* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 13 -- Determining Aggregate Demand (AD)

Survey

Document related concepts

Transcript

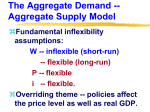

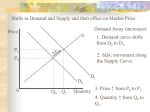

Chapter 13 -- Determining Aggregate Demand (AD) This chapter -- looks at the components of Aggregate Expenditure. Examines the major causes of Consumption (C), Investment (I), Government Expenditure Net of Taxes (G - T), and Net Exports (X - M). “Unzipping” Aggregate Expenditure (AE) Causes of AD I. Price Level (P) II. AE = C + I + (G – T) + (X – M) (a) C (i) ----------------(ii) ---------------(b) I (i) ----------------(ii) ---------------(c) (G – T) … Causes of Consumption (C) Aggregate Income (Y), Y C Wealth, Wealth C Consumer Confidence (CC), CC C Applying the Causes to Aggregate Demand (AD) Aggregate Income (Y), appears on the graph, Y C relationship affects the shape of the AD curve. Changes in Wealth or Consumer Confidence make up autonomous consumption (consumption due to causes other than Y) -- shift the AD curve. Consumer Confidence and the Economy Example -- effect of a decrease in consumer confidence. CC C Therefore the AD curve shifts leftward. In the AD-AS model, this results in Y*, P* Causes of Investment (I): The Capital Market Investment (I) – primarily business purchases of new plant and equipment. Also includes new residential housing and changes in inventories (small). Large expenditures create the need for long-term borrowing. Borrowing is done from banks (or similar loaning institutions), or by companies issuing bonds or stock. Investment and Capital Market Behavior Investment results from behavior in the (financial) capital market. The Capital Market -- The Demand and Supply for financial capital needed to finance purchases of plant and equipment and new residential housing (I). The Demand For Financial Capital (DI) -- Major Causes Nominal (Long-Term) Interest Rate (r) – cost of borrowing to finance investment. r DI Expected Inflation Rate (e) e DI Business Confidence (BC) BC DI Formalizing the Demand for Financial Capital (DI) Graph DI against one of its causes -- the nominal interest rate (r). Inverse relationship implies that the curve is downward sloping. Changes in r are described as a movement along the curve. Graph is drawn assuming that other causes are constant (ceteris paribus). Shifts in the Demand for Financial Capital Changes in causes other than r are described as shifts of the DI curve. Changes that increase the Demand for Financial Capital shift the DI curve rightward. Changes that decrease the Demand for Financial Capital shift the DI curve leftward. The Supply of Financial Capital (SI) -- Major Causes Nominal Interest Rate (r) r SI Expected Inflation Rate (e) e SI Tastes/Preferences Toward Saving (SAVE) SAVE SI Other Causes -Supply of Financial Capital Monetary Policy -- affects banks ability to loan (more later). Foreigners’ willingness to buy US bonds or stock (Capital Flow). Next Step -- Formalizing the above SI relationship Formalizing the Supply of Financial Capital (SI) Graph SI versus one of its causes -- the nominal interest rate (r). Positive relationship implies that the curve is upward sloping. Changes in r are described as a movement along the curve. Graph is drawn assuming that other causes are constant (ceteris paribus). Shifts in the Supply of Financial Capital Changes in causes other than r are described as shifts of the SI curve. Changes that increase the Supply of Financial Capital shift the SI curve rightward. Changes that decrease the Supply of Financial Capital shift the SI curve leftward. Equilibrium in the Capital Market -- Determining I Investment (I*) occurs where the Demand for Financial Capital (DI) equals the Supply of Financial Capital (SI). Shifts in the Demand or Supply of Financial Capital, as a result, change Investment (I*) Because they change Investment, they also change Aggregate Demand (AD), and Y* and P* as a result. Example 1 -- An Increase in Business Confidence (BC) BC DI DI curve shifts rightward I* Because investment increases, the AD curve shifts rightward. In the AD-AS model, this results in Y*, P*. Example 2 -- An Increase in Foreign Capital Flows to US Capital Flow SI SI curve shifts rightward I* Because investment increases, the AD curve shifts rightward. In the AD-AS model, this results in Y*, P*. Causes of (G - T) Government Purchases of Goods and Services (G), Net Taxes (T), are policy variables. Basically controlled by the government. G, T changed for policy purposes (Fiscal Policy), other reasons as well (as in war example). Causes of US Net Exports (NX) General Concepts -- NX = (X – M), must consider causes of both exports and imports. -- Assume for simplicity that the world consists of 2 countries, the US and the rest of the world. Specific Causes of US Net Exports (NX = X - M) World Output or Income (YW) YW X NX US Output or Income (Y) Y M NX Barriers to Trade (Tariffs, Quotas) The Exchange Rate (e) e NX Introduction to Exchange Rates Exchange Rate (e) -- the amount of foreign currency needed to be exchanged for one (US) dollar. Also known as the “value of the dollar”. Conversion Ratio, in units of (foreign currency)/(US dollar). Types of Exchange Rates Bilateral Exchange Rate -exchange rate between the US and an individual country. Multilateral (Trade Weighted) Exchange Rate -- weighted average of bilateral exchange rates expressed as an index (macro measure of exchange rate). Using Exchange Rates as a Conversion Ratio In Both Examples: US exchange rate vs Japanese Yen = 100 (yen/$). Example 1 -- Suppose that dinner for two people in the US costs $50. Find its price in terms of yen. ($50)(100 yen) = 5000 yen (1 $) Example 2 -- The Exchange Rate as a Conversion Ratio Example 2 -- Suppose that dinner for two people in Japan costs 6832 yen. Find its price in terms of US dollars ($). (6832 yen) (1 $) = $68.32 (100 yen) Note: e = 100 (yen/$) Exchange Rate Changes e price of American goods and services to foreigners price of foreign goods and services to Americans e price of American goods and services to foreigners price of foreign goods and services to Americans The Exchange Rate and Net Exports e (appreciating dollar, stronger dollar) X, M (X - M) e (depreciating dollar, weaker dollar) X, M (X - M) Exchange Rate Regimes Fixed (Pegged) Exchange Rates -exchange rates are fixed by the government, unless changed by economic policy (e.g. US and China). Floating Exchange Rates -- exchange rates are determined by natural forces in the foreign exchange market (e.g. US and Japan, US and European Union). Return to Aggregate Demand -- An Example Example -- effect of a decrease in world output or income (YW). YW X (X - M) Therefore the AD curve shifts leftward. In the AD-AS model, this results in Y*, P* Aggregate Demand Changes and the Economy Lots of factors shift aggregate demand (AD), affect Y* and P*. Poses challenges: economy subject to “buffeting winds,” blows the economy off course (either to where Y* < YF or Y* > YF). Role of Economic Policy – “medicine” designed to move Y* closer to YF.