Lending Booms, Reserves and the Sustainability of Short

... Yet, to our knowledge, there exists no systematic study of the determinants of the pricing of international bank loans in the 1990s that can be used to shed light on these issues. This paper takes a first step in that direction. It analyzes the pricing of over 4500 international loan commitments to ...

... Yet, to our knowledge, there exists no systematic study of the determinants of the pricing of international bank loans in the 1990s that can be used to shed light on these issues. This paper takes a first step in that direction. It analyzes the pricing of over 4500 international loan commitments to ...

Conduit loan servicing: Who`s who and what`s what?

... expense) every year for large loans, every other year for small loans. As of April 2012, Wells Fargo is the largest Master Servicer in the country with over $500 billion in master and prime servicing. The second largest is PNC Real Estate/Midland Loan Services. Master Servicers are rated and evaluat ...

... expense) every year for large loans, every other year for small loans. As of April 2012, Wells Fargo is the largest Master Servicer in the country with over $500 billion in master and prime servicing. The second largest is PNC Real Estate/Midland Loan Services. Master Servicers are rated and evaluat ...

The Story of CMLTI 2006-NC2

... The performance of CMLTI 2006-NC2 can be traced in parallel with a timeline of the crisis: • July 10, 2007: Moody’s downgraded 399 residential mortgage-backed securities—the lower three tranches of this deal were among these downgrades • August 9, 2007: BNP Paribas froze redemptions • August 28, 20 ...

... The performance of CMLTI 2006-NC2 can be traced in parallel with a timeline of the crisis: • July 10, 2007: Moody’s downgraded 399 residential mortgage-backed securities—the lower three tranches of this deal were among these downgrades • August 9, 2007: BNP Paribas froze redemptions • August 28, 20 ...

Mirae Asset Securities (USA) Inc.

... ▪ The firm has a global presence with offices in 15 markets, including the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA p ...

... ▪ The firm has a global presence with offices in 15 markets, including the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA p ...

PDF Download

... loans 6 in total assets decreased from 24.3 per cent in 2000 to 7.2 per cent in 2004 (EBRD, 2005a). Thus, the quality of the bank’s portfolio is above average. In an international comparison, the default rates we observe in our analysis are (slightly) above reported figures. Agarwal and Hauswald (2 ...

... loans 6 in total assets decreased from 24.3 per cent in 2000 to 7.2 per cent in 2004 (EBRD, 2005a). Thus, the quality of the bank’s portfolio is above average. In an international comparison, the default rates we observe in our analysis are (slightly) above reported figures. Agarwal and Hauswald (2 ...

Profitability and Balance Sheet Repair of Italian Banks

... models (they devote a larger part of their assets to lending to households and firms than in other countries) and the relatively high number of branches per capita.15 Operating costs for the Italian banking system overall are marginally higher than the weighted average of EU banks (65 percent compar ...

... models (they devote a larger part of their assets to lending to households and firms than in other countries) and the relatively high number of branches per capita.15 Operating costs for the Italian banking system overall are marginally higher than the weighted average of EU banks (65 percent compar ...

Dissertação Final

... These Directives were transposed to the Portuguese law entered into force in 2007. Since ...

... These Directives were transposed to the Portuguese law entered into force in 2007. Since ...

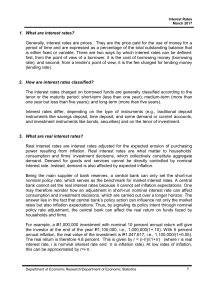

Interest Rates

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

... Interbank Call Loan Rate - the rate on loans among banks for periods not exceeding 24 hours primarily for the purpose of covering reserve deficiencies. Philippine Interbank Offered Rate (PHIBOR) - represents the simple average of the interest rate offers submitted by participating banks on a dai ...

Working Papers - Federal Reserve Bank of Philadelphia

... Statistical scoring models have been developed in a manner ensuring that, on a historical basis, they are more accurate than traditional credit analysis using the same data. Of course, past performance is no guarantee of future accuracy. The most widely available of these models use no institution-s ...

... Statistical scoring models have been developed in a manner ensuring that, on a historical basis, they are more accurate than traditional credit analysis using the same data. Of course, past performance is no guarantee of future accuracy. The most widely available of these models use no institution-s ...

here - Empirical Legal Studies

... The OCC offers these fact based assertions – that national banks are not engaged in predatory lending, and that state consumer protection laws hurt consumers anyway – in an attempt to show that the vacuum created by this preemption would not harm consumers. This factual issue – whether the proposed ...

... The OCC offers these fact based assertions – that national banks are not engaged in predatory lending, and that state consumer protection laws hurt consumers anyway – in an attempt to show that the vacuum created by this preemption would not harm consumers. This factual issue – whether the proposed ...

Overview of Credit Policy and Loan Characteristics

... Asset Concentration Group Definitions (Groups are hierarchical and mutually exclusive): Credit card lenders—Institutions whose credit card loans plus securitized receivables exceed 50 percent of total assets plus securitized receivables. International banks—Banks with assets greater than $10 billion ...

... Asset Concentration Group Definitions (Groups are hierarchical and mutually exclusive): Credit card lenders—Institutions whose credit card loans plus securitized receivables exceed 50 percent of total assets plus securitized receivables. International banks—Banks with assets greater than $10 billion ...

Dollar Funding and the Lending Behavior of

... model is that, in the presence of limited arbitrage and an endogenous CIP violation, an adverse shock to the global bank’s perceived creditworthiness leads to a drop in its dollar-denominated lending relative to its euro-denominated lending. We then go on to test the model’s key implications. To do ...

... model is that, in the presence of limited arbitrage and an endogenous CIP violation, an adverse shock to the global bank’s perceived creditworthiness leads to a drop in its dollar-denominated lending relative to its euro-denominated lending. We then go on to test the model’s key implications. To do ...

Community Development Investment Review: Conference

... The history of the Chicago Mercantile Exchange and Chicago Board of Trade may shed some light on the current problem in community development of creating liquidity in a market of heterogeneous assets. In the 1870s, the market for grain did not enjoy the very deep liquidity we see in today’s market. ...

... The history of the Chicago Mercantile Exchange and Chicago Board of Trade may shed some light on the current problem in community development of creating liquidity in a market of heterogeneous assets. In the 1870s, the market for grain did not enjoy the very deep liquidity we see in today’s market. ...

Low Income Housing in Latin America

... Our analysis will help the client in three ways. First, it will provide an assessment of the market for their bonds in Mexico. Our client does not have plans to deploy much, if any, of its bonds in Mexico, despite the market’s size and demographic appropriateness (as we will describe further below). ...

... Our analysis will help the client in three ways. First, it will provide an assessment of the market for their bonds in Mexico. Our client does not have plans to deploy much, if any, of its bonds in Mexico, despite the market’s size and demographic appropriateness (as we will describe further below). ...

Growth in Agricultural Loan Market Share for

... their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may access such as loan participation with correspondent b ...

... their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may access such as loan participation with correspondent b ...

Lending-Standards-Business-Loans-and-Output-CEA-JUNE

... GFC did not materially affect Canada’s financial sector but we did have a drop in GDP • Negative impact on GDP from a tightening of standards disappears in the extended model • Small (but stat sig) response of loans from STANDARDS • Real time data makes little difference to the results ...

... GFC did not materially affect Canada’s financial sector but we did have a drop in GDP • Negative impact on GDP from a tightening of standards disappears in the extended model • Small (but stat sig) response of loans from STANDARDS • Real time data makes little difference to the results ...

Higher Interest Rates Are on the Horizon

... Yet another cost-saving opportunity: A combined revolving line of credit, cash management and money market-like investment account enables customers to keep all their banking activities at one institution. This eliminates fees for transferring funds between institutions. ...

... Yet another cost-saving opportunity: A combined revolving line of credit, cash management and money market-like investment account enables customers to keep all their banking activities at one institution. This eliminates fees for transferring funds between institutions. ...

Project Finance Overview

... made between the two hedge counterparties. It sets out the rules governing how and when those payments are to be made, whether collateral must be posted by one or both parties, and how breakage costs are to be calculated in the event the swap is terminated (by a party defaulting or otherwise) before ...

... made between the two hedge counterparties. It sets out the rules governing how and when those payments are to be made, whether collateral must be posted by one or both parties, and how breakage costs are to be calculated in the event the swap is terminated (by a party defaulting or otherwise) before ...

What is Credit- Teacher Guide

... (Goods and services can cost more when purchased on credit. When people buy things on credit, the interest and fees they must pay amount to a deduction from the money they might otherwise use to buy things they currently want. Also, people sometimes borrow too much. That is, they use too much credit ...

... (Goods and services can cost more when purchased on credit. When people buy things on credit, the interest and fees they must pay amount to a deduction from the money they might otherwise use to buy things they currently want. Also, people sometimes borrow too much. That is, they use too much credit ...

New York Real Estate for Brokers

... Borrowers considered subprime if they have a less-than-perfect credit report Subprime lenders Companies that provide loans to home- ...

... Borrowers considered subprime if they have a less-than-perfect credit report Subprime lenders Companies that provide loans to home- ...

FCA staff - The Farm Credit Council

... Developed conditions that may apply to requests approved by the FCA Board Cannot purchase a bond unless issuer determined bond is a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must b ...

... Developed conditions that may apply to requests approved by the FCA Board Cannot purchase a bond unless issuer determined bond is a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must b ...

Assessing the risk-return trade-off in loans

... of banks as risk managers and profit maximisers. Banks aggregate profits have been analysed by Behr et al. (2007) and Hayden, Porath, and von Westernhagen (2007), among others, who find that more specialisation tends to yield higher returns but also a higher level of risk. However, the optimal degree o ...

... of banks as risk managers and profit maximisers. Banks aggregate profits have been analysed by Behr et al. (2007) and Hayden, Porath, and von Westernhagen (2007), among others, who find that more specialisation tends to yield higher returns but also a higher level of risk. However, the optimal degree o ...

Nonagency MBS, CMBS, ABS

... collateral that is not being used to pay MBS investors and fees (mortgage servicing and administrative services). The excess spread can be used to offset any losses. If the excess interest is retained, it can be accumulated in an account and used to offset futures default losses. ...

... collateral that is not being used to pay MBS investors and fees (mortgage servicing and administrative services). The excess spread can be used to offset any losses. If the excess interest is retained, it can be accumulated in an account and used to offset futures default losses. ...

1 Bank-Borrower Relationships and Transition from Joint Liability to

... of microcredit, if the reputational capital (as evidenced by the borrower’s uninterrupted repayment record) is the only factor that affects the transition from joint to individual liability loans, we should observe a certain threshold number of loan cycles after which every borrower would graduate ...

... of microcredit, if the reputational capital (as evidenced by the borrower’s uninterrupted repayment record) is the only factor that affects the transition from joint to individual liability loans, we should observe a certain threshold number of loan cycles after which every borrower would graduate ...

The Euro and the Geography of International Debt Flows

... liabilities of the five euro area periphery countries, Greece, Italy, Ireland, Portugal, and Spain (the GIIPS), vis-à-vis the rest of the euro area (the “Core”). As is well known, increasing current account deficits of these heavily borrowing countries were accompanied by a marked suppression in th ...

... liabilities of the five euro area periphery countries, Greece, Italy, Ireland, Portugal, and Spain (the GIIPS), vis-à-vis the rest of the euro area (the “Core”). As is well known, increasing current account deficits of these heavily borrowing countries were accompanied by a marked suppression in th ...