Student Financial Aid Code of Conduct

... aid office or who otherwise has responsibilities with respect to FFEL Program loans or private education loans may not solicit or accept any gift from a lender, guarantor, or servicer of FFEL Program loans or private education loans. b. This prohibition applies to a gift to a family member of an emp ...

... aid office or who otherwise has responsibilities with respect to FFEL Program loans or private education loans may not solicit or accept any gift from a lender, guarantor, or servicer of FFEL Program loans or private education loans. b. This prohibition applies to a gift to a family member of an emp ...

here - Reverse Market Insight

... Unlike US Treasury Bonds, LIBOR rates are not available for maturities greater than 1-Yr. The 10-Yr LIBOR “swap rate” is used as the equivalent of the 10-Yr Constant Maturity Treasury rate for calculation of the “expected rate” on a HECM. An interest rate swap is a financial contract used by ins ...

... Unlike US Treasury Bonds, LIBOR rates are not available for maturities greater than 1-Yr. The 10-Yr LIBOR “swap rate” is used as the equivalent of the 10-Yr Constant Maturity Treasury rate for calculation of the “expected rate” on a HECM. An interest rate swap is a financial contract used by ins ...

CUTTING THROUGH THE JARGON: A Basic Primer on

... The due diligence should also include an analysis of financial statement, income and expense statements, rent rolls and tax returns relating to the property. All of these reports are useful for negotiating the price of a property as well as financial planning. The due diligence in a real estate tran ...

... The due diligence should also include an analysis of financial statement, income and expense statements, rent rolls and tax returns relating to the property. All of these reports are useful for negotiating the price of a property as well as financial planning. The due diligence in a real estate tran ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 4Q16

... These changes may force borrowers to postpone their purchase, buy a less expensive home or make a larger down payment. As a result of these restrictions and the potential increased risk, lenders have responded by beginning to raise mortgage rates. Although the Bank of Canada seems content to keep it ...

... These changes may force borrowers to postpone their purchase, buy a less expensive home or make a larger down payment. As a result of these restrictions and the potential increased risk, lenders have responded by beginning to raise mortgage rates. Although the Bank of Canada seems content to keep it ...

THE SUB-PRIME MORTGAGE MESS Kevin M. Bahr, Ph.D

... acquisition of Bear Stearns by J.P. Morgan. After trading at $170 per share in January 2007, Bear Stearns would be acquired by J.P. Morgan for approximately $10 per share. Bear Stearns’ assets, most notably its portfolio of mortgage backed securities, were dramatically declining in value as the sub- ...

... acquisition of Bear Stearns by J.P. Morgan. After trading at $170 per share in January 2007, Bear Stearns would be acquired by J.P. Morgan for approximately $10 per share. Bear Stearns’ assets, most notably its portfolio of mortgage backed securities, were dramatically declining in value as the sub- ...

DOCX - World bank documents

... NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and capital and 2.2% of the total deposits existent in the banking sector. 6. The business model r ...

... NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and capital and 2.2% of the total deposits existent in the banking sector. 6. The business model r ...

Relationship lending - European Investment Bank

... and low cost of renegotiation in case of liquidity defaults (best achieved with one creditor). As companies of a lower credit quality are likely to face a higher risk of a liquidity default, they could ensure that they receive high liquidation values, choose one creditor or concentrate their borrowi ...

... and low cost of renegotiation in case of liquidity defaults (best achieved with one creditor). As companies of a lower credit quality are likely to face a higher risk of a liquidity default, they could ensure that they receive high liquidation values, choose one creditor or concentrate their borrowi ...

Banks! It`s time to change your game in SME Lending Why

... the historic strong relationship between banks and their SME customers has gradually begun eroding. If banks do not change their approach towards the SME lending business, they risk losing – forever – a major portion of this very important customer segment to the alternative SME lenders. It’s theref ...

... the historic strong relationship between banks and their SME customers has gradually begun eroding. If banks do not change their approach towards the SME lending business, they risk losing – forever – a major portion of this very important customer segment to the alternative SME lenders. It’s theref ...

issue of PNAS the results of her research

... housing. As those things undo, each will keep irritating the others and we will have a much bigger problem than you might expect if you just looked at one piece. You’re suggesting that a lot of the no-income-verification loans and such were made to people who haven’t a prayer of repaying them? Well, ...

... housing. As those things undo, each will keep irritating the others and we will have a much bigger problem than you might expect if you just looked at one piece. You’re suggesting that a lot of the no-income-verification loans and such were made to people who haven’t a prayer of repaying them? Well, ...

DeNovo Q1 FinTech ReCap and Funding ReView - Strategy

... sharing-economy services. Investors arguably see the value created when unlocking underutilized assets, and the potential market share gains by new entrants — Uber, for example, completed its billionth ride five and a half years after its founding. And consumers see the efficiency and convenience of ...

... sharing-economy services. Investors arguably see the value created when unlocking underutilized assets, and the potential market share gains by new entrants — Uber, for example, completed its billionth ride five and a half years after its founding. And consumers see the efficiency and convenience of ...

Money market survey 2016

... period between 2013 and 2016 show that maturity-weighted 6 activity in the FX market and the unsecured market has fallen (Chart 11). 7 This has resulted in a fall in maturity-weighted activity in the money market as a whole in recent years. Lower maturity-weighted activity in unsecured lending prima ...

... period between 2013 and 2016 show that maturity-weighted 6 activity in the FX market and the unsecured market has fallen (Chart 11). 7 This has resulted in a fall in maturity-weighted activity in the money market as a whole in recent years. Lower maturity-weighted activity in unsecured lending prima ...

Determinants of Commercial Banks` Lending

... Ojo (1999), in a study on roles and failure of financial intermediation by banks in Nigeria revealed that, “commercial banks can lend on medium and short term basis without necessarily jeopardizing their liquidity. If they must contribute meaningfully to the economic development, the maturity patter ...

... Ojo (1999), in a study on roles and failure of financial intermediation by banks in Nigeria revealed that, “commercial banks can lend on medium and short term basis without necessarily jeopardizing their liquidity. If they must contribute meaningfully to the economic development, the maturity patter ...

Document

... Federal Reserve established two programs to backstop money market mutual funds and to help those funds avoid fire sales of their assets to meet withdrawals. Together with an insurance program offered by the Treasury, the Fed's programs helped end the run; the sharp withdrawals from the funds have be ...

... Federal Reserve established two programs to backstop money market mutual funds and to help those funds avoid fire sales of their assets to meet withdrawals. Together with an insurance program offered by the Treasury, the Fed's programs helped end the run; the sharp withdrawals from the funds have be ...

Nordea - Aktiespararna

... Continued strong customer demand in household segment – increased volumes ...

... Continued strong customer demand in household segment – increased volumes ...

COM SEC(2011)

... all households reported arrears1. The difficulty in meeting repayments has led to an increase in default rates and a rise in foreclosures.2 Data can be influenced by factors other than irresponsible lending and borrowing such as the general economic downturn. However, the data collected for this imp ...

... all households reported arrears1. The difficulty in meeting repayments has led to an increase in default rates and a rise in foreclosures.2 Data can be influenced by factors other than irresponsible lending and borrowing such as the general economic downturn. However, the data collected for this imp ...

Fixed Income Opportunity

... The preceding discussion is general in nature, is intended for informational purposes only, and is not intended to provide specific advice or recommendations for any individual or organization. Because the facts and circumstances surrounding each situation differs, you should consult your attorney, ...

... The preceding discussion is general in nature, is intended for informational purposes only, and is not intended to provide specific advice or recommendations for any individual or organization. Because the facts and circumstances surrounding each situation differs, you should consult your attorney, ...

Forum for the Free Flow of Information Organizational Launch Meeting

... About Credit Reporting II Research has established that credit reporting is better for private sector lending and loan performance than no reporting but also: ...

... About Credit Reporting II Research has established that credit reporting is better for private sector lending and loan performance than no reporting but also: ...

Monetary Policy and the Risk-Taking Channel

... This type of induced behaviour—an increased appetite for risk that causes economic agents to search for investment assets and strategies that generate higher investment returns—has been called the risk-taking channel of monetary policy. Recent academic research on banks suggests that lending p ...

... This type of induced behaviour—an increased appetite for risk that causes economic agents to search for investment assets and strategies that generate higher investment returns—has been called the risk-taking channel of monetary policy. Recent academic research on banks suggests that lending p ...

Housing Finance in Emerging Markets: Policy and

... Automated Underwriting and Credit Scoring Credit Reports and Credit Scoring are used to determine credit stability and allow instant feedback on credit quality Credit scoring is a statistical modeling technique that evaluates the degree of risk posed by a prospective borrower or existing customer A ...

... Automated Underwriting and Credit Scoring Credit Reports and Credit Scoring are used to determine credit stability and allow instant feedback on credit quality Credit scoring is a statistical modeling technique that evaluates the degree of risk posed by a prospective borrower or existing customer A ...

The financial system: Strengths and weaknesses

... Financial crises are a disruption or sudden change in the activities of financial institutions or markets, which have a significantly negative impact on economic developments. Difficulties within a single financial institution, or major price changes in a single market, which do not have pervasive e ...

... Financial crises are a disruption or sudden change in the activities of financial institutions or markets, which have a significantly negative impact on economic developments. Difficulties within a single financial institution, or major price changes in a single market, which do not have pervasive e ...

Word

... notice period was viewed as dramatic – from CZK 28.2 billion to 1.7 billion, which almost annulled their balances – against the total amount of deposits of businesses and households that reached CZK 916 billion back then, it was a marginal drop. In the half year of 2012 these deposits stood at the m ...

... notice period was viewed as dramatic – from CZK 28.2 billion to 1.7 billion, which almost annulled their balances – against the total amount of deposits of businesses and households that reached CZK 916 billion back then, it was a marginal drop. In the half year of 2012 these deposits stood at the m ...

The US Response to the International Debt

... then by setting up the Institute for International Finance17 to gather and exchange debtor country information. Unfortunately, this interbank cooperation came only after the banks had collectively committed so much capital to a small group of middle-income developing countries, including Mexico, Bra ...

... then by setting up the Institute for International Finance17 to gather and exchange debtor country information. Unfortunately, this interbank cooperation came only after the banks had collectively committed so much capital to a small group of middle-income developing countries, including Mexico, Bra ...

Microcredit: Conceptual Aspects Asymmetry of Information

... assets are not, in general, valid guarantees for loans, as they do not have regularized properties nor verifiable income flow. This way, the poor’s problem is not only the need of assets or opportunities, but also the low quality of these assets, which decreases their ability to benefit the slim opp ...

... assets are not, in general, valid guarantees for loans, as they do not have regularized properties nor verifiable income flow. This way, the poor’s problem is not only the need of assets or opportunities, but also the low quality of these assets, which decreases their ability to benefit the slim opp ...

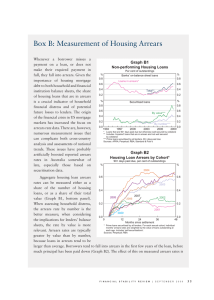

Box B: Measurement of Housing Arrears Graph B1

... Firstly, some existing ADI customers might be remaining on ADIs’ books as non-performing loans, because they are no longer able to refinance with an alternative or non-conforming lender. Secondly, as ADIs increase their market share and absorb the business of exiting lenders, they are probably picki ...

... Firstly, some existing ADI customers might be remaining on ADIs’ books as non-performing loans, because they are no longer able to refinance with an alternative or non-conforming lender. Secondly, as ADIs increase their market share and absorb the business of exiting lenders, they are probably picki ...

1 shadow banking

... Stanley) imitated the same arrangements. However, it was less of a product of regulatory arbitrage, and more a product of vertical integration. DBDs acquired lending platforms (finance companies) and asset management units in order to vertically integrate their securitization businesses (from origin ...

... Stanley) imitated the same arrangements. However, it was less of a product of regulatory arbitrage, and more a product of vertical integration. DBDs acquired lending platforms (finance companies) and asset management units in order to vertically integrate their securitization businesses (from origin ...