Housing Association Sector Restruturing

... Umbrella parent groups – a non-asset owning parent agency with ultimate control over group subsidiaries including at least one stock-owning HA. ...

... Umbrella parent groups – a non-asset owning parent agency with ultimate control over group subsidiaries including at least one stock-owning HA. ...

Quarterly Review - Q1 - Boston Advisors, LLC

... data taken by NBC on Trump’s job approval ratings. The results indicate that the President’s approval has decreased, which could further impact his credibility and ability to get things done. However, he has a reputation as a good dealmaker and many believe that with a bit more political experience ...

... data taken by NBC on Trump’s job approval ratings. The results indicate that the President’s approval has decreased, which could further impact his credibility and ability to get things done. However, he has a reputation as a good dealmaker and many believe that with a bit more political experience ...

World Bank Document

... purchased or guaranteed by these GSEs, and the government is now on the hook for these mortgages. How did this happen? There were two key economic principles that were ignored. One is that if the government and taxpayers stand behind the financial obligations of a company, the company should be reg ...

... purchased or guaranteed by these GSEs, and the government is now on the hook for these mortgages. How did this happen? There were two key economic principles that were ignored. One is that if the government and taxpayers stand behind the financial obligations of a company, the company should be reg ...

Total financial assets

... • Risk-Return Trade-Off • How do we measure risk? • How does diversification affect risk? ...

... • Risk-Return Trade-Off • How do we measure risk? • How does diversification affect risk? ...

Select Consulting, Inc.

... every year. Income growth is an issue as well. When the recession officially ended in 2009, real median household income had fallen over $2,000 from its 2007 peak of $56,063. In January, real median household income was reported at $51,584, fully $4,479 lower than the peak in 2007. As for net worth, ...

... every year. Income growth is an issue as well. When the recession officially ended in 2009, real median household income had fallen over $2,000 from its 2007 peak of $56,063. In January, real median household income was reported at $51,584, fully $4,479 lower than the peak in 2007. As for net worth, ...

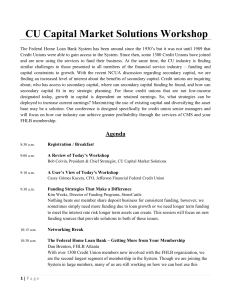

CU Capital Market Solutions Workshop

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

“Defying Gravity” Can the Equity Markets Continue to Push Higher

... gallon, it will be a major impediment to consumer spending. Due to the fact that there is not much wage growth, higher gasoline prices and higher interest rates are very combative to the consumer. Furthermore, diesel prices are very high which affects corporate business due to most tr ...

... gallon, it will be a major impediment to consumer spending. Due to the fact that there is not much wage growth, higher gasoline prices and higher interest rates are very combative to the consumer. Furthermore, diesel prices are very high which affects corporate business due to most tr ...

Slides session 7 - Prof. Dr. Dennis Alexis Valin Dittrich

... Result: economic growth was zero during this period. ...

... Result: economic growth was zero during this period. ...

14-June-Property-buyers-face-new-threat-from

... Lenders' speed limit That means lenders nearing – or breaching – the speed limit are either raising rates and fees, or in some cases not accepting more loans until demand has cooled. For example, Teachers Mutual Bank and subsidiary UniBank, which have more than $5.4 billion in assets and 175,000 mem ...

... Lenders' speed limit That means lenders nearing – or breaching – the speed limit are either raising rates and fees, or in some cases not accepting more loans until demand has cooled. For example, Teachers Mutual Bank and subsidiary UniBank, which have more than $5.4 billion in assets and 175,000 mem ...

December 16, 2016

... Housing starts tumbled -18% in November, pulling away from the 9-year high set in October. Following the +25.5% surge in October, homebuilding activity fell more than expected in November due to broad weakness in construction activity. Groundbreaking on new housing projects dropped to a seasonally ...

... Housing starts tumbled -18% in November, pulling away from the 9-year high set in October. Following the +25.5% surge in October, homebuilding activity fell more than expected in November due to broad weakness in construction activity. Groundbreaking on new housing projects dropped to a seasonally ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.