Sutela Slides - Carnegie Endowment for International Peace

... Russia, like many resource-dependent countries, had learned from earlier crises and accumulated large reserve funds in recent years. In end-2008, they amounted to 225.1 billion USD, in April 2010 to 129.4 billion USD. This was originally at least partly controversial, but the fiscal conservatives le ...

... Russia, like many resource-dependent countries, had learned from earlier crises and accumulated large reserve funds in recent years. In end-2008, they amounted to 225.1 billion USD, in April 2010 to 129.4 billion USD. This was originally at least partly controversial, but the fiscal conservatives le ...

Nominal Exchange Rates (simply called exchange rate) All

... An increase in the real exchange rate, e, is called a real appreciation. With a real appreciation, the same quantity of domestic goods can be traded for more of the foreign good than before, because e, the price of domestic goods relative to the price of foreign goods, has risen. A drop in the real ...

... An increase in the real exchange rate, e, is called a real appreciation. With a real appreciation, the same quantity of domestic goods can be traded for more of the foreign good than before, because e, the price of domestic goods relative to the price of foreign goods, has risen. A drop in the real ...

The European Monetary Crisis

... small to cushion member countries from adverse economic events. Hard to handle through monetary policy. Economic diversity in the Euro-zone – Euro-zone interest rates have to be set for both lowgrowth and high-growth Euro members ...

... small to cushion member countries from adverse economic events. Hard to handle through monetary policy. Economic diversity in the Euro-zone – Euro-zone interest rates have to be set for both lowgrowth and high-growth Euro members ...

Syllabus

... This course is intended for students who have passed FINA 3320 Principles of Finance. It extends principles of finance to international corporations in the rapid globalization of the economy. Specifically, this course study comprehensively three broad topics: (1) international financial environment, ...

... This course is intended for students who have passed FINA 3320 Principles of Finance. It extends principles of finance to international corporations in the rapid globalization of the economy. Specifically, this course study comprehensively three broad topics: (1) international financial environment, ...

Document

... - Interest rates stuck and cannot stimulate domestic investment. - With no change in interest rates, cannot repel foreign investment and depreciate currency. ...

... - Interest rates stuck and cannot stimulate domestic investment. - With no change in interest rates, cannot repel foreign investment and depreciate currency. ...

Snímek 1

... Brazil like Mexico and Argentine, had pegged its currency to the dollar to control inflation. The confidence was falling by the second year 1998 particularly with a fiscal deficit of 8 % of GDP. A flight into dollars from August to September weakened the country’s foreign exchange reserves. Attempts ...

... Brazil like Mexico and Argentine, had pegged its currency to the dollar to control inflation. The confidence was falling by the second year 1998 particularly with a fiscal deficit of 8 % of GDP. A flight into dollars from August to September weakened the country’s foreign exchange reserves. Attempts ...

Decrease in demand does not lead to currency depreciation Result

... • Decrease in demand results in overvalued dollar, causing a surplus on world market • Supply of foreign currency available for trade is insufficient • Central bank’s foreign reserves are depleted • Eventually, government must take some action ...

... • Decrease in demand results in overvalued dollar, causing a surplus on world market • Supply of foreign currency available for trade is insufficient • Central bank’s foreign reserves are depleted • Eventually, government must take some action ...

chapter 2 international monetary system

... dominant global currency – for instance, the U.S. can run trade deficits without having to maintain substantial foreign exchange reserves, can carry out international commercial and financial transactions in dollars without bearing exchange risk, etc. If the euro is to be used as a major denominatio ...

... dominant global currency – for instance, the U.S. can run trade deficits without having to maintain substantial foreign exchange reserves, can carry out international commercial and financial transactions in dollars without bearing exchange risk, etc. If the euro is to be used as a major denominatio ...

Floating exchange rates

... Floating exchange rates • Under pure/clean floating, forex markets are in continuous equilibrium • the exchange rate adjusts to maintain competitiveness • but in the short run, the level of floating exchange rates is determined by speculation – given that capital flows respond to interest rate ...

... Floating exchange rates • Under pure/clean floating, forex markets are in continuous equilibrium • the exchange rate adjusts to maintain competitiveness • but in the short run, the level of floating exchange rates is determined by speculation – given that capital flows respond to interest rate ...

PowerPoint

... intraregional exchange rates Kawai (2008): emergence in East Asia of macroeconomic and structural convergence - acknowledged as a necessary condition for common currency, first identified by Mundell in 1961 Hsu (2008): feasibility of a common currency for Hong Kong, Korea, Malaysia, Philippines, Sin ...

... intraregional exchange rates Kawai (2008): emergence in East Asia of macroeconomic and structural convergence - acknowledged as a necessary condition for common currency, first identified by Mundell in 1961 Hsu (2008): feasibility of a common currency for Hong Kong, Korea, Malaysia, Philippines, Sin ...

Summary of IS-LM

... fiscal and monetary policies under different exchange rate regimes • For any open economy, there will be: – a demand for foreign currency for imports, investment abroad – a supply of foreign currency from exports and inward investment – also international factor income payments, transfers, etc. ...

... fiscal and monetary policies under different exchange rate regimes • For any open economy, there will be: – a demand for foreign currency for imports, investment abroad – a supply of foreign currency from exports and inward investment – also international factor income payments, transfers, etc. ...

Unit 2

... If arbitrage occurs, prices that differ in two different markets would converge According to Purchasing-Power Parity, exchange rates have to ensure that the currencies have the same purchasing power in all countries ...

... If arbitrage occurs, prices that differ in two different markets would converge According to Purchasing-Power Parity, exchange rates have to ensure that the currencies have the same purchasing power in all countries ...

Exchange Rate Regimes

... Expectations that a devaluation may be coming can trigger an exchange rate crisis. The government has two options: ...

... Expectations that a devaluation may be coming can trigger an exchange rate crisis. The government has two options: ...

developing countries` choice of exchange rate regime should

... The estimated fall in output for countries with a short-term external debt of around 25% of GDP and a floating exchange rate regime is about two times larger than the response for countries with a fixed exchange rate and the same debt level. But in countries with low foreign currency debt, a flexib ...

... The estimated fall in output for countries with a short-term external debt of around 25% of GDP and a floating exchange rate regime is about two times larger than the response for countries with a fixed exchange rate and the same debt level. But in countries with low foreign currency debt, a flexib ...

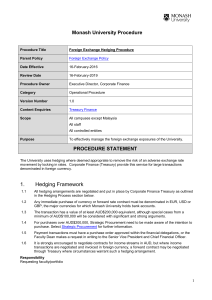

Foreign Exchange Hedge Aust Procedures

... Upon approval by faculty/ portfolio, Treasury will enter a transaction with a major Australian trading bank to lock in the exchange rate until the future date(s) specified. If a payment transaction is expected to occur within 6 months, Treasury will physically purchase and hold the currency to lock ...

... Upon approval by faculty/ portfolio, Treasury will enter a transaction with a major Australian trading bank to lock in the exchange rate until the future date(s) specified. If a payment transaction is expected to occur within 6 months, Treasury will physically purchase and hold the currency to lock ...

PDF

... significant appreciations of the country’s currency. The FCI permit running extensive budget deficits and cheap-money policies. The economy booms but at the cost of increased inflation. Inevitably, the currency appreciation decreases the country’s competitiveness and widens the current account defic ...

... significant appreciations of the country’s currency. The FCI permit running extensive budget deficits and cheap-money policies. The economy booms but at the cost of increased inflation. Inevitably, the currency appreciation decreases the country’s competitiveness and widens the current account defic ...

Lecture 5 (POWER POINT)

... • Large U.S. budget deficits and high money growth created exchange rate imbalances that could not be sustained, i.e. the $ was overvalued and the DM and £ were undervalued. • Several attempts were made at re-alignment but eventually the run on U.S. gold supplies prompted the suspension of convertib ...

... • Large U.S. budget deficits and high money growth created exchange rate imbalances that could not be sustained, i.e. the $ was overvalued and the DM and £ were undervalued. • Several attempts were made at re-alignment but eventually the run on U.S. gold supplies prompted the suspension of convertib ...

Tight monetary policy and financial stability

... peak in 1987 and 1988. A substantial increase in exports of manufactured goods excluding products of power-intensive industries, fairly good business profitability and a high rate of employment do not suggest that the real exchange rate has risen to a long-term unsustainable level. The large current ...

... peak in 1987 and 1988. A substantial increase in exports of manufactured goods excluding products of power-intensive industries, fairly good business profitability and a high rate of employment do not suggest that the real exchange rate has risen to a long-term unsustainable level. The large current ...

A Model of US Import Flows (1974-1988) Dominick Answini

... (US), one must be able to turns one's currency into US currency. This caused an increase in the demand for dollars and an appreciation of their value relative to other currencies. In terms of international trade theory, we see that Americans now held dollars with inflated value and this made imports ...

... (US), one must be able to turns one's currency into US currency. This caused an increase in the demand for dollars and an appreciation of their value relative to other currencies. In terms of international trade theory, we see that Americans now held dollars with inflated value and this made imports ...

Interwar instability

... real estate assets->another currency ends the crisis, supported by US capital inflows • 1929: US inflows end->higher interest rates are useless following Fed’s higher interest rates->collapse of foreign reserves->austerity ...

... real estate assets->another currency ends the crisis, supported by US capital inflows • 1929: US inflows end->higher interest rates are useless following Fed’s higher interest rates->collapse of foreign reserves->austerity ...

PDF Download

... averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia, Hong Kong, South Korea and Singapore and capture third market effects. Real r ...

... averages of bilateral euro exchange rates. Weights are based on 1990 manufactured goods trade with the trading partners United States, Japan, Switzerland, United Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia, Hong Kong, South Korea and Singapore and capture third market effects. Real r ...