Basel II and Implications for Capital Requirements in

... Private Investors bring conditions around management of a bank Issuing of stock has the potential of diluting share value Retained earnings may be difficult to sustain in a weak lending environment Government investment brings conditions around executive compensation, bank oversight, and lending/inv ...

... Private Investors bring conditions around management of a bank Issuing of stock has the potential of diluting share value Retained earnings may be difficult to sustain in a weak lending environment Government investment brings conditions around executive compensation, bank oversight, and lending/inv ...

Measuring systemic risk: the role of macro

... could also place households under financial strain, and increase the likelihood of default. An increase in systemic risk concentrated in the housing sector lay behind the Reserve Bank’s decision to impose restrictions on high7 ...

... could also place households under financial strain, and increase the likelihood of default. An increase in systemic risk concentrated in the housing sector lay behind the Reserve Bank’s decision to impose restrictions on high7 ...

Identifying financial services

... units create markets for securities issued by financial corporations. A residual computation similar to the simple deposit/loan case can be envisaged but under the inclusion of other financial assets and liabilities. A number of questions remain to be further discussed by the taskforce, however. ...

... units create markets for securities issued by financial corporations. A residual computation similar to the simple deposit/loan case can be envisaged but under the inclusion of other financial assets and liabilities. A number of questions remain to be further discussed by the taskforce, however. ...

Loan Intrest

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

... • Permits buying expensive items. • Permits you to use the item while paying for it. • Provides financial flexibility--spread payments over long period of time. ...

Ghossoub, E., Laosuthi, T. and Reed, R. (2009)

... positive realizations of the relocation shock will seek to withdraw funds in the form of money balances. These individuals will consume less than depositors who do not move because money is dominated in rate of return. Nevertheless, banks must acquire money holdings in order to provide individuals w ...

... positive realizations of the relocation shock will seek to withdraw funds in the form of money balances. These individuals will consume less than depositors who do not move because money is dominated in rate of return. Nevertheless, banks must acquire money holdings in order to provide individuals w ...

Countrywide Financial

... subprime lending means lending to borrowers, generally people who would not qualify for traditional loans, at a rate higher than the prime rate, although how far above depends on factors like credit score, down payment, debttoincome ratio, and recent payment delinquencies. Subprime lending is risky ...

... subprime lending means lending to borrowers, generally people who would not qualify for traditional loans, at a rate higher than the prime rate, although how far above depends on factors like credit score, down payment, debttoincome ratio, and recent payment delinquencies. Subprime lending is risky ...

Loans Classified by Special Provision

... being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ceiling on the amount the VA loan allows for the property; if the purchas ...

... being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ceiling on the amount the VA loan allows for the property; if the purchas ...

Introduction - I-Board Allied Schools

... Steagall Act prohibiting banks from affiliating with securities firms. This allowed commercial banks, investment banks, insurance companies, and securities firms to consolidate. Additionally, it created a new “financial holding company” that could engage in insurance and securities underwriting acti ...

... Steagall Act prohibiting banks from affiliating with securities firms. This allowed commercial banks, investment banks, insurance companies, and securities firms to consolidate. Additionally, it created a new “financial holding company” that could engage in insurance and securities underwriting acti ...

Lending to Companies: Key Issues for Lenders

... continue to be the same legal entity that entered into prior loan and credit transactions with their lenders and their obligations thereunder will continue in full force and effect. However, the Act brings changes for existing Irish private companies limited by shares (“Existing Private ...

... continue to be the same legal entity that entered into prior loan and credit transactions with their lenders and their obligations thereunder will continue in full force and effect. However, the Act brings changes for existing Irish private companies limited by shares (“Existing Private ...

The Renewable Heat Incentive: a reformed and refocused scheme

... Credit Act protection and Financial Conduct Authority regulation as an absolute minimum. For purposes of affordability assessments for mortgages any payments under such agreements would need to be taken into account. Q36 To what extent do you think that the RHI scheme should regulate or restrict the ...

... Credit Act protection and Financial Conduct Authority regulation as an absolute minimum. For purposes of affordability assessments for mortgages any payments under such agreements would need to be taken into account. Q36 To what extent do you think that the RHI scheme should regulate or restrict the ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 3Q16

... Liquid asset holdings increased by $672 million to $5.16 billion improving the liquidity ratio to 11.20% from 10.80% in 3Q15. This is mostly attributable to increases in deposits at the leagues/centrals held for liquidity, and commercial paper, banker’s acceptances and similar instruments. Liquidity ...

... Liquid asset holdings increased by $672 million to $5.16 billion improving the liquidity ratio to 11.20% from 10.80% in 3Q15. This is mostly attributable to increases in deposits at the leagues/centrals held for liquidity, and commercial paper, banker’s acceptances and similar instruments. Liquidity ...

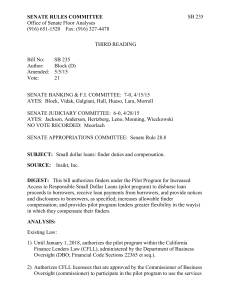

SENATE RULES COMMITTEE - SENATE FLOOR ANALYSIS

... consummated with the use of finders, and authorizes the commissioner to use this information when deciding whether a finder should be disqualified from performing services for one or more pilot program lenders. Background: Relatively few installment loans are made in California with principal amount ...

... consummated with the use of finders, and authorizes the commissioner to use this information when deciding whether a finder should be disqualified from performing services for one or more pilot program lenders. Background: Relatively few installment loans are made in California with principal amount ...

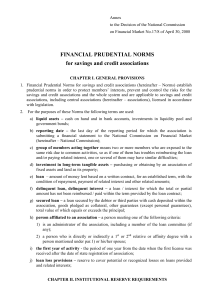

financial prudential norms

... 139 of 21.06.2007, normative acts of the National Commission and its internal documents and is responsible for ensuring its adequate implementation. 44. The investment policy will provide, but will not be limited to provisions on types of investment, practices and procedures of making decisions, car ...

... 139 of 21.06.2007, normative acts of the National Commission and its internal documents and is responsible for ensuring its adequate implementation. 44. The investment policy will provide, but will not be limited to provisions on types of investment, practices and procedures of making decisions, car ...

Diapositiva 1 - Inter-American Development Bank

... Gradual phase-out of interest rate subsidies has been coupled with the development of innovative financial solutions through our new investment banking practice FIRA’s structured finance model offers value to agribusiness community and supports institutional development in the financial system ...

... Gradual phase-out of interest rate subsidies has been coupled with the development of innovative financial solutions through our new investment banking practice FIRA’s structured finance model offers value to agribusiness community and supports institutional development in the financial system ...

Krajowe Stowarzyszenie Funduszy Poręczeniowych

... In 2011 all guarantee funds awarded of 6.118 guarantees for the amount 226 million euros. Since 2000 year all guarantee funds granted 44.326 guarantee for an amount of 1,23 billion euros. ...

... In 2011 all guarantee funds awarded of 6.118 guarantees for the amount 226 million euros. Since 2000 year all guarantee funds granted 44.326 guarantee for an amount of 1,23 billion euros. ...

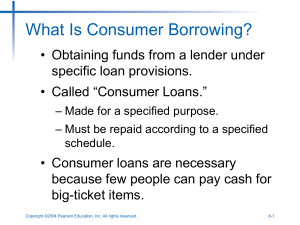

Evaluating Consumer Loans

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

Evaluating Consumer Loans

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

... Credit cards and overlines tied to checking accounts are the two most popular forms of revolving credit agreements ...

Policy Note - Levy Economics Institute of Bard College

... because among its leading creditors facing huge losses were the nation’s largest financial institutions: Goldman Sachs, Citigroup, JPMorgan Chase, and others. The Fed used its section 13(3) authority many more times during the crisis, creating liquidity loans and guarantees to protect investors acro ...

... because among its leading creditors facing huge losses were the nation’s largest financial institutions: Goldman Sachs, Citigroup, JPMorgan Chase, and others. The Fed used its section 13(3) authority many more times during the crisis, creating liquidity loans and guarantees to protect investors acro ...

The Impact of AI and Technology on Financial Services

... advice, more efficient clearing and settlement processes and easier payment methods for consumers. Financial institutions should view these developments (three of which we explore below) as an opportunity to partner with FinTech entities and adapt their services to meet consumer demand and remain co ...

... advice, more efficient clearing and settlement processes and easier payment methods for consumers. Financial institutions should view these developments (three of which we explore below) as an opportunity to partner with FinTech entities and adapt their services to meet consumer demand and remain co ...

MidCap Financial Launches Commercial Finance Company with

... Genstar Capital and Lee Equity committed the majority of the capital and will have equal representation on the Board. The Board will also include members of management and Moelis Capital Partners, with Mark K. Gormley, a Partner at Lee Equity, serving as Chairman. Tom Lee, President of Lee Equity P ...

... Genstar Capital and Lee Equity committed the majority of the capital and will have equal representation on the Board. The Board will also include members of management and Moelis Capital Partners, with Mark K. Gormley, a Partner at Lee Equity, serving as Chairman. Tom Lee, President of Lee Equity P ...

GROW... - Amerisource Funding

... True “floating” credit limit to maximize availability and facilitate client sales growth. Professional comprehensive A/R management services: Credit reviews and credit limits for customers, collection assistance and credit protection from bad debt losses. Take supplier discounts. Increase your retur ...

... True “floating” credit limit to maximize availability and facilitate client sales growth. Professional comprehensive A/R management services: Credit reviews and credit limits for customers, collection assistance and credit protection from bad debt losses. Take supplier discounts. Increase your retur ...

Mortgage Lending Rules - American Bankers Association

... responsibilities, fair lending, and other areas. These continuous rule expansions have made mortgages the riskiest and most labor-intensive products that banks can offer. The stifling burdens brought by these regulatory changes have made it difficult for institutions to stay profitable or even conti ...

... responsibilities, fair lending, and other areas. These continuous rule expansions have made mortgages the riskiest and most labor-intensive products that banks can offer. The stifling burdens brought by these regulatory changes have made it difficult for institutions to stay profitable or even conti ...

What are GSE Credit Risk Transfer securities?

... in 2016 of approximately USD14 billion, compared with USD12.6 billion in 2015.2 ...

... in 2016 of approximately USD14 billion, compared with USD12.6 billion in 2015.2 ...

Chapter 3

... checking bond ratings set by Rating Agencies • Moody’s Investor Service • Standard and Poor’s Corporation Anticipated or actual ratings changes can impact security prices and yields Different bonds issued by the same firm can differ in rating ...

... checking bond ratings set by Rating Agencies • Moody’s Investor Service • Standard and Poor’s Corporation Anticipated or actual ratings changes can impact security prices and yields Different bonds issued by the same firm can differ in rating ...

(DOC file) No 177/2006 amending Rules No 530/2004

... weighted overall rating is higher than 2.25 as shown in the following table: Weighted overall rating from: Supplementary ratio, % ...

... weighted overall rating is higher than 2.25 as shown in the following table: Weighted overall rating from: Supplementary ratio, % ...