Chapter One * Introduction - Mutual Fund Directors Forum

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

Do unitranches work?

... n the last five years, lenders in the midmarket have experienced stiff competition from a relatively new form of financing commonly referred to as “unitranche”. A typical unitranche (although they can come in many different forms) is evidenced by a single loan agreement, with one loan, one rate and ...

... n the last five years, lenders in the midmarket have experienced stiff competition from a relatively new form of financing commonly referred to as “unitranche”. A typical unitranche (although they can come in many different forms) is evidenced by a single loan agreement, with one loan, one rate and ...

Current Challenges in Housing and Home Loans: Complicating Factors and

... Using home equity can be particularly attractive to consumers because of the tax advantages of borrowing with the home as collateral, the lower interest rate on mortgage loans relative to other forms of consumer debt, and the ability to expand the credit line during a period of rapid appreciation in ...

... Using home equity can be particularly attractive to consumers because of the tax advantages of borrowing with the home as collateral, the lower interest rate on mortgage loans relative to other forms of consumer debt, and the ability to expand the credit line during a period of rapid appreciation in ...

assisting the start-up and growing business

... institutional lenders, nor can they purchase many ancillary products from the bank such as payroll or investment services. Thus, financing small businesses is perceived as high risk and low reward. In an effort to reduce the cost of loan application processing and analysis, to reduce their risks and ...

... institutional lenders, nor can they purchase many ancillary products from the bank such as payroll or investment services. Thus, financing small businesses is perceived as high risk and low reward. In an effort to reduce the cost of loan application processing and analysis, to reduce their risks and ...

Well Worth Saving: How the New Deal Safeguarded Home Ownership

... on straight mortgage loans during the 1920s, they offered longer repayment schedules and made more use of partial amortization than did savings and commercial banks. Individual investors, who held two-fifths of the residential mortgage debt in the 1920s, probably relied even more heavily on short-ter ...

... on straight mortgage loans during the 1920s, they offered longer repayment schedules and made more use of partial amortization than did savings and commercial banks. Individual investors, who held two-fifths of the residential mortgage debt in the 1920s, probably relied even more heavily on short-ter ...

Bajaj Finance to offer higher returns on smaller fixed

... looking for assured returns with a credible savings instrument. This step comes as a results of the huge demand from its 15 MM customer base, to have access to quality FD investment at a lower cap of Rs. 25,000. This will also allow small depositors to generate higher returns through traditional sav ...

... looking for assured returns with a credible savings instrument. This step comes as a results of the huge demand from its 15 MM customer base, to have access to quality FD investment at a lower cap of Rs. 25,000. This will also allow small depositors to generate higher returns through traditional sav ...

It`s the Economy Stupid

... this information to help you meet your development goals this year. You choose your competitors/peers. For each brand we can help you: • Learn about their marketing programs, where they advertise, events they attend, awards and performance claims they make • Discover industry‐wide trends that m ...

... this information to help you meet your development goals this year. You choose your competitors/peers. For each brand we can help you: • Learn about their marketing programs, where they advertise, events they attend, awards and performance claims they make • Discover industry‐wide trends that m ...

how to avoid the pitfalls of the commercial mortgage application

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

What`s Ahead for EU Mortgage Markets? ELRA General Assembly

... Property markets in a number of MS are witnessing a decline in their price growth rate (DK, ES, UK) and even some price falls (IE) Consumer demand is easing due to general increase in prices and decline in economic perspectives As a result, either due to lack of liquidity or out of caution, EU ...

... Property markets in a number of MS are witnessing a decline in their price growth rate (DK, ES, UK) and even some price falls (IE) Consumer demand is easing due to general increase in prices and decline in economic perspectives As a result, either due to lack of liquidity or out of caution, EU ...

rural housing loan fund

... income, she sells sweets, snacks and hand-made brooms from home and at a nearby school. She also has a pay phone in her house. Her entrepreneurial drive plus her meagre regular income have enabled her to afford 5 successive loans ranging between R2, 000 and R4, 000 to build a four bedroom house for ...

... income, she sells sweets, snacks and hand-made brooms from home and at a nearby school. She also has a pay phone in her house. Her entrepreneurial drive plus her meagre regular income have enabled her to afford 5 successive loans ranging between R2, 000 and R4, 000 to build a four bedroom house for ...

The Treatment of Nonperforming Loans

... Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should there be a difference between “normal” and “catastrophic” losses? ...

... Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should there be a difference between “normal” and “catastrophic” losses? ...

The Sharing Economy: Accessibility Based Business Models for

... In recent years, a transition from ownership towards accessibility can be observed across a wide variety of markets. Whereas in the conventional situation consumers would buy products and become the owners, in an accessibility-based system consumers pay for temporary access-rights to a product. Clea ...

... In recent years, a transition from ownership towards accessibility can be observed across a wide variety of markets. Whereas in the conventional situation consumers would buy products and become the owners, in an accessibility-based system consumers pay for temporary access-rights to a product. Clea ...

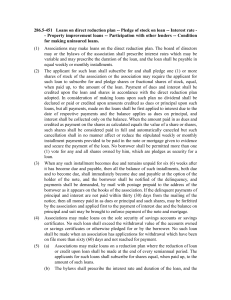

286.5-451 Loans on direct reduction plan -

... Corporation or the Federal Deposit Insurance Corporation, or are life insurance companies with assets in excess of one hundred million dollars ($100,000,000), or are employees' or self-employed persons' trusts qualified and exempt from federal income tax under the provisions of the laws of the Unite ...

... Corporation or the Federal Deposit Insurance Corporation, or are life insurance companies with assets in excess of one hundred million dollars ($100,000,000), or are employees' or self-employed persons' trusts qualified and exempt from federal income tax under the provisions of the laws of the Unite ...

Subprime mortgage lending has grown tremendously

... but are, rather, home equity loans. Home Mortgage Disclosure Act (HMDA) data for 1999 indicate that 76% of the lending by institutions identifying themselves as primarily subprime lenders was home equity lending. Subprime mortgage loans also tend to be first lien loans, meaning that the first mortga ...

... but are, rather, home equity loans. Home Mortgage Disclosure Act (HMDA) data for 1999 indicate that 76% of the lending by institutions identifying themselves as primarily subprime lenders was home equity lending. Subprime mortgage loans also tend to be first lien loans, meaning that the first mortga ...

rental market conditions - Harvard Joint Center for Housing Studies

... conservator of the GSEs) has signaled its intent to set a ceiling on the amount of multifamily lending that the GSEs can back in 2013. While the caps are fairly high—$30 billion for Fannie Mae and $26 billion for Freddie Mac—FHFA intends to further reduce GSE lending volumes over the next several ye ...

... conservator of the GSEs) has signaled its intent to set a ceiling on the amount of multifamily lending that the GSEs can back in 2013. While the caps are fairly high—$30 billion for Fannie Mae and $26 billion for Freddie Mac—FHFA intends to further reduce GSE lending volumes over the next several ye ...

Download pdf | 78 KB |

... -9of private investors to lend, particularly for terms longer than overnight. These various actions appear to have improved the functioning of the commercial paper market, as rates and risk spreads have come down and the average maturities of issuance have increased. In contrast, our forthcoming as ...

... -9of private investors to lend, particularly for terms longer than overnight. These various actions appear to have improved the functioning of the commercial paper market, as rates and risk spreads have come down and the average maturities of issuance have increased. In contrast, our forthcoming as ...

CMHC Newcomer

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

Progress Towards Creating more Effective Resolution Regimes

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

5 3 6 7

... product banks could explore. We also asked respondents about a mobile or web enabled financial management application that would track, categorize and benchmark transactions and expenditures across all of a consumer’s accounts and provide planning help, alerts and reminders. Nearly three-quarters (7 ...

... product banks could explore. We also asked respondents about a mobile or web enabled financial management application that would track, categorize and benchmark transactions and expenditures across all of a consumer’s accounts and provide planning help, alerts and reminders. Nearly three-quarters (7 ...

Determinants of the Incidence of Loan Modifications

... Non-prime more likely to be modified than prime But other risky loan types (junior liens, IO loans, undocumented loans), including ARMs ...

... Non-prime more likely to be modified than prime But other risky loan types (junior liens, IO loans, undocumented loans), including ARMs ...

Slices - personal.kent.edu

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

Residential Mortgage Lending - PowerPoint

... residential mortgage lending come from? • How do demographic forces impact real estate and the mortgage markets? © 2012 Cengage Learning ...

... residential mortgage lending come from? • How do demographic forces impact real estate and the mortgage markets? © 2012 Cengage Learning ...

The Impact of Financial Markets on Economic Stability and

... One of the biggest weapons: a compensation structure that rewarded brokers for persuading borrowers to take a loan with an interest rate higher than the borrower might have qualified for. A study done in 2004 and 2005 by the Federal Trade Commission found that many borrowers were confused by current ...

... One of the biggest weapons: a compensation structure that rewarded brokers for persuading borrowers to take a loan with an interest rate higher than the borrower might have qualified for. A study done in 2004 and 2005 by the Federal Trade Commission found that many borrowers were confused by current ...

The Impact of Financial Markets on Economic Stability and Growth

... One of the biggest weapons: a compensation structure that rewarded brokers for persuading borrowers to take a loan with an interest rate higher than the borrower might have qualified for. A study done in 2004 and 2005 by the Federal Trade Commission found that many borrowers were confused by current ...

... One of the biggest weapons: a compensation structure that rewarded brokers for persuading borrowers to take a loan with an interest rate higher than the borrower might have qualified for. A study done in 2004 and 2005 by the Federal Trade Commission found that many borrowers were confused by current ...

Belarus in recession, banking sector in difficulties

... increase of NPLs. While recorded profitability remained relatively modest up to end-2014, it further declined, but was still positive, in the crisis year 2015 and in early 2016 (end-March 2016: ROA: 1.4%, ROE: 11.4%).11 The total number of banks operating in the country fell from 31 at the beginnin ...

... increase of NPLs. While recorded profitability remained relatively modest up to end-2014, it further declined, but was still positive, in the crisis year 2015 and in early 2016 (end-March 2016: ROA: 1.4%, ROE: 11.4%).11 The total number of banks operating in the country fell from 31 at the beginnin ...