Malaysian Ringgit

... Annual Inflation Rate: Malaysia 3.7% • For currency quoted in European terms: Future spot rate = 3.78 (1+.037)5/(1+.038)5 • Future Spot rate = 3.761827 ...

... Annual Inflation Rate: Malaysia 3.7% • For currency quoted in European terms: Future spot rate = 3.78 (1+.037)5/(1+.038)5 • Future Spot rate = 3.761827 ...

forex - Herricks

... U.S. demand for cheaper imports increases… U.S. demand for pounds increases Supply of U.S. dollars increases Pound - appreciates Dollar - depreciates ...

... U.S. demand for cheaper imports increases… U.S. demand for pounds increases Supply of U.S. dollars increases Pound - appreciates Dollar - depreciates ...

Fed surprises few with rate hike At its March 15 meeting, the Federal

... As reflected in positive moves in both the stock market and relative steadiness of the quality bond market, the decision to raise short-term interest rates is not necessarily bad news for investors, Raymond James Chief Economist Scott Brown explains. It reflects an improved economic outlook. The lat ...

... As reflected in positive moves in both the stock market and relative steadiness of the quality bond market, the decision to raise short-term interest rates is not necessarily bad news for investors, Raymond James Chief Economist Scott Brown explains. It reflects an improved economic outlook. The lat ...

Macroeconomic Policies Under Globalization

... Open-economy industrial policies support innovative entrepreneurs • Industrial policies should aim at: – solving information and coordination problems in the investment process; – ensuring that production experience is translated into productivity gains; ...

... Open-economy industrial policies support innovative entrepreneurs • Industrial policies should aim at: – solving information and coordination problems in the investment process; – ensuring that production experience is translated into productivity gains; ...

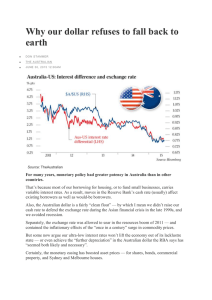

Why our dollar refuses to fall back to earth

... Glenn Stevens, the RBA’s governor, offers a good explanation of why the economy is subpar despite our record low rates: “History tells us that recovering from a financial crisis is an especially long and painful process, and more so if other countries are in the same boat.” In my view, the rate cuts ...

... Glenn Stevens, the RBA’s governor, offers a good explanation of why the economy is subpar despite our record low rates: “History tells us that recovering from a financial crisis is an especially long and painful process, and more so if other countries are in the same boat.” In my view, the rate cuts ...

Practice Exam 3

... Note: Each multiple-choice question is worth 4 points. Problems 19, 20, and 21 carry 11, 10, and 11 points, respectively. 1) Which of the following will tend to cause domestic currency to appreciate? A) an increase in foreign interest rates. B) a decrease in the expected future exchange rate C) an i ...

... Note: Each multiple-choice question is worth 4 points. Problems 19, 20, and 21 carry 11, 10, and 11 points, respectively. 1) Which of the following will tend to cause domestic currency to appreciate? A) an increase in foreign interest rates. B) a decrease in the expected future exchange rate C) an i ...

relevant macroeconomic parameters

... means that more jobs are created and more incomes are received. The per capita GNP (GNP divided by population) is also an important gauge of economic development and is often used as the basis for classifying countries as underdeveloped or developing. ...

... means that more jobs are created and more incomes are received. The per capita GNP (GNP divided by population) is also an important gauge of economic development and is often used as the basis for classifying countries as underdeveloped or developing. ...

the government`s bank

... bank controls the discount rate and the availability of money and credit. Gold reserves, while still an asset of many central banks, are virtually irrelevant these days. ...

... bank controls the discount rate and the availability of money and credit. Gold reserves, while still an asset of many central banks, are virtually irrelevant these days. ...

The Small Open Economy - The Economics Network

... • If the loanable funds market is out of equilibrium then the exchange rate adjusts to equilibrate it which in turn ensures that the goods market is in equilibrium. ...

... • If the loanable funds market is out of equilibrium then the exchange rate adjusts to equilibrate it which in turn ensures that the goods market is in equilibrium. ...

Company Name - University of Wisconsin–La Crosse

... is any asset that can easily be used to purchase goods and services. ...

... is any asset that can easily be used to purchase goods and services. ...

Kaminisky, Graciela L

... Expansionary fiscal and credit policies lead to real appreciation, and current account deficit. With sticky prices, nominal wages increase results in higher real wages and lower competitiveness. Self-fulfilling: economic policies are no predetermined but respond to changes in the economy. Economic a ...

... Expansionary fiscal and credit policies lead to real appreciation, and current account deficit. With sticky prices, nominal wages increase results in higher real wages and lower competitiveness. Self-fulfilling: economic policies are no predetermined but respond to changes in the economy. Economic a ...

Lecture 1

... The table shows data for the United States from 1990 to 2009 in billions of U.S. dollars. During this period, in all but one year U.S. expenditure exceeded income, with the U.S. current account in deficit. The last (small) surplus was in 1991. ...

... The table shows data for the United States from 1990 to 2009 in billions of U.S. dollars. During this period, in all but one year U.S. expenditure exceeded income, with the U.S. current account in deficit. The last (small) surplus was in 1991. ...

SUMMER TERM 2015 ECON1604: Economics 1 (Combined Studies)

... output, interest rate, consumption and investment in both the short and medium run. You may assume that the world economy was in medium run equilibrium before the price drop. In one sentence, give an important reason why some countries do better than others when the oil price falls sharply. A9 Write ...

... output, interest rate, consumption and investment in both the short and medium run. You may assume that the world economy was in medium run equilibrium before the price drop. In one sentence, give an important reason why some countries do better than others when the oil price falls sharply. A9 Write ...

Averting a New Depression: The New Post

... • Free trade and comparative advantage demand that inefficient industries should fail and employment should be left to the market • Employment will fluctuate with supply and demand for labor • For Liberals, too much state intervention to create demand does not allow the free market to work properly: ...

... • Free trade and comparative advantage demand that inefficient industries should fail and employment should be left to the market • Employment will fluctuate with supply and demand for labor • For Liberals, too much state intervention to create demand does not allow the free market to work properly: ...

Ch 6 MCQs File

... foreign rates of inflation. B) a nation's exchange rate will differ from another nation's exchange rate by an amount depending upon the difference between the domestic and foreign rates of inflation. C) a nation's exchange rate is determined by the extent of speculation in the foreign-exchange marke ...

... foreign rates of inflation. B) a nation's exchange rate will differ from another nation's exchange rate by an amount depending upon the difference between the domestic and foreign rates of inflation. C) a nation's exchange rate is determined by the extent of speculation in the foreign-exchange marke ...

Zimbabwe: A Country In Crisis

... Government’s policy worsens things: – Regulation of exchange rates and interest rates within certain ranges (so never reach real market values) – Price controls and ‘official’ exchange rates don’t keep pace with devaluing ZWD, so people use South African Rand, Euro, and USD for informal market trans ...

... Government’s policy worsens things: – Regulation of exchange rates and interest rates within certain ranges (so never reach real market values) – Price controls and ‘official’ exchange rates don’t keep pace with devaluing ZWD, so people use South African Rand, Euro, and USD for informal market trans ...

Fiscal Policy Under Flexible Exchange Rates

... K-Mobility) So far, we’ve examined the effects of fiscal and monetary policy holding a number of factors constant, including • domestic and foreign prices, • foreign interest rate, and • expected exchange rate changes. ...

... K-Mobility) So far, we’ve examined the effects of fiscal and monetary policy holding a number of factors constant, including • domestic and foreign prices, • foreign interest rate, and • expected exchange rate changes. ...

Finnish experiences of EU and EMU

... policy in the Monetary Union • Exchange rate is not any more a domestic issue • Too high inflation detorriorates the price competitiveness and it cannot be restored by depreciation of exchange rate • Labour markets and wage formation in important role in formulating economic development • Asymmetric ...

... policy in the Monetary Union • Exchange rate is not any more a domestic issue • Too high inflation detorriorates the price competitiveness and it cannot be restored by depreciation of exchange rate • Labour markets and wage formation in important role in formulating economic development • Asymmetric ...

Ch 33

... If a country wants to keep the value of its currency fixed, then its central bank should A. sell domestic goods when there is an increase in the supply of its domestic currency. B. buy domestic goods when there is an increase in the supply of its domestic currency. C. sell its domestic currency whe ...

... If a country wants to keep the value of its currency fixed, then its central bank should A. sell domestic goods when there is an increase in the supply of its domestic currency. B. buy domestic goods when there is an increase in the supply of its domestic currency. C. sell its domestic currency whe ...

Real Growth of GDP Euro Area Countries

... • We don’t have an official opt-out option as Denmark or UK have or de facto opt – out (after NO in 2003 referendum) of Sweden • The majority of Slovaks support Euro So the question is not IF but WHEN ...

... • We don’t have an official opt-out option as Denmark or UK have or de facto opt – out (after NO in 2003 referendum) of Sweden • The majority of Slovaks support Euro So the question is not IF but WHEN ...