Module C - Treasury Management

... to by Reserve Bank of India. Under OMO Operations Reserve Bank of India as a market regulator keeps buying or/and selling securities through it's open market window. It's decision to sell or/and buy securities is influenced by factors such as overall liquidity in the system, ...

... to by Reserve Bank of India. Under OMO Operations Reserve Bank of India as a market regulator keeps buying or/and selling securities through it's open market window. It's decision to sell or/and buy securities is influenced by factors such as overall liquidity in the system, ...

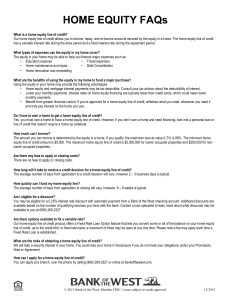

HOME EQUITY FAQs - Bank of the West

... • Benefit from greater financial control. If you’re approved for a home equity line of credit, withdraw what you need, whenever you need it and only pay interest on the funds you use. Do I have to own a home to get a home equity line of credit? Yes, you must own a home to have a home equity line of ...

... • Benefit from greater financial control. If you’re approved for a home equity line of credit, withdraw what you need, whenever you need it and only pay interest on the funds you use. Do I have to own a home to get a home equity line of credit? Yes, you must own a home to have a home equity line of ...

Final accounts of non trading organisation

... Income shown by income and expenditure Add income o/s at the beginning of year Add income recived in advance at the end of year Less income received in adv.at the beginning of year less income o/s at the end of year. ...

... Income shown by income and expenditure Add income o/s at the beginning of year Add income recived in advance at the end of year Less income received in adv.at the beginning of year less income o/s at the end of year. ...

report - Blackpool Council

... borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 2010 over 7 years. This loan is scheduled to be repaid in equal instalments on the 30th September and 31st March each year. The 2010/2011 requirements for the remainder o ...

... borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 2010 over 7 years. This loan is scheduled to be repaid in equal instalments on the 30th September and 31st March each year. The 2010/2011 requirements for the remainder o ...

ITEM 9 Treasury Management Annual Report 2011_12

... Fixed rate investments and borrowings are those where the rate of interest is fixed for the whole financial year. Instruments that mature during the financial year are classed as variable rate. All of the Council’s investments are deemed to be variable rate while the whole of its borrowing is at fix ...

... Fixed rate investments and borrowings are those where the rate of interest is fixed for the whole financial year. Instruments that mature during the financial year are classed as variable rate. All of the Council’s investments are deemed to be variable rate while the whole of its borrowing is at fix ...

Chapter 23

... The Monetary Policy Transmission Mechanism • Bank Lending and Balance Sheet Channels • By altering the supply of funds to the banking system, policymakers can affect banks' ability and willingness to lend. • an open market purchase has a direct impact on the supply of loans, increasing their availa ...

... The Monetary Policy Transmission Mechanism • Bank Lending and Balance Sheet Channels • By altering the supply of funds to the banking system, policymakers can affect banks' ability and willingness to lend. • an open market purchase has a direct impact on the supply of loans, increasing their availa ...

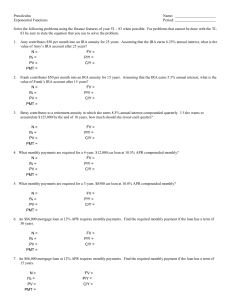

Solve the following problems using the finance

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

What are assets?

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

It is not appropriate to discount the cash flows of a bond by the yield

... Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount b ...

... Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount b ...

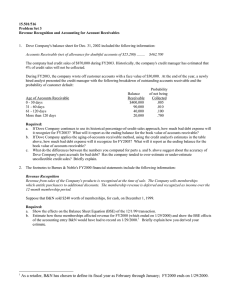

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented the credit manager with the following breakdown of outstanding accounts receivable and the probability of customer default: Probability Balance of not being Ag ...

... During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented the credit manager with the following breakdown of outstanding accounts receivable and the probability of customer default: Probability Balance of not being Ag ...

Medical Office Lesson 5 Practice Quiz

... Bank draft-Check that is a written order to pay funds drawn by a bank on its account at another bank. Traveler’s check- For travelers. Two signatures are required on checks, Denominations of $10, $20, $50, and $100. Limited check-Limited as to the amount of the check as well as the time during which ...

... Bank draft-Check that is a written order to pay funds drawn by a bank on its account at another bank. Traveler’s check- For travelers. Two signatures are required on checks, Denominations of $10, $20, $50, and $100. Limited check-Limited as to the amount of the check as well as the time during which ...

official - Government Printing Press

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

Which of the following arguments about purchasing

... 5) The government of Sweden has recently announced a five-year plan for economic growth and it includes a more comfortable business environment for foreign investors, intended to attract foreign capital. Investors in the US (especially those in Ypsilanti) are enchanted by this opportunity and decide ...

... 5) The government of Sweden has recently announced a five-year plan for economic growth and it includes a more comfortable business environment for foreign investors, intended to attract foreign capital. Investors in the US (especially those in Ypsilanti) are enchanted by this opportunity and decide ...

Reconciling the Cambridge and Wall Street

... utilization around the normal rate • ‘The stock adjustment principle, with its particular desired level of stocks, is itself a simplification. It would be more realistic to suppose that there is a range or interval, within which the level of stock is “comfortable”, so that no special measures seem c ...

... utilization around the normal rate • ‘The stock adjustment principle, with its particular desired level of stocks, is itself a simplification. It would be more realistic to suppose that there is a range or interval, within which the level of stock is “comfortable”, so that no special measures seem c ...

CAMPUS POLICY

... purposes are classified for accounting and reporting purposes into “funds” that are in accordance with the activities or objectives specified for the resources. Fund- A self-balancing set of records that include assets, liabilities, revenue, expense, transfers and fund balance. Speed type- An eight ...

... purposes are classified for accounting and reporting purposes into “funds” that are in accordance with the activities or objectives specified for the resources. Fund- A self-balancing set of records that include assets, liabilities, revenue, expense, transfers and fund balance. Speed type- An eight ...

Low interest rates and implications for financial stability

... Two main views on drivers of interest rates • Financial cycles (Borio, 2012; Lo and Rogoff, 2015): • Economic agents accumulated excessive debt in the period before the crisis, based on optimistic expectations • Consequence: Extensive deleverage, dampening of investment and real interest rates, decl ...

... Two main views on drivers of interest rates • Financial cycles (Borio, 2012; Lo and Rogoff, 2015): • Economic agents accumulated excessive debt in the period before the crisis, based on optimistic expectations • Consequence: Extensive deleverage, dampening of investment and real interest rates, decl ...

We analyze the business-cycle dynamics of commercial bank

... deposit market segments (e.g., ordinary savings deposits) either to buffer adverse shocks to other (more competitive) deposit market segments (e.g., time deposits or eurodeposits) or to their loan customers. Previous empirical studies of bank spreads had several limitations: 1) they focused almost e ...

... deposit market segments (e.g., ordinary savings deposits) either to buffer adverse shocks to other (more competitive) deposit market segments (e.g., time deposits or eurodeposits) or to their loan customers. Previous empirical studies of bank spreads had several limitations: 1) they focused almost e ...

the 9-letter dirty word - global plains advisory group

... Let’s say you have a CD you want to put into your portfolio to be invested, hopefully for a higher return. You usually wait until maturity to avoid paying the six-month penalty that banks frequently impose. It makes sense when CD rates are high, but not always when they’re low. We called a bank for ...

... Let’s say you have a CD you want to put into your portfolio to be invested, hopefully for a higher return. You usually wait until maturity to avoid paying the six-month penalty that banks frequently impose. It makes sense when CD rates are high, but not always when they’re low. We called a bank for ...

International Housing Association

... Mandatory deposit by companies into specific account for individual employees equal to 8% of monthly salary Principal means of withdrawal: Dismissal without cause Retirement Purchase of own home Investments in fund are for real-estate credits (up to 10 minimum monthly salaries) and urban devel ...

... Mandatory deposit by companies into specific account for individual employees equal to 8% of monthly salary Principal means of withdrawal: Dismissal without cause Retirement Purchase of own home Investments in fund are for real-estate credits (up to 10 minimum monthly salaries) and urban devel ...

FAQ - Countercyclical Capital Buffers and Other Systemically

... The CCB is a macro-prudential tool introduced under the European Union (Capital Requirements) Regulations 2014 (S.I. 158 of 2014).1 It is a time-varying capital requirement for banks (and investment firms) which aims to protect the banking sector from potential losses that can arise when excessive c ...

... The CCB is a macro-prudential tool introduced under the European Union (Capital Requirements) Regulations 2014 (S.I. 158 of 2014).1 It is a time-varying capital requirement for banks (and investment firms) which aims to protect the banking sector from potential losses that can arise when excessive c ...

Iowa State University, Department of Economics

... 1. (4pts/H1) A weaker U.S. dollar will make A) U.S. consumers happy because imported goods will be cheaper B) U.S. consumers unhappy because imported goods will cost more C) U.S. businesses that make products for export happy because foreigners can afford more US products D) U.S. businesses that mak ...

... 1. (4pts/H1) A weaker U.S. dollar will make A) U.S. consumers happy because imported goods will be cheaper B) U.S. consumers unhappy because imported goods will cost more C) U.S. businesses that make products for export happy because foreigners can afford more US products D) U.S. businesses that mak ...

Annex A - Hong Kong Monetary Authority

... The Hong Kong dollar exchange and money markets remained stable despite corrections in local stock prices and volatility ...

... The Hong Kong dollar exchange and money markets remained stable despite corrections in local stock prices and volatility ...

Midterm Examination

... decline in the average productivity of labor. If firms choose an amount of physical capital to maximize their total return, they will shift funds away from physical capital and toward bank deposits whenever the returns on bank deposits are above those on physical capital. A rise in the goods interes ...

... decline in the average productivity of labor. If firms choose an amount of physical capital to maximize their total return, they will shift funds away from physical capital and toward bank deposits whenever the returns on bank deposits are above those on physical capital. A rise in the goods interes ...

Repo (Repurchase) Rate Repo rate is the rate at which banks

... shares. A share under the Companies act, can either of Rs10 or Rs100 or any other value which may be the fixed by the Memorandum of Association of the company. When the shares are issued at the price which is higher than the par value say, for example Par value is Rs10 and it is issued at Rs15 then ...

... shares. A share under the Companies act, can either of Rs10 or Rs100 or any other value which may be the fixed by the Memorandum of Association of the company. When the shares are issued at the price which is higher than the par value say, for example Par value is Rs10 and it is issued at Rs15 then ...