Mitchel Gorecki Urban Economics The Perfect Storm The

... one, an increase in the price of housing resulted in a corresponding increase in value. This proved to be the fatal element in Mankiw’s findings. With 93.2% confidence, the data concluded that by 2007, the housing market would see a 47% devaluation of homes. This was highly problematic simply becaus ...

... one, an increase in the price of housing resulted in a corresponding increase in value. This proved to be the fatal element in Mankiw’s findings. With 93.2% confidence, the data concluded that by 2007, the housing market would see a 47% devaluation of homes. This was highly problematic simply becaus ...

P r e - 2 0 0 7

... US House of Representatives rejection of $700bn Troubled Asset Relief Program (TARP) to buy bad debts from ailing banks sends further shockwaves around the world. Ireland ...

... US House of Representatives rejection of $700bn Troubled Asset Relief Program (TARP) to buy bad debts from ailing banks sends further shockwaves around the world. Ireland ...

The Loanable Funds Model

... assets in circulation, because each has its own yield ... there is a full continuum i off interest i rates. There are two types of assets that offer interest: (1) yields on deposits in financial institutions, which are "sticky" and slow to change, and (2) the h yields i ld on marketable k bl securit ...

... assets in circulation, because each has its own yield ... there is a full continuum i off interest i rates. There are two types of assets that offer interest: (1) yields on deposits in financial institutions, which are "sticky" and slow to change, and (2) the h yields i ld on marketable k bl securit ...

Title of presentation

... Source: Liberum, WDZJ, AltFi Data, company data, Bank of England, FDIC, Federal Reserve, ...

... Source: Liberum, WDZJ, AltFi Data, company data, Bank of England, FDIC, Federal Reserve, ...

C3 Guidelines - University of California | Office of The President

... 2. Policy Basis. At its July 16, 2008 meeting, the Board of Regents authorized the use of the Regents’ CP Program for the financing of University working capital needs, as described in the enabling language below. The Regents’ CP Program is authorized for: (1) the interim financing of capital projec ...

... 2. Policy Basis. At its July 16, 2008 meeting, the Board of Regents authorized the use of the Regents’ CP Program for the financing of University working capital needs, as described in the enabling language below. The Regents’ CP Program is authorized for: (1) the interim financing of capital projec ...

MACROECONOMIC ENVIRONMENT

... W. Eur.) and financial markets As investments in CEE have continued to increase, the ‘other’ activities have been progressively scaled down ...

... W. Eur.) and financial markets As investments in CEE have continued to increase, the ‘other’ activities have been progressively scaled down ...

Word

... It is key from the view of the banking sector stability, how the share of nonperforming loans is developing. It was the lowest in November 2007, when it constituted 2.61%. Nevertheless, it climbed up to the level of 6% due to the worsening of economic situation in the CR in years 2008 and 2009, wher ...

... It is key from the view of the banking sector stability, how the share of nonperforming loans is developing. It was the lowest in November 2007, when it constituted 2.61%. Nevertheless, it climbed up to the level of 6% due to the worsening of economic situation in the CR in years 2008 and 2009, wher ...

chap008-- - MCST-CS

... the needed funds and dividing by (1 − c), where c is the compensating balance expressed as a decimal. • For example, if $100,000 is needed, the amount borrowed must be $125,000 considering 20% of amount borrowed as the compensating balance. This is computed as: Amount to be borrowed= Amount needed ÷ ...

... the needed funds and dividing by (1 − c), where c is the compensating balance expressed as a decimal. • For example, if $100,000 is needed, the amount borrowed must be $125,000 considering 20% of amount borrowed as the compensating balance. This is computed as: Amount to be borrowed= Amount needed ÷ ...

Digital Loan Marketplace

... A market with five hundred lenders is more valuable to an investor than a market with fifty because it provides greater opportunity for investors to expand their origination network. Similarly, a market with large numbers of investors is attractive to lenders as they may benefit from both increased ...

... A market with five hundred lenders is more valuable to an investor than a market with fifty because it provides greater opportunity for investors to expand their origination network. Similarly, a market with large numbers of investors is attractive to lenders as they may benefit from both increased ...

Chapter 1

... $5,000. She spends $8,000 as a down payment on a newly constructed mountain cabin and lends $4,000 in financial markets. Assuming that Diane spends the remainder of her income on ...

... $5,000. She spends $8,000 as a down payment on a newly constructed mountain cabin and lends $4,000 in financial markets. Assuming that Diane spends the remainder of her income on ...

This offering is being made solely by means of a - corporate

... Inc., Attn: Prospectus Department, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717; Credit Suisse Securities (USA) LLC, Attention: Prospectus Department, 11 Madison Avenue, New York, NY 10010; or J.P. Morgan, c/o Broadridge Financial Solutions, 1155 Long Island Avenue ...

... Inc., Attn: Prospectus Department, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717; Credit Suisse Securities (USA) LLC, Attention: Prospectus Department, 11 Madison Avenue, New York, NY 10010; or J.P. Morgan, c/o Broadridge Financial Solutions, 1155 Long Island Avenue ...

Are Banks Still Important for Financing Large Businesses?

... total loans outstanding grew $15 billion for the banks with high levels of loan commitments but rose only $4 billion for the other banks.12 Why Are Banks Well Positioned to Provide Liquidity Insurance? So far we have explained why companies turn to banks in times of economic turmoil, but why do bank ...

... total loans outstanding grew $15 billion for the banks with high levels of loan commitments but rose only $4 billion for the other banks.12 Why Are Banks Well Positioned to Provide Liquidity Insurance? So far we have explained why companies turn to banks in times of economic turmoil, but why do bank ...

The Rise and Fall of the US Housing Market

... housing demand and the willingness of various lenders to expand their lending on ever more attractive terms for borrowers was the notion that housing prices would most likely continue to increase, in general, even if they might dip here and there across the country from time to time. By lending acro ...

... housing demand and the willingness of various lenders to expand their lending on ever more attractive terms for borrowers was the notion that housing prices would most likely continue to increase, in general, even if they might dip here and there across the country from time to time. By lending acro ...

Let the g(bl)ame begin

... Subprime mortgage loans are riskier loans in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history. Subprime borrowers are generally defined as individuals with limited income or having FICO* credit scores below 620 ...

... Subprime mortgage loans are riskier loans in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history. Subprime borrowers are generally defined as individuals with limited income or having FICO* credit scores below 620 ...

Permira Debt Managers appoints David Hirschmann as Head of

... PDM’s direct lending funds. David’s appointment follows that of Dan Hatcher in January 2015 to lead UK origination, bringing the total team size to 19. PDM’s most recent direct lending fund, Permira Credit Solutions 2 (PCS2), has already completed seven transactions since its first close at approxim ...

... PDM’s direct lending funds. David’s appointment follows that of Dan Hatcher in January 2015 to lead UK origination, bringing the total team size to 19. PDM’s most recent direct lending fund, Permira Credit Solutions 2 (PCS2), has already completed seven transactions since its first close at approxim ...

Sustainability Bites? The Impact of Minimum Energy Efficiency

... get to grips with the impacts these regulations will have on the property portfolios they own. However, with many institutional and private equity investors increasingly focused on lending as an additional form of real estate exposure, such sustainability considerations have to be considered from a ...

... get to grips with the impacts these regulations will have on the property portfolios they own. However, with many institutional and private equity investors increasingly focused on lending as an additional form of real estate exposure, such sustainability considerations have to be considered from a ...

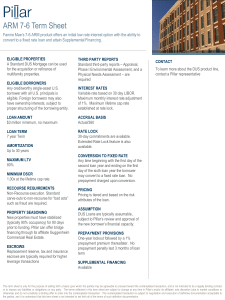

ARM 7-6 Term Sheet

... PROPERTY SEASONING New properties must have stabilized (typically 90% occupancy) for 90 days prior to funding. Pillar can offer bridge financing through its affiliate Guggenheim Commercial Real Estate. ESCROWS Replacement reserve, tax and insurance escrows are typically required for higher leverage ...

... PROPERTY SEASONING New properties must have stabilized (typically 90% occupancy) for 90 days prior to funding. Pillar can offer bridge financing through its affiliate Guggenheim Commercial Real Estate. ESCROWS Replacement reserve, tax and insurance escrows are typically required for higher leverage ...

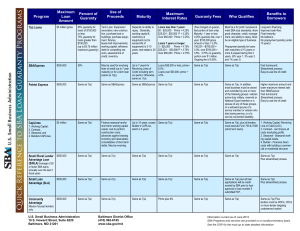

Program Maximum Loan Amount Percent of Guaranty Use of

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

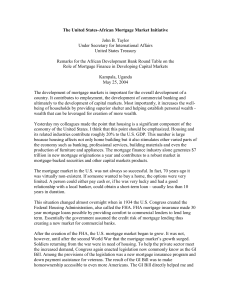

The United States-African Mortgage Market Initiative

... was virtually non-existent. If someone wanted to buy a home, the options were very limited. A person could either pay cash or, if he was very lucky and had a good relationship with a local banker, could obtain a short-term loan – usually less than 10 years in duration. This situation changed almost ...

... was virtually non-existent. If someone wanted to buy a home, the options were very limited. A person could either pay cash or, if he was very lucky and had a good relationship with a local banker, could obtain a short-term loan – usually less than 10 years in duration. This situation changed almost ...

finance company

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

Chap 19-20

... Competition and adverse selection limit ability to increase earnings from lending Other investments offer higher returns but carry interest rate risk; Rather than lending, could invest depositors cash in interest earning securities As interest rates change, value of the investment portfolio ...

... Competition and adverse selection limit ability to increase earnings from lending Other investments offer higher returns but carry interest rate risk; Rather than lending, could invest depositors cash in interest earning securities As interest rates change, value of the investment portfolio ...

Real Estate Finance - PowerPoint presentation - Ch 03

... • Although insurance companies invest most of their reserves in highgrade securities, they also make mortgage loans. • Larger companies have confined their real estate activity to large commercial ventures in which they acquire a participating interest. • Smaller companies look upon individual home ...

... • Although insurance companies invest most of their reserves in highgrade securities, they also make mortgage loans. • Larger companies have confined their real estate activity to large commercial ventures in which they acquire a participating interest. • Smaller companies look upon individual home ...

Demystifying the Federal Home Loan Banks:

... rate risk. Historically, our main product has been loans, called “advances,” that can be simple or structured, depending on a member’s needs. For lenders who portfolio their mortgages and other loans, FHLBank advances can be an ideal product to help match the duration of assets to liabilities. A sig ...

... rate risk. Historically, our main product has been loans, called “advances,” that can be simple or structured, depending on a member’s needs. For lenders who portfolio their mortgages and other loans, FHLBank advances can be an ideal product to help match the duration of assets to liabilities. A sig ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... Troubled debt restructure (TDR): Directors should understand the definition of TDR and its potential impact on asset quality. Allowance for loan and lease losses (ALLL): Directors should have a working knowledge of the ALLL and the financial impact the ALLL has on the institution. Loan review: Direc ...

... Troubled debt restructure (TDR): Directors should understand the definition of TDR and its potential impact on asset quality. Allowance for loan and lease losses (ALLL): Directors should have a working knowledge of the ALLL and the financial impact the ALLL has on the institution. Loan review: Direc ...