Set 4 The foreign exchange market

... Question 6. In table below you can find the price of “The Economist” in three different countries: price ...

... Question 6. In table below you can find the price of “The Economist” in three different countries: price ...

InternationalFinanance

... demands for imports and exports, international investment, and overseas activities of government (and ...

... demands for imports and exports, international investment, and overseas activities of government (and ...

Euro Region Debt Crisis and Exchange Rate Dynamics in EU Accession Countries

... rate dynamics in several Central and East European countries that are attempting to achieve the various Maastricht convergence criteria. In this paper, we argue that the interplay between the government budget deficits and real exchange rate misalignments over the last several years has been among t ...

... rate dynamics in several Central and East European countries that are attempting to achieve the various Maastricht convergence criteria. In this paper, we argue that the interplay between the government budget deficits and real exchange rate misalignments over the last several years has been among t ...

Chapter 7 Power Point Presentation

... EXCHANGE RATES Interest Rates and Money Supply - short run direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depr ...

... EXCHANGE RATES Interest Rates and Money Supply - short run direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depr ...

Fixed and Floating Exchange Rates pp

... King on exchange rate regimes • Countries have always faced constraints in choosing their exchange rate regime. • Any country can have only two out of the following three: – an independent monetary policy – a fixed exchange rate ...

... King on exchange rate regimes • Countries have always faced constraints in choosing their exchange rate regime. • Any country can have only two out of the following three: – an independent monetary policy – a fixed exchange rate ...

Pset8_2011_v7_11_25_11

... Over the past year, Switzerland has become subject to a large “safety premium” relative to other countries, meaning that the prevailing interest rate is the world interest rate minus a certain amount. b. On your graph from part (a), show how this safety premium would manifest itself. Is it a boon (a ...

... Over the past year, Switzerland has become subject to a large “safety premium” relative to other countries, meaning that the prevailing interest rate is the world interest rate minus a certain amount. b. On your graph from part (a), show how this safety premium would manifest itself. Is it a boon (a ...

Pset8_2011_v6

... Over the past year, Switzerland has become subject to a large “safety premium” relative to other countries, meaning that the prevailing interest rate is the world interest rate minus a certain amount. b. On your graph from part (a), show how this safety premium would manifest itself. Is it a boon (a ...

... Over the past year, Switzerland has become subject to a large “safety premium” relative to other countries, meaning that the prevailing interest rate is the world interest rate minus a certain amount. b. On your graph from part (a), show how this safety premium would manifest itself. Is it a boon (a ...

international financing and international financial markets

... 1. Recent Substantial Market Growth -due to use of swaps. a financial instrument which gives 2 parties the right to exchange streams of income over time. ...

... 1. Recent Substantial Market Growth -due to use of swaps. a financial instrument which gives 2 parties the right to exchange streams of income over time. ...

Linear Regression 1

... • Explains how investors are starting to pull out of the US • Results won’t be as dire for us… – Isn’t happening too quickly – American companies have loans payable in US$ (if it were Euros, ...

... • Explains how investors are starting to pull out of the US • Results won’t be as dire for us… – Isn’t happening too quickly – American companies have loans payable in US$ (if it were Euros, ...

Dragon strikes again

... Moreover, the uncertainties caused by the aggressive depreciation of the yuan, and fears that further such measures will be undertaken by Beijing, will raise the global demand for the US dollar, on which all international trade is based and which is perceived to be the safest currency in times of in ...

... Moreover, the uncertainties caused by the aggressive depreciation of the yuan, and fears that further such measures will be undertaken by Beijing, will raise the global demand for the US dollar, on which all international trade is based and which is perceived to be the safest currency in times of in ...

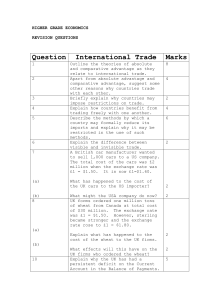

higher grade economics - Bannerman High School

... Sterling on the Foreign Exchange Market? What factors affect the supply of Sterling on the Foreign Exchange Market? Why might ‘great fluctuations in the value of Sterling’ occur if the Foreign Exchange Market is left to the forces of supply and demand? Explain the advantages and disadvantages for th ...

... Sterling on the Foreign Exchange Market? What factors affect the supply of Sterling on the Foreign Exchange Market? Why might ‘great fluctuations in the value of Sterling’ occur if the Foreign Exchange Market is left to the forces of supply and demand? Explain the advantages and disadvantages for th ...

Finland

... 1. What did Finland really believe it would gain by pegging the value of the Finnish Markka to the ECU? First of all, Finland had already participated in Western Europe’s integration for decades, both politically and by opening up its markets. With the exception of key agricultural goods, Finland’s ...

... 1. What did Finland really believe it would gain by pegging the value of the Finnish Markka to the ECU? First of all, Finland had already participated in Western Europe’s integration for decades, both politically and by opening up its markets. With the exception of key agricultural goods, Finland’s ...

Class 7: Economic Globalization

... governments to control their own monetary policy • Sometimes countries want to lower interest rates to boost the economy… – But can’t because it would hurt their currency ...

... governments to control their own monetary policy • Sometimes countries want to lower interest rates to boost the economy… – But can’t because it would hurt their currency ...

Exchange Rate Regimes

... The key to understand the sharp devaluation of these currencies during the summer 97 is the first reaction of monetary authorities: to avoid a significant monetary contraction and a significant increase in domestic interest rates, because of the fragile financial conditions A relatively loose moneta ...

... The key to understand the sharp devaluation of these currencies during the summer 97 is the first reaction of monetary authorities: to avoid a significant monetary contraction and a significant increase in domestic interest rates, because of the fragile financial conditions A relatively loose moneta ...

RESERVE BANK OF MALAWI MINUTES OF THE 5 MONETARY POLICY COMMITTEE MEETING

... Reflecting effects of the recent reduction in commercial banks’ lending rates, private sector credit from the commercial banks grew by K1.4 billion to K273.6 billion in August 2014 from K272.3 billion in July 2014. However, at 34.3 percent, the average prime lending rates in the money market are sig ...

... Reflecting effects of the recent reduction in commercial banks’ lending rates, private sector credit from the commercial banks grew by K1.4 billion to K273.6 billion in August 2014 from K272.3 billion in July 2014. However, at 34.3 percent, the average prime lending rates in the money market are sig ...

Former HKMA Official Plans Chinese Bond Fund for Institutions

... (Bloomberg) -- A former head of Hong Kong Monetary Authority’s direct investment division, which oversees more than $250 billion of foreign exchange reserves, plans to start his own Chinese bond funds. Brummer & Partners has bought a stake in Edmund Ng’s Hong Kong-based Eastfort Asset Management, th ...

... (Bloomberg) -- A former head of Hong Kong Monetary Authority’s direct investment division, which oversees more than $250 billion of foreign exchange reserves, plans to start his own Chinese bond funds. Brummer & Partners has bought a stake in Edmund Ng’s Hong Kong-based Eastfort Asset Management, th ...

Chapter 1

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

... assets The concept of equilibrium Basic supply and demand to explain behavior in financial markets The search for profits An approach to financial structure based on transaction costs and asymmetric ...

Global Bargain Hunting

... tend toward PPP in the very long run. Short run deviation from PPP are large and volatile (Indonesia and Thailand). Deviation from PPP suggests segmentation in international goods markets. There is a large buffer within which nominal exchange rate can move without producing immediate response in ...

... tend toward PPP in the very long run. Short run deviation from PPP are large and volatile (Indonesia and Thailand). Deviation from PPP suggests segmentation in international goods markets. There is a large buffer within which nominal exchange rate can move without producing immediate response in ...

Source

... To examine how financial markets such as bond, stock and foreign exchange markets work ...

... To examine how financial markets such as bond, stock and foreign exchange markets work ...

Problem 12

... central banks would have to sell marks and buy dollars, a procedure known as intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is un ...

... central banks would have to sell marks and buy dollars, a procedure known as intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is un ...

4810syllabus

... European Monetary Union (July 10) – In 2001 several countries in Europe abandoned their currencies and adopted a common currency called the euro. What is the history of this institution? What is the institutional structure of the EMU? What is the effect on the member countries? Are there any positi ...

... European Monetary Union (July 10) – In 2001 several countries in Europe abandoned their currencies and adopted a common currency called the euro. What is the history of this institution? What is the institutional structure of the EMU? What is the effect on the member countries? Are there any positi ...

presented at - Harvard University

... 5th, multinational companies that had in the past moved some stages of their production process to China, out of the US, or out of other high-wage countries, are now moving back. ...

... 5th, multinational companies that had in the past moved some stages of their production process to China, out of the US, or out of other high-wage countries, are now moving back. ...