Currency, Economics and Financial Markets

... • Only the US dollar would be convertible to gold and at a “pegged” rate. • All other currencies set their exchange rate relative to the US dollar • Countries could not devalue their currency by more than 10% without IMF approval ...

... • Only the US dollar would be convertible to gold and at a “pegged” rate. • All other currencies set their exchange rate relative to the US dollar • Countries could not devalue their currency by more than 10% without IMF approval ...

A Model of US Import Flows (1974-1988) Dominick Answini

... exchange rates it was in a deep recession. A look at the raw data illustrates this clearly. When the exchange rate should have encouraged more imports the recession reversed this tendancy to some extent. This was the primary reason for choosing GDP as the second independent variable, to smooth the e ...

... exchange rates it was in a deep recession. A look at the raw data illustrates this clearly. When the exchange rate should have encouraged more imports the recession reversed this tendancy to some extent. This was the primary reason for choosing GDP as the second independent variable, to smooth the e ...

Real exchange rate appreciation in the emerging countries

... Other adverse effects are often associated with the Dutch disease, moreover. The concentration of revenues in many oil economies can sometimes lead to capture of public interests by a handful of oil sector leaders and to rent-seeking behaviours. In addition, the short-term impact of growing wealth c ...

... Other adverse effects are often associated with the Dutch disease, moreover. The concentration of revenues in many oil economies can sometimes lead to capture of public interests by a handful of oil sector leaders and to rent-seeking behaviours. In addition, the short-term impact of growing wealth c ...

davies on argentina

... notes to summarize the process in terms of economic theory. Ultimately, this paper suggests that fixing an exchange rate is at best a short-term solution. Argentina chosen solution may not have been a mistake of choice so much as a mistake in not developing a timetable and exit strategy. By the 1989 ...

... notes to summarize the process in terms of economic theory. Ultimately, this paper suggests that fixing an exchange rate is at best a short-term solution. Argentina chosen solution may not have been a mistake of choice so much as a mistake in not developing a timetable and exit strategy. By the 1989 ...

College Fed Challenge

... Our group went to the Federal Reserve Bank of New York in November and presented our opinion on monetary policy implementation. We were the first Fed Challenge group in CT and Sacred Heart’s history to move on to the Semi-final round to then come in 4th place out of a total of 41 schools. Since we p ...

... Our group went to the Federal Reserve Bank of New York in November and presented our opinion on monetary policy implementation. We were the first Fed Challenge group in CT and Sacred Heart’s history to move on to the Semi-final round to then come in 4th place out of a total of 41 schools. Since we p ...

Chapter 10- Finance

... In the summer of 1997, Thailand experienced a speculative attack on its currency (the baht), which was under a fixed exchange rate regime. Unable to meet the demand for its foreign currency reserves, Thailand was forced to float its currency. This precipitated an economic crisis not only in that cou ...

... In the summer of 1997, Thailand experienced a speculative attack on its currency (the baht), which was under a fixed exchange rate regime. Unable to meet the demand for its foreign currency reserves, Thailand was forced to float its currency. This precipitated an economic crisis not only in that cou ...

GD_2012_post

... Friedman and Schwartz and the Monetarist Argument • Classic study of the Great Depression is Milton Friedman and Anna Schwartz, Monetary History of the United States, which held the “monetarist” view. “Throughout the near-century examined, we have found that: Changes in the behavior of the money st ...

... Friedman and Schwartz and the Monetarist Argument • Classic study of the Great Depression is Milton Friedman and Anna Schwartz, Monetary History of the United States, which held the “monetarist” view. “Throughout the near-century examined, we have found that: Changes in the behavior of the money st ...

Lecture 1

... shrank by 15% and took years to regain its previous peak, as poverty and unemployment rates remained at high levels. The country sank into an economic depression worse even than those in the 1930s, 1910s, and 1890s. ...

... shrank by 15% and took years to regain its previous peak, as poverty and unemployment rates remained at high levels. The country sank into an economic depression worse even than those in the 1930s, 1910s, and 1890s. ...

Viewpoint: Understanding the Great Depression

... Recall that the Fed attempted to use 'direct action' to deny Wall Street credit for use in speculative activities. Rather than simply relying on the classic device of a higher discount rate to reduce the volume of credit for use in financing brokers' loans (making it more expensive for banks to obta ...

... Recall that the Fed attempted to use 'direct action' to deny Wall Street credit for use in speculative activities. Rather than simply relying on the classic device of a higher discount rate to reduce the volume of credit for use in financing brokers' loans (making it more expensive for banks to obta ...

The global economic crisis

... •Drop in international trade from April 2008 – June 2009: 15% (during the first years of the Great Depression, international trade fell by ~5%) •During the Great Depression, drop in production, trade and stock prices continued for 4 years. At the end of this period, industrial production had dropped ...

... •Drop in international trade from April 2008 – June 2009: 15% (during the first years of the Great Depression, international trade fell by ~5%) •During the Great Depression, drop in production, trade and stock prices continued for 4 years. At the end of this period, industrial production had dropped ...

3.29-GL Gone Too Far?

... provide social insurance social insurance is a central gov’t function, which has helped maintain social cohesion & domestic political support for liberalization over postwar pd Gov’ts have used fiscal powers to insulate domestic groups from excessive market risks, especially when they're foreign ...

... provide social insurance social insurance is a central gov’t function, which has helped maintain social cohesion & domestic political support for liberalization over postwar pd Gov’ts have used fiscal powers to insulate domestic groups from excessive market risks, especially when they're foreign ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: International Economic Cooperation

... government borrowing absorbed more than half of all U.S. domestic saving, was it better to attract capital from the rest of the world to maintain the relative level of investment in the United States or would it have been better to permit a sharp fall in U. S. domestic investment? Was it better to s ...

... government borrowing absorbed more than half of all U.S. domestic saving, was it better to attract capital from the rest of the world to maintain the relative level of investment in the United States or would it have been better to permit a sharp fall in U. S. domestic investment? Was it better to s ...

HOT MONEY AND COLD COMFORT

... occurs, perhaps the insolvency of one or more large banks, a run by depositors, a drop in export demand, or sudden and tumultuous pressure on a fixed or crawling peg exchange rate, and a currency crisis starts. Hot capital flows out of the country, loans from foreign institutions are not rolled over ...

... occurs, perhaps the insolvency of one or more large banks, a run by depositors, a drop in export demand, or sudden and tumultuous pressure on a fixed or crawling peg exchange rate, and a currency crisis starts. Hot capital flows out of the country, loans from foreign institutions are not rolled over ...

The Federal Reserve

... – The major form of monetary policy. – What will the Fed do if we run out of Treasury bonds? ...

... – The major form of monetary policy. – What will the Fed do if we run out of Treasury bonds? ...

Monetary Law and Monetary Policy 12. Institutional and monetary

... period of low inflation.” „situation in which most indicators of actual and expected inflation in the euro area had drifted towards their historical lows” potential second-round effects on wage and pricesetting ( result of expectations) „forceful monetary policy response” needed context: key ECB in ...

... period of low inflation.” „situation in which most indicators of actual and expected inflation in the euro area had drifted towards their historical lows” potential second-round effects on wage and pricesetting ( result of expectations) „forceful monetary policy response” needed context: key ECB in ...

This PDF is a selection from a published volume from... Research Volume Title: International Dimensions of Monetary Policy

... market, and absorb excess labor force in the tradable sector as considered by the advocates of the so-called “Bretton Woods II” view3). Also assume that such a government is very successful at sterilizing its foreign exchange intervention. It is irrelevant to observe that this behavior may be subopt ...

... market, and absorb excess labor force in the tradable sector as considered by the advocates of the so-called “Bretton Woods II” view3). Also assume that such a government is very successful at sterilizing its foreign exchange intervention. It is irrelevant to observe that this behavior may be subopt ...

The Political Economy of Finance: Greece from Postwar to EMU

... Their impact is crucially mediated by the domestic institutional framework, which includes the organizational attributes of the state, the market, the political system, and civil society. Such institutional attributes at the aggregate macro-level amount to structural properties of the economy, poli ...

... Their impact is crucially mediated by the domestic institutional framework, which includes the organizational attributes of the state, the market, the political system, and civil society. Such institutional attributes at the aggregate macro-level amount to structural properties of the economy, poli ...

Inflation Targeting: Five Years From The Inside

... efficiency AND better monetary policy. Many central banks either operate in an IT framework or behave as they had formal inflation targets. Central bank credibility can be monetized on by saving interest expenditures due to lower risk premia on government debt. ...

... efficiency AND better monetary policy. Many central banks either operate in an IT framework or behave as they had formal inflation targets. Central bank credibility can be monetized on by saving interest expenditures due to lower risk premia on government debt. ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... they are good. I then evaluate the conflict of interest between private and public creditors and assess the role of the Brady deal as a vehicle for bringing about a "grand settlement" of the debt crisis. I argue that they are not as good. In the second part of the paper, I show that the group of res ...

... they are good. I then evaluate the conflict of interest between private and public creditors and assess the role of the Brady deal as a vehicle for bringing about a "grand settlement" of the debt crisis. I argue that they are not as good. In the second part of the paper, I show that the group of res ...

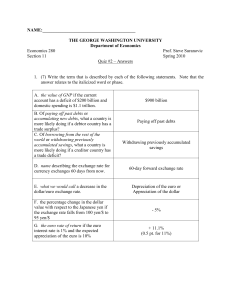

THE GEORGE WASHINGTON UNIVERSITY

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

Analyzing Curriculum Reform

... try and hit the target rate. – To decrease the money supply, the Fed instructs the Open Market Desk at the New York Fed to sell bonds. ...

... try and hit the target rate. – To decrease the money supply, the Fed instructs the Open Market Desk at the New York Fed to sell bonds. ...

A Century of Central Banking: What Have We Learned?

... The ongoing dialogue in academic circles regarding “rules versus discretion” has not found a satisfactory solution to the issue of enforcement of adopted rules. The post-WWII Bretton Woods System—often referred to as a form of gold-exchange standard— required that the United States maintain a hard p ...

... The ongoing dialogue in academic circles regarding “rules versus discretion” has not found a satisfactory solution to the issue of enforcement of adopted rules. The post-WWII Bretton Woods System—often referred to as a form of gold-exchange standard— required that the United States maintain a hard p ...

Lecture 18

... • Low effective rate of protection – Nominal rate T= !(p’-p)/p! where p’ and p are unit prices with and without tariffs – Effective rate G=[(v’-v)/v](100) where v’ and v are value added with and without tariffs. – Effective rate can be positive or negative ...

... • Low effective rate of protection – Nominal rate T= !(p’-p)/p! where p’ and p are unit prices with and without tariffs – Effective rate G=[(v’-v)/v](100) where v’ and v are value added with and without tariffs. – Effective rate can be positive or negative ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.