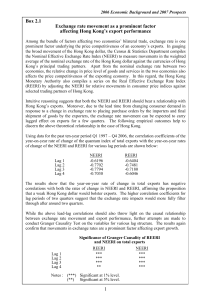

Exchange rate movement as a prominent factor affecting Hong

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

Capital Inflows and Reserve Accumulation: The Recent

... Prakash Loungani, and other participants. An earlier version was presented at the Konstanz Seminar on Monetary Policy and Theory, and we appreciate the comments of our discussant, Patrick Minford, and other participants. April Gifford and Meagan Berry provided excellent research support. The views e ...

... Prakash Loungani, and other participants. An earlier version was presented at the Konstanz Seminar on Monetary Policy and Theory, and we appreciate the comments of our discussant, Patrick Minford, and other participants. April Gifford and Meagan Berry provided excellent research support. The views e ...

Slide 1

... to the right when E dropped, and so we move from A to C. • E adjusts faster than W and P. ...

... to the right when E dropped, and so we move from A to C. • E adjusts faster than W and P. ...

Chapter 18

... The Long-Term Financing Decision • To make the long-term financing decision, the MNC must determine the amount of funds needed, forecast the price (interest rate) at which the bond may be issued, and forecast the exchange rates of the borrowed currency for the times when it has to make paymen ...

... The Long-Term Financing Decision • To make the long-term financing decision, the MNC must determine the amount of funds needed, forecast the price (interest rate) at which the bond may be issued, and forecast the exchange rates of the borrowed currency for the times when it has to make paymen ...

PowerPoint 演示文稿 - Tulane University

... When the crisis began, Soros appealed to other western countries to help Russia, the banks used to support Quantum Fund refused and ask for early loan payment. ...

... When the crisis began, Soros appealed to other western countries to help Russia, the banks used to support Quantum Fund refused and ask for early loan payment. ...

Stabilizing role of own currency in a small open economy

... created money, when the interest rate is at zero lower bound (ZLB). The main purpose of exchange rate floor is to keep exchange rate at devalued rate and, unlike common discretionary FX interventions, it has predictable and persistent impact on exchange rate. Recently, Switzerland and the Czech Repu ...

... created money, when the interest rate is at zero lower bound (ZLB). The main purpose of exchange rate floor is to keep exchange rate at devalued rate and, unlike common discretionary FX interventions, it has predictable and persistent impact on exchange rate. Recently, Switzerland and the Czech Repu ...

download

... Can a business truly be currency-proof? It can get pretty close, say our experts from HSBC Bank Australia: Andrew Skinner, head of trade and supply chain, and Ian Collins, head of sales for global banking and markets. The key to currency proofing is not about gambling on the foreign exchange market, ...

... Can a business truly be currency-proof? It can get pretty close, say our experts from HSBC Bank Australia: Andrew Skinner, head of trade and supply chain, and Ian Collins, head of sales for global banking and markets. The key to currency proofing is not about gambling on the foreign exchange market, ...

Chapter 2

... payments deficit. This deficit would put downward pressure on the dollar. To prevent any change in the exchange rate the monetary authorities would decrease the money supply, increasing interest rates to attract capital inflows that would eliminate the balance of payments deficit. This action dampen ...

... payments deficit. This deficit would put downward pressure on the dollar. To prevent any change in the exchange rate the monetary authorities would decrease the money supply, increasing interest rates to attract capital inflows that would eliminate the balance of payments deficit. This action dampen ...

ch06 - Prof Dimond

... earnings. A partial solution to this problem is to free up the market for foreign exchange. By allowing enterprises to buy or sell foreign exchange as they see fit, they will have a stronger incentive to earn foreign exchange and to conserve on its use. d. ...

... earnings. A partial solution to this problem is to free up the market for foreign exchange. By allowing enterprises to buy or sell foreign exchange as they see fit, they will have a stronger incentive to earn foreign exchange and to conserve on its use. d. ...

Chapter 9: Political and Economic Factors Affecting International

... that has worth, such as a home or stocks. Ten exchanges in three time zones are considering the set up: -Toronto, New York, Mexico, and Sao Paolo, Brazil in the Americas -Australia, Tokyo, and Hong Kong in the Asia-Pacific region -Euronext, the combined Paris, Amsterdam, and, Brussels exchange in Eu ...

... that has worth, such as a home or stocks. Ten exchanges in three time zones are considering the set up: -Toronto, New York, Mexico, and Sao Paolo, Brazil in the Americas -Australia, Tokyo, and Hong Kong in the Asia-Pacific region -Euronext, the combined Paris, Amsterdam, and, Brussels exchange in Eu ...

Slide 1

... Great uncertainty about the future course of political and economic events which induced sharp and frequent changes in expectations. ...

... Great uncertainty about the future course of political and economic events which induced sharp and frequent changes in expectations. ...

Foreign Exchange Rates I

... Increase in foreign preference for U.S. goods Increase in foreign real G.D.P. Increase in real interest rate on U.S. bonds (relative to foreign) Increase in foreign wealth Decrease in relative risk of U.S. investments Expected dollar appreciation (e.g. low U.S. inflation) ...

... Increase in foreign preference for U.S. goods Increase in foreign real G.D.P. Increase in real interest rate on U.S. bonds (relative to foreign) Increase in foreign wealth Decrease in relative risk of U.S. investments Expected dollar appreciation (e.g. low U.S. inflation) ...

Макроекономска кретања, октобар – децембар 2006. године

... As of 5 March, the functioning of the fixing session will change – the official middle exchange rate of the dinar against the euro will be set based on the daily weighted average trade in currencies in the overall interbank foreign exchange market; ...

... As of 5 March, the functioning of the fixing session will change – the official middle exchange rate of the dinar against the euro will be set based on the daily weighted average trade in currencies in the overall interbank foreign exchange market; ...

What is the nominal exchange rate?

... • Must have valid excuse • Will be scheduled either before or during the first days of the final exam period, which is May 22 to June 1 • Email Murat Usman ([email protected]) immediately! • No make up for the make up! ...

... • Must have valid excuse • Will be scheduled either before or during the first days of the final exam period, which is May 22 to June 1 • Email Murat Usman ([email protected]) immediately! • No make up for the make up! ...

Strong Dollar, Weak Dollar

... transactions. Prior to the development of forex futures, there could be a significant amount of risk in entering into a long-term contract with firms in other countries. One of the largest sources of risk was the inability to guarantee the relative value of the currencies involved at the date of de ...

... transactions. Prior to the development of forex futures, there could be a significant amount of risk in entering into a long-term contract with firms in other countries. One of the largest sources of risk was the inability to guarantee the relative value of the currencies involved at the date of de ...

Document

... – They seek to alter the market’s valuation of a specific exchange rate by influencing the motivators of market activity, rather through direct intervention in the foreign exchange markets. – The primary action taken by such governments is to change relative interest rates. Copyright © 2004 Pearson ...

... – They seek to alter the market’s valuation of a specific exchange rate by influencing the motivators of market activity, rather through direct intervention in the foreign exchange markets. – The primary action taken by such governments is to change relative interest rates. Copyright © 2004 Pearson ...

Loanable Funds Market

... Loanable Funds Market -Represents money in commercial banks and lending institutions that is available to finance investment or consumption ...

... Loanable Funds Market -Represents money in commercial banks and lending institutions that is available to finance investment or consumption ...

Economics Principles and Applications

... • In general, long-run trends in exchange rates are determined by relative price levels in two countries – According to purchasing power parity (PPP) theory, exchange rate between two countries will adjust in long-run until average price of goods is roughly the same in both countries – PPP theory ha ...

... • In general, long-run trends in exchange rates are determined by relative price levels in two countries – According to purchasing power parity (PPP) theory, exchange rate between two countries will adjust in long-run until average price of goods is roughly the same in both countries – PPP theory ha ...

Liaquat Ahmad, Currency Wars, Then and Now, Foreign Affairs

... problems of adjustment faced by Germany and the United Kingdom during the early 1930s. They are, however, being given some temporary assistance through the European Central Bank and the European Financial Stability Facility to help them weather the storm. The other major exception is the so-called d ...

... problems of adjustment faced by Germany and the United Kingdom during the early 1930s. They are, however, being given some temporary assistance through the European Central Bank and the European Financial Stability Facility to help them weather the storm. The other major exception is the so-called d ...

Document

... – Example: Suppose the central bank has been fixing E at E0 and that asset markets are in equilibrium. An increase in output would raise the money demand and thus lead to a higher interest rate and an appreciation of the home currency. Copyright © 2003 Pearson Education, Inc. ...

... – Example: Suppose the central bank has been fixing E at E0 and that asset markets are in equilibrium. An increase in output would raise the money demand and thus lead to a higher interest rate and an appreciation of the home currency. Copyright © 2003 Pearson Education, Inc. ...

European Monetary Union

... Size of OCA dependent on degree of integration of economy (highly integrated economy less susceptible to asymmetric shocks), preferences regarding inflation and unemployment, different labor market institutions, growth rates, balances of trade, fiscal systems etc. (economic policy coordination) Asym ...

... Size of OCA dependent on degree of integration of economy (highly integrated economy less susceptible to asymmetric shocks), preferences regarding inflation and unemployment, different labor market institutions, growth rates, balances of trade, fiscal systems etc. (economic policy coordination) Asym ...

Exchange Rates, Wages, and International Adjustment: Japan and

... (withdrawn October 2006, but new threat in 2007) -Section 3004 of U.S. Public Law 100-418: U.S. Secretary of Treasury must report twice a year on whether countries with trade surpluses are “manipulating” their currencies. Timothy Geitner’s congressional testimony January 2009 • RMB rises by 2.1% on ...

... (withdrawn October 2006, but new threat in 2007) -Section 3004 of U.S. Public Law 100-418: U.S. Secretary of Treasury must report twice a year on whether countries with trade surpluses are “manipulating” their currencies. Timothy Geitner’s congressional testimony January 2009 • RMB rises by 2.1% on ...

THe NK Approach to Exchange Rate Policy Analysis: Looking Forward

... Typically at the core of models such as Kiyotaki and Moore (1997), Cooley, Marimon and Quadrini, Quadrini and Jermann ...

... Typically at the core of models such as Kiyotaki and Moore (1997), Cooley, Marimon and Quadrini, Quadrini and Jermann ...