Korean Real Estate Market Mechanisms and Deregulation of

... lenders, financial institutions, and investors have become anxious that an economic recession similar to the Great Depression could occur (Lander et al. 2009). Korea is no exception to this rule. In fact, the Korean real estate market has also experienced a cooling down of business because of the gl ...

... lenders, financial institutions, and investors have become anxious that an economic recession similar to the Great Depression could occur (Lander et al. 2009). Korea is no exception to this rule. In fact, the Korean real estate market has also experienced a cooling down of business because of the gl ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

Weekly Relative Value - Balance Sheet Solutions

... The Bank for International Settlements (the central bank of central banks) also issued similar ominous warnings. The Bank for International Settlements believes interest rates have been too low for too long, encouraging too much risk-taking in financial markets. All of them fear that the global fina ...

... The Bank for International Settlements (the central bank of central banks) also issued similar ominous warnings. The Bank for International Settlements believes interest rates have been too low for too long, encouraging too much risk-taking in financial markets. All of them fear that the global fina ...

Model of Market Equilibrium in Regional Housing Markets in Russia

... affordability ratio reduction by approximately 7%. Therefore, within 10 years of economic growth at an average rate of 5% per year the housing affordability ratio should fall down approximately by 30%. In this context housing is no exception from a large group of other goods and services, the increa ...

... affordability ratio reduction by approximately 7%. Therefore, within 10 years of economic growth at an average rate of 5% per year the housing affordability ratio should fall down approximately by 30%. In this context housing is no exception from a large group of other goods and services, the increa ...

Read more - Scott Investment Advisors

... year-over-year. Expectations for wage inflation to finally begin to take root has been high for months, yet it hasn't budged in spite of the significant decline in the unemployment rate over the past few years. Should the rate of job growth begin to fall to lower levels this year as we've been predi ...

... year-over-year. Expectations for wage inflation to finally begin to take root has been high for months, yet it hasn't budged in spite of the significant decline in the unemployment rate over the past few years. Should the rate of job growth begin to fall to lower levels this year as we've been predi ...

Irish House Prices: Will the Roof Cave In?

... similar slump would occur in the Irish housing market. However, the Central Bank has suggested that a property bubble exists and this could damage the current economic boom. In addition a report by Bacon, Murphy and MacCabe (1998) stated that “there are risks of a ‘perverse cycle’ emerging in which ...

... similar slump would occur in the Irish housing market. However, the Central Bank has suggested that a property bubble exists and this could damage the current economic boom. In addition a report by Bacon, Murphy and MacCabe (1998) stated that “there are risks of a ‘perverse cycle’ emerging in which ...

The Freedom Recovery Plan

... disbelief in continuingly rising home prices and their decoupling of the carrying costs of homes from the costs of renting equivalent properties and the countervailing trends in personal incomes. That the ready availability of trillions of dollars of cheaply priced, loosely originated loans pushed r ...

... disbelief in continuingly rising home prices and their decoupling of the carrying costs of homes from the costs of renting equivalent properties and the countervailing trends in personal incomes. That the ready availability of trillions of dollars of cheaply priced, loosely originated loans pushed r ...

May 12, 2017

... Across the Atlantic in the United Kingdom, Bank of England governor Mark Carney warned of a potential consumer spending squeeze as inflation rises and real household wages fall. Mr. Carney said this year will be “a more challenging time for British households” as “wages won’t keep up with prices.” T ...

... Across the Atlantic in the United Kingdom, Bank of England governor Mark Carney warned of a potential consumer spending squeeze as inflation rises and real household wages fall. Mr. Carney said this year will be “a more challenging time for British households” as “wages won’t keep up with prices.” T ...

How might bond finance expand affordable housing in Australia?

... level of return) or by a high rating, reflecting a low risk. This is why enhancements (e.g. government guarantees or tax incentives) are required to reduce risk and improve HSB yields. The HSB proposal was modelled using an assumed scheme to raise $7 billion to finance 20 000 dwellings. On the basis ...

... level of return) or by a high rating, reflecting a low risk. This is why enhancements (e.g. government guarantees or tax incentives) are required to reduce risk and improve HSB yields. The HSB proposal was modelled using an assumed scheme to raise $7 billion to finance 20 000 dwellings. On the basis ...

Powerpoint of Housing Crisis/Economics

... or even tell the truth, because no one checked. • Well, that increased Demand for homes, did what you’d expect, it made house prices skyrocket. ...

... or even tell the truth, because no one checked. • Well, that increased Demand for homes, did what you’d expect, it made house prices skyrocket. ...

Housing Affordability: has the great Australian dream ended?

... How did we get there? Implications and explanations of changes that have occurred ...

... How did we get there? Implications and explanations of changes that have occurred ...

Was there a stock market bubble in Hungary?

... bubbles with mania (when prices are increasing) and panic (when prices are dropping). For the most part, after crashes firms have difficulties in going public, make IPOs, and listed companies could not (and wish not to) rise their capital. They may look for other forms of financing, but as the stock ...

... bubbles with mania (when prices are increasing) and panic (when prices are dropping). For the most part, after crashes firms have difficulties in going public, make IPOs, and listed companies could not (and wish not to) rise their capital. They may look for other forms of financing, but as the stock ...

Bulletin COR 14-045: Cash Reserve Requirements

... o subordinate financing payments • Base cash reserves for all transactions on the fully amortizing PITIA payment at the qualifying rate. ...

... o subordinate financing payments • Base cash reserves for all transactions on the fully amortizing PITIA payment at the qualifying rate. ...

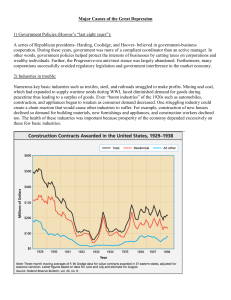

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.