example-2015

... incurred through the default of real estate loans caused by the loss in values of the properties used as collateral for those loans. This paper will show how the values decreased by about 29-31% as a result of the reduction in after-tax income from the implementation of the 1986 Tax Reform Act. With ...

... incurred through the default of real estate loans caused by the loss in values of the properties used as collateral for those loans. This paper will show how the values decreased by about 29-31% as a result of the reduction in after-tax income from the implementation of the 1986 Tax Reform Act. With ...

Nov. 30, 2015 - Centre Funds

... endured in the past and can lead to shocks and instability much more quickly as a result of the still high level of leverage and dependence upon ultra‐low interest rates in the financial system. Also, despite falling unemployment, the collapse in real wages and productivity we’re undergoing has been ...

... endured in the past and can lead to shocks and instability much more quickly as a result of the still high level of leverage and dependence upon ultra‐low interest rates in the financial system. Also, despite falling unemployment, the collapse in real wages and productivity we’re undergoing has been ...

Well Worth Saving: How the New Deal Safeguarded Home Ownership

... levels. The ratio of mortgage debt to home values, on the other hand, continued to climb into the early 1930s to levels never seen before. Part of the reason for the rise was the decline in housing values that began sometime between 1925 and 1930. Nonetheless, there was little concern expressed at t ...

... levels. The ratio of mortgage debt to home values, on the other hand, continued to climb into the early 1930s to levels never seen before. Part of the reason for the rise was the decline in housing values that began sometime between 1925 and 1930. Nonetheless, there was little concern expressed at t ...

RTF 49.1 KB - Productivity Commission

... There are also structural effects as population changes – i.e. as the population ages or single households become more common and so on. As this happens the demand for detached dwellings may fall while the demand for units rises. This will impact housing prices because the demand for the total numbe ...

... There are also structural effects as population changes – i.e. as the population ages or single households become more common and so on. As this happens the demand for detached dwellings may fall while the demand for units rises. This will impact housing prices because the demand for the total numbe ...

Grading Bonds on Inverted Curve

... The Fed's overnight funds rate now stands at 5.25%. "The market is pricing in that the Fed funds rate is not going to stay at 5.25% over the next 10 years; it's pricing in that it's going to be considerably lower," said Bill Irving, who runs a long-term Treasury-bondindex fund for Fidelity Investmen ...

... The Fed's overnight funds rate now stands at 5.25%. "The market is pricing in that the Fed funds rate is not going to stay at 5.25% over the next 10 years; it's pricing in that it's going to be considerably lower," said Bill Irving, who runs a long-term Treasury-bondindex fund for Fidelity Investmen ...

Real estate terms and definitions

... home. A Realtor can help locate the neighborhood that meets a buyers needs, navigate the process, understand the paperwork, make or accept an offer, arrange inspections, address problems and negotiate the sale of a house for a seller. A real estate agent earns the Realtor designation by advancing hi ...

... home. A Realtor can help locate the neighborhood that meets a buyers needs, navigate the process, understand the paperwork, make or accept an offer, arrange inspections, address problems and negotiate the sale of a house for a seller. A real estate agent earns the Realtor designation by advancing hi ...

Some Thoughts on Australian House Prices March 2017

... their lending is secured by residential property and partly because their own lending standards play a role in driving demand for housing assets. Beyond the banks, changes in house prices can impact consumer spending, dwelling investment and small business investment. So any major correction would b ...

... their lending is secured by residential property and partly because their own lending standards play a role in driving demand for housing assets. Beyond the banks, changes in house prices can impact consumer spending, dwelling investment and small business investment. So any major correction would b ...

Lift Off - Kapstream

... from nearly 10% to 5.4% and the 8 million jobs lost during the crisis had been recovered more than a year ago, plus an additional 2 million jobs have been created since. The US is moving closer to a balanced budget with forecasts even calling for an eventual budget surplus, the first time in more th ...

... from nearly 10% to 5.4% and the 8 million jobs lost during the crisis had been recovered more than a year ago, plus an additional 2 million jobs have been created since. The US is moving closer to a balanced budget with forecasts even calling for an eventual budget surplus, the first time in more th ...

here - University of Nottingham

... - Lower bank dependence (disintermediation) over time may reduce importance of banks. - Greater emphasis on foreign investor participation in onshore and offshore markets may alter financial structure. - Lengthening of maturity by firms may alter sensitivity of firms to capital outflows/withdrawal o ...

... - Lower bank dependence (disintermediation) over time may reduce importance of banks. - Greater emphasis on foreign investor participation in onshore and offshore markets may alter financial structure. - Lengthening of maturity by firms may alter sensitivity of firms to capital outflows/withdrawal o ...

Lynch, Troy - FSI terms of reference

... Though the terms of reference of this enquiry will ‘not make recommendations on the objectives and procedures of the Reserve Bank of Australia (RBA) in its conduct of monetary policy,’ it behoves the inquiry to examine the conduct and implications of the Reserve Bank of Australia. It is unreasonable ...

... Though the terms of reference of this enquiry will ‘not make recommendations on the objectives and procedures of the Reserve Bank of Australia (RBA) in its conduct of monetary policy,’ it behoves the inquiry to examine the conduct and implications of the Reserve Bank of Australia. It is unreasonable ...

REAL CLIENT MANAGED PORTFOLIOS MEMORANDUM

... slightly lower than the pre-crisis level. Therefore, it is reasonable for us to predict a declining trend of profit margin to below 14% in five years. We used the annualized holding period return as Return on Equity, 4% risk free rate, 6% market risk premium, and since Gentex doesn’t carry on any ki ...

... slightly lower than the pre-crisis level. Therefore, it is reasonable for us to predict a declining trend of profit margin to below 14% in five years. We used the annualized holding period return as Return on Equity, 4% risk free rate, 6% market risk premium, and since Gentex doesn’t carry on any ki ...

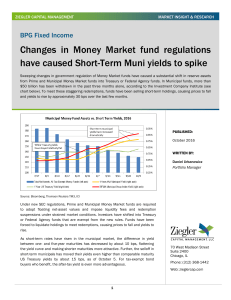

Changes In Money Market Fund Regulations

... suspensions under strained market conditions. Investors have shifted into Treasury or Federal Agency funds that are exempt from the new rules. Funds have been forced to liquidate holdings to meet redemptions, causing prices to fall and yields to rise. As short-term rates have risen in the municipal ...

... suspensions under strained market conditions. Investors have shifted into Treasury or Federal Agency funds that are exempt from the new rules. Funds have been forced to liquidate holdings to meet redemptions, causing prices to fall and yields to rise. As short-term rates have risen in the municipal ...

February 6, 2015

... Hospira’s closing stock price on Wednesday. It expects the deal to close later this year. Hospira stock increased by 35% to nearly $88 on Thursday, while Pfizer stock rose 2.7% to $32.93. Hospira makes generic versions of injectable drugs which are widely used in hospitals. It also sells biosimilars ...

... Hospira’s closing stock price on Wednesday. It expects the deal to close later this year. Hospira stock increased by 35% to nearly $88 on Thursday, while Pfizer stock rose 2.7% to $32.93. Hospira makes generic versions of injectable drugs which are widely used in hospitals. It also sells biosimilars ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.