Bond Valuation

... 1. Bond prices move inversely to bond yields (interest rates) 2. For a given change in yields, longer maturity bonds post larger price changes, thus bond price volatility is directly related to maturity 3. Price volatility increases at a diminishing rate as term to maturity increases 4. Price moveme ...

... 1. Bond prices move inversely to bond yields (interest rates) 2. For a given change in yields, longer maturity bonds post larger price changes, thus bond price volatility is directly related to maturity 3. Price volatility increases at a diminishing rate as term to maturity increases 4. Price moveme ...

MishkinCh06

... • Bonds of different maturities are not substitutes at all • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and gen ...

... • Bonds of different maturities are not substitutes at all • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and gen ...

Loanable Funds

... Interest Rates ctd We use NIR—nominal interest rate—in Money Market graph. This corresponds to Federal Funds rate, which is the interest rate used by Banks for overnight loans from other Banks. Since it's overnight, there is not room for inflationary effects. Therefore = nominal. We use RIR—real in ...

... Interest Rates ctd We use NIR—nominal interest rate—in Money Market graph. This corresponds to Federal Funds rate, which is the interest rate used by Banks for overnight loans from other Banks. Since it's overnight, there is not room for inflationary effects. Therefore = nominal. We use RIR—real in ...

AN ECONOMIC ANALYSIS OF THE DETERMINANTS OF

... specially money supply and exchange rate play main role to the Turkish inflation process. Public sector deficit and depreciation also contribute to inflation in Turkey. Khanam and Mohammad (1995) use data from 1972-73-1991-92 and show that money wage rate and import price positively influence over p ...

... specially money supply and exchange rate play main role to the Turkish inflation process. Public sector deficit and depreciation also contribute to inflation in Turkey. Khanam and Mohammad (1995) use data from 1972-73-1991-92 and show that money wage rate and import price positively influence over p ...

Adjusting Entries Review

... maintained in accounts defined in the Chart of Accounts Prepare adjusting entries - adjusting entries must be manually entered using the Make Journal Entries window Prepare trial balance – run unadjusted and adjusted trial balances from the Reports menu ...

... maintained in accounts defined in the Chart of Accounts Prepare adjusting entries - adjusting entries must be manually entered using the Make Journal Entries window Prepare trial balance – run unadjusted and adjusted trial balances from the Reports menu ...

M07_ABEL4987_7E_IM_C07

... B. The functions of money 1. Medium of exchange a. Barter is inefficient—it requires a double coincidence of wants b. Money allows people to trade their labor for money, then use the money to buy goods and services in separate transactions c. Money thus permits people to trade with less cost in time ...

... B. The functions of money 1. Medium of exchange a. Barter is inefficient—it requires a double coincidence of wants b. Money allows people to trade their labor for money, then use the money to buy goods and services in separate transactions c. Money thus permits people to trade with less cost in time ...

Chapter 18 Interest Groups and Public Opinion

... C. Many lobbyists formerly worked for government and know its politics and people; other lobbyists are lawyers or public relations experts. D. Lobbyists can: 1) provide lawmakers with useful information supporting an interest group’s position; 2) give testimony before congressional committees; and 3 ...

... C. Many lobbyists formerly worked for government and know its politics and people; other lobbyists are lawyers or public relations experts. D. Lobbyists can: 1) provide lawmakers with useful information supporting an interest group’s position; 2) give testimony before congressional committees; and 3 ...

Module_4D_1val_EN

... • The pricing of an asset is based on the cost of developing the technology asset • Cost considerations usually include: – R&D: salaries, materials & equipment – IP protection – Trials, testing and prototyping – Marketing & advertising – Cost of capital www.ip4inno.eu ...

... • The pricing of an asset is based on the cost of developing the technology asset • Cost considerations usually include: – R&D: salaries, materials & equipment – IP protection – Trials, testing and prototyping – Marketing & advertising – Cost of capital www.ip4inno.eu ...

Multinational Financial Management 896N1

... when calculating a firm’s international cost of equity • The next slide shows the domestic and international risk-free rates, market portfolios, and betas for Nestlé used to calculate required rates of return for equity • In this example the domestic required return for Nestlé of 9.4065% differs sli ...

... when calculating a firm’s international cost of equity • The next slide shows the domestic and international risk-free rates, market portfolios, and betas for Nestlé used to calculate required rates of return for equity • In this example the domestic required return for Nestlé of 9.4065% differs sli ...

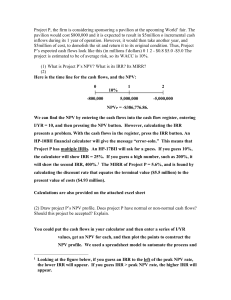

Project P, the firm is considering sponsoring a pavilion

... Project P has multiple IRRs. An HP-17BII will ask for a guess. If you guess 10%, the calculator will show IRR = 25%. If you guess a high number, such as 200%, it will show the second IRR, 400%.1 The MIRR of Project P = 5.6%, and is found by calculating the discount rate that equates the terminal val ...

... Project P has multiple IRRs. An HP-17BII will ask for a guess. If you guess 10%, the calculator will show IRR = 25%. If you guess a high number, such as 200%, it will show the second IRR, 400%.1 The MIRR of Project P = 5.6%, and is found by calculating the discount rate that equates the terminal val ...

An Empirical Study of Taiwan Bond Market Based on Nonlinear

... between the long-term and short-term rates of interest. That is to say, the premium on the yield rates in each period is not featured by unit-root under the circumstances of long-term balance. In most studies on the unit-root test and co-integration, it is hypothesized as a linear adjustment, as in ...

... between the long-term and short-term rates of interest. That is to say, the premium on the yield rates in each period is not featured by unit-root under the circumstances of long-term balance. In most studies on the unit-root test and co-integration, it is hypothesized as a linear adjustment, as in ...

Grade 9 Lesson #5 Does Money Really Grow on Trees? SS.912.FL

... 1. Ask students the following question: What does it mean when we say, “Don’t put all of your eggs in one basket?” In financial terms, what might this quote mean? (Diversification of financial investments to limit the amount of risk is the best scenario.) 2. Tell students that they are in the “drive ...

... 1. Ask students the following question: What does it mean when we say, “Don’t put all of your eggs in one basket?” In financial terms, what might this quote mean? (Diversification of financial investments to limit the amount of risk is the best scenario.) 2. Tell students that they are in the “drive ...

Financial Instruments - Faculty of Business and Economics

... • IASB proposals to revise IAS 37 on provisions • “An entity shall measure a liability at the amount that it would rationally pay at the end of the reporting period to be relieved of the present obligation” • The lowest of: PV of the resources required to fulfil obligation amount entity would ha ...

... • IASB proposals to revise IAS 37 on provisions • “An entity shall measure a liability at the amount that it would rationally pay at the end of the reporting period to be relieved of the present obligation” • The lowest of: PV of the resources required to fulfil obligation amount entity would ha ...