* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download A Primer on Bonds Bond Prices and Yields

Survey

Document related concepts

Financialization wikipedia , lookup

Greeks (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Securitization wikipedia , lookup

Pensions crisis wikipedia , lookup

Financial economics wikipedia , lookup

Interest rate swap wikipedia , lookup

Interbank lending market wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Present value wikipedia , lookup

Fixed-income attribution wikipedia , lookup

Yield curve wikipedia , lookup

Transcript

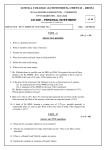

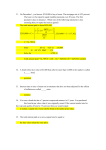

Derivatives: A Primer on Bonds • First Part: Fixed Income Securities Bond Prices and Yields • Time value of money and bond pricing – Bond Prices and Yields • Time to maturity and risk – Term Structure of Interest Rates • Yield to maturity • vs. yield to call • vs. realized compound yield • Second Part: TSOIR – Term Structure of Interest Rates – Interest Rate Risk & Bond Portfolio Management • Determinants of YTM • risk, maturity, holding period, etc. Bond Pricing • Equation: • P = PV(annuity) + PV(final payment) T • coupon ∑ (1 + r ) = t =1 t + T • Example: Ct = $40; Par = $1,000; disc. rate = 4%; T=60 60 P= ∑ t =1 $40 (1+ 0. 04) t + $1,000 (1+ 0. 04) 60 • P ↑ ⇔ yield ↓ • intuition Par (1 + r ) Prices vs. Yields = $904. 94 + $95.06 = $1, 000 Measuring Rates of Return on Bonds • Standard measure: YTM • Problems • callable bonds: YTM vs. yield to call • default risk: YTM vs. yield to expected default • reinvestment rate of coupons » YTM vs. realized compound yield • Determinants of the YTM • risk, maturity, holding period, etc. • convexity • BKM6 Fig. 14.3; ; BKM4 Fig. 14.6 • intuition: yield ↑ ⇒ P ↓ ⇒ price impact ↓ Measuring Rates of Return on Bonds 2 • Yield To Maturity • definition » discount rate such that NPV=0 • interpretation » (geometric) average return to maturity • Example: C t = $40; Par = $1,000; T=60; sells at par 60 $40 t= 1 (1+ y)t 1,000 = ∑ + $1,000 60 ⇒ y = 4% (1 + y) 1 Measuring Rates of Return on Bonds 3 • Yield To Default • Yield To Call • definition • definition » discount rate s.t. NPV=0, with TC = earliest call date • deep discount bonds vs. premium bonds » BKM6 Fig. 14.4; ; BKM4 Fig. 14.7 • Example: Measuring Rates of Return on Bonds 4 C t = $40, semi; Par = $900; T=60; P = $1,025; » discount rate s.t. NPV=0, with TD= expected default date • default premium and business cycle » economic difficulties and “flight to quality ” • Example: C t = $50, semi; Par = $1,000; T=10; P = $200; callable in 10 years (TC=20), call price = $1,000 20 $40 t =1 (1 + ytc) 1, 025 = ∑ t + $ 1, 000 (1 + ytc) 20 ⇒ ytc < 4 % Measuring Rates of Return on Bonds 5 • Coupon reinvestment rate • YTM assumption: average • problem: not often true • “solution”: realized compound yield • forecast future reinvestment rates • compute future value (BKM6 Fig.14.5; BKM4 Fig.14.9) • compute the yield (rcy) such that NPV = 0 • practical? expected to default in 2 years (TC=4), recover $150 4 200 = ∑ t= 1 $50 $150 + t 4 (1+ ytd ) (1 + ytd ) Bond Prices over Time • Discount bonds vs. premium bonds • coupon rate < market interest rates » ⇒ built-in capital gain (discount bond) • coupon rate > market interest rates » ⇒ built-in capital loss (premium bond) • Behavior of prices over time • BKM6 Fig. 14.6; BKM4 Fig. 14.10 • Tax treatment • need to forecast reinvestment rates Discount Bonds • OID vs. par bonds • capital gains vs. interest income OID tax treatment -- Discount Bonds 2 • Idea for zeroes • original issue discount (OID) bonds » less common » coupon need not be 0 • par bonds • built-in appreciation = implicit interest schedule • tax the schedule as interest, yearly • tax the remaining price change as capital gain or loss » most common • Zeroes • Other OID bonds • what? mostly Treasury strips • how? “certificates of accrual”, “growth receipts”, ... • annual price increase = 1-year disc. factor • same idea • taxable interest = coupon + computed schedule (BKM6 Fig. 14.7; BKM4 Fig. 14.11) 2 OID tax treatment -- Discount Bonds 3 • Example OID tax treatment -- Discount Bonds 4 • Example (continued) • 30-year zero; issued at $57.31; Par = $1,000 • interests on 30-year bonds fall to 9.9% • compute YTM: $57. 31 = $1,0003 0 ⇒ y = 10% (1+ y ) • capital gain $1,000 $1, 000 = − = $64.72 − $57. 31 = $7.41 29 30 (1 + 0.099) (1 + 0. 1) • 1st year taxable interest = $1,000 $ 1, 000 − = $63.04 − $ 57.31 = $5 .73 (1 +10%) 29 (1 +10%)30 • tax treatment: taxable interest = $5.73; capital gain $1, 000 $1,000 = − = $64. 72 − $63.04 = $1.68 29 29 (1 + 0. 099) (1+ 0.1) Term Structure of Interest Rates • Basic question • link between YTM and maturity • Bootstrapping short rates from strips • forward rates and expected future short rates “Term”inology • Term structure = yield curve (BKM6 Fig. 15.1) • = plot of the YTM as a function of bond maturity • = plot of the spot rate by time-to-maturity • Short rate vs. spot rate • Recovering short rates from coupon bonds • 1-period rate vs. multi-period yield • Interpreting the term structure • spot rate = current rate appropriate to discount a cash-flow of a given maturity • does the term structure contain information? • certainty vs. uncertainty Extracting Info re:Short Interest Rates • From zeroes • non-linear regression analysis • bootstrapping • From coupon bonds • system of equations • regression analysis (no measurement errors) • Certainty vs. uncertainty • forward rate vs. expected future (spot) short rate • BKM6 Figure 15.3; BKM4 Figure 14.3 Bootstrapping Fwd Rates from Zeroes • Forward rate • “break-even rate” – BKM Fig. 15.4 • equates the payoffs of roll-over and LT strategies (1 + YTM n )n = (1+ YTMn−1 ) n−1(1 + fn ) • Uncertainty • no guarantee that forward = expected future spot • General formula • f1 = YTM1 and fn = (1 + YTM n ) n −1 n −1 (1 + YTM n−1) 3 Bootstrapping Fwd from Zeroes 2 Bootstrapping Fwd Rates from Zeroes 3 • Forward interest rate for year 1 • Data • BKM Table 15.2 & Fig. 15.1 $ 925.93 = • 4 bonds, all zeroes (reimbursable at par of $1,000) • • • • • T 1 2 3 4 Price $925.93 $841.75 $758.33 $683.18 YTM 8% 8.995% 9.66% 9.993% = $1,000 (1 + y ) 1 ⇒ f1 = y1 = 8 % • Forward interest rate for year 2 $1,000 $ 1, 000 $ 925.93 = = (1 + f )(1 + f ) (1 + 8 %)(1 + f ) (1 + f ) 1 2 2 2 $ 925.93 $ 841.75 = ⇒ f = 10% 2 (1 + f ) 2 $841.75 = P 2 = Bootstrapping Fwd Rates from Zeroes 4 • Short rate for years 3 and 4 $ 1,000 (1 + f ) 1 Yield, Maturity and Period Return • Data • keep applying the method • 2 bonds, both zeroes (reimbursable at par of $1,000) • you find f3 = 11% = f4 • • • • General Formula T 1 2 Price $925.93 $841.75 YTM 8% 8.995% • f1 = YTM1 • 1+ fn = • Question (1 + YTMn ) n (1 + YTMn −1) n−1 • investor has 1-period horizon; no uncertainty • does bond 2 (higher YTM) dominate bond 1? Yield, Maturity and Period Return 2 • Answer: Nope – Bond 1 HPR: $1,000− $925. 93 = $1, 000 ⇒ HPR = 8% 1 $925.93 – Bond 2 HPR: (1+ y ) 1 • f2 = 10% • price in 1 year = Par/(1+ f2 ) = $ 909.09 • capital gain at year-1 end = $909.09 − $841.75 ⇒ HPR1 = 8% $841.75 Fwd Rate & Expected Future Short Rate • Interpreting the term structure – Short perspective – liquidity preference theory (investors) – liquidity premium theory (issuer) – Expectations hypothesis – Long perspective – Market Segmentation vs. Preferred Habitat – Examples 4 Fwd Rate & Exp. Future Short Rate 2 • Short perspective • liquidity preference theory (“ short” investors) Fwd Rate & Exp. Future Short Rate 3 • Long perspective • “long investors” wish to lock in rates » investors need to be induced to buy LT securities » roll over a 1-year zero at 8% » or lock in via a 2-year zero at 8.995% » example: 1-year zero at 8% vs. 2-year zero at 8.995% • liquidity premium theory (issuer) » issuers prefer to lock in interest rates • E[r2 ] ≥ f2 • f2 = E[r2 ] - risk “ premium” • f2 ≥ E[r2 ] • f2 = E[r2 ] + risk premium Fwd Rate & Exp. Future Short Rate 4 • Expectation Hypothesis • risk premium = 0 and E[r2 ] = f2 • idea: “ arbitrage” Fwd Rate & Exp. Future Short Rate 5 • In practice • liquidity preference + preferred habitat • Market segmentation theory • idea: clienteles » ST and LT bonds are not substitutes • reasonable? • Preferred Habitat Theory » hypotheses have the edge • Example • BKM Fig. 15.5 • investors do prefer some maturities • temptations exist Fwd Rate & Exp. Future Short Rate 6 • Example 2 • short term rates: r1 = r2 = r3 = 10% • liquidity premium = constant 1% per year • YTM Measurement: Zeroes vs. Coupon Bonds • Zeroes • ideal • lack of data may exist (need zeroes for all maturities) • Coupon Bonds y1 = r1 = 10% • plentiful y 2 = (1 + r1)(1 + f 2) −1 = (1 +10%)(1+ 10% + 1%) − 1 = 10.5% • coupons and their reinvestment » low coupon rate vs. high coupon rate y3 = 3 (1 + r1 )(1+ f 2 )(1+ f 3 ) − 1 = 3 (1 + 10%)(1 + 11%)(1 + 11%) −1 = 10.67% » short term rates −> they may have different YTM 5 Short Rates, Coupons and YTM • Example Measurements with Coupon Bonds 2 • Example • short rates are 8% & 10% for years 1 & 2; certainty • 2-year bonds; Par = $1,000; coupon = 3% or 12% • 2-year bonds; Par = $1,000; coupon = 3% or 12% • Prices: $894.78 (coupon = 3%); $1,053.87 (coupon = 12%) • Bond 1: $ 30 (1 + 8 %) • Year-1 and Year-2 short rates + $ 1,030 (1 + 8 %)(1 + 10%) = $894. 78 ⇒ YTM = 8.98% (1 + 8%) • Solve the system: d2 = 0.8417, d1 = 0.9259 + $1,120 (1 + 8%)(1 +10%) = $1,053.87 ⇒YTM = 8.94% Measurements with Coupon Bonds 3 • Example (continued) 1 1 r1 = − 1 = −1 ⇒ r1 = 8 % d1 0.9259 r2 = = d1 x 30 + d2 x 1,030 » $ 1,053.87 = d1 x 120 + d2 x 1,120 • Bond 2: $120 » $ 894.78 1 1 −1 = − 1 ⇒ r2 = 10% (1 + r1 )x d2 (1 + 8%)x0.8417 • Conclude ... Measurements with Coupon Bonds 4 • Practical problems • pricing errors • taxes » are investors homogenous? • investors can sell bonds prior to maturity • bonds can be called, put or converted • prices quotes can be stale » market liquidity • Estimation • statistical approach Rising yield curves • Causes Inverted yield curve • Easy interpretation • either short rates are expected to climb: E[rn ] ≥ E[rn-1 ] • or the liquidity premium is positive • Fig. 15.5a • if there is a liquidity premium • then inversion ⇔ expectations of falling short rates • why would interest rates fall? » inflation vs. real rates • Interpretative assumptions • estimate the liquidity premium • assume the liquidity premium is constant • empirical evidence » inverted curve ⇔ recession? • Example • current yield curve: The Economist » liquidity premium is not constant; past −> future?! 6 Arbitrage Strategies Arbitrage Strategies Answer: The price of the coupon bond, based on its YTM, is: 120 PA(5.8%, 2) + 1000 PF(5.8%, 2) = $1,113.99. Question: The YTM on 1-year-maturity zero coupon bonds is 5% The YTM on 2-year-maturity zero coupon bonds is 6%. The YTM on 2-year-maturity coupon bonds with coupon rates of 12% (paid annually) is 5.8%. What arbitrage opportunity exists for an investment banking firm? What is the arbitrage profit? If the coupons were stripped and sold separately as zeros, then based on the YTM of zeros with maturities of one and two years, the coupon payments could be sold separately for 2 [120/1.05] + [1,120/1.06 ] = $1,111.08. The arbitrage strategy is to: buy zeros with face values of $120 and $1,120 and respective maturities of 1 and 2 years simultaneously sell the coupon bond. The profit equals $2.91 on each bond. Fixed Income Portfolio Management • In general Bond Index Funds • Idea • bonds are securities just like other • US indices • −> use the CAPM » Solomon Bros. Broad Investment Grade (BIG) » Lehman Bros. Aggregate • Bond Index Funds • Immunization • net worth immunization • contingent immunization » Merrill Lynch Domestic Master • composition » government, corporate, mortgage, Yankee » bond maturities: more than 1 year • Canada: ScotiaMcLeod (esp. Universe Index) Bond Index Funds 2 Bond Index Funds 3 • Solution: • Problems • lots of securities in each index • portfolio rebalancing » market liquidity » bonds are dropped (maturities, calls, defaults, …) – “cellular approach” – idea • classify by maturity/risk/category/… • compute percentages in each cell • match portfolio weights – effectiveness • average absolute tracking error = 2 to 16 b.p. / month 7 Special risks for bond portfolios Interest Rate Risk • Equation: • cash-flow risk • call, default, sinking funds, early repayments,… • solution: select high quality bonds • P = PV(annuity) + PV(final payment) • T ∑ (1 + r ) = t =1 • interest rate risk • bond prices are sensitive to YTM coupon Par + t T (1 + r ) • Yield sensitivity of bond Prices: • P ↑ ⇔ yield ↓ • solution » measure interest rate risk » immunize • Measure? Interest Rate Risk 2 • Determinants of a bond’s yield sensitivity • time to maturity » maturity ↑ ⇒ sensitivity ↑ (concave function) • coupon rate » coupon ↑ ⇒ sensitivity ↓ • discount bond vs. premium bond • zeroes have the highest sensitivity Duration • Idea • maturity ↑ ⇒ sensitivity ↑ • ⇒ to measure a bond’s yield sensitivity, • measure its “ effective maturity” • Measure T • Macaulay duration: D = ∑ t . wt t =1 » intuition: coupon bonds = average of zeroes • YTM » initial YTM ↑ ⇒ sensitivity ↓ Duration 2 • Duration = effective measure of elasticity ∆P ∆(1 + YTM ) = − D. P 1 + YTM • Proof ∑w t t =1 = 1 T Ct P = =1 ∑ P t =1 (1 + YTM) t P Duration 4 • Interpretation 1 • T D = ∑ t .wt = t=1 average time until bond payment • Interpretation 2 • Modified duration ∆P = −D * .[∆YTM ] with P T Ct wt = P.(1 + YTM )t • D D* = 1+y % price change of coupon bond of a given duration • = % price change of zero with maturity = to duration 8 Duration 4 • Example (BKM Table 15.3) • Example: BKM4 Table 15.3 • suppose YTM changes by 1 basis point (0.01%) • zero coupon bond with 1.8853 years to maturity – old price = – new price = 1000 (1.05) 3 .7706 Duration 5 = 831. 9623 1000 (1.0501) 3 .7706 • suppose YTM changes by 1 basis point (0.01%) • coupon bond » either compare the bond ’s price with YTM = 5.01% relative to = 831.6636 ∆ P 831.6636− 831.9623 ∆ (1 + YTM ) = = −0 .0359% = −D. P 831. 9623 1 + YTM ∆P ∆ (1 + YTM ) 5.01 % − 5 % = − D. = − 1.8853 x2 x = − 0. 0359 % P 1 .05 1 + YTM Duration 6 • Properties of duration (other things constant) • zero coupon bond: duration = maturity • time to maturity » maturity ↑ ⇒ duration ↑ » exception: deep discount bonds the bond ’s price with YTM = 5% » or simply compute the price change from the duration Duration 7 • Properties of duration • duration of perpetuity = D = y 1+ y – less than infinity! • coupon rate » coupon ↑ ⇒ duration ↓ • YTM » YTM ↑ ⇒ duration ↓ » exception: zeroes (unchanged) Duration 8 • coupon bonds (“ annuities + zero”) – see book – simplifies if par bond Possible Caveats to Duration • 1. Assumptions on term structure • Importance • simple measure • essential to implement portfolio immunization • measures interest rate sensitivity effectively • Macaulay duration uses YTM T D = ∑ t.wt = t =1 1 T Ct ∑ t. P t=1 (1 + YTM ) t » only valid for level changes in flat term structure • Fisher-Weil duration measure T D = ∑ t .wt = t =1 1 T ∑ t. P t =1 Ct t ∏ (1+ r ) s =1 s 9 Possible Caveats to Duration 2 • problems with the Fisher-Weil duration Possible Caveats to Duration 3 • 2. Convexity • Macaulay duration » assumes a parallel shift in term structure – first-order approximation: » need forecast of future interest rates » bottom line: same problem as realized compound yield ∆P * = − D .∆ (1 + YTM ) P – small changes vs. large changes » duration = point estimate • Cox-Ingersoll-Ross duration » for larger changes, an “arc” estimate is needed • bottom line: let’s keep Macaulay – solution: add convexity Possible Caveats to Duration 4 – Convexity (continued) Possible Caveats to Duration 5 – Convexity: numerical example – P = Par = 1,000; T = 30 years; 8% annual coupon – second-order approximation: – computations give D*=11.26 years; convexity = 212.4 years – suppose YTM = 8% -> YTM = 10% convexity = T 1 Ct ∑ (t 2 + t). (1 + YTM P(1 + YTM ) 2 t =1 )t ∆P 1 2 = − D* .∆YTM + .convexity.(∆YTM ) P 2 ∆P = −D * .∆ YTM = −11.26 x0 .02 = −22.52% P ∆P 1 2 = −D * .∆ YTM + .convexity.(∆YTM ) = −18. 27% P 2 ∆P 811.46 −1,000 = = −18.85% P 1,000 Bottom Line on Duration Immunization • Why? • Very useful • obligation to meet promises (pension funds) » protect future value of portfolio – But take it with a grain of salt for large changes • ratios, regulation, solvency (banks) » protect current net worth of institution • How? • measure interest rate risk: duration • match duration of elements to be immunized 10 Immunization • What? • net worth immunization Net Worth Immunization • Gap management • assets vs. liabilities » match duration of assets and liabilities • target date immunization – long term (mortgages, loans, …) vs. short term (deposits, …) » match inflows and outflows » immunize the net flows • match duration of assets and liabilities – decrease duration of assets (ex.: ARM) • Who? – increase duration of liabilities (ex.: term deposits) • insurance companies, pension funds • condition for success » target date immunization • banks – portfolio duration = 0 (assets = liabilities) » net worth immunization Target Date Immunization • Idea Target Date Immunization 2 • Solution • Example: suppose interest rates fall • match duration of portfolio and fund’s horizon – single bond • good for the pension fund – bond portfolio – price risk » duration of portfolio » existing (fixed rate) assets increase in value » = weighted average of components’ duration • bad for the pension fund » condition: assets have equal yields – reinvestment risk » PV of future liabilities increases » so more must be invested now Target Date Immunization 3 Target Date Immunization 4 Question: Pension funds pay lifetime annuities to recipients. è Firm expects to be in business indefinitely, its pension obligation ≈ perpetuity. è Suppose, your pension fund must make perpetual payments of $2 million/year. è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon rates of 12% (paid annually) is 4 years duration of 20-year bonds with coupon rates of 6% (paid annually) is 11 years è how much of each of these coupon bonds (in market value) should you hold to both fully fund and immunize your obligation? (b) What will be the par value of your holdings in the 20-year coupon bond? Answer: (a) • PV of the firm’s “perpetual” obligation = ($2 million/0.16) = $12.5 million. • duration of this obligation = duration of a perpetuity = (1.16/0.16) = 7.25 years. Denote by w the weight on the 5-year maturity bond, which has duration of 4 years. Then, w x 4 + (1 – w) x 11 = 7.25, which implies that w = 0.5357. Therefore, 0.5357 x $12.5 = $6.7 million in the 5-year bond and 0.4643 x $12.5 = $5.8 million in the 20-year bond. The total invested = $(6.7+5.8) million = $12.5 million, fully matching the funding needs. 11 Target Date Immunization 5 Dangers with Immunization • 1. Portfolio rebalancing is needed Answer: ( b ) Price of the 20-year bond = 60 x PA(16%, 20) + 1000 x PF(16%, 20) = $407.11. Therefore, the bond sells for 0.4071 times Par, and Market value = Par value x 0.4071 => $5.8 million = Par value x 0.4071 => Par value = $14.25 million. Another way to see this is to note that each bond with a par value of $1,000 sells for $407.11. If the total market value is $5.8 million, then you need to buy 14,250 bonds, which results in total par value of $14,250,000. Dangers with Immunization 2 • 2. Duration = nominal concept • immunization only for nominal liabilities • counter example » children’s tuition » why? • solution » do not immunize – Time passes ⇔ duration changes • bonds mature, sinking funds, … – YTM changes ⇔ duration changes • example: BKM4 Table 15.7 • duration YTM 5 4.97 5.02 8% 7% 9% An Alternative? Cash-Flow Dedication • Buy zeroes • to match all liabilities • Problems • difficult to get underpriced zeroes • zeroes not available for all maturities – ex.: perpetuity » buy assets Contingent Immunization • Idea • try to beat the market • while limiting the downside risk • Procedure (BKM6 Fig. 16.10; BKM4 Fig. 15.6) • compute the PV of the obligation at current rates • assess available funds • “play” the difference • immunize if trigger point is hit 12