Change is upon us - Dubai City of Gold

... among other things, some commodities and metals prices rose more than what could be accounted for by the dollar alone. The gold price, on the other hand, was almost exactly paired to the US dollar exchange rate up to the middle of 2005. Now let us evaluate the current situation of the twin deficits ...

... among other things, some commodities and metals prices rose more than what could be accounted for by the dollar alone. The gold price, on the other hand, was almost exactly paired to the US dollar exchange rate up to the middle of 2005. Now let us evaluate the current situation of the twin deficits ...

chapter 9 - U of L Class Index

... The steel company would be expected to have greater business risk. As discussed in Question #5, sales variability and operating leverage are the two components of business risk. We expect the steel mill to have the greater operating leverage because of fixed costs (unionized labour costs, amortizati ...

... The steel company would be expected to have greater business risk. As discussed in Question #5, sales variability and operating leverage are the two components of business risk. We expect the steel mill to have the greater operating leverage because of fixed costs (unionized labour costs, amortizati ...

StrongPCMP4e-ch11

... Feature (cont’d) The market price of a bond can never be less than its conversion value The difference between the bond price and the conversion value is the premium over conversion value ...

... Feature (cont’d) The market price of a bond can never be less than its conversion value The difference between the bond price and the conversion value is the premium over conversion value ...

Document

... consistent with the properties of credit spreads implicit in Moody’s corporate bond yield averages, which in turn provide strong evidence that both default risk and interest rate risk are necessary components for a valuation model for corporate debt. ...

... consistent with the properties of credit spreads implicit in Moody’s corporate bond yield averages, which in turn provide strong evidence that both default risk and interest rate risk are necessary components for a valuation model for corporate debt. ...

The Optimal Extraction of Exhaustible Resources

... then purchase a financial asset with the proceeds. In other words, the owner can keep the oil as a physical asset or turn it into a financial asset. Suppose the price of one barrel of oil is currently $100. If the oil is extracted and sold right away, the owner will have gained, at the end of the ye ...

... then purchase a financial asset with the proceeds. In other words, the owner can keep the oil as a physical asset or turn it into a financial asset. Suppose the price of one barrel of oil is currently $100. If the oil is extracted and sold right away, the owner will have gained, at the end of the ye ...

NBER WORKING PAPER SERIES UNCERTAINTY AND LIQUIDITY Alberto Giovannini Working Paper No. 2296

... This paper studies a model where money is valued for the liquidity services it provides in the future. These liquidity services cannot be provided by any other asset. Changes in expectations of the value of future liquidity services affect the desired proportions of money and other assets in agentst ...

... This paper studies a model where money is valued for the liquidity services it provides in the future. These liquidity services cannot be provided by any other asset. Changes in expectations of the value of future liquidity services affect the desired proportions of money and other assets in agentst ...

Loan Intrest

... What Is Consumer Borrowing? • Obtaining funds from a lender under specific loan provisions. • Called “Consumer Loans.” – Made for a specified purpose. – Must be repaid according to a specified schedule. ...

... What Is Consumer Borrowing? • Obtaining funds from a lender under specific loan provisions. • Called “Consumer Loans.” – Made for a specified purpose. – Must be repaid according to a specified schedule. ...

Demand for Money

... What is the current market price of a perpetuity ? We can reduce this to a simple formula that shows the inverse relationship between bond prices and interest rates. In order to do so we should multiply both sides by (1+r). If we subtract 1 from 2, we have: (1+r) PB - PB = C + C/ (1+r)1 + C/ (1+r)2 ...

... What is the current market price of a perpetuity ? We can reduce this to a simple formula that shows the inverse relationship between bond prices and interest rates. In order to do so we should multiply both sides by (1+r). If we subtract 1 from 2, we have: (1+r) PB - PB = C + C/ (1+r)1 + C/ (1+r)2 ...

Revision: Sources of finance

... This is a facility provided by a bank when the balance of your current account goes into negative figures. It is for an agreed amount and an agreed period of time and if this is exceeded then high costs will occur. ...

... This is a facility provided by a bank when the balance of your current account goes into negative figures. It is for an agreed amount and an agreed period of time and if this is exceeded then high costs will occur. ...

Money Supply and Demand - personal.kent.edu

... relationship between growth of the money stock and the rate of inflation, after allowing for real GDP growth. Principles of Macroeconomics Inflation Greg Chase, Charles Upton ...

... relationship between growth of the money stock and the rate of inflation, after allowing for real GDP growth. Principles of Macroeconomics Inflation Greg Chase, Charles Upton ...

Hong Kong dollar exchange rate

... 10. Reflecting decreased public demand for banknotes after the Chinese New Year holidays, the three note-issuing banks redeemed HK$13.18 billion worth of CIs to the HKMA in ...

... 10. Reflecting decreased public demand for banknotes after the Chinese New Year holidays, the three note-issuing banks redeemed HK$13.18 billion worth of CIs to the HKMA in ...

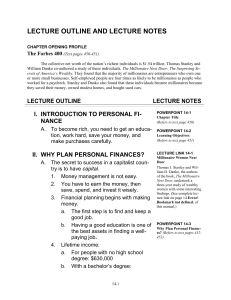

what is management

... findings. (See complete lecture link on page 14.Error! Bookmark not defined. of this manual.) ...

... findings. (See complete lecture link on page 14.Error! Bookmark not defined. of this manual.) ...

Journal of Monetary Economics 22 (1988) 133-136. North

... support the price of government debt as it had said it would. Similarly, if the low-probability event precipitating the large decline in consumption were a nuclear war, the perceived probability of such an event surely has varied in the last 100 years. It must have been low before 1945, the first an ...

... support the price of government debt as it had said it would. Similarly, if the low-probability event precipitating the large decline in consumption were a nuclear war, the perceived probability of such an event surely has varied in the last 100 years. It must have been low before 1945, the first an ...