Introduction - Missouri Center for Career Education

... 17. Buying stock in a company would be a good way for me to invest my weekly paycheck. Purchasing stock is an investment option once all fixed expenses are accounted for and the variable expenses have been covered to the best of one’s ability. Investing in stock must be considered for a long term. S ...

... 17. Buying stock in a company would be a good way for me to invest my weekly paycheck. Purchasing stock is an investment option once all fixed expenses are accounted for and the variable expenses have been covered to the best of one’s ability. Investing in stock must be considered for a long term. S ...

Presented by

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

PROBLEM SET 2 Solutions 14.02 Principles of Macroeconomics February 23, 2005

... False. When the nominal interest rate is already 0 (liquidity trap), governments cannot increase money supply. 3. Investment decreases if government spending increases. @I @I @Y @I @i @Y @Y @I @I @i Uncertain. Given I = I(Y; i), @G = @Y @G + @i @Y @G = @G @Y + @i @Y 7 @I @I @i @I 0 since @Y + @i @Y ...

... False. When the nominal interest rate is already 0 (liquidity trap), governments cannot increase money supply. 3. Investment decreases if government spending increases. @I @I @Y @I @i @Y @Y @I @I @i Uncertain. Given I = I(Y; i), @G = @Y @G + @i @Y @G = @G @Y + @i @Y 7 @I @I @i @I 0 since @Y + @i @Y ...

Word

... purchase of real estate for rent. The rates were low throughout the whole year 2015, regardless of the fixation period. Nevertheless, those who negotiated the loan in June with the fixation of the interest rate over 1 and up to 5 years (2.32%), reached the most advantageous conditions, even historic ...

... purchase of real estate for rent. The rates were low throughout the whole year 2015, regardless of the fixation period. Nevertheless, those who negotiated the loan in June with the fixation of the interest rate over 1 and up to 5 years (2.32%), reached the most advantageous conditions, even historic ...

Review Packet

... be purchased in large amounts for a relatively small initial premium, it is well suited for providing life insurance protection during the child-raising years. Liability Insurance is insurance protects you from being held responsible for another party’s losses; for example when you own a store or ...

... be purchased in large amounts for a relatively small initial premium, it is well suited for providing life insurance protection during the child-raising years. Liability Insurance is insurance protects you from being held responsible for another party’s losses; for example when you own a store or ...

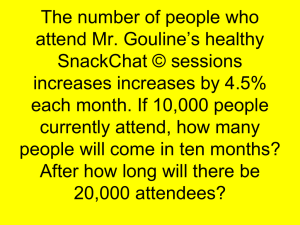

The value of Mr. Gouline’s car is cut in half every three

... 75 pound block of radium, but it is too heavy. If he waits until the radium is 60 pounds, how long will he have to wait? ...

... 75 pound block of radium, but it is too heavy. If he waits until the radium is 60 pounds, how long will he have to wait? ...

interest rates and your fixed income investments

... one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. 3. Source: © 2017 Morningstar. Returns include reinvestment of interest. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past p ...

... one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. 3. Source: © 2017 Morningstar. Returns include reinvestment of interest. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past p ...

Quantitative Techniques and Financial Mathematics

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

Quantitative Techniques and Financial Mathematics

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

Quantitative Techniques and Financial Mathematics

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

... NPV=C0+C1/(1+r).Where C0 is cash flow today which will be negative. Relation of risk to present value-We do not use the same discount factor while comparing alternative investment avenues. The discount rate for PPF may be 9%,or 0.09 but discount rate for the building property may be 11% or0.11.Only ...

YEARNING FOR YIELD

... Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of p ...

... Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of p ...

HOMEWORK 3 SOLUTION Chapter 8 1. Assume that your company

... The risks are interest rate risk because the Euromarket loan is on floating rate terms, and roll‐over risk if the bank has the option to refuse to renew or roll‐over the loan. If ABC has a commitment for the year, then it has no roll‐over risk as long as the bank remains in operat ...

... The risks are interest rate risk because the Euromarket loan is on floating rate terms, and roll‐over risk if the bank has the option to refuse to renew or roll‐over the loan. If ABC has a commitment for the year, then it has no roll‐over risk as long as the bank remains in operat ...

Negative Interest Rates – A Panacea?

... time. Real estate developers can borrow more for a larger, new building investment; corporations can put more capital projects to work since the cost to finance them has dropped. The economy starts to perk up. Suppliers of funds (savers) have a different incentive. They want more interest and a high ...

... time. Real estate developers can borrow more for a larger, new building investment; corporations can put more capital projects to work since the cost to finance them has dropped. The economy starts to perk up. Suppliers of funds (savers) have a different incentive. They want more interest and a high ...

**** 1

... the rate as prescribed in the Ordinance of the Prime Ministry, within the scope of not exceeding 3/1000 per annum of their loans. ...

... the rate as prescribed in the Ordinance of the Prime Ministry, within the scope of not exceeding 3/1000 per annum of their loans. ...

IRD - Mortgage Concepts Inc.

... Let’s take a closer look at how most Banks calculate INTEREST RATE DIFFERENTIAL While, advertising low rates for new business, the Bank’s published interest rates are generally much higher and be can found in the fine print of the mortgage commitment. Although, it seems like you are catching a great ...

... Let’s take a closer look at how most Banks calculate INTEREST RATE DIFFERENTIAL While, advertising low rates for new business, the Bank’s published interest rates are generally much higher and be can found in the fine print of the mortgage commitment. Although, it seems like you are catching a great ...

Show all necessary work in a neat and orderly manner.

... intensity during the 11th, 12th, and 13th hours. Do NOT integrate. ...

... intensity during the 11th, 12th, and 13th hours. Do NOT integrate. ...

Year 11 Mathematics Standard Topic Guidance

... Students can use prepared spreadsheets to determine Pay As You Go (PAYG) income tax and the Medicare levy for different taxable incomes. The internet can be used to provide up-to-date financial information, for example interest rates, income tax scales, current values of vehicles, stamp-duty rates, ...

... Students can use prepared spreadsheets to determine Pay As You Go (PAYG) income tax and the Medicare levy for different taxable incomes. The internet can be used to provide up-to-date financial information, for example interest rates, income tax scales, current values of vehicles, stamp-duty rates, ...

Chapter 16 Chapter 16 1- A Prepare journal entries for the following

... On July 1, Whyte Co. accepted a $20,000, 90-day, 12% notes from Olson Inc. for the purchase of equipment. On July 31, Whyte discounts the note receivable at First Federal Savings. The bank charges a discount rate of 15%. ...

... On July 1, Whyte Co. accepted a $20,000, 90-day, 12% notes from Olson Inc. for the purchase of equipment. On July 31, Whyte discounts the note receivable at First Federal Savings. The bank charges a discount rate of 15%. ...

homework 3

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

money_lecs_2_2013_v3_post

... to rise in coming years. Note that this can explain why Fed makes statement about future rates (look back at Fed statement.) ...

... to rise in coming years. Note that this can explain why Fed makes statement about future rates (look back at Fed statement.) ...

EU MONETARY AND FISCAL POLICY TOPICS IN ECONOMIC …

... • 1) It’s what I have to pay in order to borrow a given quantity of money (mortgage, etc) • 2) It’s what I give up in order to be able to hold money in my pocket (= liquidity) : opportunity cost. Raising the interest rate makes money more expensive (so it cools down the economy) Decreasing the inter ...

... • 1) It’s what I have to pay in order to borrow a given quantity of money (mortgage, etc) • 2) It’s what I give up in order to be able to hold money in my pocket (= liquidity) : opportunity cost. Raising the interest rate makes money more expensive (so it cools down the economy) Decreasing the inter ...

Personal Finance Jeopardy $100

... $800 a month on rent and $20 a week on gas to get too and from work. How much are Staci’s monthly expenses if there are 4 weeks in a month? Food, Entertainment, and Personal Items $50 x 4 = $200 each ($600); Rent $800 a month; Transportation is $20 x 4 = $80. ...

... $800 a month on rent and $20 a week on gas to get too and from work. How much are Staci’s monthly expenses if there are 4 weeks in a month? Food, Entertainment, and Personal Items $50 x 4 = $200 each ($600); Rent $800 a month; Transportation is $20 x 4 = $80. ...

Module Capital Flows and the Balance of Payments

... savers in the United States do with their money? Savers in the U.S. begin to look for countries like Australia where the return on a financial asset is higher! ...

... savers in the United States do with their money? Savers in the U.S. begin to look for countries like Australia where the return on a financial asset is higher! ...