And Development

... outside of the Banking sector to provide secured credit to a local entity—such as where immovable property is the security––would have to evolve from the National Investment Policy, before automatic incorporation into the exchange control process. Liberalisation in these instances will therefore req ...

... outside of the Banking sector to provide secured credit to a local entity—such as where immovable property is the security––would have to evolve from the National Investment Policy, before automatic incorporation into the exchange control process. Liberalisation in these instances will therefore req ...

Committee:

... globalizing, and entertaining vast competing national economies—if the individually small European economies do not come together to form a collective power, they may all become obsolete, and their individual economies will suffer among larger competing powers 1. “As a whole, Europe is an important ...

... globalizing, and entertaining vast competing national economies—if the individually small European economies do not come together to form a collective power, they may all become obsolete, and their individual economies will suffer among larger competing powers 1. “As a whole, Europe is an important ...

Strong Dollar Weak Dollar: Foreign Exchange Rates and the U.S.

... amount of pounds, lira, yen or d-marks. This idea is not new. Through most of the modern era the world was on a fixed-rate system. The most recent version is referred to as the Bretton Woods System. In 1947, the industrialized countries of the world met in Bretton Woods, New Hampshire, to discuss th ...

... amount of pounds, lira, yen or d-marks. This idea is not new. Through most of the modern era the world was on a fixed-rate system. The most recent version is referred to as the Bretton Woods System. In 1947, the industrialized countries of the world met in Bretton Woods, New Hampshire, to discuss th ...

Breaking point

... in more detail on this in the second part of this month’s Market Commentary. But this much can serve now as an appetiser, as it were: global growth is weakening. The currency devaluations being seen only lead to a redistribution of growth; they do not create new wealth – quite the contrary. And the ...

... in more detail on this in the second part of this month’s Market Commentary. But this much can serve now as an appetiser, as it were: global growth is weakening. The currency devaluations being seen only lead to a redistribution of growth; they do not create new wealth – quite the contrary. And the ...

Effects of the Financial Crisis on The US-China

... towards trade, there are in fact more subtle forms of protectionism that remain pervasive. For instance, through its repressed financial system that mainly consists of state-owned banks, China provides cheap capital to many of its enterprises. Subsidies to land and energy have also held down the eff ...

... towards trade, there are in fact more subtle forms of protectionism that remain pervasive. For instance, through its repressed financial system that mainly consists of state-owned banks, China provides cheap capital to many of its enterprises. Subsidies to land and energy have also held down the eff ...

Folie 1

... • The exchange rate mechanism allowed larger fluctuations (+/– 6%) for currencies of Portugal, Spain, Britain (until 1992) and Italy (until 1990). – These countries wanted greater flexibility with monetary policy. ...

... • The exchange rate mechanism allowed larger fluctuations (+/– 6%) for currencies of Portugal, Spain, Britain (until 1992) and Italy (until 1990). – These countries wanted greater flexibility with monetary policy. ...

OVERVIEW

... Meanwhile, within the context of financial stability, the Central Bank monitors developments in financial market infrastructures closely. Especially the rise in transaction volume in financial markets requires the use of effective and reliable payment and settlement systems. Recent experience gained ...

... Meanwhile, within the context of financial stability, the Central Bank monitors developments in financial market infrastructures closely. Especially the rise in transaction volume in financial markets requires the use of effective and reliable payment and settlement systems. Recent experience gained ...

Students in International Monetary Economics can choose between

... What lessons do you draw from the 1992-3 wave of speculative attacks? In particular, why did speculators attack some obviously not overvalued currencies (the Belgian and French francs, the Danish kronor) after other currencies were forced to leave ERM of to devalue? ...

... What lessons do you draw from the 1992-3 wave of speculative attacks? In particular, why did speculators attack some obviously not overvalued currencies (the Belgian and French francs, the Danish kronor) after other currencies were forced to leave ERM of to devalue? ...

The global economic system

... VOL. 7 NO. 1 2005, pp. 11-25, Q Emerald Group Publishing Limited, ISSN 1463-6689 ...

... VOL. 7 NO. 1 2005, pp. 11-25, Q Emerald Group Publishing Limited, ISSN 1463-6689 ...

Paper: Financial-Market Turbulence

... financial-market developments? (3) Does the balance between greed and fear matter for the global economy? One’s assessment of the potential economic consequences of a collapse in equity prices depends on one’s view of how much stock markets matter. The principal channels are via the cost of capital ...

... financial-market developments? (3) Does the balance between greed and fear matter for the global economy? One’s assessment of the potential economic consequences of a collapse in equity prices depends on one’s view of how much stock markets matter. The principal channels are via the cost of capital ...

PART I: PARSIFAL SCHEDULING

... This chapter considers exchange-rate adjustments and the balance of payments. The chapter notes that currency depreciation (devaluation) can affect a nation’s trade position through its impact on relative prices, incomes, and purchasing power of money balances. The chapter first considers the situat ...

... This chapter considers exchange-rate adjustments and the balance of payments. The chapter notes that currency depreciation (devaluation) can affect a nation’s trade position through its impact on relative prices, incomes, and purchasing power of money balances. The chapter first considers the situat ...

Theme 3

... • purchase of one currency in one financial EM and its selling in other • the aim - reach the profit from the price difference in two or three financial exchange markets • involves: - no negative cash-flow at any probabilistic or temporal state - a positive cash-flow in at least one state Conditions ...

... • purchase of one currency in one financial EM and its selling in other • the aim - reach the profit from the price difference in two or three financial exchange markets • involves: - no negative cash-flow at any probabilistic or temporal state - a positive cash-flow in at least one state Conditions ...

Monetary Policy

... percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

... percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

Impact of lower US growth on eastern Europe Willem Buiter

... Maastricht conditions for EMU membership: Inflation (no more than 1.5% above average of 3 lowest inflation countries) Nominal interest rate (10 year rate no more than 2.0% above average of 3 lowest inflation countries) Nominal exchange rate Respect normal fluctuation margins for ERM without severe ...

... Maastricht conditions for EMU membership: Inflation (no more than 1.5% above average of 3 lowest inflation countries) Nominal interest rate (10 year rate no more than 2.0% above average of 3 lowest inflation countries) Nominal exchange rate Respect normal fluctuation margins for ERM without severe ...

Sample Final Exam

... buy dollars in order to signal that the currency is no longer a one-way bet. But that would probably not succeed unless America were to join in—which currently seems unlikely. If the ECB is really worried about the impact of a rising euro, then its best weapon is to cut interest rates. Most economis ...

... buy dollars in order to signal that the currency is no longer a one-way bet. But that would probably not succeed unless America were to join in—which currently seems unlikely. If the ECB is really worried about the impact of a rising euro, then its best weapon is to cut interest rates. Most economis ...

PDF Download

... will allow those countries with high private and public indebtedness to reduce their deficits faster in the current crisis. But the highly indebted countries in the eurozone have already gained considerable relief from the rescue packages. Going beyond this and having additional interest-rate conver ...

... will allow those countries with high private and public indebtedness to reduce their deficits faster in the current crisis. But the highly indebted countries in the eurozone have already gained considerable relief from the rescue packages. Going beyond this and having additional interest-rate conver ...

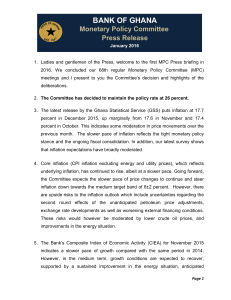

MPC Press Release

... unchanged for the delivery of the medium term target of 8±2 percent in early 2017, barring any further unanticipated shocks. The Committee therefore concluded that the current tight monetary policy stance, supported by continued fiscal consolidation and improvement in the energy situation, would pro ...

... unchanged for the delivery of the medium term target of 8±2 percent in early 2017, barring any further unanticipated shocks. The Committee therefore concluded that the current tight monetary policy stance, supported by continued fiscal consolidation and improvement in the energy situation, would pro ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.