The Fed`s 405% problem

... The broadly held consensus of strong US growth and higher rates took a bit of a knock in the past week, when Fed Chairman Ben Bernanke delayed tapering of QE. The markets had fully priced the policy change. What monster on the horizon prompted the U-turn? The official reason is that the economic dat ...

... The broadly held consensus of strong US growth and higher rates took a bit of a knock in the past week, when Fed Chairman Ben Bernanke delayed tapering of QE. The markets had fully priced the policy change. What monster on the horizon prompted the U-turn? The official reason is that the economic dat ...

Global Recession: Spending Cuts Are Not the Answer

... as 20% on 2008. By contrast, Birdsall (2009) estimates that no less than $1 trillion in development assistance must be unlocked to help developing countries cope with the crisis. The state of commodity prices is a problem too, particularly for those developing countries that are net importers of oil ...

... as 20% on 2008. By contrast, Birdsall (2009) estimates that no less than $1 trillion in development assistance must be unlocked to help developing countries cope with the crisis. The state of commodity prices is a problem too, particularly for those developing countries that are net importers of oil ...

G.S. 58-7-173

... Bonds, notes, or other interest-bearing or interest-accruing obligations of any solvent institution organized under the laws of the United States, of any state, Canada or any Canadian province; provided the instruments are designated and valued in accordance with the Purposes and Procedures Manual o ...

... Bonds, notes, or other interest-bearing or interest-accruing obligations of any solvent institution organized under the laws of the United States, of any state, Canada or any Canadian province; provided the instruments are designated and valued in accordance with the Purposes and Procedures Manual o ...

10 Best States for First-Time Homebuyers

... The ratio of first-time home buyers in Massachusetts saw a big jump from 2003 to 2013 -- 74.3 percent -- showing more residents in the state are ready to take the leap. The state also has a foreclosure rate on the lower end, showing that its residents have a good chance at retaining homeownership on ...

... The ratio of first-time home buyers in Massachusetts saw a big jump from 2003 to 2013 -- 74.3 percent -- showing more residents in the state are ready to take the leap. The state also has a foreclosure rate on the lower end, showing that its residents have a good chance at retaining homeownership on ...

EM Corporate Bonds – Cheap Again

... With lots of negative news and deteriorating sentiment around emerging markets related to the financial implications of lower commodity prices, currency devaluations and slower economic growth, might there be any value in those markets? We have repeatedly argued that poor liquidity has exaggerated p ...

... With lots of negative news and deteriorating sentiment around emerging markets related to the financial implications of lower commodity prices, currency devaluations and slower economic growth, might there be any value in those markets? We have repeatedly argued that poor liquidity has exaggerated p ...

Fair Value Hierarchy In determining fair value, we utilize various

... various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted market price of publicly traded securities with similar duration and yield, time value, yield curve, a ...

... various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted market price of publicly traded securities with similar duration and yield, time value, yield curve, a ...

Coastlines - Sunshine Coast Credit Union

... over $500,000 having been purchased to date by members. Sunshine Coast Credit Union’s Class D Equity Share dividends, in recent years, have paid well above prevailing interest rates. “This product has allowed members to share even further in the credit union’s success,” says Eichar. Also sharing in ...

... over $500,000 having been purchased to date by members. Sunshine Coast Credit Union’s Class D Equity Share dividends, in recent years, have paid well above prevailing interest rates. “This product has allowed members to share even further in the credit union’s success,” says Eichar. Also sharing in ...

THE FIRST-WORLD DEBT CRISIS IN GLOBAL PERSPECTIVE

... • Demand shock from falling house prices • New defaults in corporate & consumer debt INTERNATIONAL • Perverse interaction b/w capital markets and foreign exchange rate • Internat. rules: Basel 2 and IAS 39 ...

... • Demand shock from falling house prices • New defaults in corporate & consumer debt INTERNATIONAL • Perverse interaction b/w capital markets and foreign exchange rate • Internat. rules: Basel 2 and IAS 39 ...

Weekly Advisor Analysis 06-24-13 PAA

... However, a potential problem which can arise when financial institutions become illiquid is that business activity can seize up due to extraordinarily high borrowing costs. Furthermore, this can result in slower economic growth at a time when China’s economy is already decelerating. It appears by n ...

... However, a potential problem which can arise when financial institutions become illiquid is that business activity can seize up due to extraordinarily high borrowing costs. Furthermore, this can result in slower economic growth at a time when China’s economy is already decelerating. It appears by n ...

Recent volatility in the markets has resulted in more fear and anxiety

... all that it will entail both financially and geopolitically. We also believe it is important not to over react to the noise that has been created in the short term. Although it remains to be seen whether the stock markets will push lower, we don’t believe we will see a retracement to, or near, the l ...

... all that it will entail both financially and geopolitically. We also believe it is important not to over react to the noise that has been created in the short term. Although it remains to be seen whether the stock markets will push lower, we don’t believe we will see a retracement to, or near, the l ...

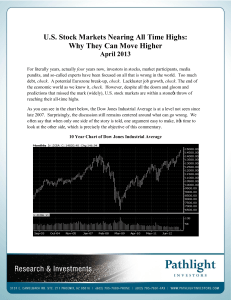

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... But let’s look at what actually happened. The European Central Bank backstopped its banking system. We are aware that European troubles still persist and that a real solution is not in place; however, we think those betting on an imminent Euro collapse are severely underestimating the power of monet ...

... But let’s look at what actually happened. The European Central Bank backstopped its banking system. We are aware that European troubles still persist and that a real solution is not in place; however, we think those betting on an imminent Euro collapse are severely underestimating the power of monet ...

December 25, 2015

... gained +2.97% and +3.01%, respectively. The Nasdaq composite rose +2.55%, ending the week at 5,048. Canada’s Toronto Stock Exchange Index gained also, rising +2.3%. Among European markets, the United Kingdom’s FTSE led the way up with a pop of +3.3%, Germany’s DAX gained +1.1% and France’s CAC 40 ad ...

... gained +2.97% and +3.01%, respectively. The Nasdaq composite rose +2.55%, ending the week at 5,048. Canada’s Toronto Stock Exchange Index gained also, rising +2.3%. Among European markets, the United Kingdom’s FTSE led the way up with a pop of +3.3%, Germany’s DAX gained +1.1% and France’s CAC 40 ad ...

Real Money Rob Rikoon Good news for retirees: low

... real economy to be stuck in neutral. Today, with ultra-low interest rates, banks do not have to lend money to real companies when they can make similar returns, with almost no risk, by playing it safe and keeping their money in government securities. When rates rise, this will no longer be true as b ...

... real economy to be stuck in neutral. Today, with ultra-low interest rates, banks do not have to lend money to real companies when they can make similar returns, with almost no risk, by playing it safe and keeping their money in government securities. When rates rise, this will no longer be true as b ...

Monthly Column Anchored on a drifting seabed Imagine you are

... moves on and the gold price actually falls? Investors risk hanging onto a losing investment by clinging to these psychological price anchors. Forecasts of share prices, economic growth, consumer demand or commodity supply are invariably anchored to the current state of affairs, combined with an anal ...

... moves on and the gold price actually falls? Investors risk hanging onto a losing investment by clinging to these psychological price anchors. Forecasts of share prices, economic growth, consumer demand or commodity supply are invariably anchored to the current state of affairs, combined with an anal ...

Why Equity Funds? - Federated Investors

... The value of equity securities in a mutual fund will rise and fall. These fluctuations could be a sustained trend or a drastic movement. A fund’s portfolio will reflect changes in prices of individual portfolio stocks or general changes in stock valuations. Consequently, a fund’s share price may dec ...

... The value of equity securities in a mutual fund will rise and fall. These fluctuations could be a sustained trend or a drastic movement. A fund’s portfolio will reflect changes in prices of individual portfolio stocks or general changes in stock valuations. Consequently, a fund’s share price may dec ...

Chapter 17 An Introduction to the Process of Real Estate Finance

... Yield Curve (Contd.) Real risk free rates in the United States ...

... Yield Curve (Contd.) Real risk free rates in the United States ...

New Century Financial - San Francisco State University

... through its operating subsidiaries. The company enjoyed a rapid growth since its founding, from $357 million mortgage loans in 1996 to approximately $60 billion in 2006.New Century’s Equity securities started to trade on New York Stock Exchange from 1997. In 2004, New Century changed its corporate s ...

... through its operating subsidiaries. The company enjoyed a rapid growth since its founding, from $357 million mortgage loans in 1996 to approximately $60 billion in 2006.New Century’s Equity securities started to trade on New York Stock Exchange from 1997. In 2004, New Century changed its corporate s ...

PDF 212KB - Reserve Bank of New Zealand

... When supply is relatively constrained in the short‐term, swings in demand matter a lot for the determination of house prices. Lots of factors influence changes in the demand for housing but factors such as migration and demography appear to have been particul ...

... When supply is relatively constrained in the short‐term, swings in demand matter a lot for the determination of house prices. Lots of factors influence changes in the demand for housing but factors such as migration and demography appear to have been particul ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.