exchange rates

... Supply and demand is caused by foreign investment, import/export ratios, inflation and other economic factors The floating exchange rates show the strength of a country’s economy (the more valuable a currency is, the stronger that country’s economy) This balance is sometimes upset by speculato ...

... Supply and demand is caused by foreign investment, import/export ratios, inflation and other economic factors The floating exchange rates show the strength of a country’s economy (the more valuable a currency is, the stronger that country’s economy) This balance is sometimes upset by speculato ...

Lecture 3: Int`l Finance

... – Mexican central bank simply sells pesos-which it can print freely--and exchanges them for foreign exchange (U.S. dollars) – This alleviates the shortage of pesos in the FOREX market, causing the peso’s value to depreciate back to the promised ...

... – Mexican central bank simply sells pesos-which it can print freely--and exchanges them for foreign exchange (U.S. dollars) – This alleviates the shortage of pesos in the FOREX market, causing the peso’s value to depreciate back to the promised ...

Exchange Rates - Uniservity CLC

... Government. The government and/or monetary authorities can set interest rates for domestic economic purposes rather than to achieve a given exchange rate target It is rare for pure free floating exchange rates to exist - most governments at one time or another seek to "manage" the value of their cur ...

... Government. The government and/or monetary authorities can set interest rates for domestic economic purposes rather than to achieve a given exchange rate target It is rare for pure free floating exchange rates to exist - most governments at one time or another seek to "manage" the value of their cur ...

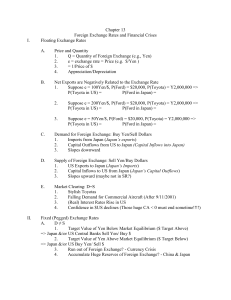

Measuring Trade

... Trade surplus– a nation exports more than it imports Trade deficit– when a nation imports more than it exports ...

... Trade surplus– a nation exports more than it imports Trade deficit– when a nation imports more than it exports ...

Temas Públicos

... issuing bonuses at interests rates each time higher to avoid the inflationary pressure that might be developed due to the increase in the amount of national currency in the economy. Under the current conditions, this would increase the gap of low term rates with other countries, increasing the dilem ...

... issuing bonuses at interests rates each time higher to avoid the inflationary pressure that might be developed due to the increase in the amount of national currency in the economy. Under the current conditions, this would increase the gap of low term rates with other countries, increasing the dilem ...

幻灯片 1

... goals and meeting other countries' demand for reserve currencies. On the one hand,the monetary authorities cannot simply focus on domestic goals without carrying out their international responsibilities��on the other hand,they cannot pursue different domestic and international objectives at the same ...

... goals and meeting other countries' demand for reserve currencies. On the one hand,the monetary authorities cannot simply focus on domestic goals without carrying out their international responsibilities��on the other hand,they cannot pursue different domestic and international objectives at the same ...

Macro_5.2-_Foreign_Exchange_FOREX

... 3. Changes in Relative Price Level (Resulting in more imports)- ...

... 3. Changes in Relative Price Level (Resulting in more imports)- ...

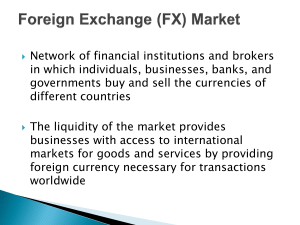

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

Chap31

... The euro has been viable and fairly stable. It has developed a very large public and cooperate capital market denominated in euros. Since its inception at $1.17, the euro has weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; ...

... The euro has been viable and fairly stable. It has developed a very large public and cooperate capital market denominated in euros. Since its inception at $1.17, the euro has weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; ...

The Role of Exchange Rate

... A rise in U.S. interest rates relative to those abroad will increase demand for U.S. assets. The demand for dollars will increase. The supply of dollars will decrease as fewer Americans sell their dollars to buy foreign assets. ...

... A rise in U.S. interest rates relative to those abroad will increase demand for U.S. assets. The demand for dollars will increase. The supply of dollars will decrease as fewer Americans sell their dollars to buy foreign assets. ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

Chapter 17 International Finance Name

... 8. A change in the supply or demand changes the money’s ( ) ( ). 9. After the Lord of the Rings, if there was a sudden demand by Americans for travel to New Zealand, the equilibrium price of the NZ dollar would ( ). The US dollar becomes worth ( ) in terms of the NZ dollar, and the NZ dollar become ...

... 8. A change in the supply or demand changes the money’s ( ) ( ). 9. After the Lord of the Rings, if there was a sudden demand by Americans for travel to New Zealand, the equilibrium price of the NZ dollar would ( ). The US dollar becomes worth ( ) in terms of the NZ dollar, and the NZ dollar become ...

lecture 5.slides - Lancaster University

... Why are policy makers concerned about the BP? How can govts ‘correct’ a BP problem? How are exchange rates determined? How can the CB affect the exchange rate? Is a single currency for Europe desirable? ...

... Why are policy makers concerned about the BP? How can govts ‘correct’ a BP problem? How are exchange rates determined? How can the CB affect the exchange rate? Is a single currency for Europe desirable? ...

Document

... climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate. Countries will invest their money in the countries with high interest rates. ...

... climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate. Countries will invest their money in the countries with high interest rates. ...

Demand for a currency - yELLOWSUBMARINER.COM

... Changes in the exchange rate In a floating system, an increase in the exchange rate is an appreciation; a fall is a depreciation. In a fixed system, if the rate at which it is fixed is increased, this is a revaluation. If a lower rate is fixed it is a devaluation. Real exchange rate: takes infla ...

... Changes in the exchange rate In a floating system, an increase in the exchange rate is an appreciation; a fall is a depreciation. In a fixed system, if the rate at which it is fixed is increased, this is a revaluation. If a lower rate is fixed it is a devaluation. Real exchange rate: takes infla ...

Lecture Slides Chapter 15

... domestic assets 3) pro: government can control its balance of payments position and possibly prevent speculative attacks 4) con: weakened confidence in the government may actually cause an increase in capital outflows ...

... domestic assets 3) pro: government can control its balance of payments position and possibly prevent speculative attacks 4) con: weakened confidence in the government may actually cause an increase in capital outflows ...

Exchange Rates Theories

... to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

... to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

Monetary & Fiscal Policy in a Global Economy

... interest rate in the short run. Expansionary fiscal policy increases interest rates. ...

... interest rate in the short run. Expansionary fiscal policy increases interest rates. ...

B. Exchange Rates and the Foreign Exchange Market Exchange

... Foreign exchange market is in equilibrium when deposits of all currencies offer same expected rate of return ...

... Foreign exchange market is in equilibrium when deposits of all currencies offer same expected rate of return ...

The Difference Between Currency Manipulation and Monetary Policy

... First, it is important to note that the real (i.e., inflationBank of China (PBC, the central bank of China) has preadjusted) exchange rate matters for international trade, not vented rapid appreciation of the renminbi (RMB) by purthe nominal exchange rate. Manipulation of real exchange chasing U.S. ...

... First, it is important to note that the real (i.e., inflationBank of China (PBC, the central bank of China) has preadjusted) exchange rate matters for international trade, not vented rapid appreciation of the renminbi (RMB) by purthe nominal exchange rate. Manipulation of real exchange chasing U.S. ...

From Bretton Woods to the Euro

... Basically failed due to lack of harmonised macroeconomic policy (need similar IR, inflation and debt and deficit levels) ...

... Basically failed due to lack of harmonised macroeconomic policy (need similar IR, inflation and debt and deficit levels) ...