Downlaod File

... In Saudi Arabia the monetary policy is ruled and managed by the Saudi Arabian monetary agency of government (SAMA) it deals on with fixed exchange-rate rule. The exchange rate is important because it impart the long-term structure for monetary policy. Within this structure, there are some benefits t ...

... In Saudi Arabia the monetary policy is ruled and managed by the Saudi Arabian monetary agency of government (SAMA) it deals on with fixed exchange-rate rule. The exchange rate is important because it impart the long-term structure for monetary policy. Within this structure, there are some benefits t ...

Global Economic Development

... - from savings of citizens - most people in LDCs don’t have enough $ to save … & the wealthy often keep $ in foreign banks and invest in foreign companies ...

... - from savings of citizens - most people in LDCs don’t have enough $ to save … & the wealthy often keep $ in foreign banks and invest in foreign companies ...

Foreign Exchange (FOREX)

... 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency ...

... 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency ...

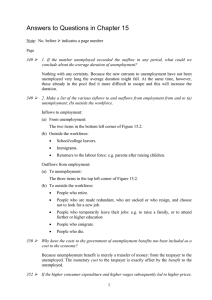

Answers to Questions in Chapter 14

... It is not really possible to tell, as the policy would work in either case. Were the unemployment to be disequilibrium then reducing the employers’ contribution would reduce the ‘real wage’ paid by employers. Such a policy might also solve demand deficient unemployment. This is because cutting the c ...

... It is not really possible to tell, as the policy would work in either case. Were the unemployment to be disequilibrium then reducing the employers’ contribution would reduce the ‘real wage’ paid by employers. Such a policy might also solve demand deficient unemployment. This is because cutting the c ...

International Political Economy

... • Free trade relied on the free convertibility of currencies. Negotiators at the Bretton Woods conference, fresh from what they perceived as a disastrous experience with floating rates in the 1930s, concluded that major monetary fluctuations could stall the free flow of trade. • The liberal economic ...

... • Free trade relied on the free convertibility of currencies. Negotiators at the Bretton Woods conference, fresh from what they perceived as a disastrous experience with floating rates in the 1930s, concluded that major monetary fluctuations could stall the free flow of trade. • The liberal economic ...

May 14, 2007 - Harvard University

... overoptimistic throughout the first Bush term. – The surplus of $5 trillion+ forecasted in Jan. 2001 over 10 years became a 10-year deficit of $5 trillion. ...

... overoptimistic throughout the first Bush term. – The surplus of $5 trillion+ forecasted in Jan. 2001 over 10 years became a 10-year deficit of $5 trillion. ...

operating_exposure

... A revaluation lowers input prices and raises an importer’s dollar total revenue, total cost, and profit. Devaluation lowers the prices of imports when these prices are measured in the foreign currency. Dollar devaluation lowers an importer’s total revenue, total cost, and profit in terms of th ...

... A revaluation lowers input prices and raises an importer’s dollar total revenue, total cost, and profit. Devaluation lowers the prices of imports when these prices are measured in the foreign currency. Dollar devaluation lowers an importer’s total revenue, total cost, and profit in terms of th ...

Uri Dadush Bennett Stancil 9 May 2011, VOX.EU

... findings – the main motivation for reserve accumulation was to prevent real-exchange-rate appreciation, had all emerging markets agreed to allow their exchange rates to appreciate together, losing competitiveness would have been less of a concern. Moreover, advanced countries, particularly those tha ...

... findings – the main motivation for reserve accumulation was to prevent real-exchange-rate appreciation, had all emerging markets agreed to allow their exchange rates to appreciate together, losing competitiveness would have been less of a concern. Moreover, advanced countries, particularly those tha ...

Mexico_en.pdf

... of a central bank operating surplus, replenishment of the Oil Revenue Stabilization Fund or yields on oil hedging contracts. The tax burden (excluding the petroleum sector) was equivalent to 10% of GDP —one of the lowest in the Organization for Economic Cooperation and Development (OECD) and in Lati ...

... of a central bank operating surplus, replenishment of the Oil Revenue Stabilization Fund or yields on oil hedging contracts. The tax burden (excluding the petroleum sector) was equivalent to 10% of GDP —one of the lowest in the Organization for Economic Cooperation and Development (OECD) and in Lati ...

POST FINANCIAL CRISIS: Options for SIDS & emerging economies

... US multilateral trade deficit or broader global imbalances Change in exchange rate could benefit other developing and emerging markets—likely to come directly or indirectly (real appreciation through inflation) Win-win path through a global growth strategy ...

... US multilateral trade deficit or broader global imbalances Change in exchange rate could benefit other developing and emerging markets—likely to come directly or indirectly (real appreciation through inflation) Win-win path through a global growth strategy ...

Course Outline School of Business and Economics BUSN 6030/1

... education, economic philosophy, and political philosophy. 3. Describe the different approaches to business ethics that can be derived from moral philosophy, and show how these approaches can help managers to make international business decisions that do not violate ethical norms. 4. Explain the impo ...

... education, economic philosophy, and political philosophy. 3. Describe the different approaches to business ethics that can be derived from moral philosophy, and show how these approaches can help managers to make international business decisions that do not violate ethical norms. 4. Explain the impo ...

EASY - Testbank44

... b. raise the value of the dollar because it will lead to higher U.S. interest rates c. reduce the value of the dollar because of inflation fears in the United States d. decrease the value of the dollar because it will force other countries to raise their interest rates Ans: c Section: The fundamenta ...

... b. raise the value of the dollar because it will lead to higher U.S. interest rates c. reduce the value of the dollar because of inflation fears in the United States d. decrease the value of the dollar because it will force other countries to raise their interest rates Ans: c Section: The fundamenta ...

June 2012

... Sources: Chinese State Administration of Foreign Exchange; RMB/eff(ective) is the value of the RMB against its trade-weighted basket, calculated by JP Morgan, extracted from Bloomberg. Legend: line down (up) indicates depreciation (appreciation) of the currency or a basket against the RMB. ...

... Sources: Chinese State Administration of Foreign Exchange; RMB/eff(ective) is the value of the RMB against its trade-weighted basket, calculated by JP Morgan, extracted from Bloomberg. Legend: line down (up) indicates depreciation (appreciation) of the currency or a basket against the RMB. ...

real exchange rate

... small part of the world economy. By itself it will have only a negligible effect on the prices of goods and services and interest rates in the rest of the world. Price taker—particularly with interest rates and MKT for loanable funds. ...

... small part of the world economy. By itself it will have only a negligible effect on the prices of goods and services and interest rates in the rest of the world. Price taker—particularly with interest rates and MKT for loanable funds. ...

Chapter 7 presentation.

... the long run price level will increase. This means TL will depreciate in the long run, due to purchasing power parity theory. Since the expected value of TL next year is smaller, current demand for TL assets decline. Causes TL to depreciate. (first ...

... the long run price level will increase. This means TL will depreciate in the long run, due to purchasing power parity theory. Since the expected value of TL next year is smaller, current demand for TL assets decline. Causes TL to depreciate. (first ...

Safety is our 1° commandment

... the European Union member countries - many of which use the same currency, the euro. • All tariffs between Euromarket member countries have been abolished, and import duties from all non-member countries have been fixed for all of the member countries. • The Euromarket also has one central bank for ...

... the European Union member countries - many of which use the same currency, the euro. • All tariffs between Euromarket member countries have been abolished, and import duties from all non-member countries have been fixed for all of the member countries. • The Euromarket also has one central bank for ...

doc

... There are 18 banks and 3 branches of foreign banks operating in Slovakia, as of the beginning of the year 2004. With regard to the size of the Slovak market and scope of services and products provided, one can say that there is no demand in Slovakia for a service or a product that could not be offer ...

... There are 18 banks and 3 branches of foreign banks operating in Slovakia, as of the beginning of the year 2004. With regard to the size of the Slovak market and scope of services and products provided, one can say that there is no demand in Slovakia for a service or a product that could not be offer ...

File - BSC Economics

... 19) The purpose of diversification is to a) Reduce the volatility of a portfolio's return. b) Raise the volatility of a portfolio's return. c) Reduce the average return on a portfolio. d) Raise the average return on a portfolio. 20) Which of the following is a contractual savings institution? a) A l ...

... 19) The purpose of diversification is to a) Reduce the volatility of a portfolio's return. b) Raise the volatility of a portfolio's return. c) Reduce the average return on a portfolio. d) Raise the average return on a portfolio. 20) Which of the following is a contractual savings institution? a) A l ...

international Banking

... especially Latin American countries and major international loan loss by many international banks. ...

... especially Latin American countries and major international loan loss by many international banks. ...

International financial and foreign exchange markets Tentative

... situation (G. Schlitzer) A brief history of international finance from the gold standard to the recent financial crisis. The role of the IMF and the debate about fixed vs flexible exchange rates Working within an international context: arising risks and available mechanisms for hedge (A. Ziliotto) T ...

... situation (G. Schlitzer) A brief history of international finance from the gold standard to the recent financial crisis. The role of the IMF and the debate about fixed vs flexible exchange rates Working within an international context: arising risks and available mechanisms for hedge (A. Ziliotto) T ...

Problem Set 3

... The savings rate in the United States is low in comparison with that of other industrialized nations. If the U.S. were a closed economy, how would a low savings rate affect domestic (tangible) investment? How do governmental budget deficits affect investment? b. How would the results change if the U ...

... The savings rate in the United States is low in comparison with that of other industrialized nations. If the U.S. were a closed economy, how would a low savings rate affect domestic (tangible) investment? How do governmental budget deficits affect investment? b. How would the results change if the U ...

Who could fix the messy global economy

... resources, hiked up the overnight interest rates at least two times; the emerging markets countries, such as China, Brazil, Korea, and India, also picked up overnight interest rates for fighting inflation pressure. This kind of instance of the monetary policy seems to indicate that the global econom ...

... resources, hiked up the overnight interest rates at least two times; the emerging markets countries, such as China, Brazil, Korea, and India, also picked up overnight interest rates for fighting inflation pressure. This kind of instance of the monetary policy seems to indicate that the global econom ...

Currency Regimes: The Latin American Experience Chris Dailey- Senior Sophister

... flexible regimes are sometimes managed as if they were fixed but without the benefits of the pre-commitment provided by fixity. This was illustrated in Chile, Mexico, Peru and Venezuela during 1997-1998 as these countries reacted to economic difficulties by dramatically increasing interest rates rat ...

... flexible regimes are sometimes managed as if they were fixed but without the benefits of the pre-commitment provided by fixity. This was illustrated in Chile, Mexico, Peru and Venezuela during 1997-1998 as these countries reacted to economic difficulties by dramatically increasing interest rates rat ...

Carbaugh, International Economics 9e, Chapter 16

... A currency board is a monetary authority empowered to issue domestic currency which can be converted at a fixed exchange rate The rate is usually set in law, and the board must have foreign exchange reserves large enough to cover the domestic currency in circulation Put another way, the domest ...

... A currency board is a monetary authority empowered to issue domestic currency which can be converted at a fixed exchange rate The rate is usually set in law, and the board must have foreign exchange reserves large enough to cover the domestic currency in circulation Put another way, the domest ...