Securitisation

... cash flow of the underlying assets represents the interest claims of the securities issued Increasing complexity with the emergence of financial intermediaries: special purpose entities (SPEs) ...

... cash flow of the underlying assets represents the interest claims of the securities issued Increasing complexity with the emergence of financial intermediaries: special purpose entities (SPEs) ...

A Detailed Look into Peer to Peer Lending

... the car loan borrowers are mostly high quality and low risk of default. The most recent versions of FICO have been proven to be validated against economic cycle risk11. All told, this is a robust measure of riskiness that has been vetted by the financial industry for decades and is a continued commo ...

... the car loan borrowers are mostly high quality and low risk of default. The most recent versions of FICO have been proven to be validated against economic cycle risk11. All told, this is a robust measure of riskiness that has been vetted by the financial industry for decades and is a continued commo ...

Lender of last resort

... is issued by a modern corporation whereas an acceptance was issued by either an unincorporated firm or a 19th c. British joint stock firm. ...

... is issued by a modern corporation whereas an acceptance was issued by either an unincorporated firm or a 19th c. British joint stock firm. ...

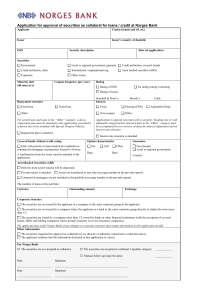

Søknadsskjema for godkjenning av obligasjoner og

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

Issues in the Financing of Small and Medium Enterprises in China

... get credit from banks without qualified collaterals. The current financial system in China provides reasonably good access to deposit and payment service to the Chinese people. Chinese banks have extensive branch network. The total branches of the four SCBs are about 120,000. If branches of RCCs (ab ...

... get credit from banks without qualified collaterals. The current financial system in China provides reasonably good access to deposit and payment service to the Chinese people. Chinese banks have extensive branch network. The total branches of the four SCBs are about 120,000. If branches of RCCs (ab ...

2009 - Homex

... • Mortgage industry in Mexico proved its strength in this difficult times and also identified areas of opportunity, in spite of economic downturn and unemployment. • Financial Institutions have strenghthened their origination loan process and loan servicing standards, including collection policies t ...

... • Mortgage industry in Mexico proved its strength in this difficult times and also identified areas of opportunity, in spite of economic downturn and unemployment. • Financial Institutions have strenghthened their origination loan process and loan servicing standards, including collection policies t ...

The Full Report from Bond Talk

... lending money. The decision by Nersa to grant Eskom a tariff hike of 31.3% will make it even difficult for home owners and many are likely to lose their homes, said Venter. The Reserve Bank has missed an opportunity to help stimulate the economy by leaving the repo rate unchanged, was his view. Acco ...

... lending money. The decision by Nersa to grant Eskom a tariff hike of 31.3% will make it even difficult for home owners and many are likely to lose their homes, said Venter. The Reserve Bank has missed an opportunity to help stimulate the economy by leaving the repo rate unchanged, was his view. Acco ...

The Great Liquidity Squeeze of 2017: Cash dries up as loan

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

... cash flow will naturally be available from the current mix of assets and liabilities, given an assumed future interest rate path. ...

AIF 25 Anniversary Symposium: The Better Future of Finance 27

... – need to get money out of firms not only in firms ...

... – need to get money out of firms not only in firms ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... As corporations and companies represent the major category of clients, for the corporate lending banks do analyze a set of basic and additional criteria such as the ability of continuing business, the expected future cash flows, security and collateral, the rate of return to the bank as well as the ...

... As corporations and companies represent the major category of clients, for the corporate lending banks do analyze a set of basic and additional criteria such as the ability of continuing business, the expected future cash flows, security and collateral, the rate of return to the bank as well as the ...

Causes and Implications of the US Housing Crisis

... bubble is an example of adverse selection because risks that were not creditworthy were improperly screened. The result of this is that after the financial crisis, banks see too much risk to provide many loans, even to individuals with excellent credit. The lack of funds available to finance economi ...

... bubble is an example of adverse selection because risks that were not creditworthy were improperly screened. The result of this is that after the financial crisis, banks see too much risk to provide many loans, even to individuals with excellent credit. The lack of funds available to finance economi ...

Weekly Advisor Analysis 06-24-13 PAA

... much harsher. The yield on the 10-year U.S. Treasury bond has now soared from 1.6 percent at the beginning of May to just below 2.5 percent as of the end of last week, according to CNBC. This has pressured the prices of bonds lower which move inversely to interest rates. Although the Federal Reserve ...

... much harsher. The yield on the 10-year U.S. Treasury bond has now soared from 1.6 percent at the beginning of May to just below 2.5 percent as of the end of last week, according to CNBC. This has pressured the prices of bonds lower which move inversely to interest rates. Although the Federal Reserve ...

An enhanced methodology of compiling financial

... The reference rate should contain no service element and reflect the risk and maturity structure of deposits and loans ...

... The reference rate should contain no service element and reflect the risk and maturity structure of deposits and loans ...

Notification of countercyclical buffer in Denmark

... Notification of countercyclical buffer in Denmark When CRD IV/CRR was implemented in Denmark a possibility was introduced whereby the countercyclical buffer could be introduced already from 2015 (up to 0.5 percent). In line with Article 160(6) of CRD IV, Denmark is hereby notifying you of this possi ...

... Notification of countercyclical buffer in Denmark When CRD IV/CRR was implemented in Denmark a possibility was introduced whereby the countercyclical buffer could be introduced already from 2015 (up to 0.5 percent). In line with Article 160(6) of CRD IV, Denmark is hereby notifying you of this possi ...

Europe`s bank loan funds – where now?

... Europe and US go separate ways For all those uncertainties, the US market in CLOs is humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then ...

... Europe and US go separate ways For all those uncertainties, the US market in CLOs is humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then ...

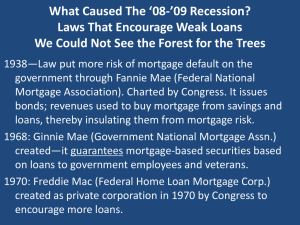

What Caused This Mess? Bad Laws Built Up Over Time

... risky loans, but government “guarantees” loans. • Mortgage brokers encourage people to buy houses or trade up to more expensive house. No down payment needed! • Bush Admin had easy money policy—low interest rates—housing bid up 65% from 2001-2006. • Adjustable rate mortgages—ARMs—first year or two, ...

... risky loans, but government “guarantees” loans. • Mortgage brokers encourage people to buy houses or trade up to more expensive house. No down payment needed! • Bush Admin had easy money policy—low interest rates—housing bid up 65% from 2001-2006. • Adjustable rate mortgages—ARMs—first year or two, ...

SimBank Presentation

... – Selling Treasury securities – Issuing and redeeming subordinated debt (capital notes) – Issuing stock ...

... – Selling Treasury securities – Issuing and redeeming subordinated debt (capital notes) – Issuing stock ...

Box B: Banks` Exposures to Inner

... Banks would experience losses on these exposures in default events where the value of the properties is insufficient to cover the debt outstanding. Australian mortgage lending has historically had very low default rates – around ½ per cent – and had high levels of collateralisation. In Sydney in par ...

... Banks would experience losses on these exposures in default events where the value of the properties is insufficient to cover the debt outstanding. Australian mortgage lending has historically had very low default rates – around ½ per cent – and had high levels of collateralisation. In Sydney in par ...

Debt Financing in a Challenging Regulatory and Market Environment

... Less competition from CMBS lenders and higher demand for bank and life company money. Life companies will likely get through most of their allocations by late summer ...

... Less competition from CMBS lenders and higher demand for bank and life company money. Life companies will likely get through most of their allocations by late summer ...

General - Website

... For existing and start up businesses£10000 to £100,000, secured and unsecured. Average deal size currently £25k. Up to 7 year loan period . Average 5 years. Can lend alone or as part of a package for large deals. Commercial rates of interest and fees- 12./base> min 10%. Compare banks for similar loa ...

... For existing and start up businesses£10000 to £100,000, secured and unsecured. Average deal size currently £25k. Up to 7 year loan period . Average 5 years. Can lend alone or as part of a package for large deals. Commercial rates of interest and fees- 12./base> min 10%. Compare banks for similar loa ...

Trends in loans to the private sector and their fundamental

... their low cost, as indicated by the fact that, in real terms, lending rates were at historically low levels in 2001 and 2002 (see Chart B). Finally, the significant fall in equity prices since early 2000 may also have had an impact on developments in loans via its effects on the balance sheets and ...

... their low cost, as indicated by the fact that, in real terms, lending rates were at historically low levels in 2001 and 2002 (see Chart B). Finally, the significant fall in equity prices since early 2000 may also have had an impact on developments in loans via its effects on the balance sheets and ...

Real Money Rob Rikoon Good news for retirees: low

... program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this last month. Bond investors reaped great gains during this long period of rising market prices but they now face significant market risk as interest rates rise. A 10 year bond drops nearly 10 ...

... program and control of the federal funds rate. The bull market in bonds that began in 1981 all but ended this last month. Bond investors reaped great gains during this long period of rising market prices but they now face significant market risk as interest rates rise. A 10 year bond drops nearly 10 ...

Maturity Mismatch Stretching: Banking Has Taken a Wrong Turn

... bank margins and hence leading to more risk-taking. World War II led to banks becoming stuffed with government debt, with loans to the private sector limited to large, mostly manufacturing companies, and with competition in this banking industry strictly restricted. Banks lived in a government-manag ...

... bank margins and hence leading to more risk-taking. World War II led to banks becoming stuffed with government debt, with loans to the private sector limited to large, mostly manufacturing companies, and with competition in this banking industry strictly restricted. Banks lived in a government-manag ...

PDF - EMM Wealth Management

... opposed to being driven by improving fundamentals, may indicate that investors receive less return for the risks they take. In other words, the demand for investment opportunities suppresses the need to understand and limit risk. This behavior sets the stage for boom and bust cycles. The Financial C ...

... opposed to being driven by improving fundamentals, may indicate that investors receive less return for the risks they take. In other words, the demand for investment opportunities suppresses the need to understand and limit risk. This behavior sets the stage for boom and bust cycles. The Financial C ...