The IMF, the World Bank and Debt

... have to be working on the European debt crisis: • The impacts are huge • We are irrelevant to our fellow citizens if we don’t • The crisis, and response to it, are a central part of the financial system which has dominated the world for 40 years ...

... have to be working on the European debt crisis: • The impacts are huge • We are irrelevant to our fellow citizens if we don’t • The crisis, and response to it, are a central part of the financial system which has dominated the world for 40 years ...

Discussion: Financial Crises, Bank Risk Exposure and Government Financial Policy by

... – If only banks would lend more then the economy would recover and we would be back to a normal world again… • But as always with lower bank lending, there is the question of which direction causality goes, are banks not lending or are creditworthy firms not borrowing? • Very few, if any, convinc ...

... – If only banks would lend more then the economy would recover and we would be back to a normal world again… • But as always with lower bank lending, there is the question of which direction causality goes, are banks not lending or are creditworthy firms not borrowing? • Very few, if any, convinc ...

Banking Services

... ◦ Liquid Money (Easy Access) ◦ 44%= Currency, money not in an account ◦ 55%= Checking Accounts ...

... ◦ Liquid Money (Easy Access) ◦ 44%= Currency, money not in an account ◦ 55%= Checking Accounts ...

session_6_ne_yh_money_ecology_bs

... • Select appropriate designers and contractors • Ask yourselves, do we have all the right skill sets in our management team to make this work? • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases and S106 agreements. Are they practical and “f ...

... • Select appropriate designers and contractors • Ask yourselves, do we have all the right skill sets in our management team to make this work? • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases and S106 agreements. Are they practical and “f ...

Thank you for the business

... high-yield or junk-bond market to finance these deals. As a result, as many as 40 bond offerings have been cancelled in the past 4 weeks, including the Chrysler bonds which Cerberus Capital had intended on using to finance its purchase of Chrysler. What we all want to know, of course, is whether the ...

... high-yield or junk-bond market to finance these deals. As a result, as many as 40 bond offerings have been cancelled in the past 4 weeks, including the Chrysler bonds which Cerberus Capital had intended on using to finance its purchase of Chrysler. What we all want to know, of course, is whether the ...

download soal

... financial statements? Why or why not? 4. (Introductory) What is the regulatory impact of moving some loans to a new subsidiary? What is the impact on the financial statements? Why are these different? 5. (Advanced) What are the public relations issues involved with these kinds of actions? Should the ...

... financial statements? Why or why not? 4. (Introductory) What is the regulatory impact of moving some loans to a new subsidiary? What is the impact on the financial statements? Why are these different? 5. (Advanced) What are the public relations issues involved with these kinds of actions? Should the ...

The Global Financial Crisis

... Securities activities can be risky, leading to enormous losses, which could threaten the integrity of deposits • In turn, the Government insures deposits and could be required to pay large sums if depository institutions were to collapse as the result of securities losses ...

... Securities activities can be risky, leading to enormous losses, which could threaten the integrity of deposits • In turn, the Government insures deposits and could be required to pay large sums if depository institutions were to collapse as the result of securities losses ...

Microcredit vs. Microsaving

... Interesting that prob of having a business is NOT correlated with wealth, yet prob of borrowing is. Should we be concerned with refusal to participate in the survey? How did enumerators introduce themselves? Tab 2: How many HHs borrow from more than one source? Do they link type of borrowing to type ...

... Interesting that prob of having a business is NOT correlated with wealth, yet prob of borrowing is. Should we be concerned with refusal to participate in the survey? How did enumerators introduce themselves? Tab 2: How many HHs borrow from more than one source? Do they link type of borrowing to type ...

Teaching students how to manage money can pay off

... Brian Norton, the American chief executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out ...

... Brian Norton, the American chief executive of Future Finance, a new private student loan lender in the UK, says that he has devised a way to cut defaults and to get borrowers into the repayment habit early: the company requires its customers to pay back small monthly amounts as soon as they take out ...

Small Banks Gain Reprieve on Balloon Mortgages

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

Bank Lending During the Financial Crisis of 2008

... Economic magnitude: banks with revolving line exposure to Lehman one standard deviation above the mean (12%) cut lending by 44%, while banks with Lehman exposure one standard deviation below the mean (0%) cut lending by only 25% ...

... Economic magnitude: banks with revolving line exposure to Lehman one standard deviation above the mean (12%) cut lending by 44%, while banks with Lehman exposure one standard deviation below the mean (0%) cut lending by only 25% ...

Document

... Three Faulty Assumptions About 21st Century Finance Securitization • Capital markets are so advanced that banks can lend more aggressively while off-loading risk through debt securities ...

... Three Faulty Assumptions About 21st Century Finance Securitization • Capital markets are so advanced that banks can lend more aggressively while off-loading risk through debt securities ...

q Given its current status as a Public Trading Body, the Office

... q Given its current status as a Public Trading Body, the Office recognizes the need to develop a more effective and improved service to secure the position of a financially self-funding body. To realize this need, the Office must achieve the following objectives: ...

... q Given its current status as a Public Trading Body, the Office recognizes the need to develop a more effective and improved service to secure the position of a financially self-funding body. To realize this need, the Office must achieve the following objectives: ...

PEACHTREE CITY, GA., July 21, 2014

... PEACHTREE CITY, GA., July 21, 2014. SouthCrest Financial Group, Inc., is pleased to announce Claudia J. Wilson as Vice President, SBA Lending In this new position, Wilson will serve businesses in the state of Georgia and beyond, concentrating on SBA 7(a) and SBA 504 lending programs for small busine ...

... PEACHTREE CITY, GA., July 21, 2014. SouthCrest Financial Group, Inc., is pleased to announce Claudia J. Wilson as Vice President, SBA Lending In this new position, Wilson will serve businesses in the state of Georgia and beyond, concentrating on SBA 7(a) and SBA 504 lending programs for small busine ...

The Burgeoning Crisis of Student Loans: What to Do and Where to Go!

... In a recent study released by the U.S. Department of Education (“USDE”), the number of people severely behind in their student loans has soared in the past year, and continues to grow. This is evident by the sheer number of student loans that default on a daily basis which was last reported to be ap ...

... In a recent study released by the U.S. Department of Education (“USDE”), the number of people severely behind in their student loans has soared in the past year, and continues to grow. This is evident by the sheer number of student loans that default on a daily basis which was last reported to be ap ...

LENDING BOOMS, FOREIGN BANK ENTRY AND COMPETITION

... • These measures are mainly aimed at slowing growth, not at preventing asset quality problems per se ...

... • These measures are mainly aimed at slowing growth, not at preventing asset quality problems per se ...

Bild 1

... ” Upon the request of the Riksbank, a credit institution or another company which is subject to the supervision of the Financial Supervisory Authority shall provide the Riksbank with such information as the Riksbank considers necessary…“ Also applies to subs and branches, but… ...

... ” Upon the request of the Riksbank, a credit institution or another company which is subject to the supervision of the Financial Supervisory Authority shall provide the Riksbank with such information as the Riksbank considers necessary…“ Also applies to subs and branches, but… ...

Why the Fed`s rate cuts won`t help you

... But its effort will have little effect on the ability of the average American to get a cheap loan for a new home, car or college education even as it has a large effect on U.S. banks' ability to fix their balance sheets by racking up fat profits. If that sounds unfair, welcome to the latest episode ...

... But its effort will have little effect on the ability of the average American to get a cheap loan for a new home, car or college education even as it has a large effect on U.S. banks' ability to fix their balance sheets by racking up fat profits. If that sounds unfair, welcome to the latest episode ...

Why Won`t Those Banks Lend

... The Federal Reserves stance in this case is designed to improve bank profitability and support improvement in bank balance sheets over the near term. In addition to bad loans, banks have lots of other investments whose value is questionable. As the bank regulator, the Federal Reserve likes excess re ...

... The Federal Reserves stance in this case is designed to improve bank profitability and support improvement in bank balance sheets over the near term. In addition to bad loans, banks have lots of other investments whose value is questionable. As the bank regulator, the Federal Reserve likes excess re ...

UK consumer credit

... (a) Whole market end-month data, excluding values of zero and nil returns. (b) The maximum 0% balance transfer term available across all lenders. (c) The average 0% balance transfer term is the average of the maximum 0% balance transfer term available for each lender. ...

... (a) Whole market end-month data, excluding values of zero and nil returns. (b) The maximum 0% balance transfer term available across all lenders. (c) The average 0% balance transfer term is the average of the maximum 0% balance transfer term available for each lender. ...

Illegal Money Lending Team information

... Presentations to staff to raise awareness Articles for newsletters and publicity tools, including a shark suit, banners and more. Tailored training for staff (lasting 1.5 hours) to provide in depth discussion about intelligence, victim support and crime prevention One to one support for any ...

... Presentations to staff to raise awareness Articles for newsletters and publicity tools, including a shark suit, banners and more. Tailored training for staff (lasting 1.5 hours) to provide in depth discussion about intelligence, victim support and crime prevention One to one support for any ...

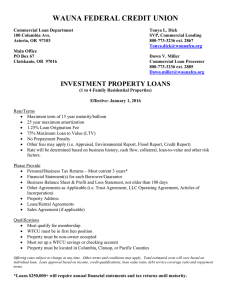

Investment - Wauna Federal Credit Union

... • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for membership • WFCU must be in first lien position • Property must be non-owner o ...

... • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for membership • WFCU must be in first lien position • Property must be non-owner o ...

UK property markets

... (a) Investment valuations are based on assuming property is held for five years with the cash flows from the rent and sale discounted. It is assumed that the property is sold at a rental yield (in line with long-run averages fifteen years). The sale proceeds and rental income are discounted by the t ...

... (a) Investment valuations are based on assuming property is held for five years with the cash flows from the rent and sale discounted. It is assumed that the property is sold at a rental yield (in line with long-run averages fifteen years). The sale proceeds and rental income are discounted by the t ...