Exam I - UTSA.edu

... the value of the Swiss franc with respect to the U.S. dollar will generally appreciate the value of the Swiss franc with respect to the U.S. dollar will generally depreciate the value of the Swiss franc with respect to the U.S. dollar would generally remain constant The value of the Swiss franc with ...

... the value of the Swiss franc with respect to the U.S. dollar will generally appreciate the value of the Swiss franc with respect to the U.S. dollar will generally depreciate the value of the Swiss franc with respect to the U.S. dollar would generally remain constant The value of the Swiss franc with ...

Notes on Armenia`s growth strategy

... Moving people from unemployment and agriculture into higherproductivity activities is key Armenia’s growth strategy and industrial policies cannot rely on IT ...

... Moving people from unemployment and agriculture into higherproductivity activities is key Armenia’s growth strategy and industrial policies cannot rely on IT ...

An Exploration of Renminbi-USD Exchange Rate

... For countries with floating exchange rate system, in which exchange rates are allowed to float freely and to be determined merely by the supply and demand of the market, intervention is often used in attempt to help stabilizing domestic macroeconomic conditions. As unexpected or large fluctuation of ...

... For countries with floating exchange rate system, in which exchange rates are allowed to float freely and to be determined merely by the supply and demand of the market, intervention is often used in attempt to help stabilizing domestic macroeconomic conditions. As unexpected or large fluctuation of ...

14.02 PRINCIPLES OF MACROECONOMICS QUIZ 3 READ INSTRUCTIONS FIRST:

... 13. Higher government spending will not crowd out investment in A. an open economy with fixed exchange rates. B. an open economy with flexible exchange rates. C. a closed economy. D. none of the above. ...

... 13. Higher government spending will not crowd out investment in A. an open economy with fixed exchange rates. B. an open economy with flexible exchange rates. C. a closed economy. D. none of the above. ...

Chapter 13 -- Determining Aggregate Demand (AD)

... Exchange Rate Regimes Fixed (Pegged) Exchange Rates -exchange rates are fixed by the government, unless changed by economic policy (e.g. US and China). Floating Exchange Rates -- exchange rates are determined by natural forces in the foreign exchange market (e.g. US and Japan, US and European Uni ...

... Exchange Rate Regimes Fixed (Pegged) Exchange Rates -exchange rates are fixed by the government, unless changed by economic policy (e.g. US and China). Floating Exchange Rates -- exchange rates are determined by natural forces in the foreign exchange market (e.g. US and Japan, US and European Uni ...

Sample questions

... systematically short-run exchange rate movements and yet major economic disturbances affecting output, such as the Great Depression, can be explained with these models. Explain this statement using a Dornbusch-type model, by showing that a monetary contraction can affect output, prices and exchange ...

... systematically short-run exchange rate movements and yet major economic disturbances affecting output, such as the Great Depression, can be explained with these models. Explain this statement using a Dornbusch-type model, by showing that a monetary contraction can affect output, prices and exchange ...

International Monetary Economics – ECO 353

... in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy (that is, an economy that trades goods and assets with the rest of the world), balance of payment crisis, the choice of exchange rate systems and their advantages and di ...

... in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy (that is, an economy that trades goods and assets with the rest of the world), balance of payment crisis, the choice of exchange rate systems and their advantages and di ...

relationship of exchange rate with macro economic variables

... (Barter system, Paper currency, Plastic money). ...

... (Barter system, Paper currency, Plastic money). ...

Waiting for Godot*

... SEAMARK’s daily morning scrums. Whether we subscribe to them or not, we admit that the low interest rate period has now stretched into the better part of a decade. Since the Fed started to remove the stimulus, both U.S. and Canadian 10-year yields have declined 50 bps. In no particular order, the fo ...

... SEAMARK’s daily morning scrums. Whether we subscribe to them or not, we admit that the low interest rate period has now stretched into the better part of a decade. Since the Fed started to remove the stimulus, both U.S. and Canadian 10-year yields have declined 50 bps. In no particular order, the fo ...

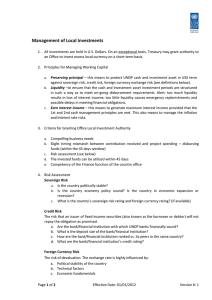

Interest Rate Risk

... c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Currency Risk The risk of devaluation. The exchange rate is highly influenced by: a. Political stability of the country b. Technical factors c. Econ ...

... c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Currency Risk The risk of devaluation. The exchange rate is highly influenced by: a. Political stability of the country b. Technical factors c. Econ ...

The IMF and Bretton Woods Conference

... on the size of their economies, into the IMF, which could be drawn, according to quotas, when they lacked sufficient reserves to back their currency. The outcome represented the American view of how the liquidity problem should be solved. The Bretton Woods arrangements were incorporated in a Bre ...

... on the size of their economies, into the IMF, which could be drawn, according to quotas, when they lacked sufficient reserves to back their currency. The outcome represented the American view of how the liquidity problem should be solved. The Bretton Woods arrangements were incorporated in a Bre ...

Problem Set #1 - Wharton Finance Department

... that the higher US interest rates should attract foreign capital into the US and raise the FC value of the USD. However, in response to the rate increase, the value of the dollar fell slightly against all major currencies. Foreign central banks did not alter their interest rates on that day. Offer a ...

... that the higher US interest rates should attract foreign capital into the US and raise the FC value of the USD. However, in response to the rate increase, the value of the dollar fell slightly against all major currencies. Foreign central banks did not alter their interest rates on that day. Offer a ...

Parkin-Bade Chapter 34

... Nominal exchange rate is the value of the U.S. dollar expressed in units of foreign currency per U.S. dollar. The real exchange rate is the relative price of foreignproduced goods and services. It is a measure of the quantity of real GDP of other countries that we get for a unit of U.S. real GDP. ...

... Nominal exchange rate is the value of the U.S. dollar expressed in units of foreign currency per U.S. dollar. The real exchange rate is the relative price of foreignproduced goods and services. It is a measure of the quantity of real GDP of other countries that we get for a unit of U.S. real GDP. ...

Explanatory Notes - Central Bank of Nigeria

... were selected. These are: Belgium, France, Italy, Japan, The Netherlands, Spain, Switzerland, Germany, United Kingdom and the United States of America. However, following the dynamism in Nigeria’s International Trade, there had been some modifications in the group of selected trading partners. Thus, ...

... were selected. These are: Belgium, France, Italy, Japan, The Netherlands, Spain, Switzerland, Germany, United Kingdom and the United States of America. However, following the dynamism in Nigeria’s International Trade, there had been some modifications in the group of selected trading partners. Thus, ...

The Four Big Questions For Investors After `Black Monday

... the Fed saidconditions for a hike were "approaching", but there was trepidation about firming rate policy too soon as pressures on inflation and concerns about China weighed. Only one member voted for a hike last month. However, contrarian voices, including Neptune, believe the Fed will stick to its ...

... the Fed saidconditions for a hike were "approaching", but there was trepidation about firming rate policy too soon as pressures on inflation and concerns about China weighed. Only one member voted for a hike last month. However, contrarian voices, including Neptune, believe the Fed will stick to its ...

Chamberlain Canadian Imports has agreed to

... a. What is the price of the beer, in U.S. dollars, if it is purchased at today's spot rate? b. What is the cost, in U.S. dollars, of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? c. If the exchange rate for the Canadian dolla ...

... a. What is the price of the beer, in U.S. dollars, if it is purchased at today's spot rate? b. What is the cost, in U.S. dollars, of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? c. If the exchange rate for the Canadian dolla ...

A Case Study of a Currency Crisis: The

... and financial sector reduces the amount of credit available to firms and increases the likelihood of a crisis. They suggest that a currency crisis is brought on by a combination of high debt, low foreign reserves, falling government revenue, increasing expectations of devaluation, and domestic borro ...

... and financial sector reduces the amount of credit available to firms and increases the likelihood of a crisis. They suggest that a currency crisis is brought on by a combination of high debt, low foreign reserves, falling government revenue, increasing expectations of devaluation, and domestic borro ...

Trade Blocs, Monetary Unions, and Reserve

... – Labor needs to be able & willing to move around in search of opportunities. – Fiscal union is advisable. Because members usually retain sovereignty, they usually do not get transfers to make up for revenue shortfalls or increased social spending during a crisis. Nota bene: Robert Mundell won the N ...

... – Labor needs to be able & willing to move around in search of opportunities. – Fiscal union is advisable. Because members usually retain sovereignty, they usually do not get transfers to make up for revenue shortfalls or increased social spending during a crisis. Nota bene: Robert Mundell won the N ...

Trade Blocs and Monetary Unions

... – Labor needs to be able & willing to move around in search of opportunities. – Fiscal union is advisable. Because members usually retain sovereignty, they usually do not get transfers to make up for revenue shortfalls or increased social spending during a crisis. Nota bene: Robert Mundell won the N ...

... – Labor needs to be able & willing to move around in search of opportunities. – Fiscal union is advisable. Because members usually retain sovereignty, they usually do not get transfers to make up for revenue shortfalls or increased social spending during a crisis. Nota bene: Robert Mundell won the N ...

Colombian Highlights 2015 Financial Analysis and Projections for 2016 www.pwc.com/co

... are the ingredients necessary for the exchange rate to continue to increase. The likely increase in interest rates by the Federal Reserve, which would subtract external capital flows from the Colombian economy, is added to the lower demand for raw materials and contributes to the dollar increase. Co ...

... are the ingredients necessary for the exchange rate to continue to increase. The likely increase in interest rates by the Federal Reserve, which would subtract external capital flows from the Colombian economy, is added to the lower demand for raw materials and contributes to the dollar increase. Co ...

Balance –of-Payments Adjustments with Exchange Rate Changes

... times physical output at full employment. With V and Q assumed constant , the change in P is directly proportional to the change in M. Equation: MV=PQ ( M the nation’s money supply, V the velocity of circulation of money, P the general price index, Q the physical ...

... times physical output at full employment. With V and Q assumed constant , the change in P is directly proportional to the change in M. Equation: MV=PQ ( M the nation’s money supply, V the velocity of circulation of money, P the general price index, Q the physical ...

Icelandic banks 2008 in context

... US per capita GDP Clear sign that correction was due Even so, many households and firms borrowed in cheap foreign currencies at low interest even if their entire earnings were in domestic currency Even senior bankers and ministers did this An indication of wide-spread euphoria ...

... US per capita GDP Clear sign that correction was due Even so, many households and firms borrowed in cheap foreign currencies at low interest even if their entire earnings were in domestic currency Even senior bankers and ministers did this An indication of wide-spread euphoria ...

Chapter No. 6

... • Exchange rate: price of one currency in terms of another • Foreign exchange market: the financial market where exchange rates are determined • Spot transaction: immediate (two-day) exchange of bank deposits – Spot exchange rate ...

... • Exchange rate: price of one currency in terms of another • Foreign exchange market: the financial market where exchange rates are determined • Spot transaction: immediate (two-day) exchange of bank deposits – Spot exchange rate ...

(IMF) International Monetary Fund

... permanent forum for consideration of issues of international payments, in which member nations are encouraged to maintain an orderly pattern of exchange rates and to avoid restrictive exchange practices. The IMF was established, along with the International Bank for Reconstruction and Development, a ...

... permanent forum for consideration of issues of international payments, in which member nations are encouraged to maintain an orderly pattern of exchange rates and to avoid restrictive exchange practices. The IMF was established, along with the International Bank for Reconstruction and Development, a ...