Commercial paper may not be economical for big companies

... Going forward, economists expect interest rates to tighten by at least another percentage point by December, which will push lending rates of banks higher. Shah, along with bankers, said the situation will likely loosen a bit in about two months when liquidity eases. Goldman Sachs , however, said i ...

... Going forward, economists expect interest rates to tighten by at least another percentage point by December, which will push lending rates of banks higher. Shah, along with bankers, said the situation will likely loosen a bit in about two months when liquidity eases. Goldman Sachs , however, said i ...

impact of capping of interest rates

... - Investments in terms of deposits may go up especially where the return is higher than those offered by alternative investments in the market. - The constrained credit product mix in price capped markets leads borrowers to use products which are less suited to their needs and expose them to greater ...

... - Investments in terms of deposits may go up especially where the return is higher than those offered by alternative investments in the market. - The constrained credit product mix in price capped markets leads borrowers to use products which are less suited to their needs and expose them to greater ...

Small businesses are a vital part of the fabric of... can raise the rates when those firms are old with-

... Small businesses are a vital part of the fabric of the U.S. economy—according to the Small Business Administration, small businesses employ roughly half of the nation’s workers. So the question of how much bank financing small businesses are able to obtain is of real importance. Indeed, a regard for ...

... Small businesses are a vital part of the fabric of the U.S. economy—according to the Small Business Administration, small businesses employ roughly half of the nation’s workers. So the question of how much bank financing small businesses are able to obtain is of real importance. Indeed, a regard for ...

mortny m McCormally 3-14

... The Subprime Crisis: A Perfect Storm Mortgage Market: Between 2003 and 2005, use of subprime and nontraditional mortgage products more than doubled By early 2006, nearly 80% of securitized subprime mortgage loans were ARMs (2/28s and 3/27s) Loans were underwritten without consideration of ris ...

... The Subprime Crisis: A Perfect Storm Mortgage Market: Between 2003 and 2005, use of subprime and nontraditional mortgage products more than doubled By early 2006, nearly 80% of securitized subprime mortgage loans were ARMs (2/28s and 3/27s) Loans were underwritten without consideration of ris ...

Real Estate Finance: An Overview

... had been in 2004 before the crisis – but at credit unions they were higher after the crisis than before. Possible reasons were good deals offered by a few very large credit unions (no mortgage insurance required despite low or no down-payments) and the observation that credit union members tend to b ...

... had been in 2004 before the crisis – but at credit unions they were higher after the crisis than before. Possible reasons were good deals offered by a few very large credit unions (no mortgage insurance required despite low or no down-payments) and the observation that credit union members tend to b ...

Mortgage Lending Discrimination - Fair Housing Center of West

... determine which bank’s was the worst Created a chart using +/‐ 2 to see if any banks fell far outside the norms Shortfall analysis a good proxy for debt service and credit scores Found one bank with higher shortfalls than others ...

... determine which bank’s was the worst Created a chart using +/‐ 2 to see if any banks fell far outside the norms Shortfall analysis a good proxy for debt service and credit scores Found one bank with higher shortfalls than others ...

page one economics - Federal Reserve Bank of St. Louis

... securitized in a multistep process; that is, various financial instruments are created from the underlying loan payments. For example, let’s consider one possible scenario: A finance company specializing in residential home loans extends 100 mortgages to borrowers and subsequently sells the loans to ...

... securitized in a multistep process; that is, various financial instruments are created from the underlying loan payments. For example, let’s consider one possible scenario: A finance company specializing in residential home loans extends 100 mortgages to borrowers and subsequently sells the loans to ...

How Housing Policy Hurts the Middle Class

... subsidizing loans that borrowers couldn't otherwise afford. This encouraged housing speculation supported by financial leverage. Ultimately, taxpayers got the bill. Housing's 2008 collapse led to the U.S. Treasury takeover of Fannie's and Freddie's obligations even as the Federal Housing Administra ...

... subsidizing loans that borrowers couldn't otherwise afford. This encouraged housing speculation supported by financial leverage. Ultimately, taxpayers got the bill. Housing's 2008 collapse led to the U.S. Treasury takeover of Fannie's and Freddie's obligations even as the Federal Housing Administra ...

Risk Based Capital for Mortgage Securitization Firms

... Islamic Islamic finance window (purchase of deferred payments sales and housing leasing contracts) ...

... Islamic Islamic finance window (purchase of deferred payments sales and housing leasing contracts) ...

The Origins of the U.S. Financial and Economic Crises

... even threatened some U.S. financial institutions that had lent to these countries. By their very nature, financial markets are prone to periods of euphoria where lending and speculation expand rapidly (the “boom”), alternating with periods of deep decline (“bust”), when lending collapses. This is be ...

... even threatened some U.S. financial institutions that had lent to these countries. By their very nature, financial markets are prone to periods of euphoria where lending and speculation expand rapidly (the “boom”), alternating with periods of deep decline (“bust”), when lending collapses. This is be ...

Doral Financial Corp

... § 20% of personal income in PR comes from transfer payments (Wikipedia) § US Government has strong interest in stabilizing economy for security reasons. PR is a gateway to the US § PR unemployment h ...

... § 20% of personal income in PR comes from transfer payments (Wikipedia) § US Government has strong interest in stabilizing economy for security reasons. PR is a gateway to the US § PR unemployment h ...

Management Information Strategy and Project Oscar

... their own housing stock for the long-term and to drive up quality and efficiency; and • to give tenants the information they need to hold their landlord to account, by replacing the current opaque system with one which has a clear relationship between the rent a landlord collects and the services th ...

... their own housing stock for the long-term and to drive up quality and efficiency; and • to give tenants the information they need to hold their landlord to account, by replacing the current opaque system with one which has a clear relationship between the rent a landlord collects and the services th ...

Chapter 3 Interbank Lending Interbank lending forms a critical

... Uncertainty about their own needs combined with concerns about potential borrowers prompted banks to be unwilling to lend for more than a few days, and even then only at very high interest rates. The rising cost and reduced availability of interbank loans created a vicious circle of increased cau ...

... Uncertainty about their own needs combined with concerns about potential borrowers prompted banks to be unwilling to lend for more than a few days, and even then only at very high interest rates. The rising cost and reduced availability of interbank loans created a vicious circle of increased cau ...

Commercial Mortgage Backed Securities (CMBS)

... Mortgage Association • Government National Mortgage Association • Federal Home Loan Mortgage Corporation • Federal Agricultural Mortgage Corporation ...

... Mortgage Association • Government National Mortgage Association • Federal Home Loan Mortgage Corporation • Federal Agricultural Mortgage Corporation ...

Statement of Financial Position Form

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

... reached where any candidate beginning ordained ministry has been required to repay a government student loan taken out prior to ordination training. This is because the Student Loan Scheme, up until September 1998, stipulated that a loan need not be repaid in any year where a graduate’s income falls ...

Ontario District Commercial Banking Presentation to: Ontario North

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

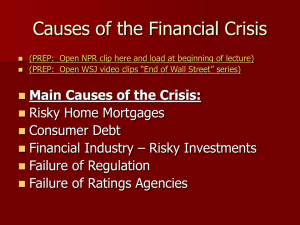

Causes of the Financial Crisis

... Mutual savings & loan) – Largest bankruptcy in American history (Lehman Brothers investment bank) – Failure of Fannie Mae and Freddie Mac (together owned/guaranteed roughly half of all mortgages in U.S.) ...

... Mutual savings & loan) – Largest bankruptcy in American history (Lehman Brothers investment bank) – Failure of Fannie Mae and Freddie Mac (together owned/guaranteed roughly half of all mortgages in U.S.) ...

US housing crisis special features not generally present in Europe

... where no credit checks were carried out to verify the information supplied by the borrower) became legion. In 2001, around 30% of securitised subprime mortgages were relatively undocumented, with the proportion exceeding 50% for the 2006 vintage2. The same year, less than half of all ALT-A loans, de ...

... where no credit checks were carried out to verify the information supplied by the borrower) became legion. In 2001, around 30% of securitised subprime mortgages were relatively undocumented, with the proportion exceeding 50% for the 2006 vintage2. The same year, less than half of all ALT-A loans, de ...

The Global Financial Crisis

... Critics charge the bill is weak, and many provisions won’t take effect for years Bill does not fundamentally address incentive structures that promote risk taking or Too Big To Fail (TBTF) -- systemic risk TARP (aka the bank bail-out) made big banks bigger ...

... Critics charge the bill is weak, and many provisions won’t take effect for years Bill does not fundamentally address incentive structures that promote risk taking or Too Big To Fail (TBTF) -- systemic risk TARP (aka the bank bail-out) made big banks bigger ...

Banks and Interest

... loans & charging interest on the loans. • Banks serve consumers by paying them to let the bank borrow their money (interest rate) in a savings account. ...

... loans & charging interest on the loans. • Banks serve consumers by paying them to let the bank borrow their money (interest rate) in a savings account. ...